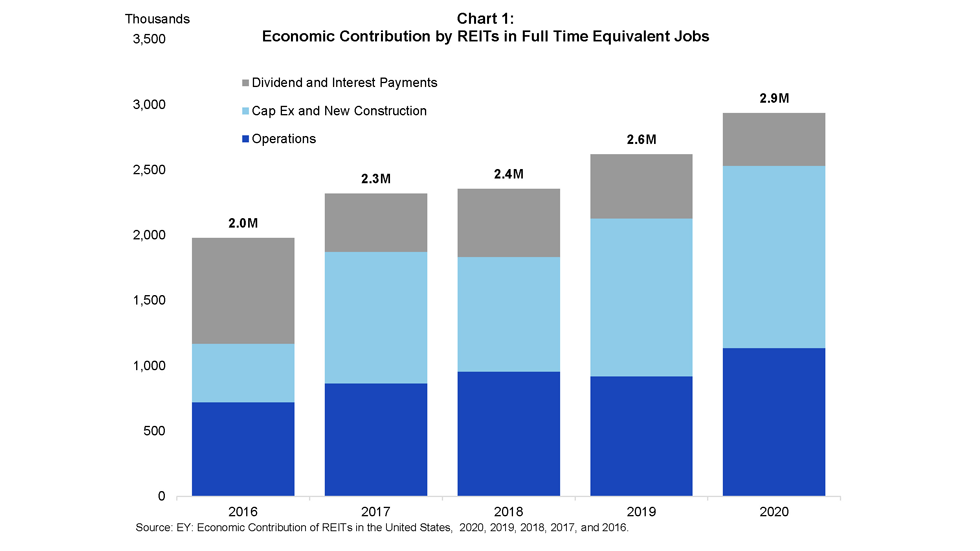

EY’s latest REIT Economic Contributions report, commissioned by Nareit, estimates REITs supported 2.93 million full time equivalent (FTE) jobs in the U.S in 2020, producing $197.0 billion in labor income. Chart 1 shows the increasing contribution from REITs to the American economy over the past five years as measured in FTE jobs. From 2016 to 2020, the jobs equivalent contribution from REITs has risen by nearly one million FTEs. This increase reflects both increased direct employment and investment and indirect and induced economic activity.

Comparing the 2020 estimate to the 2019 report, REITs’ domestic economic contribution as measured by FTEs increased by 12%. The increase is attributable to an increase in REIT operations and increased REIT capital expenditures on existing structures and support of construction activity.

As shown in Chart 1, the overall REIT economic contribution is comprised of 1.1 million FTEs supported by REIT operations, 403 thousand FTEs supported by dividends and interest payments, and 1.4 million FTEs supported by REIT capital expenditures and induced construction activities, including the employees doing the construction, as well as the materials and supplies and the induced activity from that expenditure and employment. REITs support new construction through both their own development activity and purchases of newly constructed structures.

REITs employed an estimated 308 thousand FTEs in 2020.