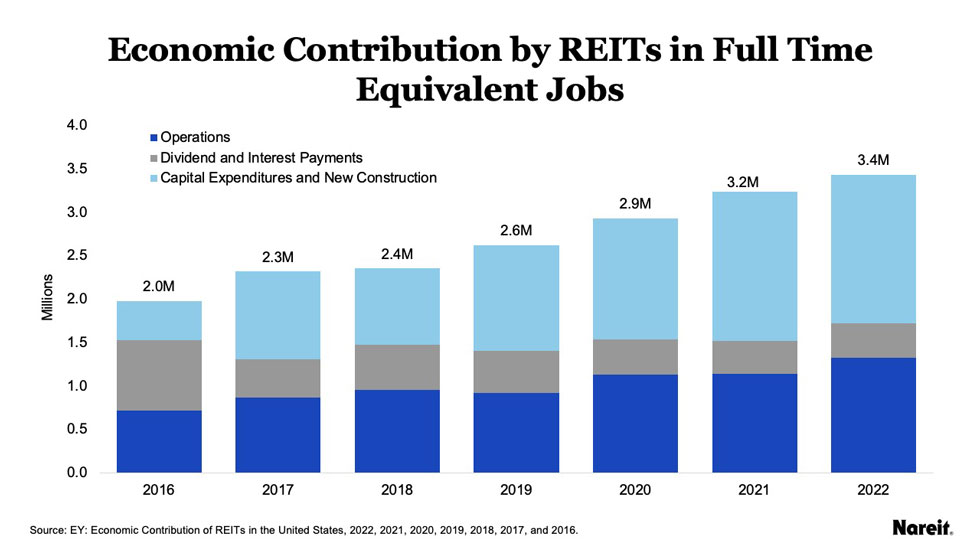

REITs supported an estimated 3.4 million fulltime equivalent (FTE) jobs in the U.S. in 2022, producing $263 billion in labor income, according to EY’s latest Economic Contribution of REITs report , commissioned by Nareit.

The chart above shows the increasing contribution from REITs to the American economy over the past five years as measured in FTE jobs. From 2016 to 2022, the jobs equivalent contribution from REITs has risen by more than 1 million FTEs. This growth reflects both increased direct employment and investment and indirect and induced economic activity.

The overall REIT economic contribution is comprised of:

- 1.3 million FTEs supported by REIT operations;

- 398,000 FTEs supported by dividends and interest payments ; and

- 1.7 million FTEs supported by REIT capital expenditures and induced construction activities, including the employees doing the construction, as well as the materials and supplies, and the induced activity from that expenditure and employment.

REITs support new construction through both their own development activity and purchases of newly constructed structures. REITs directly employed an estimated 330,500 FTEs in 2022.

REITs’ domestic economic contribution as measured by FTEs increased by more than 6% in 2022 compared to 2021. Most of the increase is attributable to a 16% increase in FTEs supported by REIT operations.