In the U.S., Labor Day marks the unofficial end of summer and the start of the new school year. This fall, the vast majority of elementary, middle, and high schools, as well as colleges and universities, have embraced in-person instruction as the primary learning mode. Students have returned to classrooms en masse.

While many employers have been yearning for employees to spend more time in the office, some office workers remain reluctant to return. With companies like Apple, Disney, Tesla, and Goldman Sachs pressing employees to work in the office on a more regular basis post-Labor Day, the holiday may also mark the start to an acceleration in the return of workers to the office.

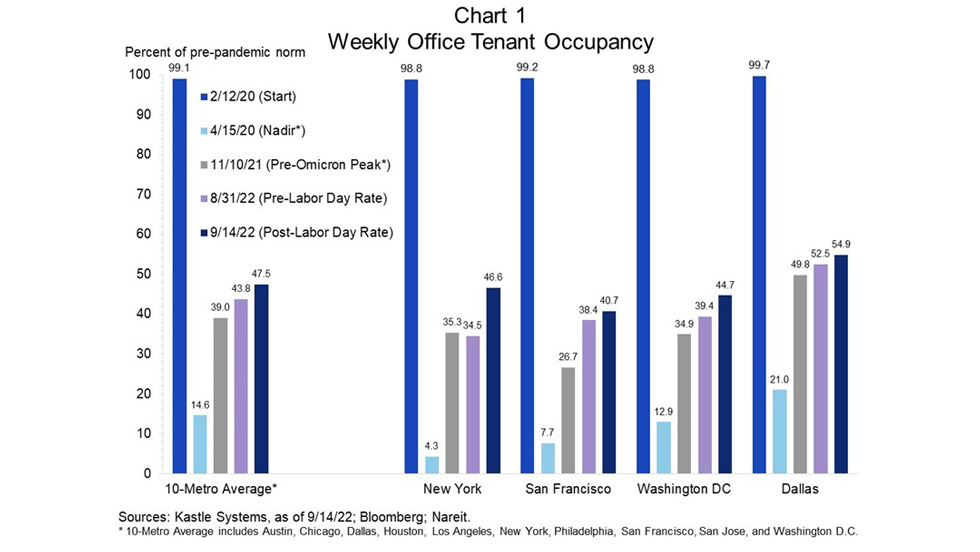

Using data from Kastle Systems, Chart 1 displays in-person office working trends during the pandemic across select geographies. Kastle Systems utilizes keycard, fob, and app access data to determine weekly office tenant occupancy rates for 10 U.S. metropolitan areas.

The 10-metro average in Chart 1 highlights the challenges and slow recovery of office occupancy during the pandemic, as well as its recent acceleration. During the week of April 15, 2020, the average office occupancy rate plunged to its nadir, 14.6% of its pre-pandemic norm. It slowly worked its way to its pre-Omicron peak of 39.0% by the week of November 10, 2021. Maintaining essentially the same level since April, the average office occupancy rate was 43.8% in the week prior to Labor Day 2022. It surged to 47.5% in the week after the holiday.

As displayed in Chart 1, the listed metro areas also experienced significant increases in their occupancy rates from the pre- to post-Labor Day periods. With banks pushing to get their employees back into the office after the holiday, New York enjoyed the most marked gain (over 12%). The rise in the Dallas market was more modest but still meaningful, placing its occupancy rate at 54.9% of the pre-pandemic level, the highest among the listed metro areas. While it is too early to call, these material increases may mark the start to an acceleration in the return of workers to the office.

Although employees have shown reluctance to return to the office, their employers have remained diligent in paying rent. As discussed in another recent Nareit Market Commentary, “The Recovery and Resiliency of U.S. REIT Operational Performance,” the office sector posted an average quarterly funds from operations (FFO) decline of just 1.9% from 2019 to 2020. According to the Nareit T-Tracker®, the office sector’s quarterly FFO well-exceeded its 2019 (pre-pandemic) average in the second quarter of 2022.