After a spate of soft numbers had hinted the housing market might stall, more recent reports show the recovery is back on. If the renewed upturn shows staying power, there are important implications not only for the housing sector, but also for the broader economy… and for REITs.

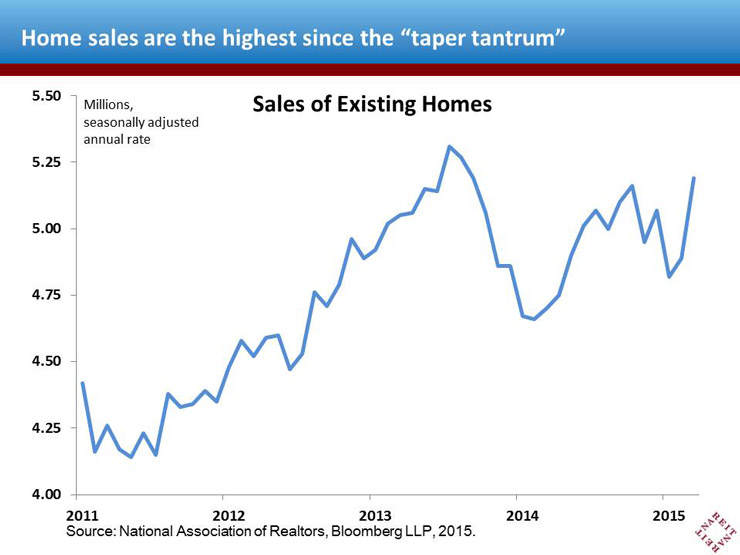

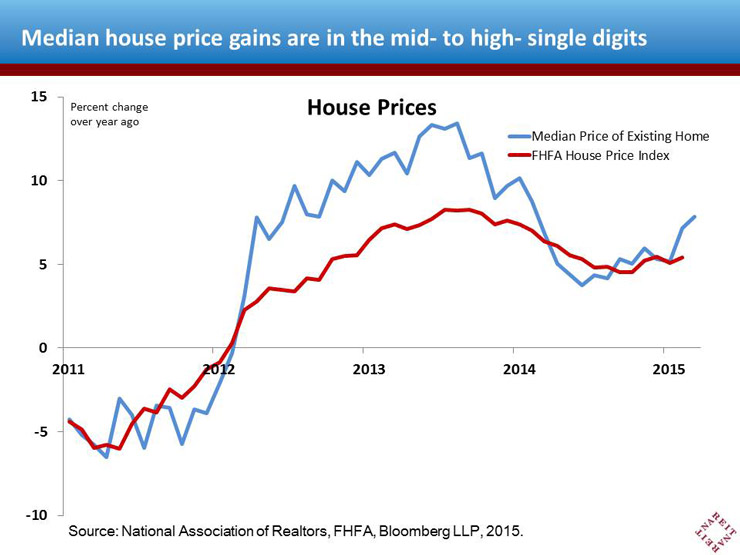

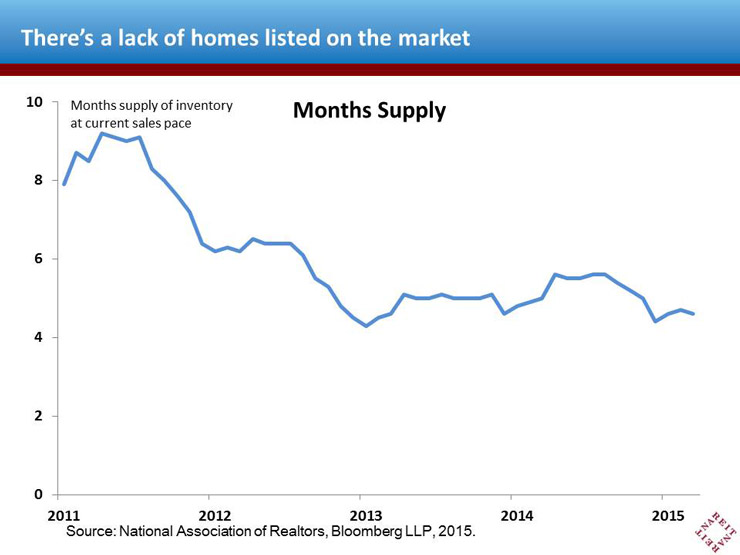

Sales of existing homes rose 6.1% in March, according to the National Association of Realtors®, to a 5.19 million unit annual rate. This is the highest sales pace since interest rates spiked higher during the “taper tantrum” in 2013. A lack of supply of homes listed on the market might be holding sales back from even stronger gains, as the months supply of inventory of homes for sale remains near recent lows. With the rebound in demand but still not much supply, price gains are turning up again.

The housing market is a key part of the U.S. economy. While most other sectors have shown considerable improvement, in particular the stronger job growth since early 2014, housing markets have lagged. A more vigorous housing sector would help generate employment, construction, household wealth and confidence that tend to benefit nearly all types of commercial property and REITs.

The relationship between the single-family home market and multifamily REITs, however, is a bit more complex. On the one hand, renters who are able to buy a home reduce the demand for rental units, which can take the steam out of the multifamily market. Also important, though, is that many of the same factors fueling the single family market—more robust job gains, higher consumer confidence—also bolster rental demand.

Moreover, with inventories of both new and existing homes for sale at extremely low levels, there’s not much scope for large numbers of renters to move into homeownership, even if they can overcome tight lending standards. For the time being, therefore, a stronger housing market is likely to help the overall economy, without becoming a drag on the rental market.