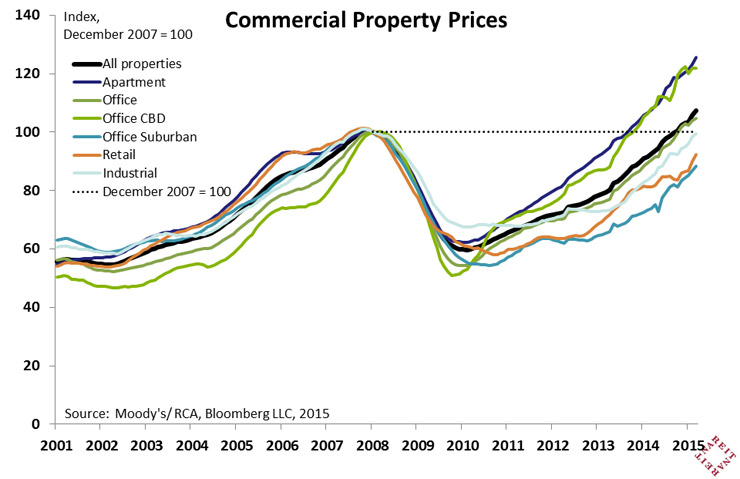

Commercial property prices continued their steady march upwards in February, according to Moody’s/ Real Capital Analytics. Rising occupancy, firming rent growth, increasing transaction activity and still-muted national supply trends are boosting valuations across all property sectors.

The national all-property commercial property price index rose 1.5% in February, to be 15.9% above year-earlier levels (chart). The retail sector, which had lagged earlier in the recovery, posted a robust 2.6% increase, while apartments continued their strong streak with a 1.9% gain. Suburban office is also making up lost ground with a 1.8% rise. CBD office has stumbled in recent months, with a slight decline in February; its strong gains through 2013 and 2014, however, still leave the sector about even with apartments in terms of overall recovery, at 122% and 125% of the December 2007 level.