The bedrock of any investor’s portfolio—no matter how small, no matter how large—is an allocation to the broad U.S. stock market. To go just the tiniest step further, most investors start with a mix of U.S. stocks and U.S. bonds. The question is what to add to that basic portfolio, and many investors believe that international diversification should be their next move. That hasn’t turned out to be the best answer.

When you’re trying to decide whether to add any asset to your portfolio, three numbers determine whether it’ll make you better off:

- The first is the Sharpe ratio (measuring risk-adjusted returns) of your existing portfolio; the Sharpe ratio is equal to the (arithmetic) average annual return of the existing portfolio minus the average return on risk-free investments (basically meaning one-month U.S. T-bills), divided by the annualized volatility of your existing portfolio. Two caveats: this assumes that volatility is your only risk—so it’s totally inappropriate if you have illiquid assets or assets with some other significant form of risk—and it assumes that volatility is correctly measured.

- The second is the Sharpe ratio of the asset you’re thinking about adding to your portfolio.

- The third is the correlation between your existing portfolio and the potential new asset.

If the Sharpe ratio of the new asset is greater than the Sharpe ratio of the existing portfolio multiplied by their correlation, then adding the new asset will increase the risk-adjusted returns of your overall portfolio. That’s simple in a sense—but of course all of this depends on forward-looking returns, volatilities, and correlations, which means it works only if your predictions are correct.

As I said, most investors—including the largest institutional investors as well as small individual investors—think more or less automatically about adding international investments. The reason is simple: international investments should offer diversification benefits to a domestic portfolio through (1) lower correlations and (2) higher returns from an added “country risk premium.”

Isn’t it amazing how frequently “should” fails to work out in investing? Private equity “should” provide an illiquidity risk premium and positive alpha—but it hasn’t. Hedge funds “should” provide absolute returns, drawdown protection, diversification benefits, and positive alpha—but they haven’t. And international investments “should” provide lower correlations, higher returns, and diversification benefits—but they haven’t.

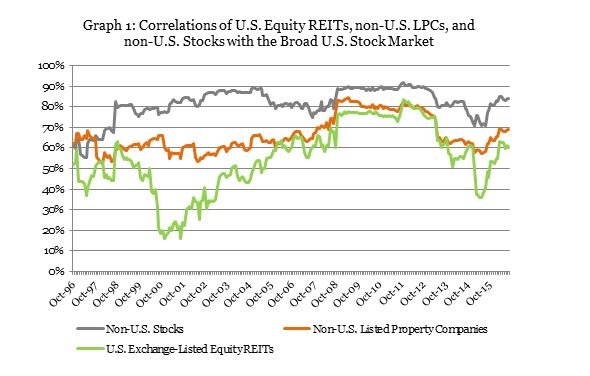

I don’t pretend to be able to forecast, so let’s just look at historical data—that is, whether the predictions of 20 years ago worked out as expected. First let’s look at correlations over the last 20 years, from 9/30/1996 through 9/30/2016. Graph 1 shows the correlations between the broad U.S. stock market (Russell 3000 Index) and three other equity categories: non-U.S. stocks, non-U.S. listed property companies, and exchange-traded U.S. equity REITs.

Surprise #1: The correlation between U.S. Equity REITs and the U.S. stock market have almost always been lower than the correlation of non-U.S. stocks with the U.S. stock market, even though U.S. REITs are part of the U.S. stock market and non-U.S. stocks are not! The reason for this is straightforward, but has not generally been adequately recognized: asset class diversification is more important than geographic diversification. The returns on real estate investments, including exchange-traded Equity REITs, are driven by developments in the real estate market cycle, while the returns on (most) non-REIT stock investments, regardless of “sector,” are driven by developments in the business cycle. The real estate market cycle is entirely different from the business cycle, even within one country; in contrast, the business cycles across different countries are synchronized to an impressive extent, partly because the largest companies from any given country typically have operations in multiple countries, whereas most U.S. REITs own very few if any properties outside the U.S.

Surprise #2: The correlation between U.S. Equity REITs and the U.S. stock market have almost always been lower than the correlation of non-U.S. listed property companies with the U.S. stock market, even though non-U.S. LPCs are not in the U.S. stock market AND not in the same asset class as the U.S. stock market! The reason for this is not as straightforward, but two explanations come to mind. First, non-U.S. listed property companies, especially in the Asia/Pacific region, tend to do much more property development than U.S. Equity REITs, and the returns from property development may be more closely attuned to business cycle conditions than are the returns from ownership of stabilized properties. Second, and perhaps more important, investors—especially institutional investors—in non-U.S. countries may not as fully recognize the differences between real estate and non-real estate investments, and may therefore base their real estate investment decisions on business cycle developments: after all, the correlation between U.S. exchange-traded Equity REITs and the U.S. stock market was significantly higher during the “pre-modern REIT era,” and that seems to be the best explanation.

Given that non-U.S. stocks and, to a lesser extent, non-U.S. listed property companies showed higher correlations with the U.S. stock market than exchange-traded U.S. Equity REITs did, they would have to have generated stronger risk-adjusted returns in order to have provided the same diversification benefits to an existing U.S. stock allocation. Again, let’s check out the historical data. Table 1 shows the average returns, volatilities, and Sharpe ratios for seven key asset categories over the same 20-year period.

Table 1: Average Total Returns, Volatilities, and Sharpe Ratios, Sep ’96 – Sep ‘16

|

|

U.S. Stocks |

U.S. Bonds |

U.S. Equity REITs |

Non-U.S. Stocks |

Non-U.S. Bonds |

Non-U.S. Listed Property Companies |

60/40 U.S. Stock/Bond Portfolio |

|

Average |

8.99% |

5.52% |

12.48% |

6.51% |

4.45% |

8.79% |

7.60% |

|

Volatility |

15.6% |

3.4% |

20.5% |

17.4% |

8.1% |

19.9% |

9.4% |

|

Sharpe |

0.441 |

1.004 |

0.507 |

0.255 |

0.291 |

0.337 |

0.585 |

Surprise #3: Exchange-traded U.S. Equity REITs have generated better risk-adjusted returns than any of the other equity asset categories: U.S. stocks, non-U.S. stocks, or non-U.S. listed property companies. In fact, none of the non-U.S. categories generated returns as strong as their U.S. counterparts during that historical period, whether on an absolute basis or on a risk-adjusted basis: that is, U.S. stocks provided higher returns (8.99% vs 6.51%) and a higher Sharpe ratio (0.441 vs 0.255) than non-U.S. stocks, U.S. bonds provided higher returns (5.52% vs 4.45%) and a higher Sharpe ratio (1.004 vs 0.291) than non-U.S. bonds, and exchange-traded U.S. Equity REITs provided higher returns (12.48% vs 8.79%) and a higher Sharpe ratio (0.507 vs 0.337) than non-U.S. listed property companies. In short, investors did not benefit from any generalized country risk premium over the past 20 years (just as private equity investors have not benefited from any illiquidity risk premium).

What does the historical data on returns and correlations tell us about the diversification benefits of each of these asset categories over the past 20 years? Using the average correlation over the historical period (from Graph 1) along with the Sharpe ratios (from Table 1) we can see that an investor with an existing allocation to the broad U.S. stock market—remember, the bedrock of the portfolio—would have benefited from adding U.S. bonds, non-U.S. bonds, exchange-traded U.S. Equity REITs, or non-U.S. listed property companies—but not from adding non-U.S. stock investments. For example, the average correlation between U.S. Equity REITs and the broad U.S. stock market was 55%, and the Sharpe ratio for U.S. Equity REITs (0.507) was greater than the Sharpe ratio for the U.S. stock market (0.441) multiplied by their correlation. (Of course, given their strong risk-adjusted returns, adding U.S. Equity REITs to an existing U.S. stock allocation over that period would have improved the risk-adjusted performance of the overall portfolio even if their correlation had been 100%!)

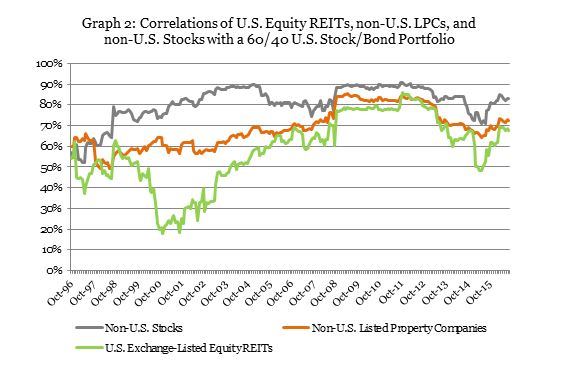

What if your existing portfolio was already a 60/40 blend of U.S. stocks and U.S. bonds? Actually the results don’t change very much. As graph 2 shows, the correlations of the different asset categories with a 60/40 portfolio are almost identical to their correlations with an all-stock portfolio; the difference is that an existing 60/40 portfolio would have provided higher risk-adjusted returns than an existing all-stock portfolio (0.585 vs 0.441, as shown in Table 1), making the hurdle higher for additional assets to be included. In fact, neither non-U.S. stocks nor non-U.S. listed property companies would have provided diversification benefits to an existing 60/40 portfolio over the past 20 years—but exchange-traded U.S. Equity REITs would have done so, with risk-adjusted returns (0.507) greater than the risk-adjusted returns of the 60/40 portfolio (0.585) times the average correlation between them (58%).

Does this tell you how to construct your own investment portfolio? Of course not, for at least two reasons: first because it’s based on historical data rather than predictions about what’s going to happen in the future, and second because it doesn’t take into account your own risk tolerance, existing portfolio, or other individual circumstances. That’s not the point. The point is merely to show that the simple rule of thumb that investors, from those with the largest institutional portfolios to those with the smallest individual ones, have been using for decades—that adding non-U.S. holdings could be expected to provide diversification benefits to an existing U.S. investment portfolio—has not actually held up in practice. Instead, U.S. Equity REITs, traded as part of the U.S. stock market, have provided higher returns, higher risk-adjusted returns, lower correlations, and therefore greater diversification benefits than any of the non-U.S. investments considered here.

Keep that in mind when you’re constructing your own portfolio: the benefits of diversification into the real estate asset class by investing in exchange-traded U.S. equity REITs have been greater than the benefits of international diversification in any of the three main asset classes.

Technical notes: I estimated correlations using a dynamic conditional correlation model with generalized autoregressive conditional heteroscedasticity (DCC-GARCH, developed by Nobel prize-winning economist Robert Engle). DCC-GARCH is pretty much the state of the art for this sort of analysis because it’s both accurate and sensitive to the most recent market conditions. I computed the DCC-GARCH model using Matlab. The indices I used to measure monthly returns were the Russell 3000 (U.S. stocks), Barclays Capital Aggregate U.S. Bond Market (U.S. bonds), FTSE NAREIT All Equity REIT (exchange-traded U.S. Equity REITs), MSCI AC World ex-USA (non-U.S. stocks), BC Aggregate Global ex-USD Bond Market (non-U.S. bonds), and FTSE EPRA/NAREIT Developed ex-US (non-U.S. listed property companies).