December 2018 was bitter for investors. Total returns in the broad REIT market were -7.73 percent—but that was good news compared with large-cap stocks (-9.03 percent according to the S&P 500), small-cap stocks (-11.88 percent for the Russell 2000) and especially small-cap value stocks (-12.09 percent). The same was true for 2018 as a whole: REIT investors saw total returns of -4.10 percent, but that was good news compared with large-cap stocks (-4.38 percent), small-cap stocks (-11.01 percent), and small-cap value stocks (-12.86 percent).

Even more worrisome was the surge in market volatility: the broad stock market declined by more than 1.5 percent on December 4, 7, 14, 17, 19, 20, 21, and 24—and again on January 3, giving investors nine especially poor days in less than a month. (REIT investors were spared most of those migraine days, with just four drops exceeding 1.5 percent.) As a result, stock market volatility surged to 30 percent, more than twice its normal level—and REIT investors were carried along for the ride with volatility increasing to 28 percent, even though downside volatility remained 13 percent less for REIT investors than for investors in the broad stock market.

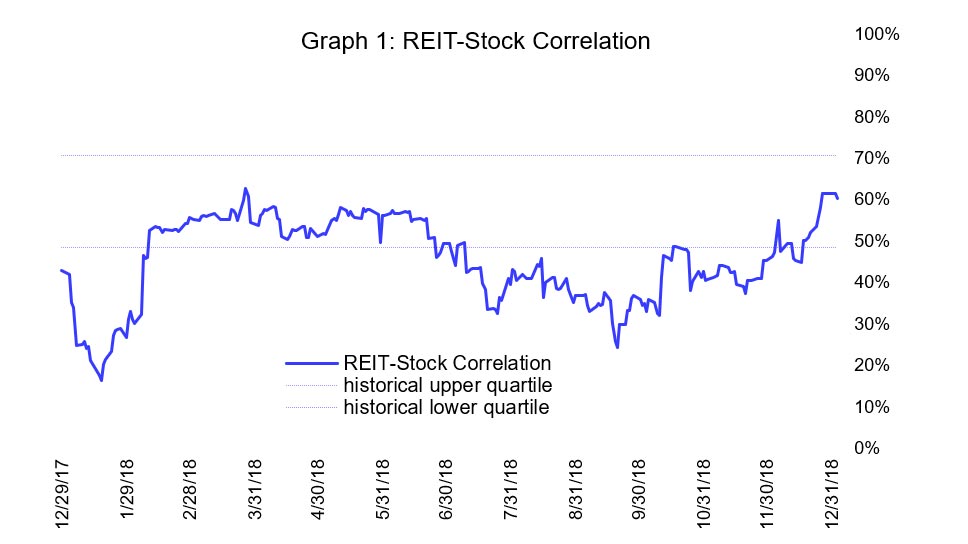

The idea that “diversification benefits disappear during market turmoil” is one of those maddening sayings that are (1) false and (2) easily shown to be false, but (3) repeated often enough that people simply assume they’re true. December 2018 provided a good illustration. Graph 1 shows the correlation in daily total returns between equity REITs and the broad stock market during 2018. Yes, there was an increase in the REIT-stock correlation during December—but from an abnormally low value of 45 percent at the end of November to just 60 percent at the end of December. In fact, the REIT-stock correlation has been abnormally low during almost all of 2018, and even as a result of the market turmoil in December it was just one percentage point above its long-term median value of 59 percent.

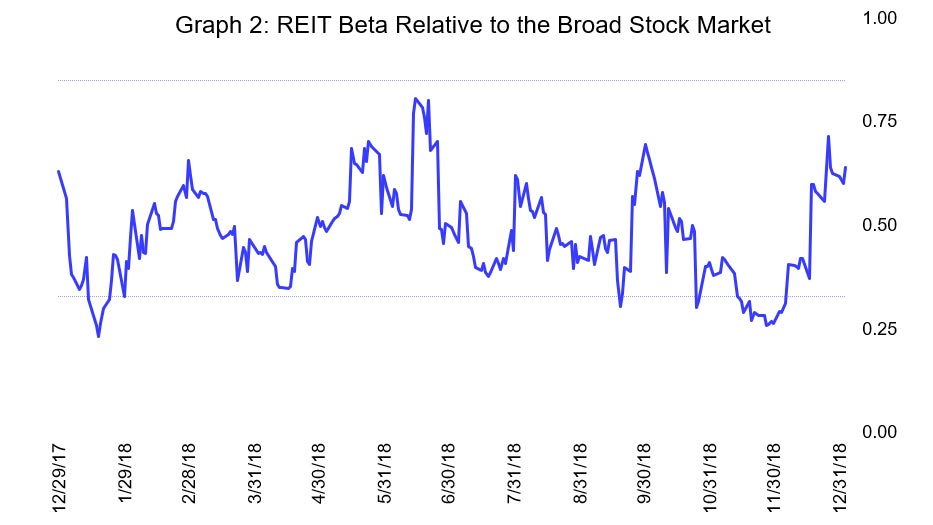

Graph 2 shows another way of looking at the relationship between REITs and the broad stock market. REIT investments have generally shown a beta of between 0.33 and 0.85 relative to the broad stock market, and the market turmoil of December increased REIT beta from an abnormally low level of 0.26 at the end of November to 0.62 at the end of December—again, not much greater than the long-term median of 0.51.

That low REIT-stock correlation and low REIT beta mean than investors with substantial holdings of REITs in their portfolio typically experience substantially less volatility than investors with holdings in the broad stock market but without a separate allocation to REITs.

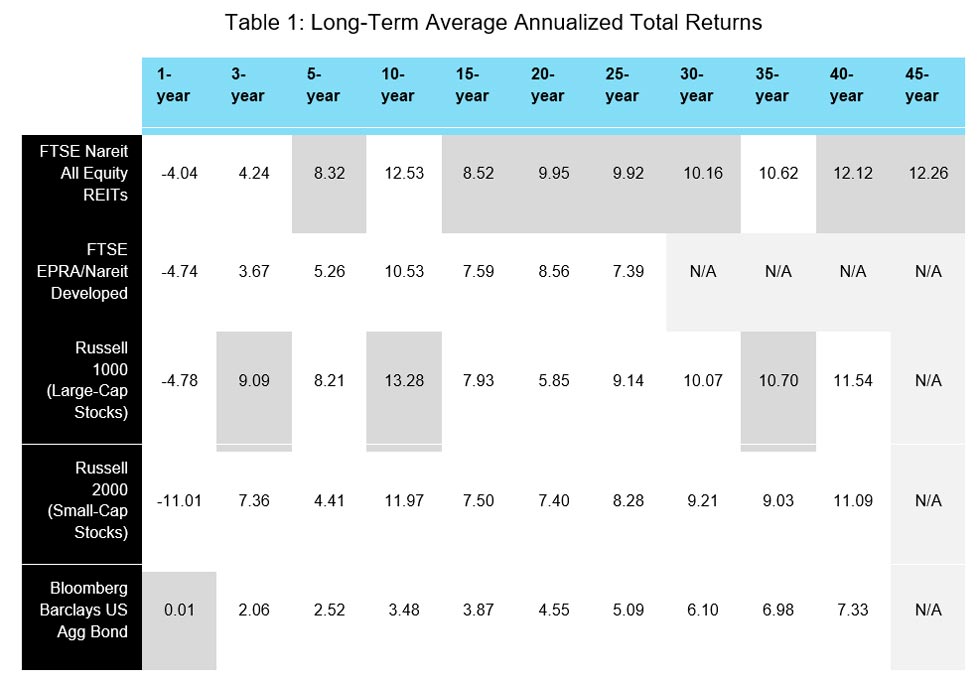

Diversification benefits, though, are not just about reducing portfolio volatility: they’re about increasing portfolio returns, too. The past decade has been famously strong for large-cap U.S. stocks, with total returns averaging 13.28 percent per year for the Russell 1000 as shown in Table 1. Many investors may be surprised to realize that REIT returns were only slightly less at 12.53 percent per year over the same “decade of stocks”—and many will probably be even more surprised to learn that REITs have outperformed not just large-cap stocks but also small-cap stocks over the past one, five, 15, 20, 25, 30, and 40 years.

Finally, valuation metrics and real estate market conditions continue to suggest that REITs investors can anticipate relatively strong returns going forward. In Nareit’s Economic Outlook my colleague Calvin Schnure and I agreed that 2019 offers more to look forward to than to be concerned about—and events of the last couple of weeks seem only to have added to our optimism about the coming year. For example, the spread between equity REIT dividend yields and Baa-rated corporate bond yields—historically a dependable predictor of future REIT performance—narrowed from 112 basis points on December 14 to 62 basis points on January 3. If my analysis of the historical relationship between yield spreads and subsequent performance continues to hold, that narrowing suggests that REIT investors can anticipate double-digit annualized total returns over the next several years, and also that they can expect to get stronger returns from their investments in the equity REIT market than from their investments in the broad stock market.

Strong long-term total returns, along with low correlation and low beta, even during a period of market turmoil—that’s the diversification benefit of having a substantial portfolio allocation to REITs. I, too, wish we might have avoided the bitter experience of December 2018—but I’m certainly glad that a very substantial portion of my own portfolio was invested in REITs.

Technical note: my estimates of volatility, correlation and beta come from a DCC-GARCH model (dynamic conditional correlation with generalized autoregressive conditional heteroskedasticity) estimated using daily total returns for equity REITs and the Russell 3000 since January 1, 1990. Daily returns for the FTSE Nareit All Equity REIT Index begin January 4, 1999; before that date I used a composite of available daily returns from the S&P US REIT Index, the FTSE EPRA/Nareit USA Index, the MSCI US REIT Index, the Wilshire US REIT Index, and the Dow Jones US Select REIT Index.

If you have any questions or comments, please drop me a note at bcase@nareit.com.