Nareit has released its Q3 REIT Performance Report showing that REITs continued to make gains. Some key findings include:

- In the third quarter of 2021, the FTSE Nareit All Equity REIT Index continued to generate positive returns, rising 0.23% in Q3 after a 12.03% increase in Q2.

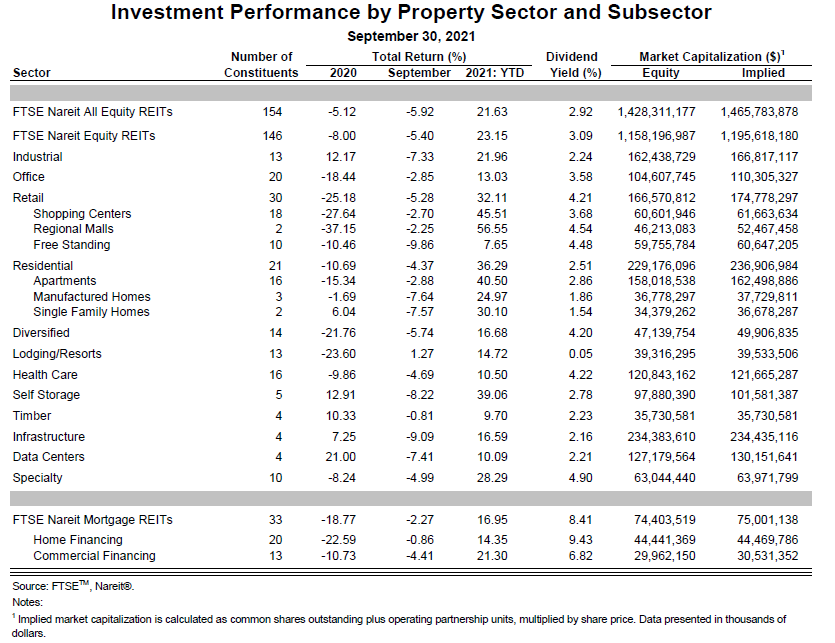

- The top performing REIT sectors on a YTD basis at the end of Q3 included:

- Self Storage – up 39.1%

- Residential – up 36.29%

- Apartments – up 40.50%

- Single Family Homes – up 30.10%

- Manufactured Homes – up 24.97%

- Retail – up 32.11%

- Regional Malls – up 56.55%

- Shopping Centers – up 45.51%

- Free Standing – up 7.65%

- Specialty – up 28.29%

- Industrial – up 21.96%

REIT performance by sector can be seen in the chart below:

- REITs conducted 57 equity and debt offerings in Q3 2021 raising $24.3 billion, including

- $8.38 billion in common shares

- $1.98 billion in preferred shares

- $13.38 billion in secondary debt offerings

- The FTSE Nareit All Equity REITs Index reported a dividend yield of 3.18% in Q3, more than double the 1.32% dividend yield paid by the S&P 500.

- In Q3, year to date there were $54 billion in M&A deals (pending or completed),

- $38 billion of which is attributed to REIT-to-REIT transactions

- $16 billion of which represents privatizations.

The entire Q3 report can accessed here .