In a recent webinar hosted by Nareit, experts shared insights from market research on institutional investors’ attitudes and usage of REITs. The session included findings from a research collaboration with Coalition Greenwich, alongside a separate study by Hodes & Weill, and covered perspectives from various asset owners, including pension funds and endowments.

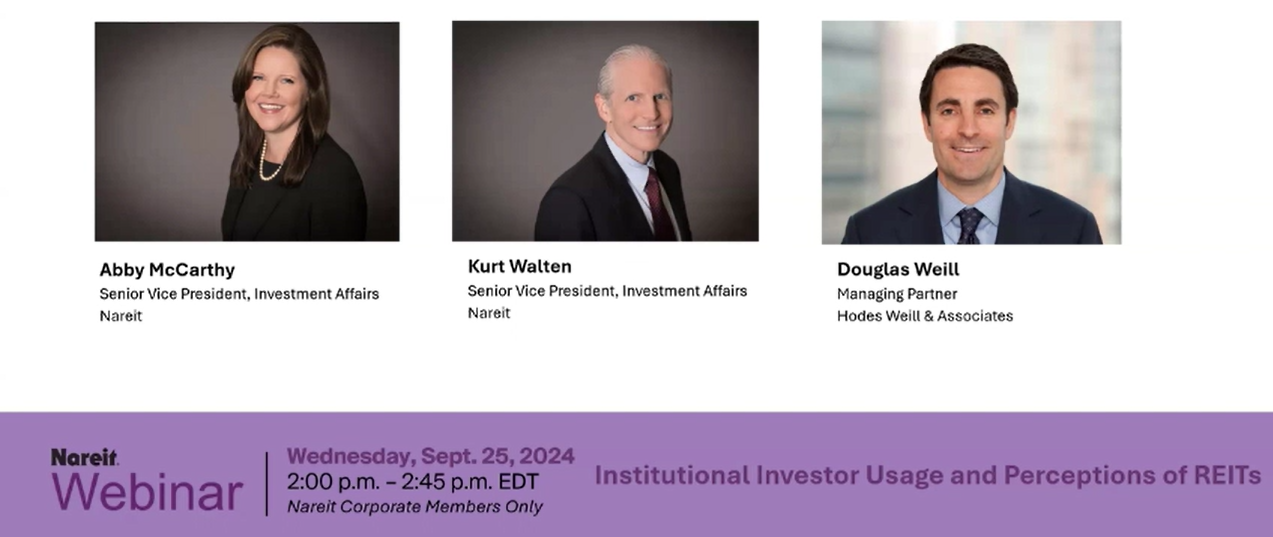

Kicking off the discussion, Abby McCarthy, Nareit’s senior vice president for investment affairs, outlined the goal of the research, noting that "close to 90% of respondents said that they feel an investment in REITs is an investment in real estate." This insight highlights a significant shift in the perception of REITs over the years, solidifying their status as a key real estate investment vehicle.

Kurt Walten, Nareit’s senior vice president for investment affairs, shared that the research involved interviews with 141 investors and 10 consultants, conducted both online and over the phone.

"What we’re seeing is a growing recognition of REITs as strategic investments," Walten said, citing that 82% of respondents view REITs as a long-term, strategic part of their portfolios, a sharp contrast to earlier views where REITs were often seen as tactical, short-term holdings.

One of the most compelling takeaways was the broad spectrum of asset owners involved, ranging from defined benefit plans to endowments and foundations, with an even distribution across different asset sizes. Walten noted that "how we communicate our message about the REIT investment proposition really can be dependent on the size of the institution," stressing the need for tailored approaches to different investor groups.

Doug Weill, a founding partner of Hodes & Weill, brought in a global perspective, sharing insights from his firm’s collaboration with Cornell University.

"84% of institutions that invest in REITs do so out of their real estate allocation," Weill remarked, reinforcing the idea that REITs are now seen as complementary to private real estate investments rather than standalone alternatives.

Weill also pointed out that larger institutions, particularly sovereign wealth funds and insurance companies, tend to use REITs tactically, often in sector-specific plays that private real estate can't fully replicate.

The webinar also revealed a growing interest in newer property sectors, with Walten highlighting that “data centers, telecommunications, and health care are gaining traction as prime targets for REIT investments in the next one to three years.” These sectors are seen as critical opportunities for diversification and growth, particularly as institutional investors continue to expand their real estate portfolios in both public and private markets.

The webinar underscored how REITs have evolved into a vital tool for institutional investors, not only offering liquidity and diversification, but also enabling access to emerging real estate sectors.

"For institutions, REITs are increasingly viewed as a strategic complement to private investments, offering a balance that’s hard to find elsewhere,” Weill said.

Receive access to a replay of this webinar by registering here.