During the first quarter of 2016, NAREIT's investor outreach team conducted 155 meetings with many large and influential investment organizations within the institutional investment marketplace. Collectively, these entities represent close to $23 trillion in assets under management or advisement.

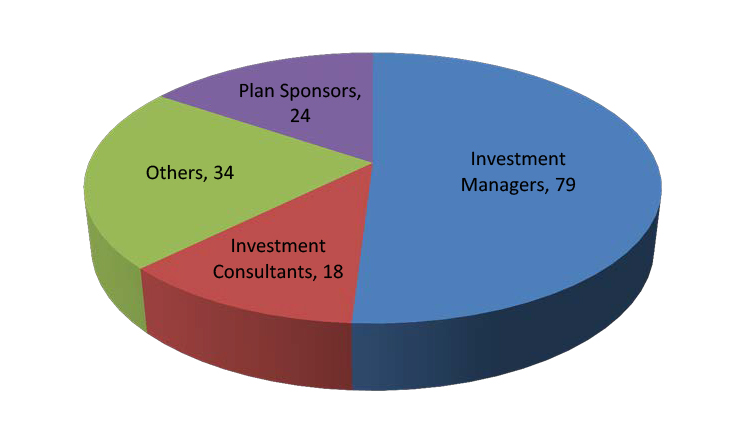

The 155 meetings included:

- 24 with global pension, retirement and sovereign wealth funds representing close to $1.5 trillion in assets;

- 18 with investment consultants with assets under advisement of more than $7 trillion; and

- 79 with investment managers representing over $14 trillion.

Another 34 meetings were held with other organizations and associations active in the pension and retirement industry. NAREIT was also active on the institutional investment conference circuit in 2016. Members of the Investor Outreach team attended 10 events in the first quarter, participating in six as a speaker, board member or sponsor.

Total assets of NAREIT's primary outreach target, the $21.5 trillion domestic pension and retirement savings market, are fairly evenly distributed across pension plans, endowments and foundations, defined contribution plans, and individual retirement plans, consisting predominantly of individual retirement accounts (IRAs), including rollover, traditional and Roth IRAs.

Many of the meetings with investment managers and investment consultants within the $6.5 trillion defined contribution (DC) market focused on research NAREIT sponsored with Wilshire Associates on the role of U.S. REITs and global listed real estate securities within target date funds, the most rapidly growing investment products in most 401(k) accounts and other tax-advantaged savings plans.

In terms of the $7.3 trillion IRA market, NAREIT continues to implement a comprehensive outreach program targeted at financial intermediaries, including financial advisors, who have a strong influence over the investment allocation decisions made on a significant portion of IRA assets. It is notable that 34 of the 79 meetings NAREIT had with investment managers during the year were with managers active in both the $6.5 trillion DC and $7.3 trillion IRA markets.

(Contact: Kurt Walten at kwalten@nareit.com)