Understanding the potential financial risk to individual properties from the increasing frequency and intensity of extreme weather events —both today and over the next 30 years—is becoming ever more important for the REIT industry as it prepares for and manages the effects of changing climate conditions. Increased regulatory scrutiny in the years ahead will also require REITs to have ready access to such information.

First Street Foundation, a nonprofit research and technology group, is filling that need for granular, property-level data. Using the most recent peer-reviewed scientific data available, it has been building physical climate-related hazard exposure models for the past eight years, covering flood, fire, heat, and wind risks for commercial and residential properties in the United States. In collaboration with Nareit, First Street will provide complimentary access for one year to two employees of any Nareit member REIT to its Risk Factor™ platform, which encompasses the current range of risk models.

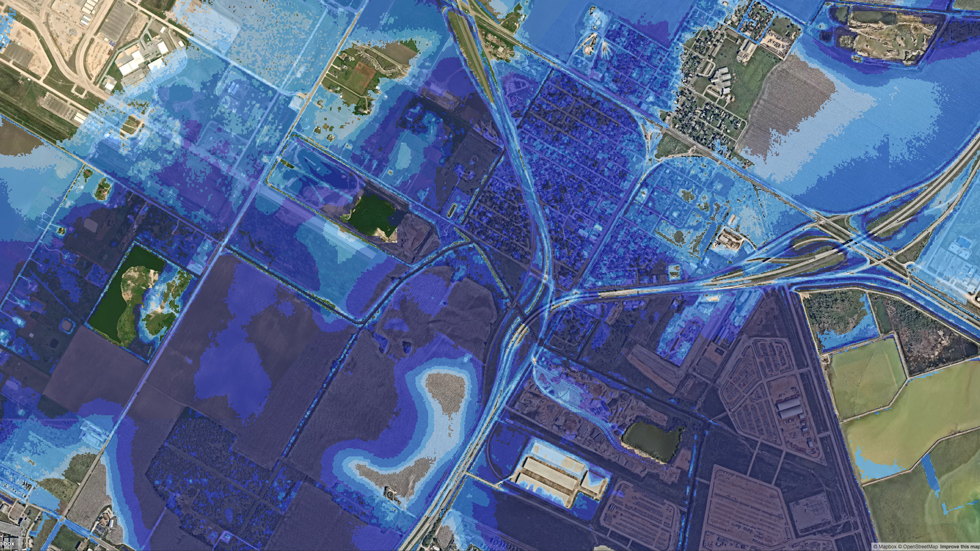

The Risk Factor™ platform allows users to type in an individual address and receive a score correlating to the risk level for a range of climate events. In the case of flood risk, for example, it can show how likely it is for water to reach a particular building, the potential damage and cost to repair the structure, if it has flooded in the past, and if there is a larger community risk to critical infrastructure such as electric substations and emergency services.

Matthew Eby, First Street founder and CEO, who will be participating in a REITworld 2023 panel on preparing REIT communities for climate change, explains how the platform allows users to “look at maps and understand specifically how the building might be impacted by showing where on the site and what depth the water might reach, indicating whether it's just the parking lot and roads, or to what extent it could reach the building itself.”

Jessica Long, Nareit’s senior vice president of environmental stewardship and sustainability, discusses with member REITs the value of climate risk data and the importance of actionable insights. She believes the level of and type of detail provided in the Risk Factor™ tool could support building owners to create targeted and specific action plans to mitigate the potential financial impacts of various hazards and communicate with key stakeholders on the level of risk facing a specific property.

Because everything is modeled at the property level, First Street research demonstrates where risk exists and the concentration of that risk, Eby says. That expertise was the basis of the organization’s recently released ninth National Risk Assessment: The Insurance Issue.

“We were able to correlate our models to locations where we're seeing insurance companies pull out of markets, such as California, because of regulations that prevent them from charging actuarially-sound premiums,” Eby says.

“That leaves everyone to go to the insurer of last resort, the state itself, which has much higher premiums. It's not just California, it's Louisiana and Florida, and the whole host of markets with these high risks,” he adds.

Other National Risk Assessments released by First Street include The Precipitation Problem, Worsening Winds, Hazardous Heat, Fueling the Flames, and Infrastructure on the Brink.

Eby shared that additional risk models covering air quality and drought are in the works. In the coming years, First Street also plans to analyze how major extreme weather events could create secondary impacts impacting REIT communities, such as shifts in local demographics, tax revenue, and more.

Information such as that produced by First Street Foundation is vital not only for the REIT industry but for lenders, insurers, and governments, according to Eby, as tackling climate challenges becomes increasingly integrated into decision-making at every level in the future.