A panel discussion during Nareit’s REITworks: 2020 Virtual Conference highlighted the latest developments from the Financial Accounting Standards Board (FASB) and the U.S. Securities and Exchange Commission (SEC) that impact REITs and commercial real estate.

The panel, moderated by Steve Theriot, CFO, JBG Smith (NYSE: JBGS), discussed, among other items, the actions that the FASB and SEC took in response to COVID-19. Panelists included:

- Alicia Posta , Assistant Director & Executive Director of Financial Accounting Standards Advisory Council (FASAC), FASB

- Jonathan Wiggins , Sr. Associate Chief Accountant, U.S. Securities and Exchange Commission

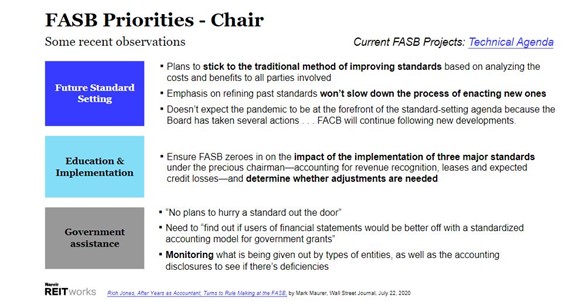

Posta began the panel by highlighting Richard R. Jones’s, FASB’s newly installed chair, current priorities:

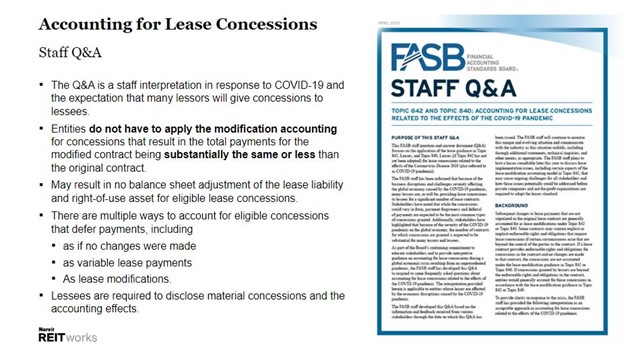

She then described FASB’s latest staff Q&A concerning accounting for lease concessions related to COVID-19:

Posta also described FASB’s recent public roundtables regarding leases. Some of the highlights include:

- Incremental borrowing rate - Lessee’s application of the discount rate guidance on the incremental borrowing rate and difficulties encountered during implementation

- Lessee use of the rate implicit in the lease - Determining whether a lessee can “readily determine” the rate implicit in the lease given lessor specific inputs (for example – residual value)

- Lease modification model - Complexities and outcomes associated with lessee and lessor application of the modification guidance

- Embedded leases - Identifying leases embedded in nonlease contracts, such as service contracts

- Lessee allocation of payments - Complexities and outcomes associated with lessee allocation guidance in Topic 842 when fixed and variable payments exist in conjunction with lease and nonlease components

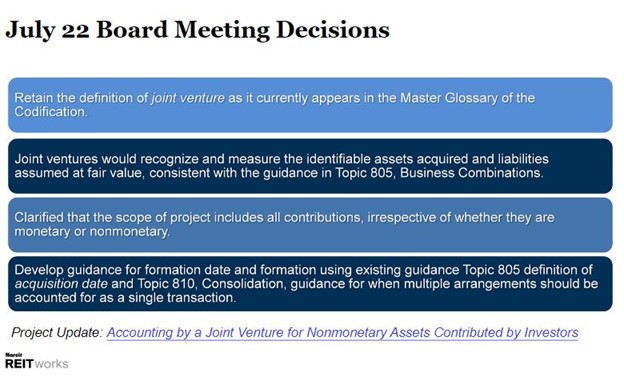

She also shared decisions made by the board regarding accounting by a Joint Venture for nonmonetary assets contributed by investors :

Wiggins then discussed how the SEC has been dealing with the challenges and uncertainty brought on by the pandemic.

He said that the relief provided by the SEC, such the 45-day extension to file certain disclosure reports in the first quarter, was called for during this extraordinary situation, but that the system has largely be able to adapt since then. “We are largely back to business as usual, even in the throes of a global pandemic,” said Wiggins.

He also shared the priorities from the SEC Office of the Chief Accountant (OCA)

- Rulemaking under the Regulatory Flexibility Act (Reg Flex)

- Engagement with and the Vital Role of Audit Committees

- Registrant Consultation and OCA on Complex Accounting Matters

- Engagement with International Standard Setters and Other Regulators