WASHINGTON, DC, Oct. 29— U.S. equity REITs delivered higher returns for pension funds than unlisted real estate over a 20-year period, according to new research released today. REITs also benefited from more than 50% lower management fees.

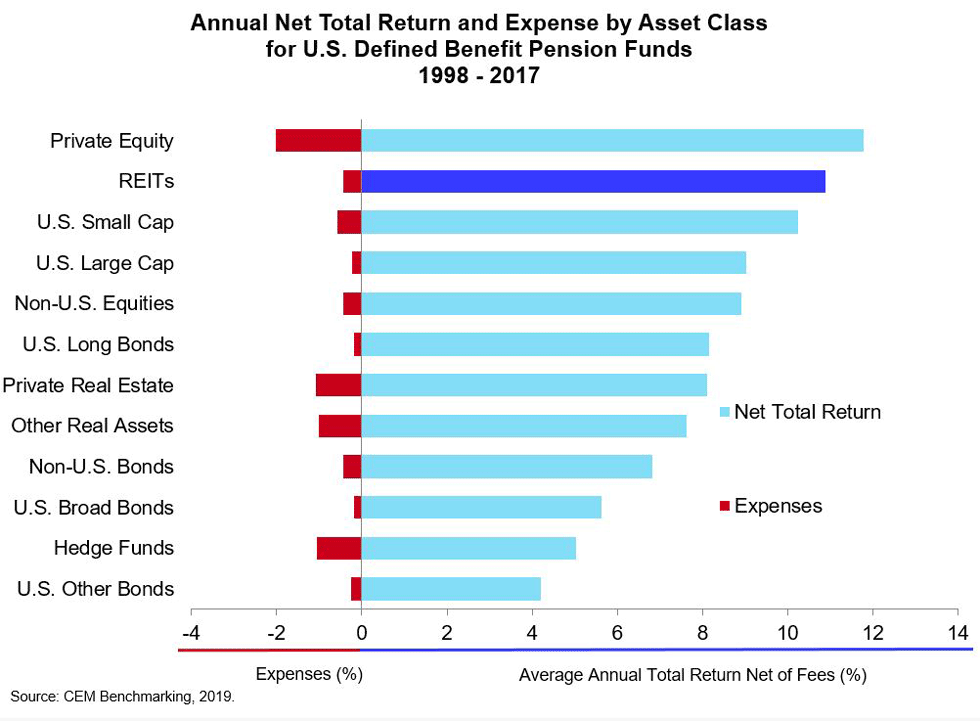

The annual analysis, conducted for Nareit by research firm CEM Benchmarking, looked at the allocation and performance of assets in 200 public and private pension funds, representing nearly $3.8 trillion in combined assets under management. The study provides a comprehensive review of investment allocations and realized investment performance across 12 asset groups from 1998-2017.

Key takeaways from the study, entitled “Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States,” include:

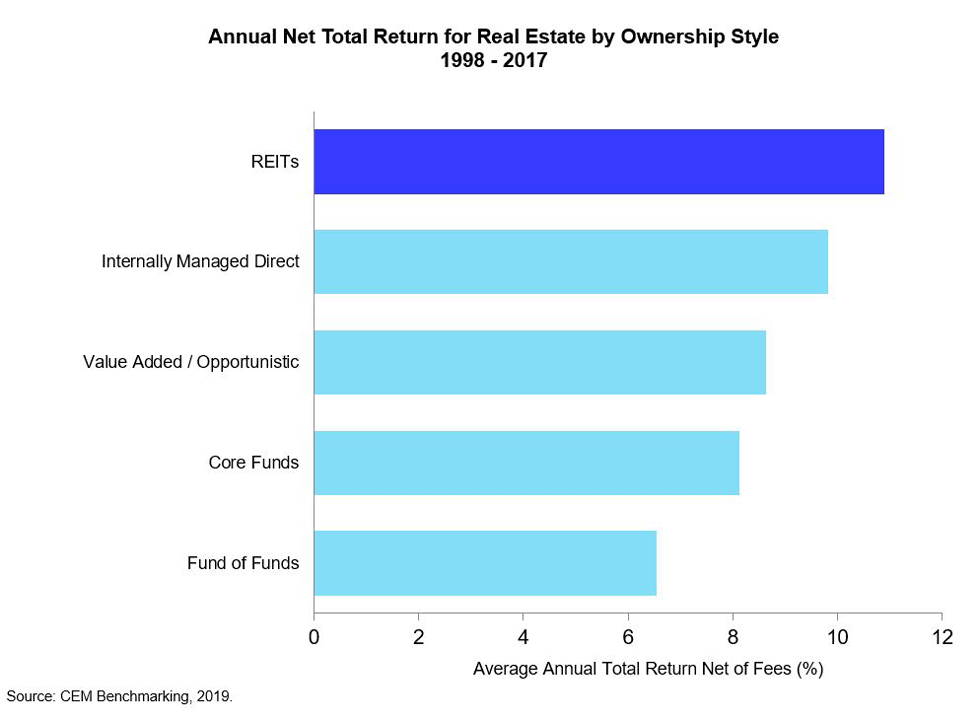

REITs continue to outperform other real estate assets

REITs have delivered an average annual net return of 10.89% over the 20-year period examined in the study. In comparison, opportunistic unlisted equity real estate funds delivered 8.64%, and opportunistic funds managed in the fund-of-funds style had the lowest annual net return of all real estate assets at 6.54%.

Fees add up for unlisted real estate

Management fees for unlisted real estate were more than 50% higher than those of REITs: 1.07% compared to .05%.

REITS underutilized despite high returns

Although they had the highest returns of all real estate assets, listed equity REITs were the least used asset class covered in the study. In the latest year of the study, 2017, allocations to listed equity REITs averaged just 0.74% of total pension fund assets. Unlisted real estate, by contrast, had a 4.95% allocation in 2017, with opportunistic unlisted real estate (external LP and external fund-of-funds styles) at 1.9%.

REITs provided higher risk adjusted returns or Sharpe ratio

On a risk adjusted basis listed equity REITs provided a higher Sharpe ratio (0.44) than all unlisted real estate styles (.33).

REITs have low correlation with other assets

Besides unlisted real estate, REITs were not highly correlated to any other aggregate asset classes in the study. REITs had a correlation of 0.91 with unlisted real estate, compared to 0.62 with U.S. small cap stocks, .53 with U.S. large cap stocks, and 0.49 with private equity.

“Each year we update the study, and each year we find that REITs had the best long-term returns along with private equity, said Alex Beath, senior research analyst at CEM Benchmarking. “Perhaps more important is the fact that REITs essentially track unlisted real estate while consistently outperforming it.”

Nareit Executive Vice President of Research and Investor Outreach John Worth said, “The results of this year’s CEM Benchmarking study confirm again for pension funds that listed equity REITs continue to deliver better results than unlisted real estate. Furthermore, the study reveals that REITs have much lower management costs and a higher Sharpe ratio than unlisted real estate. Pension fund managers should look to REITs as they seek to boost investment performance.”

Learn more about the CEM Benchmarking study here.

About CEM Benchmarking and its Pension Fund Research

CEM Benchmarking is a Toronto-based provider of investment cost and performance benchmarking for large institutional investors, including pension funds, sovereign wealth funds, buffer funds and others. The results of this study are derived from CEM’s unique database, which contains detailed information regarding asset allocation, investment performance and investment expenses for approximately 1,000 large institutional investors around the world. The study used realized investment performance information, rather than performance data as measured by broad asset class benchmarks, providing a window into actual pension fund investment choices and their performance.