Despite better performance, REITs remain underutilized by pensions

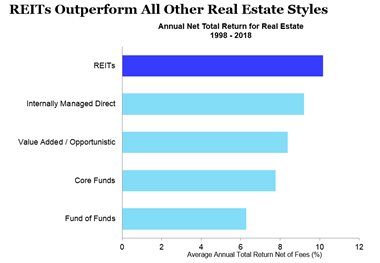

WASHINGTON, DC, (Oct. 19, 2020) — According to newly released research, equity REITs outperformed unlisted real estate investments over a more than two-decade period, delivering higher returns for pension funds. REITs outperformed private real estate by nearly 2.7 percentage points per year on average and also provided better risk adjusted returns.

The analysis is sponsored by Nareit and conducted annually by research firm CEM Benchmarking. This year, with access to a 21-year data set, the study looked at the allocation and performance of assets in more than 200 public and private sector pensions with nearly $3.9 trillion in combined assets under management.

Nareit Executive Vice President of Research and Investor Outreach John Worth said, “CEM Benchmarking’s study shows the striking disparities between the returns of REITs and unlisted real estate. On average, REIT annual returns are nearly 2.7 percentage points higher than private real estate. REITs outperformed all styles of private real estate. This 21-year study reaffirms that pension fund managers and institutional investors should continue to look to REITs as a key component of their real estate strategy.”

Key takeaways from the study, entitled “Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States,” include:

- REITs outperformed all styles of unlisted real estate. CEM compared returns, correlations and volatilities of four key private real estate ownership styles with varying risk profiles and costs. The study concluded that REITs outperformed private real estate irrespective of ownership style.

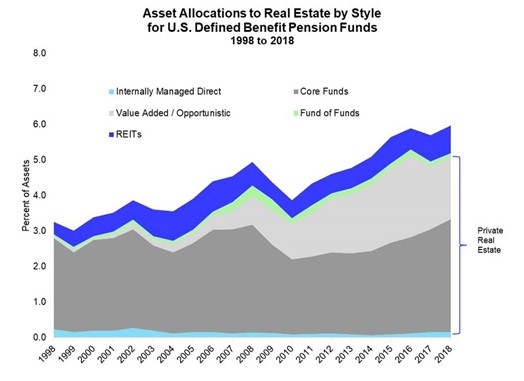

- In spite of their high performance, REITs have the lowest allocation of any asset in the study. Over the 21-year period, pension funds allocations to REITs have been flat while allocations for private real estate, especially, value-add/opportunistic funds, have increased. As the figure shows, in 2018, REITs accounted for 0.78% of total pension assets compared with 5.19% of assets invested in private real estate.

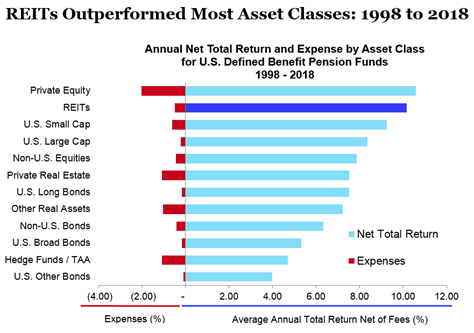

- REITs had the second highest average annual return of the 12 asset classes covered. Over the 21-year period covered by the study, listed equity REITs had the second highest average annual net return at 10.2%.

- REITs had low correlation with equities and are highly correlated with private real estate. REIT and unlisted real estate returns are highly correlated and both had low correlations with bonds and listed equity returns. These relatively low correlations reflect the well-known diversification benefits associated with the real estate asset class, whether REITs or unlisted real estate.

- REITs had the highest non-fixed income risk adjusted return. The study compared risk adjusted returns using the Sharpe ratio. REITs had the highest non-fixed income Sharpe ratio of .41, reflecting their high returns and just above average volatility. In comparison, unlisted real estate had a much lower Sharpe ratio of .30, reflecting lower returns and comparable volatility to REITs. The data also indicated REITs provide better risk adjusted returns than any style of private real estate.

“Our analysis finds that REITs consistently provide strong long-term returns and critically important investment diversification to millions of Americans who rely on these pensions for their retirement security,” said Alex Beath, Senior Research Analyst at CEM Benchmarking.

Learn more about the CEM Benchmarking study at reit.com/cemstudy.

About CEM Benchmarking and its Pension Fund Research

CEM Benchmarking is a Toronto-based provider of investment cost and performance benchmarking for large institutional investors, including pension funds, sovereign wealth funds, buffer funds and others. The results of this study are derived from CEM’s unique database, which contains detailed information regarding asset allocation, investment performance and investment expenses for approximately 1,000 large institutional investors around the world. The study used realized investment performance information, rather than performance data as measured by broad asset class benchmarks, providing a window into actual pension fund investment choices and their performance.