REIT CEOs outline efforts to sustain earnings momentum through 2015.

After a healthy performance by the REIT industry in 2014, positive market fundamentals are expected to remain in place in 2015. For a close-up view of how REITs intend to navigate the next 12 months, REIT magazine assembled a roundtable of REIT CEOs to discuss their areas of focus for 2015, industry trends, debt financing and competition from private players.

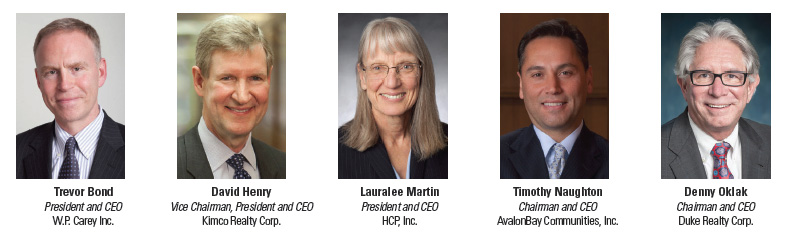

Participants included: Trevor Bond, president and CEO of W.P. Carey Inc. (NYSE: WPC); David Henry, vice chairman, president and CEO of Kimco Realty Corp. (NYSE: KIM); Lauralee Martin, president and CEO of HCP, Inc. (NYSE: HCP); Timothy Naughton, chairman and CEO of AvalonBay Communities, Inc. (NYSE: AVB); and Denny Oklak, chairman and CEO of Duke Realty Corp. (NYSE: DRE).

REIT: What do you expect will be the main focus for your company in 2015?

Trevor Bond: We’ll remain focused on growing our balance sheet, net of our ongoing efforts to improve the quality of the portfolio through capital recycling. For us that entails selling non-core assets. We’ll use the capital generated to buy property with longer lease terms and with attractive residual characteristics. Europe still offers attractive risk-adjusted returns. We’ve seen pricing become competitive enough in the U.S. that it makes us somewhat more cautious here.

David Henry: The primary focus will be redevelopment, where we’re taking some of our older properties and renovating and expanding them. With 850 properties, we’ve got a good inventory, and now that rents and tenant interest have come back, it’s a good time to do these projects because the economics make sense.

A second area we’ll continue to focus on is selling some of our secondary locations and assets. It’s a wonderful time to sell, even for secondary assets.

Lauralee Martin: The main focus is always growth for our shareholders and quality growth that can translate into dividend growth. Starting the year, we’re looking at a high single-digit growth for shareholders—again, of a very quality nature that produces cash for dividends. Going into 2015, we think we’re strongly positioned and we need to seek to enhance that.

Tim Naughton: Our first priority is really maximizing and optimizing performance on the existing portfolio where we get most of our revenue and funds from operations [FFO].

Second, we’re very active in development. We expect to deliver around 4,000 new units in 2015. We’re able to deliver those at initial yields that are 200 to 300 basis points above our cost of capital, so getting those leased up and delivered is a big priority.

Other priorities include continuing to refine our product offerings to the market and deploying our consumer-facing technology systems.

Denny Oklak: We continue to downsize the suburban office piece of our business, and now is a good time to do that. Disposing of non-strategic properties is going to be our number one objective for the next year. We do a lot of development, particularly on the industrial and medical office side, so that will be another major focus, as well as taking advantage of the capital markets to build our balance sheet.

REIT: How does that focus fit in with the broader trends you anticipate for your sector?

Henry: Unfortunately, everyone’s got the same strategy right now. You’re selling your bottom-tier assets and selectively buying higher-quality properties in primary markets. If you’re public, that’s what the investors want. Although there’s a little bit of ground-up development occurring, it’s still very limited. Most of the big companies’ capital is going into redevelopment. It’s very competitive in terms of buying properties–the “A” properties are extremely hard to purchase and in fierce demand.

Oklak: Most of the markets are not getting overbuilt. E-commerce continues to grow, which really benefits the warehouse business.

Overall, we think that the industrial business is going to be very strong through 2015.

Bond: Improving secondary markets in the U.S. are certainly helping on the capital-recycling side. That’s letting us achieve attractive pricing on our dispositions.

In 2015, we expect the cost of capital to remain an important issue in the sector. Flows into the broader REIT market have been volatile for much of this year, but recently it looks like this has tilted to the benefit of REITs generally–and it’s benefitted the net lease sector in particular. That helps in the short run by extending the rally or reviving an interest rate-based rally, but we’re also looking forward to the time when net lease REITs are less connected in the mind of the average investor with interest rates.

Naughton: While supply is leveling off, there is more competition as it relates to newer product coming online. Our focus on product development and refining the brands is really aimed at trying to provide more targeted offerings to different customer segments to hopefully stand apart from the crowd.

REIT: How do private real estate players factor into your forecast?

Bond: Private investors like the stability, the cash flow and the rising income stream that are inherent in these net lease structures, so that is factoring into the competition that we’re seeing. It’s not just the [public, non-listed REITs], it’s sovereign wealth funds and other foreign investors and other forms of private capital.

If you start to see the public REITs increasingly trade at wider discounts to net asset value, then you may have some opportunity for smaller public REITs to sell large chunks of themselves to private investors. I don’t think we’re there yet, but that’s a possibility.

Henry: The private real estate players are excellent buyers of some of these secondary locations because they can get cheap financing. The private market is alive and well for the “B” assets. On the A assets that the REITs are buying, there’s tremendous private competition from pension funds and life insurance companies and sovereign wealth funds and others.

Martin: Health care has been an asset class that has offered a higher comparative yield. As a result there’s been more interest in our space. Some of that interest has not necessarily been backed with an understanding of the industry, meaning what is happening with health care reform, what is required to know the quality of operators and how important operators are to the quality of ongoing performance.

Oklak: A lot of our competition on new development comes from private folks. Funding doesn’t seem to be an issue for them, so we expect the private guys to be very competitive on the development side again in 2015.

Clearly, some of the private equity folks have been very active in buying properties in the industrial sector, and I think we’ll continue to see some of those private equity funds be active across the country.

Naughton: Supply is probably the area we’re watching most closely with respect to the private sector. As it relates to ownership, private equity is just not much of a player in multifamily rental.

REIT: How is your company approaching the use of debt financing right now?

Oklak: We are funding a lot of new development and acquisitions with proceeds from our dispositions pipeline, so for us, it’s been about recycling. The good news is that we do have some unsecured debt maturing early in 2015 at a relatively higher interest rate, so I think we’ll be able to take advantage of the markets and lower that interest rate pretty significantly early in the year.

Henry: Generally we issue unsecured bonds and we’re able to do that very cheaply. We have an investment grade-rating.

Rates are low and spreads are low, so it’s a good time to do that.

Bond: We’re committed to reducing our secured indebtedness and shifting toward unsecured corporate level debt. We did obtain an investment-grade rating [in 2014] from both S&P and Moody’s. We issued our first bond offering and that was well received and we expect to continue with that strategy.

We don’t intend to take advantage of the secured debt markets for now.

Martin: We’re proud of our balance sheet. It’s levered at 40 percent debt, 60 percent equity. Because a significant portion of our investments are long-term triple-net leases, we also match that with long-term debt. Most of our debt issuances are 10-year maturities, which matches up and gives protection to our organic growth. We generally do unsecured debt because of our investment-grade balance sheet capabilities.

Naughton: Typically for us, debt to total enterprise value is less than 25 percent and debt to EBITDA is less than five-and-a-half times, which is at the low end of the sector. So, we’ve resisted the temptation to lever up during a period when financing costs are low. We’ve been equitizing more of our business than financing it with debt.

To the extent that we do employ debt, we definitely have a preference going forward on unsecured, since we’re a rated borrower. We inherited a lot of secured debt, and we have an objective to slowly work down that secured debt that we got as part of buying a private company. To the extent we’re using debt, we’re trying to extend maturity.

REIT: What is the most common question or topic you are hearing from your investors or analysts?

Oklak: The question we got pretty much at every meeting at REITWorld 2014 was a supply question. That’s a big concern in the industrial business. All the analysts and investors are wondering what the supply side is like out there today on the industrial side and how that stacks up to what’s going on with the demand side. So far in this recovery, it’s been pretty well-balanced between the new construction versus the demand that’s out there.

Naughton: Probably the question we hear most is “when will you know it’s the right time to cut back on development?” To the extent that we’re conservative and disciplined in terms of how we manage the balance sheet, we can continue to create a lot of value through the development platform over the next few years.

Bond: We do get a lot of questions about how the new FINRA rules will affect the raising of capital in the space.

Another question that’s coming up is our view of Europe. We are still very positive. We underwrite our tenants in Europe to withstand short term swings in cash flow and we generally go with recession-resistant industries, so we’re confident that our tenants will continue to pay rent through the downturn.

Martin: It’s the competitive landscape for investments and how does one find growth in that environment without sacrificing investment returns. We have focused on the strengths of our businesses in order to do that.

Henry: Kimco’s performance is resonating well. We’ve had good performance in terms of our stock. Everybody seems happy with the transformation of the portfolio, people like the redevelopment of the projects we’re doing. In our case, they like that we’ve simplified.

REIT: Five years from now, will we have more or fewer stock exchange-listed REITs in the United States than we do today?

Bond: On balance, I think you’ll have fewer REITs in five years. But between now and then, you’ll have a proliferation of smaller REITs as some non-traded REITs seek liquidity by public listings. Following a life in public, some of those may go private or become consolidated.

Henry: The REIT business model makes a lot of sense and is very sound. REITs are proven and tested through the recession, and as an industry, I expect them to continue to grow.

I see more REITs rather than less, I don’t see a lot of consolidation.

Martin: I think the REIT structure will continue to be used very successfully. That being said, REITs as companies need to have a differentiation so that they are the choice of investors. I think there’ll be REITs that have difficulty finding their differentiation and may consolidate. At the same time, I think there will be new REITs that will be formed that offset some of that consolidation.

Naughton: I think it will probably be about the same. There will be some structural issues that will drive consolidation and mergers and acquisitions over the next five years, but there will be some new sectors that start to gain traction that hadn’t traditionally been thought of as part of the REIT world over the last few years.

There’ll be more sectors, but fewer companies per sector.

Oklak: We’ll have more listed REITs in five years than we have today. If you look back over the last 20 years or so, REITs have really been one of the best performing sectors of really all the asset classes out there that people invest in.

Also, today, REITs own a relatively small percentage of all the commercial real estate that’s out there, so there’s definitely opportunity for growth and there’s opportunity for new players to come in and take advantage of the public REIT market.

CEO Spotlights

A sampling of additional CEO insights garnered from video interviews conducted at REITWorld 2014. Visit REIT.com/news/videos to view the full interviews.

How do you see the transactions market playing out in the multifamily sector in 2015?

Eric Bolton, MAA: “We are actually seeing much more product being brought to market and believe that our acquisition environment will be more robust in 2015 than it was in 2014.”

What’s your sense of demand for hotel space in the U.S. gateway cities?

Jon Bortz, Pebblebrook Hotel Trust: “The gateway cities are very strong, and they look to get stronger on an ongoing basis.”

What changes are you seeing in the self storage market?

Christopher Marr, CubeSmart: “Our consumer continues to find innovative ways to use our product that we never would have thought of before.”

Three to five years from now, what is the retail real estate business going to look like?

Sandeep Mathrani, GGP: “There were bazaars in 600 B.C., and there will be bazaars 600 years after I die. I actually don’t think it will be much different.”

How is the likelihood of rising interest rates affecting your planning for 2015?

W. Edward Walter, Host Hotels & Resorts : “Assuming that the higher interest rates are driven by better economic activity, that bodes well for our business because that probably means more travel and better rates.”

What stands out as the biggest potential game changer for the office sector in 2015?

Roger Waesche Jr., Corporate Office Properties Trust: “We do think, based on our view of the market, that job growth is finally getting some traction. I think the positive surprise could actually be that the economy is going to do better.”