Gaming REITs are in the early stages of what is expected to be a lengthy period of heightened investor interest.

Last fall’s proposed sale of the iconic Bellagio resort in Las Vegas to Blackstone Real Estate Income Trust (BREIT) is seen by many as a potential harbinger of even more high-stakes deals in the gaming real estate arena, and confirmation of the growing institutionalization of this niche REIT segment.

“Validation drives valuation.” That’s how Ed Pitoniak, CEO of gaming REIT VICI Properties Inc. (NYSE: VICI), describes the increasing interest in the gaming real estate sector.

In October 2019, Las Vegas-based MGM Resorts International entered a joint venture with BREIT for the purchase of the Bellagio property. Under the new partnership, the joint venture will own the Bellagio’s real estate assets and leases them back to an MGM Resorts subsidiary for initial annual rent of $245 million. In exchange, MGM Resorts receives a 5% equity stake in the joint venture and about $4.2 billion in cash. MGM Resorts is a tenant of gaming REIT MGM Growth Properties LLC (NYSE: MGP).

James Stewart, CEO of MGM Growth Properties, says the Bellagio deal—conducted at a 5.7% cap rate—is “very significant” because it marks the first time the public has had any real insight into the level of institutional interest in the gaming real estate sector.

“The multiple that Blackstone paid to get into the space was the highest ever paid” for any gaming real estate asset, he notes. “I couldn’t be more pleased with the transaction because it shines a light on the asset quality of the space and our own assets, which I think will prove to be very beneficial.”

Pitoniak says gaming real estate assets constitute “fundamentally very good real estate that’s obtainable at very, very good values in relation to other sectors.”

Room for Growth

REIT executives and industry observers believe there’s more room for growth in the gaming real estate sector, particularly considering that the three leading REITs in the space MGM Growth Properties, VICI, and Gaming and Leisure Properties, Inc. (Nasdaq: GLPI)) own only about 35% of commercial gaming assets in the U.S., according to John DeCree, equity research analyst at Union Gaming Group LLC, an investment bank that serves the gaming sector.

“REITs in the gaming space are still relatively new. The space has been very active from an M&A perspective,” DeCree says, “but we are still in the early days of valuation discovery and investor education about casinos as a real estate asset class.”

MGM’s Stewart agrees. “We’re really in the first half of the first inning of institutionalization, but it’s coming, and I think the Blackstone transaction is the public’s first view of that occurring.”

Penn National Gaming is credited with launching the gaming REIT sector in 2013 with the spinoff of its real estate assets into Gaming and Leisure Properties, Inc. In 2016, it became the first publicly traded gaming REIT in North America. The Wyomissing, Pennsylvania-based company holds interests in 44 gaming facilities in the U.S., with 33 of those operated by Penn National.

Next to enter the sector was MGM Growth Properties, a 2016 REIT created by MGM Resorts International. At the outset, MGM Resorts contributed 10 of its real estate assets to the publicly traded REIT, including seven in Las Vegas, and retained an 80% interest. The Las Vegas-based REIT owns 13 gaming and gaming-related properties in the U.S.

The final member of the American gaming REIT trio is VICI, a spinoff of Caesars Entertainment Operating Co., a subsidiary of Caesars Entertainment Corp. that emerged from Chapter 11 bankruptcy protection in October 2017. VICI went public in 2018 as an “experiential” REIT focusing on casinos and other entertainment venues. VICI’s portfolio is comprised of 24 gaming facilities leased to operators like Caesars, Penn National, and Hard Rock International, along with four golf courses and a 34-acre undeveloped plot on the Las Vegas Strip.

For the time being, Gaming and Leisure Properties, MGM Growth Properties, and VICI dominate the gaming real estate domain. However, Blackstone and Kansas City, Missouri-based REIT EPR Properties (NYSE: EPR) have signaled their intent to be players in gaming real estate.

To be sure, Blackstone’s acquisition of the Bellagio—its first acquisition in the gaming sector—has upped the ante for gaming REITs. According to Stewart, the gaming real estate sector could ultimately see $50 billion of transactions. “I’m really confident about the runway we have for growth.”

Indeed, in January 2020 MGM Growth Properties and BREIT said they had agreed to form a new joint venture to acquire the Las Vegas real estate assets of the MGM Grand and Mandalay Bay for $4.6 billion.

It’s Not All About Vegas

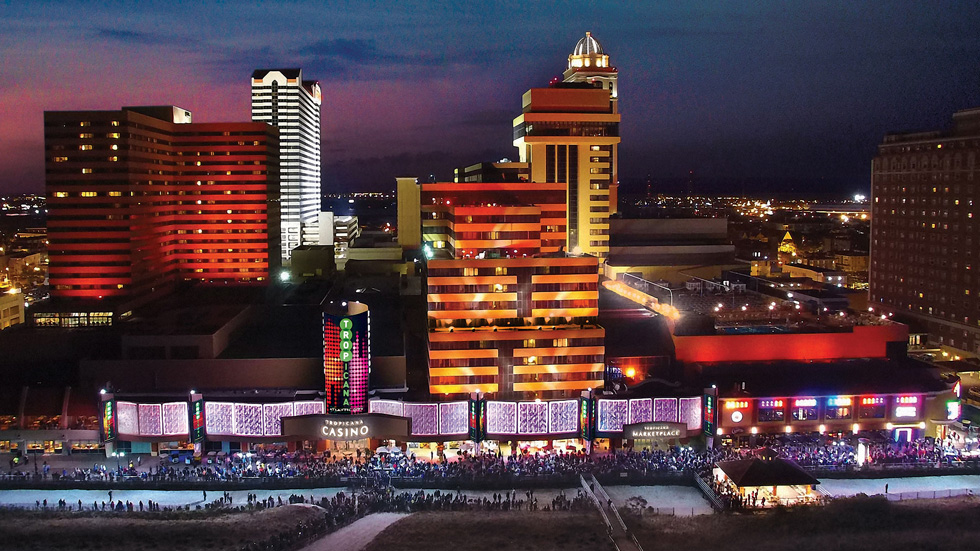

MGM Growth Properties’ portfolio is anchored by casinos on the Vegas Strip, which accounted for nearly $6.6 billion in commercial gaming revenue in 2018, or roughly 15% of the nationwide take. But during a third quarter conference call, Stewart said high-quality gaming assets are “certainly not limited to Strip assets in any way,” citing his REIT’s MGM National Harbor in Baltimore and MGM Grand Detroit as examples.

Michael Parks, senior vice president in the Global Gaming Group at commercial real estate services company CBRE, believes Blackstone’s purchase of the Bellagio underscores the “trophy status” of the Strip property, but he doesn’t think Blackstone will compete with the gaming REITs for regional casino properties or non-trophy assets.

From Pitoniak’s perspective, that gives VICI and his two publicly held REIT peers a competitive advantage. That’s because a big chunk of U.S. gaming revenue comes from regional casinos, as opposed to Las Vegas or tribal casinos, he says. Roughly $4 billion in gaming rent remains up for grabs in the U.S. commercial casino industry, according to Pitoniak.

“There’s a whole lot of economic activity in American gaming that takes place outside of Las Vegas, and it’s got characteristics that we really like because it’s actually even more recession-resistant than Las Vegas gaming,” Pitoniak says.

That philosophy underpinned VICI’s agreement in October 2019 to execute a $843.3 million sale-leaseback deal for the JACK Cleveland Casino, located in downtown Cleveland, and the JACK Thistledown Racino, located in the Cleveland suburb of North Randall, at an implied cap rate of 7.8%. Detroit-based JACK Entertainment LLC operates both facilities.

Matthew Demchyk, senior vice president of investments at Gaming and Leisure Properties, notes that non-trophy properties away from the Vegas Strip make up his REIT’s entire portfolio. “Our assets are really corner stores. They’re convenience-driven,” he says.

As industry observers await Blackstone’s next move in gaming real estate, they’re also keeping an eye on EPR Properties. In November 2019, EPR said it was selling most of its charter school portfolio for approximately $454 million and planned to rapidly redeploy the proceeds to fund investments in experiential real estate, including potential casino resort investments.

In May 2019, the REIT added longtime gaming executive Virginia Shanks to its board. Shanks is a strategic adviser for Penn National and was executive vice president and chief administrative officer of Las Vegas-based Pinnacle Entertainment Inc. before its merger with Penn National. EPR says it expects its primary casino resort and hotel investments will consist of premier assets in major gaming markets, including Las Vegas and dynamic regional markets.

Pitoniak says EPR’s management team “is very smart in its current real estate investment strategies, and their interest in our sector is, we believe, an endorsement of our sector, much as Blackstone’s purchase of the Bellagio real estate was a validation of our sector.”

Expanding Universe

DeCree at Union Gaming Group says that the continuing nationwide expansion of the gaming business enlarges the universe for acquirers of gaming properties. He cites the opening in June of the $2.6 billion, 33-acre Encore Boston Harbor casino resort; the planned addition of up to six new casinos in Illinois; and the possibility of three full-fledged casinos opening in the New York metro area.

Meanwhile, Demchyk doesn’t discount the idea of Gaming and Leisure Properties casting its net in Canada, where rigorous casino licensing and regulation mirrors the U.S. system.

Furthermore, CBRE’s Parks says, the prospect of smaller regional operators monetizing their assets, as some public companies have done, or consolidating among themselves bodes well for growth in gaming real estate. DeCree notes, however, that many casino operators remain uncertain about whether to sell their underlying real estate.

Demchyk doubts that other pure-play gaming REITs might emerge, given that the IRS banned tax-free REIT spinoffs in 2016. However, he does foresee real estate investors—possibly entering the gaming sector through joint ventures or direct investments in the gaming REITs.

Additionally, DeCree doesn’t envision near-term consolidation among the three gaming REITs.

“At this point, we believe the opportunity for growth is so significant that there is no need for horizontal integration just yet. Over time, as the sector matures, it might make sense to see some consolidation in the gaming REIT space,” he says. “But right now, we see plenty of opportunity for all three gaming REITs, plus some opportunity for non-gaming-dedicated REITs such as Blackstone.”