Everyone knows the three most important things in real estate: location, location, location.

When people move locations, however, they often need to store their belongings, sometimes for a few months, and sometimes longer. The pandemic has led many people to move and others to downsize, and as a result, self-storage REITs have been one of the sectors that has been recession-resistant during the pandemic.

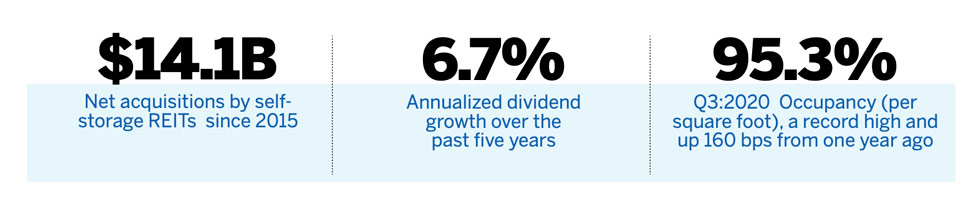

Increased needs for storage during the pandemic helped push occupancy rates for self-storage REITs to a record high of 95.3% in the third quarter of 2020, an increase of 160 basis points from one year ago. Operators have implemented contactless rental programs to improve customer safety during the pandemic.

Even before the pandemic began, REITs have been helping drive consolidation of a self-storage industry that had previously been fragmented among many small owners. REITs provide secure, climate-controlled locations for storage for households and businesses. REITs use technology to increase market penetration through search engine optimization, digital marketing, and call centers.

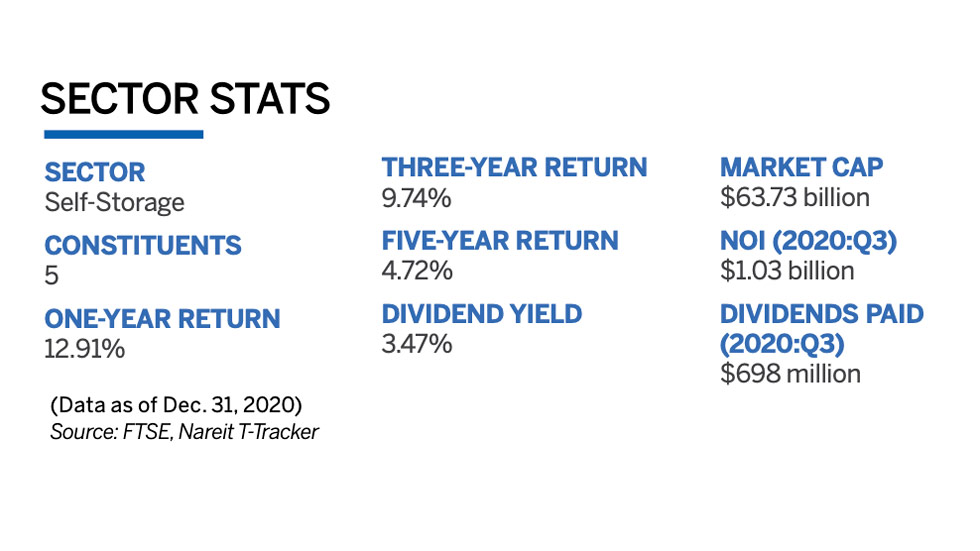

Self-storage REITs provide an attractive investment, with geographically diversified property holdings as well as third-party management of facilities owned by other investors. Self-storage is one of the few REIT sectors with positive investment returns in 2020, with total return of 12.91% for the full year to Dec. 31.