Canada’s REIT industry celebrates a quarter century.

Twenty-five years after the first REITs emerged as a solution to the collapse of Canada’s real estate market, the country’s REIT industry continues to evolve as new investment opportunities emerge.

Two recent deals highlight that evolution. A union completed in May created Canada's largest diversified REIT with an enterprise value of about C$16 billion ($12.5 billion). Choice Properties Real Estate Investment Trust (TSX:CHP.UN), the real estate arm of the country’s top retailer, Loblaw Companies, Ltd., purchased Canadian Real Estate Investment Trust (TSX:REF.UN). In January, meanwhile, a Blackstone group affiliate agreed to purchase Pure Industrial Real Estate Trust (TSX:AAR.UN) in a deal valued at C$3.8 billion ($3 billion).

Canada’s REIT industry has come a long way in a relatively short time. In 1996, there were five publicly traded REITs on the Toronto Stock Exchange. Today, there are 38, according to REALpac, a Canadian real estate industry trade group that has 96 members comprised of both REITs and pension funds, lenders, banks, and brokerages.

Unlike their REIT counterparts in the United States, which were created by Congress in 1960, Canadian REITs didn’t exist until 1993.

In the wake of a crippling economic downturn, Canada’s “open-end” real estate mutual funds found themselves facing a rush of investors who were cashing in their units, or shares. To finance the redemptions, mutual funds were forced to sell their properties in a depressed market, often below appraised values. Ultimately, the mutual funds got permission from Canadian regulators to suspend redemptions and evaluate other options.

That’s when the Canadian government amended finance legislation to create a new generation of “closed-end” real estate-focused funds that didn’t have redemption rights. Instead, those vehicles could be publicly traded, giving investors an alternative source of liquidity.

That’s when the Canadian government amended finance legislation to create a new generation of “closed-end” real estate-focused funds that didn’t have redemption rights. Instead, those vehicles could be publicly traded, giving investors an alternative source of liquidity.

“That was the genesis of our industry. It came out of a crisis,” says Michael Brooks, CEO of REALPAC, which backed the legislation that ultimately led to the creation of Canada’s REITs.

Bumpy Early Ride

In the early days, Canada’s REITs had an unsteady ride. From 1998 to 2000, as technology stocks took center stage, Canada’s REITs traded at a discount. Then, the tech bubble burst, leaving investors scouring for companies with assets that were tangible. That led Canada’s investors to REITs. Since then, REITs have taken off, becoming a widely accepted investment vehicle in Canada.

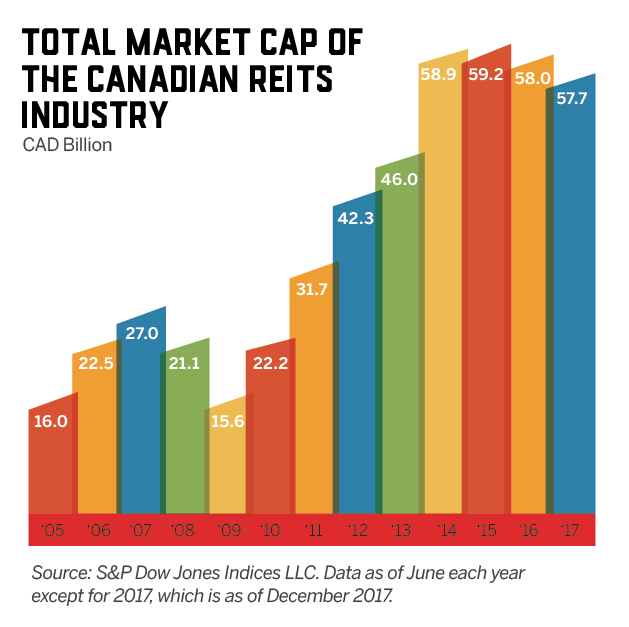

As the real estate industry has evolved, the Canadian REIT industry’s total market capitalization has risen, from about C$16 billion ($12.5 billion) in 2005 to hover just shy of C$60 billion ($46.8 billion) for the past four years, according to statistics from S&P Dow Jones Indices LLC that were released in March.

After peaking at C$59.2 billion ($46.2 billion) in 2015, the total market capitalization of Canada’s publicly traded REITs dipped to C$58 billion ($45.3 billion) in 2016 and fell again, to C$57.7 billion ($45 billion), last year, according to S&P Dow Jones. Meanwhile, the TSX-REIT aggregate market cap is expected to fall about

5 percent to 6 percent in the second quarter as consolidation removes some players from the public market, according to RBC Capital Markets in its April industry report.

“I think that there is a lot of good growth within the existing Canadian REITs. I just think we’re in a slow growth phase. If you talk to the CEOs, they’ll tell you about their development pipeline and how much extra land they’ve got and how rents are going up in almost every asset class. So, I think there will be internal growth to reverse the trend,” Brooks says.

Looking at a longer timeline, Canada’s REITs have outperformed both the equities and fixed income asset classes on an annualized return basis during the 20-year period from July 1996 to December 2017, S&P Dow Jones points out.

“Despite higher returns, the risk over the test period was similar to that of equities,” according to Smita Chirputkar, S&P Dow Jones director, global research and design.

“Despite higher returns, the risk over the test period was similar to that of equities,” according to Smita Chirputkar, S&P Dow Jones director, global research and design.

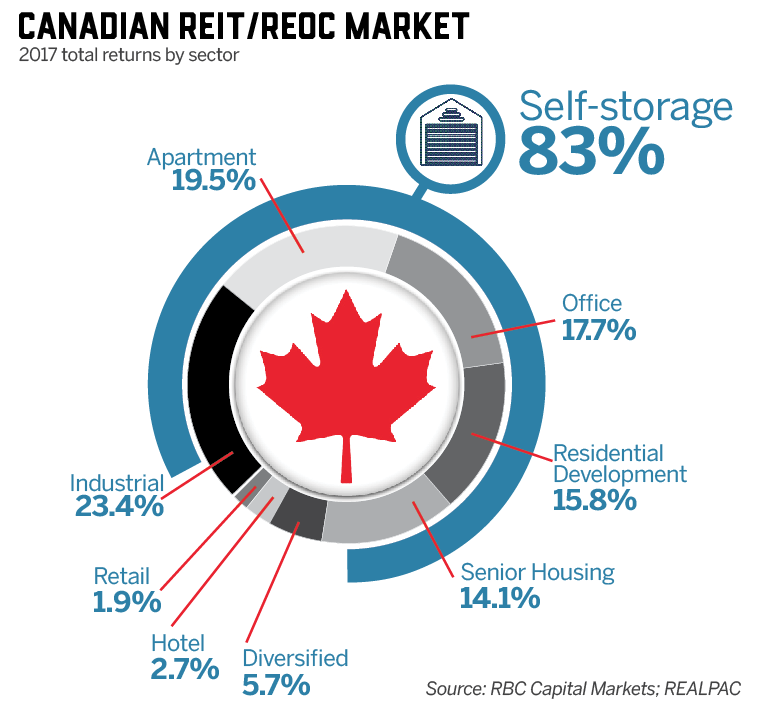

In 2017, the S&P/TSX Canadian Real Estate Index delivered a total return of 11.2 percent, outperforming the S&P/TSX Composite Index at 9.1 percent and Government of Canada 10-year bonds, which dropped 0.01 percent, according to a January report from GMP Equity Research. During that period, Canada’s REITs also outperformed REITs trading in the U.S., Europe and Asia, the company said.

Similarities and Differences

REITs in Canada bear many similarities to their counterparts in the U.S. They are required to distribute all their earnings to unit holders to not be subject to corporate-level tax, rather than plow profits back into the business. That means that REIT executives might think twice about “aggressively bidding on certain types of assets that have a much lower yield,” Brooks says.

Bob Dhillon, founder and CEO of the publicly held Calgary-based Mainstreet Equity Corp., highlights the similarities between Canadian REITs and their southern neighbors: “Our real estate looks the same, our legal system is all the same. There’s a lot of cross-over from investments, cross-over from banking and interest rates are usually in sync. If the U.S. booms, we do well. If the U.S. gets a cold, we catch pneumonia.”

There are also plenty of differences, however, particularly when it comes to specialization. REITs in the U.S. “have a lot of these niche property types, like student housing and self-storage and data centers. They’ve burgeoned significantly the last several years,” says Paul Meierdierck, who covers Canada’s listed equity REIT market with LaSalle Investment Management Securities in Baltimore.

But, Meierdierck says, due to Canada’s smaller population, specialized REITs there “haven’t taken off to the same degree. The evolution has actually gone the other way, toward…more diversified property holdings, but concentrating more in desirable markets.”

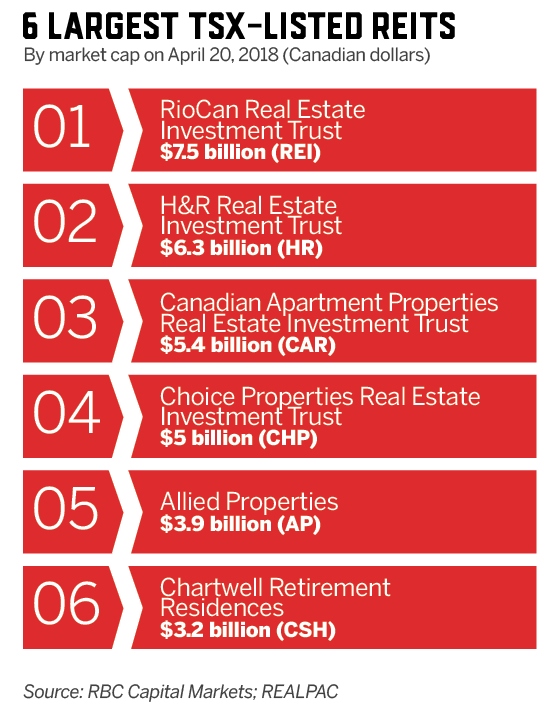

Toronto-based RioCan Real Estate Investment Trust (TSX:REI.UN), the country’s major shopping mall owner, clearly exemplifies the diversification trend. Right now, retail holdings comprise the majority of RioCan’s income, and that sector “is doing extremely well,” CEO Edward Sonshine told investors during the company’s second-quarter earnings call. The company has embarked on a strategy that includes selling holdings in smaller markets in favor of fortifying its presence in Canada’s major cities.

Toronto-based RioCan Real Estate Investment Trust (TSX:REI.UN), the country’s major shopping mall owner, clearly exemplifies the diversification trend. Right now, retail holdings comprise the majority of RioCan’s income, and that sector “is doing extremely well,” CEO Edward Sonshine told investors during the company’s second-quarter earnings call. The company has embarked on a strategy that includes selling holdings in smaller markets in favor of fortifying its presence in Canada’s major cities.

Yet RioCan is also pushing into the residential market as some of its retail tenants have struggled or closed, including Sears Canada. The REIT is now developing its first condos and apartments, which are located near its retail centers or along prominent transit lines in Toronto, Ottawa and Calgary.

Looking to Grow

While Canada’s REIT industry has made great strides, challenges persist. “I think the main concern is how to grow, how to find accretive purchases, when their unit yields are now trading fairly high. In a competitive market and with a high yield, some of the Canadian REITs find that they’re uncompetitive,” Brooks says.

Another issue nagging the industry is the likelihood that interest rates will rise. “The specter of higher interest rates may spook some investors into sitting on the sidelines, versus holding REIT stock, thinking that the REIT stock will go down if interest rates go up. I think that’s an issue on both sides of the border,” Brooks observes.

Recent Canada REIT Merger & Acquisition Activity

February 2018

Canadian Real Estate Investment Trust agreed to be purchased by Choice Properties Real Estate Investment Trust, the real estate arm of Loblaw Companies Limited. The transaction adds more industrial and office space to Choice Properties’ heavily retail portfolio.

January 2018

Vancouver, Canada-based Pure Industrial Real Estate Trust acquired by New York City-based Blackstone Property Partners, a major privately-held real estate investment company whose holdings include Hilton Worldwide. The deal was valued at $3.8 billion.

October 2017

OneREIT acquired by SmartCentres REIT and Strathallen Acquisitions Inc.

June 2017

Brookfield Property Partners L.P. bought the 15.9 million units it did not already own of Brookfield Canada Office Properties. The transaction now gives Brookfield Property Partners full ownership of the company.

April 2017

Milestone Apartments REIT approved being taken over by Starwood Capital Group, a U.S.-based private investment firm.