Few sectors demonstrate the adage that “commercial real estate houses the economy” as clearly as industrial REITs. As the evolution of the U.S. economy to a more digital platform has accelerated over the past half-decade, industrial REITs have been transformed as well.

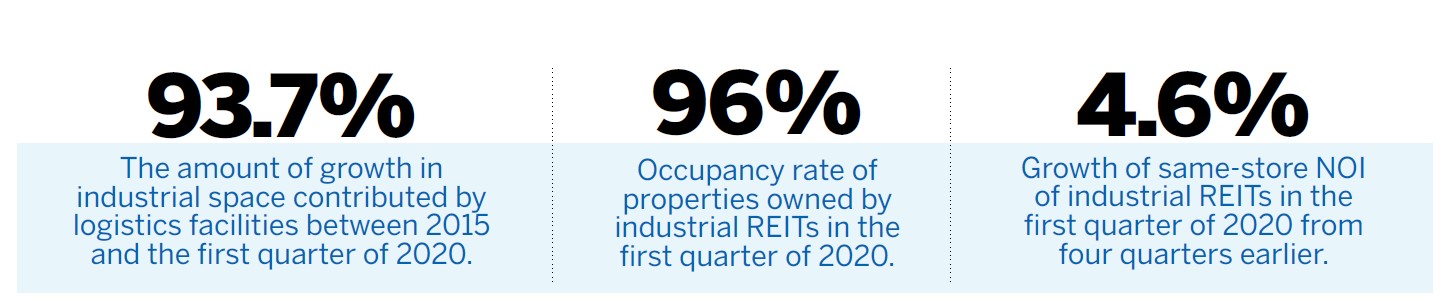

Industrial REITs have grown rapidly as demand for logistics facilities, used in shipment of goods bought on the internet, has exploded. Logistics facilities account for two-thirds of all industrial space, the rest being flex and specialized space, according to data from CoStar. As ecommerce accelerated since 2015, 93.7% of the growth of all industrial space has been from logistics facilities.

Industrial REITs are an important part of this growing logistics market, and have increased their property holdings by 57.7% since 2015, according to the Nareit T-Tracker®. The rapid growth of this market was barely able to keep pace with demand, and occupancy rates have remained quite high.

The shutdown of broad parts of the economy during the COVID-19 pandemic has impacted nearly every aspect of American life. Shoppers avoid in-store purchases under social distancing guidelines, leading to a surge in online sales. And since commercial real estate houses the economy, industrial REITs are facing solid demand for logistics facilities to ship those goods to consumers.