The timberlands REIT sector highlights several key attributes of the REIT structure for income-producing real estate: a long-term focus, the flexible application of the REIT business model to a diverse range of property types, and an innate understanding of the need for sustainable management.

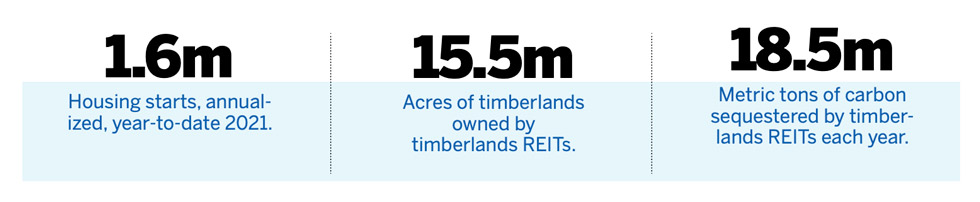

Timberlands REITs own and manage millions of acres of timberlands, generating income from timber and wood products. Timberlands require careful management of yields for long-term performance over the timber lifecycle.

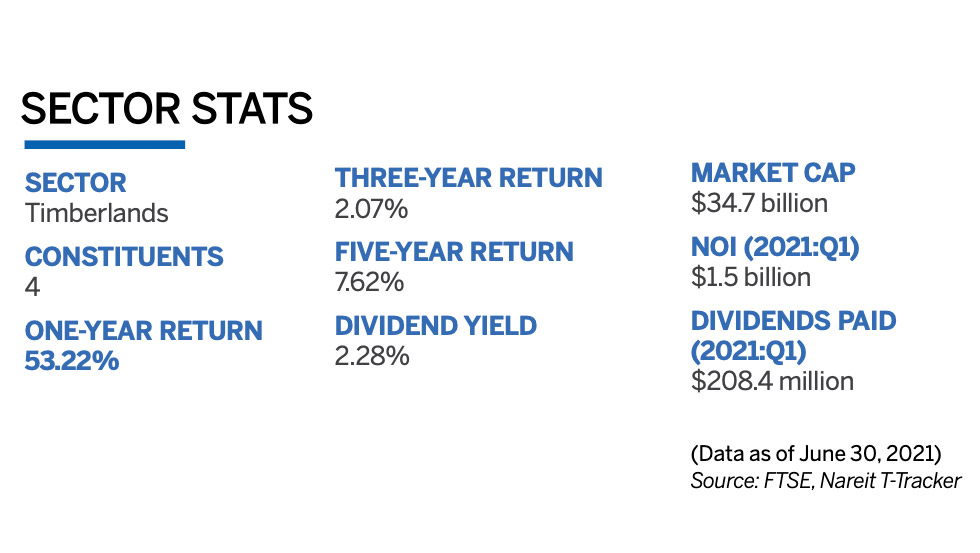

The economic drivers of timber are strongly linked to housing markets. Demand for housing has surged during the pandemic, helping lift the stock market total return of timberlands REITs to among the strongest-performing property sectors.

It is well known that holding REITs can reduce investor risk by improving portfolio diversification; including timberlands REITs in the portfolio can yield even greater diversification.

A business model focused on the long-term health of a forest has a natural interest in environmentally sustainable management practices.

Timberlands REITs place a high priority on clean water, clean air, and biodiversity in the timberlands they own and manage. Biodiversity can help reduce risks of fires, an increasing concern in warmer and drier climates.