REITs prep for the SEC’s proposed climate risk reporting rules.

REITs that have been moving down the path of decarbonization and gathering information to assess climate-related portfolio risk have a running start to comply with potential changes ahead in the reporting and compliance landscape. Others that have been slow to start might need to scramble to catch up.

In March, the Securities and Exchange Commission (SEC) released its proposed Enhancement and Standardization of Climate-Related Disclosures for Investors. If finalized, it would become the first rule requiring all companies registered with the SEC to report, measure, and quantify material risks related to climate change in their registration statements and periodic filings.

Specifically, the rule addresses reporting on Scope 1, Scope 2, and Scope 3 emissions, as well as exposure to physical risks to assets and operations from climate-related events and transition risk related to compliance with federal, state, and local climate laws.

However, the final rule likely will be challenged in court as an overreach of the SEC’s regulatory authority and possibly on constitutional grounds, and it is quite possible that Congress might seek to change or overturn a final rule if Republicans win majorities of the House of Representatives and the Senate in the November elections.

“What the SEC has put forward sends a really strong message to companies about the importance of measurement, verification, and transparency around greenhouse gas emissions,” says Sarah King, senior vice president, sustainability at Kilroy Realty Corp. (NYSE: KRC). “For a long time we’ve thought that voluntary action from industry leaders will help solve the climate problem, and I think we can all agree that voluntary action alone won’t get society where we need to be fast enough. So, it is really impactful that the SEC has weighed in with such a comprehensive proposal,” she says.

Lack of standardization has been a common frustration for both REITs and investors. In addition, voluntary sustainability and ESG reporting have become increasingly complex over the past decade with multiple disclosure and guidance frameworks such as CDP, GRESB, GRI, and the Task Force on Climate-related Financial Disclosures (TCFD). The various reporting platforms all request ESG data and narratives in slightly different ways. There also is room for interpretation from the investors and other stakeholders using the data from those frameworks to inform their decisions and engagement with companies, King notes.

Adapting to new SEC rules is rarely easy, and in this case, there are concerns about the resources companies will need to allocate in order to comply, with the heavy lifting ahead for some companies in a relatively short timeline. As currently written, compliance would start in 2024 (FY 2023) for the largest SEC registrants (market cap of $700 million or more), with a gradual phase-in for smaller companies.

REITs represent property sectors with different types of tenants, lease structures, and operating models, and not everyone has the same access to data, notes Fulya Kocak, LEED Fellow, senior vice president, ESG issues at Nareit. “The conversations that we’re having with REIT industry participants are around how can these disclosures be done in an effective way; how can challenges be handled; and how can we make it consistent based on all of these differentiating factors,” she says.

Unpacking the Proposed Rules

It remains to be seen what, if any, changes or modifications to the proposed SEC rules might occur following the public comment period, which closed on June 17. However, the REIT industry has been busy working to better understand details and developing strategies for compliance.

Indeed, on June 17 Nareit submitted comments to the SEC on the proposal, reflecting the key concerns of its members, noted Victoria Rostow, senior vice president & deputy general counsel at Nareit. She said that those concerns include the view that the proposal is a “highly prescriptive ‘one size-fits all’ approach” that would require REITs and other registrants to disclose information that could not be useful and/or could be confusing to their investors.

Rostow pointed out that other issues raised by Nareit include the need for increased liability protections, the need for more flexible timing and better mechanics for reporting, the need to lower the cost and burdens of compliance, and the desire for extended phase-in periods.

Nareit is also requesting that Scope 3 disclosures be voluntary, while reiterating its long-standing view that REITs and other landlords should only be required to report on climate data arising from operations under their direct and immediate control and that REITs and other landlords should not be required, as a default, to report on their tenants’ emissions.

If the proposed rules around Scope 3 reporting move forward in their present form, there will need to be more conversations around how Scope 3 is defined and how data is accessed, Kocak adds. For example, there are bigger barriers to data acquisition with respect to assets with long-term triple net lease structures. “Because that data is not always easily accessible, or may not be accessible at all, there will have to be a lot of engagement with tenants,” she says. Introducing green leases is a solution, but some assets have long-term existing leases in place that will take time to transition.

A second issue is how to report on physical and transition risk when the methodologies for doing so are not standardized, while a third issue centers around the timing of reporting.

Typically, financials come out before most companies finish finalizing climate-related data for the year. As currently written, the SEC would require “limited assurance” on Scope 1 and 2 emissions in the first two years of compliance and then “reasonable assurance” thereafter. Some companies are wary that there isn’t sufficient time to both collect the data and complete the third-party assurance process so that the data can be included within the 10-K document. Most REITs are reporting on dozens, if not hundreds, of assets. So, it is a large undertaking to manage all of that data, and there can also be a lag in collecting data, King notes.

A fourth issue is how to encourage the use of standardized tools, such as the EPA’s EnergyStar Portfolio Manager and Green Button, and whether using those tools could get some sort of benefit or safe harbor.

“For the industry, two key challenges to standardized ESG reporting include Scope 3 data availability and the need for context across key metrics. We support efforts that improve the rigor of ESG reporting and provide quality and comparable data to investors and other stakeholders, complemented with industry and company-specific context,” says Suzanne Fallender, vice president, global ESG at Prologis, Inc. (NYSE: PLD).

Prologis has a long-standing commitment to ESG and has been reporting on its ESG performance for more than a decade, including its Scope 1, 2, and 3 emissions. “We are committed to providing data that is in context, useful and actionable. This meets the data needs of not only our investors, but also those of our customers as we help them advance their own ESG goals and decarbonization strategies,” she says.

What the SEC has put forward sends a really strong message to companies about the importance of measurement, verification, and transparency around greenhouse gas emissions. For a long time we’ve thought that voluntary action from industry leaders will help solve the climate problem, and I think we can all agree that voluntary action alone won’t get society where we need to be fast enough. So, it is really impactful that the SEC has weighed in with such a comprehensive proposal.

Heavy Lifting Ahead

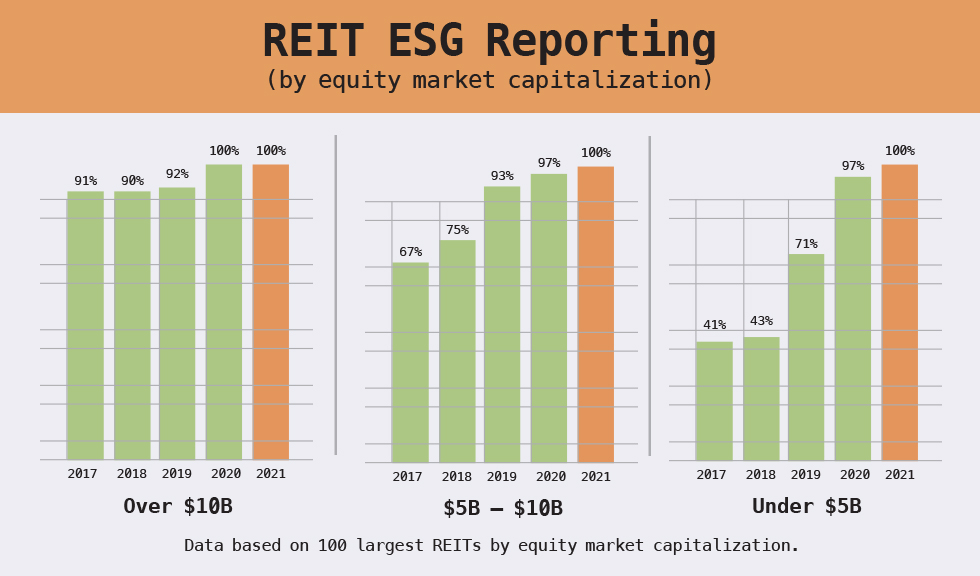

The REIT industry as a whole is exhibiting strong momentum in its voluntary reporting on ESG and climate-related issues. “When you look at the Nareit ESG Dashboard, every single aspect of disclosures we have been tracking is trending in the right direction,” Kocak says.

All of the largest 100 REITs by equity market cap are now reporting their ESG efforts publicly, including on company websites, annual reports, proxy statements and/or stand-alone sustainability reports. In addition, 78% of the 100 largest REITs reported on their carbon emissions in 2021—double the 38% that were reporting on carbon emissions in 2017 .“We definitely see that progress and maturity, but there is still room to grow,” Kocak adds.

Although new reporting rules would be an added catalyst for the REIT industry to focus on critical issues of decarbonization and climate risk, new rules would likely have a varied impact on individual companies with some better positioned than others to comply within proposed timelines.

“Today, everyone is aware and understands that these issues are important for stakeholders. And as it relates to the long-term sustainability of the business itself, these are fairly crucial issues,” Uma Pattarkine, global ESG lead and investment strategy senior analyst at CenterSquare Investment Management, says. “However, it can be somewhat daunting for some of the smaller REITs that don’t necessarily have the resources earmarked for this level of a lift as it relates to collecting asset-level data that will be required as part of these disclosures,” she notes.

Even for those firms that are already reporting on ESG performance, the new rules will require additional work in order to comply. For example, Kilroy published its 11th annual sustainability report in April and is now in its ninth year in securing a third-party limited assurance statement. The company has included Scope 1 and 2 emissions in its 10-K in years prior and the firm works to align its reporting with GRI, TCFD and SASB guidance, as well as reporting to GRESB and CDP.

“I think that does put us a little bit ahead of the curve in that we have existing processes in place for tracking and reporting and managing some of those climate-related risks and opportunities,” King says. “However, when you look at the breadth and the depth and the specificity of the SEC proposed rules, even for companies like Kilroy that is a leader, it is a really heavy lift.”

The SEC rules would require a big increase in the level of data verification on information, and that is where a lot of the additional cost and resources will come into play.

Elena Alschuler, head of Americas Sustainability at LaSalle Investment Management, says LaSalle sees climate risk as relevant to its investment strategy and is already tracking a lot of this information and considering it in its investment process and talking to clients about it, including for its daily NAV REIT. LaSalle reports to GRESB and also is a TCFD signatory. “We see that tracking and reporting of this information as where the world is going, whether that’s voluntarily or through regulation globally. So, we’re focused on doing it in the most cost-effective way possible and making sure it is accurate and easy to implement,” she adds.

Laying the Groundwork

Despite the clear progress the REIT industry is making in voluntary ESG and sustainability reporting, there are still those companies that need to start from “square zero,” collecting and measuring Scope 1 and 2 data at the asset level, Pattarkine says.

“For the companies that have already been tracking a lot of this information for their assets, it’s really just a continuation of the status quo,” she says. “For those who have not, it is going to require a total build-out of the infrastructure that they will need to start collecting and measuring this data.”

Creating that infrastructure involves putting tools and processes in place to capture, measure and monitor Scope 1, 2 and 3 emissions. Companies across the board are now looking more deeply at tools and resources that can help them to do that with greater accuracy and efficiency.

REITs also need to step up their game in “triaging” data to identify what data is missing or incorrect, Alschuler notes. LaSalle uses EnergyStar Portfolio Manager to track energy use and also diagnose where information is missing. Solutions to accessing information include getting a whole building data feed from the utility, installing new meters, or introducing green leases or separate agreements with the tenants to access that information.

REITs will need to start laying the groundwork to tackle the more complex Scope 3 emissions, and industry leaders are providing some best practices. For example, Prologis reports annually on its Scope 3 emissions, using a combination of actual data and estimated emissions based on guidance outlined in GHG reporting standards.

“We recognize that companies in our sector have varying levels of reliance on estimated emissions for Scope 3 reporting,” Fallender says. One such area is tenant energy use, especially for REITs that operate using triple-net leases, where the tenant does not have a legal obligation to share data with the building owner.

“In anticipation of potential regulation and to support our customers’ sustainability goals, we have been working to improve the collection of direct tenant/customer energy data through data requests and meter management agreements,” Fallender says. A second area where Scope 3 emissions data processes are still maturing is embodied carbon, including data related to construction materials and life cycle assessments (LCA), she notes .

REITs also need to make sure the data they’re collecting is being processed and analyzed by the right people. “This has led me to kickstart an effort to deepen engagement between sustainability, finance, accounting, legal, and risk management,” King says. All of those different groups were involved with the review and internal collaboration of information published in the firm’s most recent sustainability report in April. “Having seen the SEC proposal, all of those internal stakeholders will be much more involved,” she says. “So, now is the time to get everyone more deeply fluent in the language of sustainability and carbon.” In addition, sustainability and carbon reporting have grown somewhat parallel, and it also is important to make sure those efforts are synced up and complementary, she adds.

For the industry, two key challenges to standardized ESG reporting include Scope 3 data availability and the need for context across key metrics. We support efforts that improve the rigor of of ESG reporting and provide quality and comparable data to investors and other stakeholders, complemented with industry and company-specific context.

Shift in Reporting

It remains to be seen how the shift from voluntary disclosures to compliance-based disclosures might impact the information that companies are putting out. Voluntary disclosures often dig into the sustainability story and the leadership vision, whereas compliance-based disclosures are likely to be more standardized and prescriptive.

Information that was often being reported on websites and within annual corporate reports or standalone sustainability or corporate reports are now going to appear in financial documents, which are subject to specific controls and audits. So, the liability related to the shift is very different.

“We as investors want our companies to put out the right information. Our big challenge is how to standardize it across region and across sector so that we can compare and contrast the best practices and have a uniform standard. So, initiatives that work towards that are good, but if it starts to get in the way of good disclosure by scaring companies off, that’s a concern,” says Steve Ralff, managing director, Global Securities at LaSalle Investment Management.

“The cost of this also is a concern. We always try to fight against market cap bias where a large cap company has the resources to provide all of the information and a small cap doesn’t. That leaves it to us to figure out whether it is a cost issue or a participation issue,” he says.

Putting this information in financial disclosures versus a website or CSR likely means that information will be held to a higher standard. “It gives investors a lot more confidence in the data we’re looking at, because we know these data points are going through the same level of audit and assurance process as the rest of their financial data,” Pattarkine says. Generally, what investors want is to know that the data and information they’re looking at to make investment decisions is being verified and assured by a third party. “So, putting this information into official SEC filings is going to give investors that additional level of confidence that we’re looking at the best data,” she says.