REIT magazine asked a range of analysts to assess current conditions and offer insight into how the rest of 2022 could shape up.

Following a particularly strong performance in 2021, the signs are pointing to a solid year for REITs in 2022—supported by further improvement in overall economic conditions, a favorable financial market environment, and steps taken across the industry to adapt and prepare for changing market circumstances.

“The REIT sector should continue to benefit from improved economic growth leading to better demand for space, increasing market rents, and continued robust private market activity—all backed by continued supportive fiscal and monetary policies,” says Michael Bilerman, managing director and head of the real estate and lodging research team at Citi.

In terms of driving outperformance within REITs, property sector and stock selection will continue to be important alpha generators over the next 12 months, Bilerman says.

To help gauge prospects across key segments of the industry, REIT magazine asked a range of analysts to assess current conditions and offer insight into how the rest of 2022 could shape up.

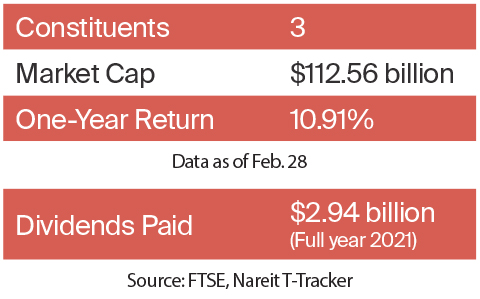

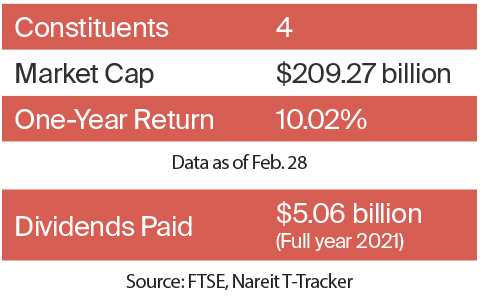

Data Centers

Sami Badri

Senior Analyst

Credit Suisse Securities (USA) LLC

“Our reservations on the data center group hinge on two pain points: limited pricing power, the ability to increase lease pricing or renewal pricing higher than prior years to grow sales ahead of expectations; and, margin pressures that have been digesting tough comparisons, elevated labor/power costs, and the return of sales and marketing expenses.

The results of these dynamics are slower per share growth metrics in 2022, and we believe the combination of elevated investor expectations on the back of strong cloud/enterprise activity and slowing metrics make the data center group’s premium valuations difficult to justify. Further, the rising interest rate environment puts even more pressure on group multiples. For these reasons, we are neutral on the large cap data center operators.

Capital inflows have been relatively robust into the data center space over the past couple of years, but especially in 2021. The infusion of deep pockets from private equity (PE) could have an adverse effect on pricing and renewal rates as PE owners look to take market share.”

(Badri’s quotes are from a recent Credit Suisse Analyst report.)

Nate Crossett

Equity Research Analyst

Berenberg Capital Markets

“Overall we would describe the outlook for 2022 as net positive as the current fundamentals in terms of secular demand drivers remain very strong. We continue to see enterprises shift their IT deployments to third-party data center operators, and continue to see the hyperscale companies spend large amounts of capex to expand their offerings around the globe. In terms of headwinds, we will be watching operating costs of the data center operators closely, as this will impact margins.

The ability to push rental rates in response to higher expenses will be of particular focus, especially given the fact that the amount of private capital within the data center space (or competition for public REITs) remains robust. Interest rates will also be a focus, as the relatively longer duration leases within the data center space tend to make this subsector more sensitive to interest rate moves.

On balance, we view the recent pull-back as an opportune time to invest, particularly for longer term investors.”

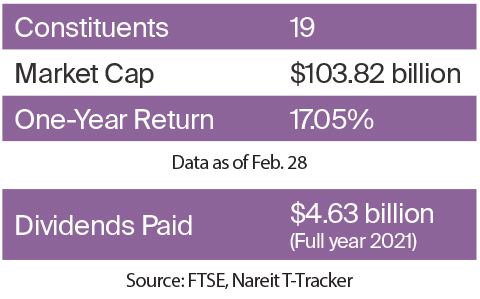

Health Care

Nick Joseph

Equity Research Senior Analyst

Citi

“The health care REIT sector is made up of a handful of major subsectors—including senior housing, skilled nursing, medical office, and life science—with each having a unique fundamental backdrop, catalysts, and risks. Across all the subsectors, long-term demand for health care related real estate is supported by positive demographic trends, mainly the aging of the U.S. population. Near term, COVID and the economic environment continue to affect each subsector differently.

For senior housing, we expect improving results in 2022 driven by increasing occupancy and solid rate growth benefiting the top line. Partially offsetting this is expected elevated expenses primarily driven by labor costs. For skilled nursing, COVID and staffing concerns are near-term risks. Government support has been sufficient to keep most operators liquid, but there are some operator-specific issues arising, and the timing of the occupancy recovery will be important to offset the eventual reduction in government support.

We expect medical office to remain an attractive lower cost and lower acuity setting to deliver health care, which should drive continued demand. We also expect life science operating results to remain strong given a robust leasing environment and to benefit in the long term as the pandemic highlights the need for continued medical research and development.”

Nick Yulico

Managing Director, Head of U.S. REIT Research

Scotiabank

“Fundamentals remain impacted by COVID-19 in the senior housing and skilled nursing sectors. While demand and occupancy have been better for assisted living/independent living versus skilled nursing, both property types are facing wage pressure due to use of temporary agency labor. Earnings have been far less impacted in medical office, while life science segment trends are very favorable.

The National Investment Center for Seniors Housing & Care’s (NIC) fourth quarter 2021 industry data shows occupancy has recovered by 230 basis points off the 2020 bottom for assisted living/independent living in 2022, now at 81%, while skilled nursing occupancy is up 310 basis points to 77.2%. However, both segments are still below pre-COVID occupancy levels of 87.6% and 86.4% respectively.

Improvements in senior housing occupancy and labor costs will be key metrics to watch in 2022. We expect the first quarter to post seasonally weak occupancy, but estimate 400 basis points of occupancy growth by the end of 2022, as move-in trends accelerate in the spring and summer.

Scotiabank’s proprietary seniors housing survey measures sentiment among prospective assisted living/independent living residents; results have continued to highlight a slower move-in pace due to COVID impacting consumer behavior.”

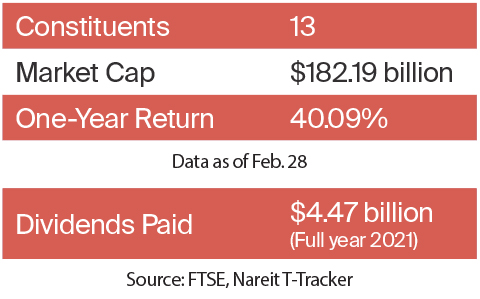

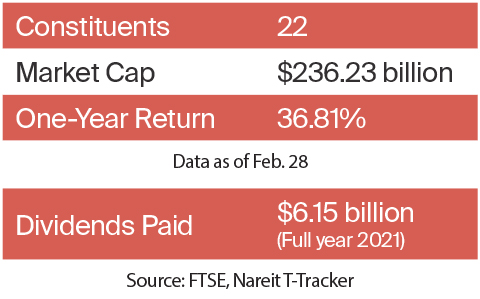

Industrial

John Kim

Analyst

BMO Capital Markets

“Industrial fundamentals are at incredibly strong levels, reflected in their compressed cap rates, with tailwinds apparent over the next few years due to increasing e-commerce adoption, strong demand for consumer goods, and rising inventory levels for tenants. Rent growth was 10%-15% in major markets last year with vacancy rates at its all-time low of 4.2%, despite an uptick in new supply.

The asset class has the additional benefit of requiring lower capex to maintain, and also being at a low price point in the overall logistics supply chain for tenants. Over the next couple of years, we will monitor the supply picture as developers look to address the market with increasing development starts, many on a speculative basis.

With rising interest rates and construction, land, and labor costs, this could compress yields and margins. We will also look to see how the asset class evolves, with multi-story construction likely, increasing use of solar panels to improve sustainability, and conversions from office, retail, and other asset classes into last-mile distribution centers. Finally, we will observe if Amazon and other major retailers and delivery companies decide to own more of their warehouse space, potentially impacting pricing and rents.”

Sheila McGrath

Senior Managing Director

Evercore ISI

“We expect another strong year for industrial fundamentals. Demand is expected to remain strong, driven in part by e-commerce growth as well as an increasing desire to house more inventory in the U.S. as supply disruptions have been a clear challenge.

Inventory levels remain below pre-pandemic levels and tenants want to re-stock as well as have excess inventory on hand. Surging shipping costs for ocean freight and challenges with supply disruption have driven on-shoring trends.

There has been significant new supply which generally has kept pace with demand. Currently, new supply has higher than average pre-leasing levels. The cost of construction moving higher should be another factor driving rents higher.

The transaction market should remain very active, following a record volume year in 2021. While industrial REITs started off 2022 underperforming REITs overall, we believe capital will shift back as fundamentals in 2022 should remain strong.”

Lodging

Dori Kesten

Senior Equity Research Analyst

Wells Fargo Securities, LLC

“2021 began with U.S. RevPAR (revenue per available room) one-half that of its prior peak and ended with December RevPAR exceeding its prior peak, on the back of a resilient leisure traveler and a lack of price sensitivity.

While COVID-19 was a clear headwind to travel from early 2020 to early 2021, as vaccination levels rose, illness severity declined, and virus fatigue grew, those headwinds lessoned considerably during 2021 with RevPAR indexed to 2019 strengthened during the rise of the delta and omicron variants as compared to the month prior to the rise. In the second half of 2021, weekend/leisure RevPAR remained steadily above prior peak levels, while midweek/corporate RevPAR varied widely by week but averaged around 80% of 2019 levels, although under 70% in the top 25 markets.

We expect key themes of 2022 to be: the recovery in corporate transient and group demand, notably in the top 25 markets, with continued strength in domestic leisure travel; inflation and its differentiated impact on rates among lower-/higher-end hotels; the potential for early cycle M&A over the typical mid-to-late cycle M&A in lodging; structural changes at the property level driven by shifting consumer preferences; and, long-term headcount reductions in an elevated labor cost environment.”

Richard Anderson

Research Analyst

SMBC Nikko

“Leisure demand largely recovered last year as a pandemic-fatigued society pounced on the chance to make memories with family and friends, made easier given flexibilities offered by a work-from-anywhere environment. We think a reversion to the mean is likely in 2022—i.e., a continuation of leisure travel in a strong economy, but also a catch-up of business and group demand as corporate America finally learns to live with COVID-19.

It is logical to connect return to the office with the return of business travel, but we aren’t sure whether the chicken or the egg comes first. Either way, we think this critical side of the demand spectrum for the hotel industry will start a sustained run as warmer weather approaches.

Other positive considerations for hotel REITs include the potential for permanent margin expansion, return of common dividends (we think late 2022 at the earliest), and slower supply growth tied to economic shocks of the pandemic.”

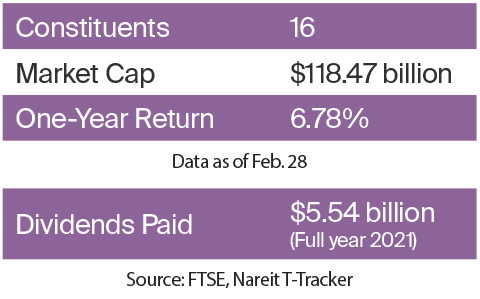

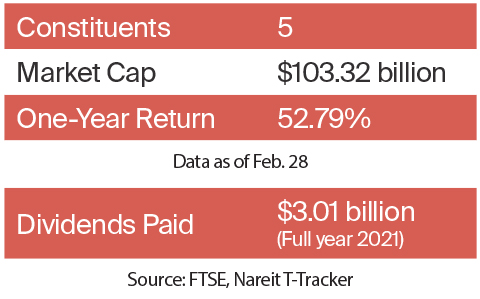

Infrastructure

Colby Synesael

Managing Director, Senior Research Analyst

Cowen

(as of 2/28/2022)

“We expect a step up in gross revenue for U.S. towers this year following a notable step up in leasing last year driven by 5G spectrum deployments from multiple carriers, with the potential for some carriers to shift spending higher or lower in the second half of 2022 driven by company specific situations. This will be partially offset by a step up in churn from carrier consolidation, although from a timing perspective it will vary meaningfully across tower operators.

Company specific growth for the biggest players will be augmented by exposure to faster growing segments including international towers or small cells. Key trends in outer years that could potentially drive upside largely focus on ‘true’ or non-phone oriented 5G use cases that would require more network densification and the emergence of edge computing.

Other big drivers of fiber growth, include a sizable step up in fiber to the home (FTTH) deployments driven by the ‘criticality of broadband’ narrative that emerged during the pandemic, and more recently a sizable step up in government subsidy programs including the Infrastructure Act, with much of these new fiber networks/routes likely to also be used to further support 5G/edge requirements.”

(co-authored with Greg Williams, analyst, Cowen)

Nick Del Deo

Senior Equity Research Analyst

MoffettNathanson

“Tower fundamentals remain solid. Incumbent U.S. wireless carriers are aggressively deploying new spectrum and augmenting their networks in support of 5G, while new wireless entrant Dish Network continues to make progress, all of which bode well for tower leasing in 2022 and beyond.

The long term promise of 5G is a function of the use cases that require it, making monitoring the development of 5G-centric applications important. The mobile edge will continue to garner attention, but any benefits from tower sites hosting edge data centers remain years away, if they materialize at all. Look for tower M&A activity to remain robust outside of the U.S.

Demand for fiber infrastructure has held up well throughout the pandemic, supported by secular trends like cloud computing adoption, digital content delivery, and the move away from legacy telecom services. Purchasing decision cycles have extended as business customers wait to get a better handle on their eventual return to office versus work from home requirements and their broader post-pandemic needs.”

Office

Michael Carroll

Director

RBC Capital Markets

“The office sector is among the last re-opening plays in the industry. Leasing activity has been limited throughout the pandemic but should improve as more businesses re-open their offices.

Tenants generally shut down their offices during the pandemic in order to slow the spread of COVID-19 and protect their employees. These stakeholders were unwilling to make long-term real estate decisions during this period. Encouragingly, businesses started returning to the offices in mid-2021 and we expect most companies should re-open in early 2022 post the omicron wave.

The post-COVID operating environment is evolving as companies and employees demand a new hybrid work setup. Tenants still likely prefer employees to work at the office to help establish a strong culture, encourage collaboration, and train younger professionals. Therefore, we believe business will prefer to lease higher-quality buildings with modern build outs in strategic locations in order to create an environment where employees will want to work.

We believe the REITs with higher quality, well-located portfolios are positioned to thrive in a post-COVID world, and conversely, more commodity type product should lag. Additionally, we believe life science should continue to benefit from the strong macro trends, not only due to biotech technology advance and increased R&D funding, but also next generation manufacturing demand.”

Ranjini Venkatesan

Analyst

Moody’s Investors Service

“Long-term leases and tenants’ inclination to carefully defer their office space strategy has helped maintain occupancy well above utilization rates. However, tenants’ leverage has manifested in larger concession packages, which has resulted in a modest decline in net pricing and shorter lease terms. We expect the operating metrics for Moody’s rated universe to improve in 2022, while being periodically stymied by the emergence of new variants.

Performance over the next 12 months will be most influenced by space needs in the hybrid work world and office utilization and leasing trends. That hybrid work will become the norm for most companies is a given. However, the expected 20%-30% reduction in office use is not likely to result in a corresponding reduction in space needs due to factors such as peak usage days and an increase in space per employee. An important risk to the current forecast is that health and safety concerns continue to affect utilization and leasing activity.

We expect meaningful differences in performance metrics across markets (high value coastal locations will underperform Sunbelt cities, and there will be more interest in suburban assets) and product type (energy efficient buildings will be preferred). Increased demand for flex space and reconfiguration of the office layout are also likely.”

Residential

Alex Goldfarb

Managing Director, Senior Research Analyst

Piper Sandler & Co.

“The trends for residential are quite good. Apartments bounced back strong in the coastal areas, and the Sunbelt never took its foot off the gas. The real question for 2022 is if the coasts will continue their strong rebound and growth.

The Sunbelt never had real material rent decline during COVID, and has been putting up real growth because of jobs, population, etc. The coast saw a massive return of people, which was great. Rent in the Sunbelt averages $1,500 a month, which is very affordable to a wide group of people, and they’re seeing rent growth of 10% plus sustained.

In New York, rents are back to $3,500 a month. To raise it 10% is a big ask. Therefore when you have rising crime and employers still delaying the return to office—and you already have everyone back in town—what’s the incremental driver to get rents to continue to grow at last year’s pace? That’s why we continue to favor the Sunbelt.

Without a doubt, apartments across the board will do well, but we think the Sunbelt will have sustained growth, whereas the coast’s growth will likely slow.”

Chandni Luthra

VP & Equities Lead Analyst –REITs

Goldman Sachs & Co. LLC

“High inflation driving higher interest rates poses risks to the flow of capital, especially if the move happens rather quickly, driving higher volatility in asset prices and downward pressure on multiples. However, we think several fundamental factors should not be ignored.

Interest rates are still low in a multi-decade context, and the amount of capital pursuing real estate, especially when several sub-sectors have secular pressures, or at least continued periods of uncertainty, bode well for pockets that have stronger fundamentals, including residential.

In addition, housing was in short supply even before the pandemic and current supply chain bottlenecks have further pressured the outlook for supply. Meanwhile, demand is high, led by changing consumer preferences for geography and living situations, demographics, one-time factors such as young adults decoupling from parental residencies, and householders hedging with multiple residencies during the pandemic.

With support from favorable demand-supply dynamics and strong GDP, we believe residential REITs can pass-through inflation to tenants in the form of higher rents.”

(Luthra’s quotes are from a recent Goldman Sachs note.)

Retail

Lindsay Dutch

REIT Equity Analyst

Bloomberg Intelligence

“Retail REIT fundamentals—and occupancy in particular—are improving, with momentum extending in 2022. The key items we’re watching this year are rent spreads and the pace of occupancy improvement, as these metrics should reveal the strength of demand and the possibility for longer-term rent growth after the pandemic helped show the value of brick-and-mortar stores.

Another key theme for 2022 that we’re watching for in the retail real estate sector is more acquisitions. Many large shopping center and single-tenant landlords are pursuing expansion after M&A jumped in 2021. These moves suggest leasing and rent growth confidence and should aid funds from operations (FFO) growth as year-over-year comparisons get tougher this year.

We believe mall owners are less likely to pursue acquisitions in the near term and may continue to face rental rate pressure in 2022, given the possibility for a pick-up in store closings and since short-term leases were key to filling empty stores quickly in 2021.”

Linda Tsai

SVP, REITs, Senior Research Analyst

Jefferies

“Retail fundamentals are positive given favorable supply and demand. Some retail real estate continues to go offline, given obsolescence or repurposing. Meanwhile, the absence of chain-wide bankruptcies and credit rating upgrades outpacing downgrades over the last year or so paint a picture of relative tenant health.

The pandemic opened the opportunity to occupy better-located space, as reflected in lower-than-average retail vacancy. Move-outs have declined, and retailers are investing in their stores to drive customers to their physical locations to avoid margin-sapping delivery costs.

Continued migration and the recent omicron wave underscore how flexible work arrangements likely will persist, which aids density in various markets and by extension, boosts shopping center values. We will look to see if consumer strength continues, given 2021’s government stimulus checks and child tax credits. That said, household savings across the income spectrum and expected wage growth should help to offset that.

Higher taxes, materials, and operating costs remain a concern, but the ability to grow the top line through organic lease-up and stronger pricing power are where investors remain most focused. Finally, given open air shopping centers’ continued cap rate compression, we expect 2022 to be a busy year in terms of transaction activity, with REITs remaining very active in the space.”

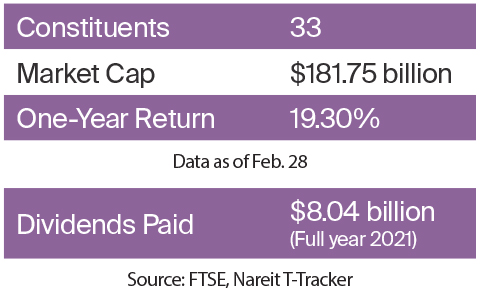

Self-storage

Spenser Allaway

Senior Analyst

Green Street

“Self-storage REITs experienced peak fundamentals in 2021 as COVID-related demand and increased national mobility (like work from home) led to all-time high occupancy and unprecedented pricing power for landlords.

The first half of 2022 should continue to feature extremely strong operating results. Current data suggest that move-in rate growth will remain strong, and landlords are likely to maintain pricing power on existing customer rent increases (ECRIs). As for occupancy, we are expecting mostly parity with 2021 for the first half of the year.

Supply does not appear poised to have a significant impact on operating results, but there will be pockets of submarkets facing material new competition in 2022. The appetite for storage facilities continues to push acquisition and development activity further into secondary and tertiary markets.

The two biggest trends to look out for in 2022 are: demand unwinding concerns (i.e., sharp demand reversals in coastal markets); and supply concerns (i.e., where are new development projects slated to take place?).”

Todd Thomas

Managing Director

Equity Research and REITs

KeyBanc Capital Markets Inc.

“Self-storage fundamentals remain very strong—2021 was a remarkable year for REITs and the broader industry. Demand outstripped supply by a wide margin as individuals continued to declutter their residences in order to make room for working, learning, and entertaining indoors. Elevated moving and home remodeling activity also provided support.

The increase in demand led to higher levels of occupancy across the industry, which enabled operators to drive outsized rent growth. It was also a banner year for investments, with sellers looking to capitalize on higher valuations given a significant increase in capital earmarked for investment across the space. We expect 2022 to be a strong year for the industry, but occupancy gains may diminish, rental rate growth may slow, and expense growth could rise more than it has in prior years.

Accordingly, we forecast 18% earnings growth (i.e. AFFO) for the self-storage sector in 2022, which would mark a decrease from 26% estimated growth in 2021. Despite the slower growth forecast, the self-storage sector remains well-positioned compared to the REIT industry overall, which we forecast to grow approximately 12% in 2022.”

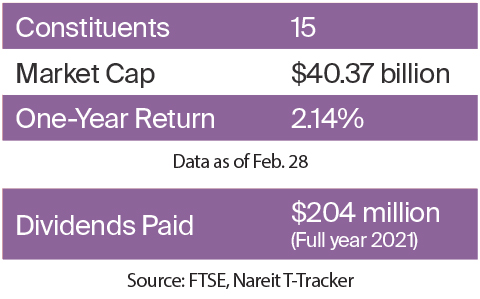

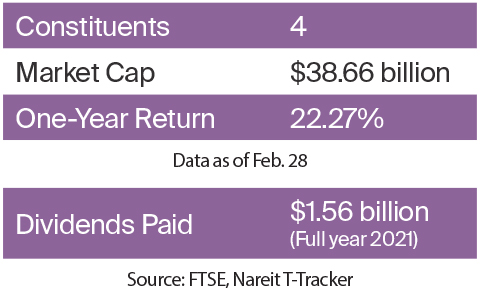

Timberland

George Staphos

Senior Paper and Packaging Analyst

BofA Securities

“We expect steady-to-improving demand trends for the products important to the timber REIT sector, namely timber and wood products such as lumber and panels, with strong pricing.

On the wood products side, after an expected lull in the third quarter of 2021, the subsequent rebound in lumber and panel pricing in the early portions of 2022 has been driven by favorable building conditions, including warmer weather during the fourth quarter and supply constraint angst.

Supply was disrupted in the fourth quarter in part as heavy rains led to landslides in British Columbia, which made it difficult for mills to ship product. Winter weather also slowed the speed of rail, and this further contributed to increased product demand and pricing. To illustrate, we expect lumber pricing to average $699/1,000 board feet (MBF), down from 2021’s $850/ MBF, but well above a normal level of around $350/MBF (based on Random Lengths Composite).

In timber, there have also been encouraging signs in sawlog pricing, consistent with our research views. Overall, we expect about 3% growth in southern sales realizations. In the West, we forecast some pricing pullback given the potential for slower export shipments to China, but this will be counterbalanced by the strength of domestic housing markets, particularly in California.”

Kurt Yinger

Associate Vice President, Research Analyst

D.A. Davidson & Co.

“Fundamentals remain favorable, led by underlying demand strength in new residential construction and residential repair and remodel activity. In turn, sawmill demand for fiber continues to rise, providing some green shoots for Southern sawlog pricing, following a relatively flat 10-plus years, and an above-average pricing environment in the West. Timberlands REITs that are vertically-integrated with manufacturing operations reaped the rewards of record 2021 commodity lumber and panel prices. A still strong pricing backdrop entering 2022 leaves us optimistic that those businesses can continue to generate attractive, excess cash flow.

Looking ahead, rising interest rates and the impact that may have on overall housing activity is top of mind for investors. Specific to the timberlands REITs, capital allocation will be in focus, with a strong 2021 driving elevated shareholder distributions and balance sheets that remain supportive of M&A. We will also be monitoring sawmill capacity expansions in the South and the potential for that to drive increased pricing tension. Finally, with a growing corporate focus on sustainability/climate, we are excited to see the potentially expanding role timberlands can play in helping companies achieve their goals, and how REITs in this sector can increasingly monetize those opportunities.”