Spurred on by attractive financing and solid returns, health care REITs continue their aggressive pursuit of senior housing properties.

Spurred on by attractive financing and solid returns, health care REITs continue their aggressive pursuit of senior housing properties.

Data from the National Investment Center for Seniors Housing & Care (NIC) show that 2014 was the most active year on record for transactions in the sector, with more than 500 senior housing deals closed. Acquisitions of senior housing and care properties by public, private and institutional real estate investors stood at $17.4 billion for the year, up nearly 20 percent from the previous year. Publicly traded companies accounted for nearly $10 billion of that total.

Deal-making in the senior housing segment has moved along at a healthy clip in the first half of the year, too, according to Rick Matros, chairman and CEO of Sabra Health Care REIT (NASDAQ: SBRA). “We’re seeing much more inflow than we usually see this early in the year,” observes Matros, who describes the financing environment for stock exchange-listed REITs as “awesome.”

Daniel Bernstein, an analyst at Stifel Nicolaus & Co., says current market conditions suggest more deals are on the way for health care REITs. “Given the decrease in interest rates and the continued increase in capital availability, it’s very likely that the REITs are going to be very aggressive buyers,” he says.

Matthew Whitlock, senior vice president at CBRE National Senior Housing Group, agrees.

Matthew Whitlock, senior vice president at CBRE National Senior Housing Group, agrees.

“The overall marketplace is very healthy although it’s also very aggressive,” he says. “We’ve noticed cap rate compression over the last eight to 12 quarters and a corresponding increase in per-unit values.”

What’s more, sellers appear motivated, too.

“Cap rates have compressed enough that it’s brought out the sellers,” Bernstein notes. “There are enough portfolios for everyone to buy for now.”

Enjoy the RIDEA

The graying of the U.S. population has played a clear role in the explosion of investor demand for senior housing. Yet, it’s not the only factor for REITs. They are also taking advantage of changes to the economics of the senior housing business resulting from the REIT Investment Diversification and Empowerment Act (RIDEA).

Passed in 2008, RIDEA enabled health care REITs to create taxable subsidiaries for their assets, allowing them to share a limited amount of both the risks and rewards at the operational level. Prior to RIDEA, the health care assets were operated solely within a triple-net lease structure.

“The wagers REITs made in RIDEA senior housing have proved to be winning bets,” says Michael Knott, a managing director with Green Street Advisors who covers the health care sector.

Take Health Care REIT, Inc. (NYSE: HCN), for instance. The Ohio-based REIT began doing RIDEA-structured investments roughly five years ago. The firm saw same store net operating income (SSNOI) from its senior housing portfolio climb 7.3 percent in 2014 over the previous year. Health Care REIT is forecasting 5 percent SSNOI growth in 2015.

“In 2014, both occupancy and rates drove our overall NOI performance,” says Scott Estes, Health Care REIT’s CFO. “Occupancy was in excess of a 1 percent improvement for the year, and we’re seeing 3 to 4 percent rate increases across” the company’s senior housing portfolio.

Bernstein points out that those REITs that have increased their exposure to senior housing assets as a result of RIDEA’s passage have been rewarded with higher valuations.

“As long as [REITs] get rewarded for being a little bit more aggressive on growth and not penalized for risk, they’ll increase their exposure to senior housing,” he says.

Public Advantage

Senior housing currently accounts for about half of the net operating income (NOI) of the three largest health care REITs, Ventas Inc. (NYSE:VTR), HCP Inc. (NYSE: HCP) and Health Care REIT, according to analysts. Among the various groups competing for in-demand senior housing assets, public real estate companies such as these three appear to have an important edge at the moment.

“There’s no doubt that the public companies have a distinct advantage on the cost of capital front,” Knott says. “They are afforded very large premiums to the underlying value of their assets.”

Yet, as large senior housing portfolios become harder to find, the number of deals occurring may start to level off for REITs, according to Chris McGraw, a senior research analyst at the NIC. “To get to that level of volume [for publicly traded health care REITs], there need to be some multibillion-dollar deals, and those are just getting harder to come by,” he says.

According to Lori Wittman, senior vice president for capital markets and investor relations with Ventas, compelling acquisition targets in senior housing are already starting to taper off. Wittman explains that investors already recognized the demographic factors pumping up demand for senior housing. The segment’s strong performance during the recession only heightened its appeal.

“There is a lot of capital looking to make acquisitions in the sector,” she says. “Fundamentals and demographics provide great demand long term for the sector, but it doesn’t have the same sort of unbelievable acquisition fundamentals as it did coming out of the recession.”

Supply Still Roaring

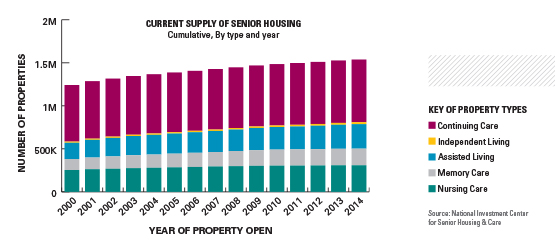

Demand for senior housing is doing more than just raising the number of properties changing hands. Not surprisingly, analysts say they expect the current popularity of the sector to trigger an increase in the supply of senior housing stock. For example, the NIC is projecting the total supply of senior housing to increase about 1.9 percent in 2015, versus a gain of 1.7 percent in 2014. Green Street is forecasting supply growth of about 3 percent in the coming years.

Sector stats

Sector: Health Care

Constituents: 15

1-Year Return: 9.6%

3-Year Return: : 10.7%

5-Year Return: : 12.7%

Dividend Yield: : 4.87

Market Cap ($M): : 94,072.9

Avg. Daily Volume (shares): : 1,058.3

(Data as of May 2, 2015)

Source: FTSE NAREIT Equity Health Care.

While supply growth has been flat recently, “there are a lot of new participants in the space interested in development,” Knott says. He cautions that new supply could mean declines in NOI for some companies.

Bernstein, meanwhile, downplays the potential effects of supply growth, noting that the senior housing sector is “coming off historically low supply.”

The upswing in development isn’t just a matter of investors chasing returns, though, according to Sabra’s Matros. Sabra currently has 35 projects in some phase of development and is anticipating $450 million in new assets coming online in the next three years.

Matros maintains that the current stock of senior housing falls short of the changing needs of retirees. Whereas senior housing units built during the 1990s and 2000s followed apartment-style models, those layouts don’t work for the growing numbers of older residents who are less independent, Matros says.

“We still see a lot of development projects that we think are insensitive to the needs of today’s and tomorrow’s resident,” he says.

In the meantime, boosting the overall number of those elderly residents is an increasingly important task for the industry, according to Wittman.

“The penetration rate is very low,” she says. Raising that number is “obviously a huge potential positive for the business.”

Wittman says the health care industry is starting to pay attention to educating the public about the senior housing model. “There is a push across the industry to increase awareness…not only of the residents but also their adult children who are helping to make the decisions,” Wittman notes.