The elevation of real estate to a Headline Sector under the Global Industry Classification Standard (GICS®) later this year should result in new real estate-based investment products, such as REIT exchange-traded funds (ETFs). Dave Nadig, director of exchange-traded funds with FactSet, spoke with REIT magazine about the market for ETFs and the implications of the GICS move for listed REITs and real estate companies on the buy side of the investing industry.

The elevation of real estate to a Headline Sector under the Global Industry Classification Standard (GICS®) later this year should result in new real estate-based investment products, such as REIT exchange-traded funds (ETFs). Dave Nadig, director of exchange-traded funds with FactSet, spoke with REIT magazine about the market for ETFs and the implications of the GICS move for listed REITs and real estate companies on the buy side of the investing industry.

REIT: I want to start just by talking about ETFs and their value proposition in general. For novice investors like myself, why buy an ETF instead of, say, an index fund? If ETFs are meant to track indexes, why would I want to hold those investments in the ETF format?

Dave Nadig: You can think of ETFs as a hybrid between a stock and a mutual fund. At their core, the vast majority of ETFs are in fact regular, old, [Investment Company of] 1940 Act, registered mutual funds. But they take those mutual funds and get special permission to trade intraday on an exchange, just like a stock.

When you buy shares of an ETF, you’re buying those shares from some other investor or market maker who wants to sell them to you, and you’ll pay a price based on the bid and ask prices, just like you would for a stock. You can look and see if that price is “fair” relative to the value of the underlying shares using an intraday-net-asset-value (INAV).

So why doesn’t the price of the ETF shares deviate from fair value? And how does money get into the fund, if you’re buying from another investor? Well, there’s a special class of investor that gets to create new ETF shares, or get rid of them, directly with the issuer, called “Authorized Participants” (APs). If the price of the ETF in the open market gets too high [relative to the underlying shares of the fund], the APs will go ahead and sell at that inflated price, and they’ll simultaneously make new shares of the ETF by giving the issuer the actual stocks (or bonds, or whatever) they need to create and issue the new shares.

All that’s the plumbing. What you get is:

- Intraday trading and all of the related things you can do with stocks, like shorting or buying on margin;

- Tax efficiency because the ETF rarely has to buy or sell securities, they just “in kind” them with the APs;

- Transparency—because the AP needs to know which stocks to deliver to make new shares, they generally publish that info for everyone to see; and

- Low cost because all of the messy business of keeping track of shareholders goes away and most ETFs are indexed to widely used benchmarks.

REIT: So, to sum it up…?

Nadig: While you can certainly get highly tax-efficient, low-cost index funds, ETFs give you more flexibility.

REIT: Listed REITs have been part of mainstream investing for a while now, but a new Headline Sector for real estate under GICS coming later this year means more visibility and interest from a broader range of investors. Do you have the sense there’s any trepidation on the buy side over investing in listed REITs and real estate companies?

Nadig: Not really. I think people have genuine opinions about real estate, and having it in its own sector makes a ton of sense.

Having dedicated REIT products is just a sensible way for any buy side investor to “fine tune” their exposure to the space, either buying more of it than a broad index might have, or constructing sector portfolios to exclude it.

Having dedicated REIT products is just a sensible way for any buy side investor to “fine tune” their exposure to the space, either buying more of it than a broad index might have, or constructing sector portfolios to exclude it.

REIT: How would you describe the popularity on the buy side of REIT-centric products, such as REIT ETFs, in the current environment?

Nadig: Well, honestly, 2015 showed pretty tepid growth in U.S. REIT ETFs—those focused just on U.S. REITs. We had about $470 million in new assets in 2015, for example, on a base of over $40 billion.

However, growth in international REITs was really interesting. We had growth of about $1.4 billion in new assets on a base of just over $10 billion–that was surprisingly strong interest. I don’t think it’s a secret why: With flat, volatile equity markets and no income to be found in fixed-income, the case for real estate is pretty strong. Adding an international twist just ups the diversification benefits.

REIT: In terms of new investment products, can you give us a general idea of what a new Headline Sector for real estate under GICS will mean for the listed REIT and real estate industry?

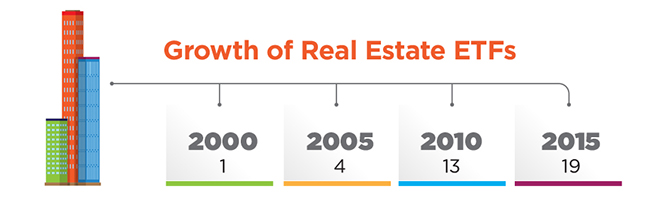

Nadig: Well, I think it opens up real estate even more to traditional sector investors. While there are plenty of REIT ETFs and mutual funds out there, having them lined up alongside other GICS sectors will definitely bring a whole new class of investors to the table.

Will it be a huge game changer? I don’t think so. But it will increase the attention, particularly from quants, I would think. u

Dave Nadig serves as director of exchange-traded funds with FactSet, having joined the company from ETF.com in March 2015. He oversees research in ETF analysis in his role with FactSet. Previously, he served as managing director at Barclays Global Investors and helped design and market some of the first exchange-traded funds.