REITs work to attract larger allocations from retail investors.

REITs are drawing a bigger target on retail investors, reflecting the broader shift in overall retirement assets that is putting more money in the hands of individuals and their financial advisors versus the traditional pension fund manager or defined benefit (DB) plan sponsor.

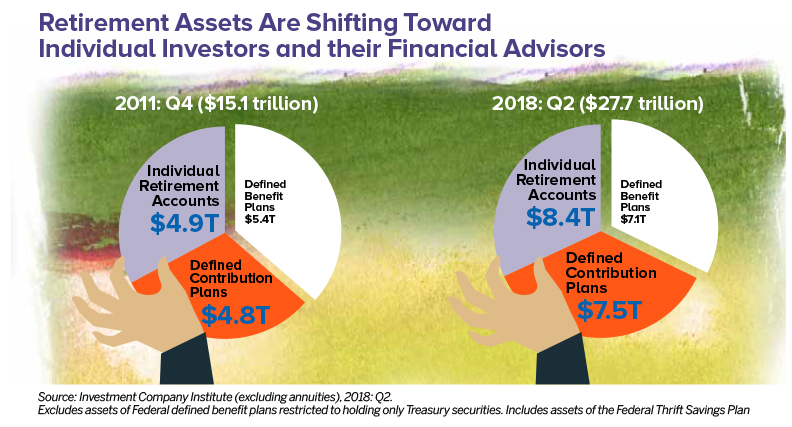

Individual retirement accounts now represent the largest slice of the pie when it comes to overall retirement assets—37.8 percent of the $27 trillion in total U.S. retirement assets, according to data from the Investment Company Institute. Defined contribution (DC) plans, including 401(k)s also have increased slightly over the past several years to comprise 31.7 percent, while the volume held by DB plans slipped from 35.8 percent in 2011 to 30.5 percent in the second quarter of 2018.

“Plan sponsors, particularly on the corporate side, are shifting away from DB plans and into DC plans,” notes Kurt Walten, senior vice president, investment affairs and investor education at Nareit. In addition, individuals have growing 401(k) balances that are eventually rolling over into IRAs when someone changes jobs or retires. That’s why IRAs are growing, and as such, it is also why that segment of the market is getting more attention, he adds.

Retail investors have long been a focus for Nareit and the REIT industry. “REITs were first introduced by an act of Congress in 1960, and the purpose was to give the average investor access to real estate investment,” says Tim Berryman, director of investor relations at Medical Properties Trust, Inc. (NYSE: MPW).

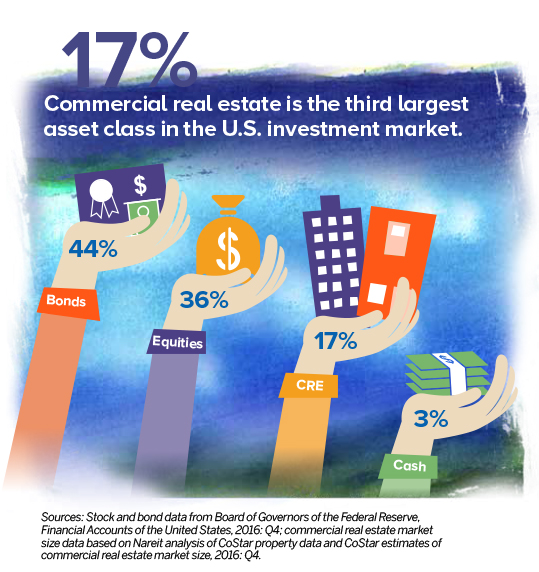

Real estate is a good complement to a portfolio of stocks and bonds because it provides added diversification and has a low correlation to other asset classes, Berryman says. “In addition to other capital sources, REITs like retail investors because they represent growing demand for their shares and tend to be long-term holders, which can help to dampen share price volatility,” he adds.

As REITs continue to move into the mainstream of retail investment portfolios in both retirement and non-retirement accounts, REITs are recognizing an opportunity to capture a bigger share of those dollars.

Retail investors accounted for about 15 percent of direct REIT ownership in 2017, according to an annual report released by Michael Bilerman, managing director at Citi and head of real estate and lodging research. That data includes only those individuals who buy specific REIT stocks directly for their own personal stock portfolio and does not include more passive investment via exchange-traded funds (ETFs) or mutual funds. Dedicated U.S. REIT funds account for 23 percent of REIT ownership, which can include capital from both individuals and institutions.

Courting Retail Investors

Nareit has made a concerted effort to reach out to retail investors and strategically communicate the REIT investment proposition to financial advisors and financial intermediaries. Likewise, individual REITs also are working to get in front of retail investors and their financial advisors. “These outreach efforts cannot be half-hearted. It needs to be a consistent, dedicated initiative consisting of regular branch visits, calls to top financial advisors, and C-suite time and effort over many years,” says Sumit Roy, president and CEO of Realty Income Corp. (NYSE: O).

Realty Income started out with a grassroots approach to growing brand awareness with the brokerage community. “As a privately held partnership prior to our public listing in 1994, our investor outreach program was built by telling the Realty Income story one firm at a time,” Roy says. A decade ago, retail investors accounted for nearly 50 percent of the REIT’s ownership, but investment from institutional investors has grown so that retail investors now account for about 30 percent of ownership—still among the highest of the S&P 500 REITs, Roy notes.

Realty Income refers to itself as the “monthly dividend company.” “Retail investors, particularly those looking for income, are generally looking for reliable dividend payments that grow over time,” Roy says. “As baby boomers age—10,000 people per day are now turning 65—we think the value proposition of REITs will continue to appeal to retail investors looking for income.”

Since its initial public offering (IPO) in 2005, Medical Properties Trust has made a point to attend retail investor-focused events. Twice a year, the company attends larger events, such as MoneyShows, along with ongoing meetings and communications with individual investors and financial advisors.

“From our standpoint, we consider retail investors a very important component of our overall shareholder base,” Berryman says. “Currently, retail investors account for more than 15 percent of our stock ownership because they are attracted to the steady and predictable income that our dividends provide.”

Education Remains A Priority

REITs have pushed further into retail investment strategies, but education is still an important component in terms of reaching new investors and expanding allocations for existing investors. The challenge is that education often needs to run the gamut from explaining the basics to first time investors to having more detailed conversations with REIT-savvy investors.

Medical Properties Trust participates in sessions and panels at the larger retail investment conferences that might include a basic discussion explaining the benefits of REIT ownership and the different types of REITs that exist, to a more in-depth talk on industry news and trends specific to its asset base of hospitals. One topic resonating in 2018 is how individual investors can benefit from new tax laws that allow a 20 percent income tax exemption from the ordinary income component of dividends received from REIT shares held in a taxable investment account. “So, it is just a constant refresh to make people aware of the benefits of REIT ownership and also keep them apprised of new developments that might impact REIT investing,” Berryman says.

Medical Properties Trust participates in sessions and panels at the larger retail investment conferences that might include a basic discussion explaining the benefits of REIT ownership and the different types of REITs that exist, to a more in-depth talk on industry news and trends specific to its asset base of hospitals. One topic resonating in 2018 is how individual investors can benefit from new tax laws that allow a 20 percent income tax exemption from the ordinary income component of dividends received from REIT shares held in a taxable investment account. “So, it is just a constant refresh to make people aware of the benefits of REIT ownership and also keep them apprised of new developments that might impact REIT investing,” Berryman says.

Retail investors do have more information and resources available today, and their sophistication level has grown, Roy adds. For example, online financial communities like Seeking Alpha have built a loyal following among REIT investors. “As a result, we find that retail investors are prepared with a greater understanding of our business and are better equipped to understand what drives the stock,” he says.

The focus for many REITs is also educating investors on what differentiates their company from other REITs, and especially other REITs in the same category or subsector.

“People do understand what REITs are and how they work. What we’re finding is that the more we educate people on Global Net Lease, the more positive the response is,” says James Nelson, CEO and president of Global Net Lease Inc. (NYSE: GNL). Understanding factors such as the strength of the net lease portfolio, tenant quality and duration of leases gives people a greater comfort level, he says.

One way that Global Net Lease reaches out to retail investors is by doing road shows with fund managers and financial advisors. “We have done a number of those in the past, and we will continue to do more of those as a way to educate and [help] people understand both our REIT and how REITs work in general,” Nelson says. As with most REITs, the investor relations team also will speak directly with investors and financial advisors and field inbound calls from its long-term investors and other shareholders.

Rising Allocations

One of the key educational efforts for Nareit has focused on raising REIT allocations. “We are making the assertion that all retail accounts should have somewhere between 5 and 15 percent invested in REITs, and that is what our research supports,” Walten says. For example, David Swensen, PhD, CIO of the Yale University endowment and author of Unconventional Success: A Fundamental Approach to Personal Investment, recommends a 15 percent allocation to REITs for most investors.

Through suggested guidelines from its investment policy committee, Edward Jones recommends including REITs as part of a diversified portfolio with suggested allocations that range between 3 and 7 percent, depending on the specific portfolio objectives. “It’s up to the individual advisor to understand the client and what’s important to them, using an established process to understand and document their goals and comfort with risk,” says Kevin Lampo, CFA, a financial advisor with Edward Jones in Overland Park, Kansas.

Once that is established, the advisor helps the client build a portfolio based on that profile. So, a portfolio may or may not have an allocation to REITs depending on the circumstances, notes Lampo. In addition, the focus at Edward Jones is to partner with clients throughout their lives. “Why that’s important is because while REITs might not be appropriate for them today, they may be appropriate at some point in their lives.”

Honing Selling Points

Both Nareit and individual REITs are sending a consistent message on the advantages REITs offer to retail investors that include portfolio diversification, liquidity, and long-term investments that provide income and growth.

The discussion on public REITs with individual clients typically revolves around the diversification benefit of adding REITs to any portfolio, agrees Lampo. Some clients also are attracted to the dividend yield that REITs offer. However, when people come in focused solely on that dividend yield, it is important to bring the conversation back to their long-term goals and objectives and make sure they understand why or why not a specific REIT would fit in their portfolio, Lampo adds. “So, there is still a lot of education opportunities out there for the industry to teach individual investors what role REITs provide,” he says.

The discussion on public REITs with individual clients typically revolves around the diversification benefit of adding REITs to any portfolio, agrees Lampo. Some clients also are attracted to the dividend yield that REITs offer. However, when people come in focused solely on that dividend yield, it is important to bring the conversation back to their long-term goals and objectives and make sure they understand why or why not a specific REIT would fit in their portfolio, Lampo adds. “So, there is still a lot of education opportunities out there for the industry to teach individual investors what role REITs provide,” he says.

According to advisor surveys conducted by Investment News, 80 percent of investment advisors recommended REITs to their clients in 2017, which is up compared to 73 percent in 2016. In addition, leading investment management firms, such as BlackRock, Fidelity, and State Street Global Advisors, offer REIT-focused products.

Certified Financial Planner Delia Fernandez frequently talks about REIT investing with her clients. In most cases, the larger clients are more apt to buy individual REIT stocks, while smaller clients tend to gravitate toward a mutual fund or a REIT index fund. “I do consider REITs as a category to include in most portfolios, and that’s mainly because of its income,” says Fernandez, president and owner of Fernandez Financial Advisory LLC in Los Alamitos, California.

Fernandez typically deals with middle-class clients who have saved money in their 401(k)s or IRAs or perhaps have inherited money, but they don’t have great wealth. “These people like income. So, they are attracted to REITs for that purpose, but they also take a look at the increases in certain asset classes,” she says.

People do get excited about the yield they can get with a REIT stock—without having to worry about the “tenants and toilets” of directly owning and managing a real estate rental property, Fernandez notes.

Nareit has a number of marketing initiatives, including brochures, email campaigns, and newsletters, that are designed to tell the REIT story to the financial advisor audience and to retail investors. “It is really meant to equip financial advisors with the tools to be able to educate their clients,” says Abby McCarthy, vice president, investment affairs and investor education at Nareit. For example, Nareit does a quarterly newsletter with an organization called Advisor Access, which reaches a broad retail financial advisor audience with a database of about 100,000 people, that includes both the registered investment advisor (RIA) and the broker-dealer community.

Twenty years ago, the average person on the street didn’t know what REIT stood for and there was a lot of investor 101 education that was necessary. “REITs are now really mainstream investments,” she says. As such, REIT education is more sophisticated. “We are no longer having to teach people what REITs are, but rather we are going straight into what REITs can do for an investment portfolio,” McCarthy says.