Ventas sees a key role for innovation districts in the growth of its research and innovation portfolio.

Earlier this year, Ventas, Inc. (NYSE: VTR) became a founding partner of a fledgling nonprofit institute that conducts research on innovation districts. The move isn’t merely an academic exercise. Over the last several years, the Chicago-based health care REIT has risen to become a major stakeholder in the nation’s burgeoning innovation districts—which some experts describe as the 21st century answer to the suburban corporate campus or research park.

Ventas Chairman and CEO Debra A. Cafaro says The Global Institute on Innovation Districts’ (GIID) “impressive ambitions to create a global network of innovation districts, foster collective engagement, and provide detailed, evidence-based strategies and data for future evolution directly aligns to our growth aspirations in the research and innovation (R&I) portfolio.”

Typically located in urban settings, innovation districts are dense, mixed-use areas where leading-edge anchor institutions and companies “cluster and connect” with startups, business incubators, and accelerators, according to a 2014 Brookings Institution study. The districts also tend to be compact—some measuring just a quarter square mile—and are transit-accessible.

Some of these districts have emerged organically in the shadow of innovation-focused universities or companies but have become more intentional over time regarding oversight and planning. Others have grown out of deliberate public and private sector efforts to reinvigorate local economies, attract and retain talent, and keep the proverbial fruits of research close to home.

Today, there are more than 100 innovation districts in cities across the globe with varying economic landscapes, regional advantages, and population sizes, according to Julie Wagner, president of GIID and a co-author of the 2014 Brookings study.

Will Germain, a senior investment officer at Ventas, explains that innovation districts “are really ecosystems within cities” that often hinge on university research activity.

“You have companies that want to be close to that research activity, and entrepreneurs who want to be close as well. And they’re all working together to really drive innovation and economic growth within these markets,” he says. Germain leads a team at Ventas focusing on investments in R&I-oriented markets.

A Transformative Deal

In some sense, Ventas took an indirect path to becoming one of the largest owners of commercial real estate in U.S. innovation districts. In 2016, the company acquired a $1.5 billion portfolio of “university-centric assets” in innovation districts from Wexford Science & Technology’s former parent company, BioMed Realty, an affiliate of Blackstone Real Estate Partners. Wexford and Ventas simultaneously entered into a long-term agreement to jointly develop new R&I-focused assets.

Now owned and operated by its management team, Wexford is a pioneer in the development of what it calls “knowledge communities”—which take the popular live-work-play concept a step further by adding innovation and learning to the mix. “Wexford brings a lot of the expertise and knowledge in putting these projects together, and we bring the industry experience in real estate and structuring complex transactions, along with capital, to the equation,” Germain says.

Today, Ventas, an S&P 500 company, owns more than 30 properties in its R&I portfolio and has a development pipeline of $1.5 million additional projects. Nearly all the properties are anchored by leading research universities—with startups, incubators, established biotech firms, and corporate titans like Microsoft Corp. and Boeing Co. among the names rounding out the tenant mix.

“Anchored by the world’s top research institutions—including the University of Pennsylvania, Yale, Brown, Duke, Washington University in St. Louis and Wake Forest—the Ventas R&I knowledge communities are highly sought-after, medically-focused ecosystems where trailblazing research, medical innovation, and life-science discovery and commercialization converge in cutting-edge facilities to bring about groundbreaking discoveries, applications, and life-saving cures,” Cafaro says.

The Heartland and Beyond

Through its acquisition of Wexford’s real estate assets, Ventas established a foothold in some of the country’s most successful innovation districts and has since expanded its presence in them through its exclusive development partnership with Wexford.

The two companies, for instance, own and operate more than 700,000 square feet of LEED-certified office and lab space in the nonprofit-run Cortex Innovation Community in St. Louis—a 200-acre, tech-focused district that has helped revitalize the city.

Cortex got its start in 2002 thanks to a $15 million investment from Washington University in St. Louis. Other institutions joined Washington University, and over time the coalition managed to transform an industrial complex in the heart of St. Louis into a vibrant, mixed-use, tech-focused district, complete with restaurants, shops, green spaces, and apartments. Cortex is now home to more than 400 companies (including seven Fortune 500 companies) and has generated upwards of 5,800 jobs, according to Washington University. It has also generated more than $34 million in tax revenue since 2014.

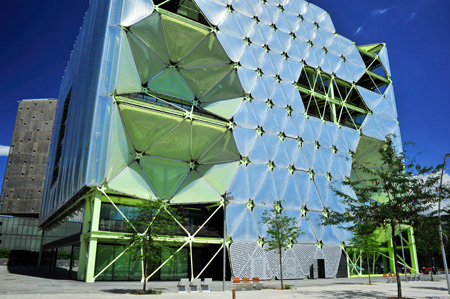

One of Ventas’s largest assets at Cortex—a 203,000-square-foot, LEED-Platinum building containing office and lab space—is the focal point of a growing innovation cluster within the district. Opened in 2014, @4240 is home to the first location of the Cambridge Innovation Center (CIC) outside of Cambridge, Massachusetts. CIC is the leading operator of inclusive, flexible office and co-working space in the world, according to Ventas. Boeing and St. Louis-based Nestlé Purina PetCare have opened innovation divisions within the building, where weekly venture capital-funding meetups often draw hundreds of entrepreneurs, investors, and other innovation enthusiasts.

Cortex is just one example of how innovation districts are transforming smaller cities—not just core markets like Boston and Pittsburgh, says Bruce Katz, director of the Nowak Metro Finance Lab at Drexel University and a former director of Brookings’ Metropolitan Policy Program.

“Cortex in St. Louis and burgeoning efforts in Erie, Pennsylvania, for instance, show that smaller cities—if they can harness their assets and bring anchor companies and institutions together—can transform themselves from an economic perspective” and, in the process, rejuvenate areas once plagued by high vacancies, says Katz, who co-authored the 2014 Brookings study and is part of the Global Institute on Innovation Districts’ (GIID) steering committee. “This is a way to inject some incredible energy into your economy, but also to regenerate areas of the city that have been left behind.”

Together with Wagner and Thomas Osha of Wexford, Katz has co-authored GIID’s first-ever research paper, “The Evolution of Innovation Districts: The New Geography of Global Innovation.” It shines a light on how some innovation districts have come up with initiatives aimed at creating a more inclusive model of growth at a time of widening income inequality, particularly in the U.S. Many districts are adjacent to or part of neighborhoods with relatively high levels of poverty.

“The growing economic divide is a lightening-rod issue, and many innovation districts are working hard to create pathways for inclusive growth through training and mentorship programs and on-site schools for science, technology, engineering, and math (STEM),” Wagner says.

“Innovation districts can be engines for growing local and regional economies and creating jobs that pay living wages. If that intention is tied with growing local residents into jobs where they can be mentored and promoted, then you have a multiplier effect.”

Closing the Divide in The City of Brotherly Love

Philadelphia’s innovation district, University City, has been at the forefront of the push for more-inclusive growth, says Katz. The booming district, which spans just 2.4 square miles in West Philadelphia, is home to world-class academic institutions (including the University of Pennsylvania and Drexel University), leading hospitals, companies that are innovating in fields from robotics to gene therapy, shops and restaurants, public spaces, and more than 50,000 residents.

The driving force behind the district is a nonprofit, University City District, that in 2011 rolled out the West Philadelphia Skills Initiative (WPSI) to address what it calls the dichotomies of Philadelphia’s economy. University City District is a partnership between anchor institutions, small businesses, and residents.

Despite Philadelphia’s substantial growth in recent years, it remains the poorest big city in the U.S., according to WPSI. The nationally recognized job-training program connects West Philadelphians seeking opportunity with employers seeking talent. Since 2011, program participants who had previously been unemployed for an average of 53 weeks have earned more than $30 million in collective wages, WPSI reports.

University City is also home to FirstHand, an educational initiative at the nonprofit University City Science Center that aims to spark interest in STEAM (science, technology, engineering, arts, and math) disciplines among local youth from under-resourced schools. Through FirstHand’s free programs, students experiment alongside scientists and educators. The goal is to help them grasp the power of STEAM subjects and become excited about how to apply the subjects in their own lives.

The University City Science Center—one of the country’s oldest and largest research parks—is located in the uCity Square area of University City. Ventas and Wexford have developed nearly 1 million square feet in uCity Square, a 6.5 million-square-foot, mixed-use community of retail, residential, clinical, office, and lab space concentrated around an open-air public square. University City Science Center—affiliated with Drexel, the University of Pennsylvania, Children’s Hospital of Philadelphia, and other big institutions—is their institutional partner in the projects.

Programs like FirstHand, Germain says, “try to demystify what’s happening in these [research and innovation] buildings, creating a line of sight for local students and young minds who are looking for exciting and new career opportunities.”

Prioritizing Research and Innovation

For its part, Ventas sees plenty of opportunity in places like University City. The company has made its R&I portfolio its top capital allocation priority. It has a development pipeline of more than $1.5 billion worth of projects in the space.

Since 2016, Ventas has invested and committed more than $3 billion in its R&I portfolio—which is benefitting from several powerful demand drivers. The booming life-sciences market is expected to grow by $170 billion by 2023, giving rise to more breakthroughs in pharmaceuticals, health care, biotech and diagnostics, and other fields. Among the trends fueling that growth are the rising cost of health care and prescription drugs and the spike in chronic conditions among Americans.

“The way to drive down rising health care costs is through research and innovation, and that is what’s happening in our buildings,” Germain says, adding that there are overlaps between Ventas’ work on the R&I property front and other areas of its business.

“Just like we do with our medical office and seniors housing properties—where our goal is to create great places for people to be cared for and for care to be delivered—with our R&I properties, we want to create great communities and places for growth, innovation, healing, and research to happen,” he explains.

Barcelona and Beyond

A decade ago, former Brookings Institution researchers Bruce Katz and Julie Wagner stumbled across an innovation district in Barcelona, Spain. The two began to wonder whether Barcelona’s 22@ district—one of the most-ambitious urban renewal projects in the world—represented a larger trend, perhaps one with implications for the U.S.

Their hunch proved correct. In 2014, Wagner and Katz co-authored “The Rise of Innovation Districts: A New Geography of Innovation in America,” a Brookings research report that documented a profound shift in the “spatial geography of innovation.” Today, Wagner and Katz are part of the leadership team at GIID, which aims to strategically advance innovation districts through the creation of a global network and focused research initiatives.

Why did Barcelona’s 22@ pique your interest when you first visited the district?

Katz: We looked at this ambitious effort underway in Barcelona and began to think through how it might represent a broader dynamic. We explored various parts of the U.S. and discovered that a different spatial geography of innovation was taking hold in various cities.

What do you mean by a different spatial geography of innovation?

Katz: If you wanted to define an innovation district 30 years ago in the U.S., you would look to a suburban research park or a suburban corporate campus. The theory of innovation was to go away from the central core of a city, erect your own campus and keep your secrets, well, secret. Really wall yourself off. Innovation was internal to corporations.

An innovation district is meant to mash up university hospitals, incubators, accelerators [and other players] in a vibrant urban place and leverage a fundamental dynamic in our economy today. That dynamic is based on seamless interactions across sectors.

To what extent are innovation districts formally organized?

Wagner: We have learned that successful innovation districts have developed some form of organized governance structure. They can be organized as not-for-profits, redevelopment corporations, or business improvement districts (BID). In some cases, a university takes the lead and drives the district in a more orchestrated way. Innovation districts, in fact, might not even call themselves a district but have created a distinct name to describe their area or purpose.

Are innovation districts a relatively new phenomenon?

Wagner: Most have been decades in the making. They are most often the result of various actors—research institutions, companies, start-ups, and others—organically concentrating in a relatively small, walkable geography. In many cases, research and development-strong institutions, such as universities and medical universities were the catalyst to this growth. There’s a tipping point where they realize that they can do more with a collaborate-to-compete approach. We estimate that globally there are at least 100 districts that have a degree of intentionality and a minimum threshold of the kinds of things that matter: talent, research, and research-and-development funding, for instance. GIID is developing some quantitative metrics so we can give those that are aspiring [to create a district or to improve an existing one] a sense of what to shoot for.

What opportunities do innovation districts present for REITs and other types of real estate investors?

Katz: Innovation districts are an emerging asset class and should enable REITs and other investors to move to a broader set of metro areas. These places will generate value not just for the owners of companies, but many other stakeholders. If I were a REIT [executive], I’d probably look at the 100 innovation districts around the world and try to determine which 15 I should be investing in. These are places that will grow faster than their surrounding cities and metro areas. I really think that in a relatively short time we’ll see a diverse set of investors discovering innovation districts.