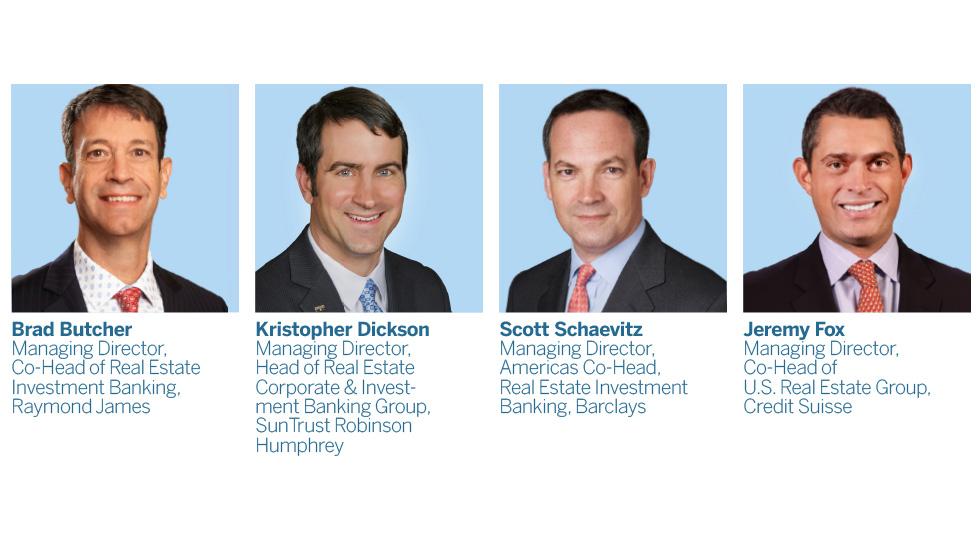

REIT magazine recently spoke with four investment bankers to assess their views on 2019 and gauge their expectations for 2020.

As 2019 heads to a close, commercial real estate fundamentals remain relatively healthy on the whole. Lower interest rates should aid valuations across most sectors and may bolster capital market activity in the months ahead. After a slow IPO environment in 2019, activity could pick up in 2020, bankers say, while merger and acquisitions (M&A) could also see an uptick, particularly in niche sectors. Meanwhile, in a low and declining interest rate environment, foreign capital continues to find U.S. real estate attractive from a returns perspective.

What is your general outlook for real estate in 2020?

Brad Butcher: The general outlook is positive but as is normal, it is really sector dependent. There are certain sectors that are performing well fundamentally and others that are experiencing a more challenged environment right now. From a public valuation perspective, you have a handful of sectors trading at net asset value (NAV) or premiums to NAV, such as triple net lease, health care, self-storage, data centers, multifamily, and manufactured housing. Companies trading at premiums to NAV will be able to continue to raise the equity capital necessary to fund their external growth strategies and will be able to do so accretively. Those trading at discounts to NAV will need to focus on internal fundamentals and look toward other ways to add value for shareholders, such as value-added projects in their current portfolio or the sale of assets along with share buybacks.

Kristopher Dickson: We are “late cycle”—a phrase we’ve all been using for multiple years at this point—and will unquestionably experience another downturn in the future. But time alone doesn’t kill a cycle, and the commercial real estate market (CRE) and its fundamentals continue to be healthy overall. Net operating income (NOI) and rents are growing, albeit at a slowing and more inflation-like pace. So, we’re in a mature spot, and I expect that to persist through 2020. The low interest rate environment should aid values, as should the significant amount of capital waiting to be deployed, as CRE is an attractive option relative to many other low-or-no-yield global investment alternatives, although with more limited return upside than what’s been enjoyed in recent years.

Jeremy Fox: Overall, it’s bullish. The economy is strong. Generally speaking, real estate fundamentals are pretty good. Interest rates are low and there is plenty of liquidity and access to capital, so that bodes well broadly speaking for real estate. We have seen, though, a bifurcation both in terms of geography and in terms of asset types. Overall the outlook is positive, but I think it’s extremely strong for certain geographies and certain asset types, and it’s weaker for other asset types and geographies.

Scott Schaevitz: We continue to see solid demand from users across most property types along with few signs of over-building. However, risks to the economy are also risks to real estate fundamentals. Trade uncertainty and a global economic slowdown that could reach the U.S. would impact tenant demand. We have a real estate market that has not had to manage through a recession in quite some time. And we know trees do not grow to the sky.

Where do you see capital market activity heading for REITs in terms of equity and debt?

Dickson: We have seen an increase in issuance activity, in 2019 as REITs have played more offense with their improved cost of capital versus generally having been net sellers in recent years amidst the public/private market valuation disconnect. 2020 equity capital markets issuance should continue to benefit from improved valuations across most sectors. The market has been receptive to deals associated with a growth story and has rewarded REITs who have kept leverage levels in check. Debt capital markets issuance will likely have a difficult time keeping pace with 2019 levels, as many REITs have taken advantage of the back-up in interest rates to term out debt and/or prepay near/medium-term maturities.

Butcher: If interest rates remain around this level or go lower, we’ll see a significant amount of capital market activity, particularly on the debt side. The availability of debt capital is quite strong from both banks and the public markets. On the equity side, it’s sector dependent. Certain sectors will be active in the equity markets and growing their companies. Others that are trading at discounts to NAV will be less active.

Fox: This is shaping up to be a very strong year for issuance both in the debt market as well as in the equity market. I don’t see any reason to believe that is going to slow down. I think low interest rates will continue to be a catalyst for debt issuance. In terms of equity issuance, we’re seeing an overwhelming majority of the issuance coming from the emerging sectors. I expect that trend to continue.

Schaevitz: Currently, REITs have a green light to grow and billions of dollars have been raised. Recent lows in Treasury yields led to a flood of bond issuance, including Equity Residential’s lowest ever yield for a 10-year bond by a REIT. On the equity front, the market appreciates the dividend yield from REITs that is averaging nearly twice the yield of the S&P 500. Many companies have taken advantage of the strong demand for REIT shares by issuing equity, including VEREIT’s nearly $900 million all primary raise in September. VEREIT’s raise was the largest property REIT all-primary block trade since 2012. The raise was also completed at the tightest re-offer discount for a property REIT all-primary block greater than $500 million since VEREIT’s offering in 2016. However, the opportunity to raise capital is not open to all. Certain property types and specific names are trading below underlying real estate values, either due to perceptions of sector earnings growth or company specific factors.

Schaevitz: Currently, REITs have a green light to grow and billions of dollars have been raised. Recent lows in Treasury yields led to a flood of bond issuance, including Equity Residential’s lowest ever yield for a 10-year bond by a REIT. On the equity front, the market appreciates the dividend yield from REITs that is averaging nearly twice the yield of the S&P 500. Many companies have taken advantage of the strong demand for REIT shares by issuing equity, including VEREIT’s nearly $900 million all primary raise in September. VEREIT’s raise was the largest property REIT all-primary block trade since 2012. The raise was also completed at the tightest re-offer discount for a property REIT all-primary block greater than $500 million since VEREIT’s offering in 2016. However, the opportunity to raise capital is not open to all. Certain property types and specific names are trading below underlying real estate values, either due to perceptions of sector earnings growth or company specific factors.

What is the appetite for risk among banks?

Butcher: Everyone from the banks, alternative capital sources, and companies are trying to manage through the lower rate environment. However, banks are in the lending business and they’ll continue to lend. Their risk appetite is fine right now.

Dickson: Most banks have become more cautious, as they’re cognizant of where we may be in the cycle. This is leading to increased selectivity, with a focus on well-positioned and high-profile projects with experienced sponsors. As such, competition for such opportunities is high and exacerbated by the expansion of non-bank lenders who are likewise competing for this business.

Schaevitz: Banks have remained disciplined. We are all accustomed to seeing lenders loosen criteria as we get later into an economic cycle. However, whether due to stricter regulatory controls or better institutional memory, banks have maintained prudence in the current cycle. Non-bank financial institutions have filled the gap, lending on riskier assets and at higher loan-to-value ratios. We have seen examples of non-bank lenders becoming more aggressive on both price and terms.

What do you expect in terms of IPO and M&A activity for 2020?

Fox: To the extent that there are private companies in some of the hot sectors, like the tech-oriented sectors or the logistics-oriented sectors, I think that there would be massive appetite for IPOs. But we don’t see a lot of companies lining up in the queue.

In terms of M&A, it should be busy. On the one hand, you have a lot of companies that are growing quickly in some of the sectors, like data centers, single family rental, and cold storage—they all have attractive cost of capital and are looking to grow. On the flip side, there are also some companies that are trading at big discounts to NAV—mostly in the traditional REIT sectors—that could become M&A targets as well. There is a significant amount of private capital looking for deals.

Dickson: We’re likely to see a pick-up relative to the dearth of 2019 REIT IPO activity, though still fairly limited overall. There continues to be plenty of private capital available. The public market wants a growth story and something different—a unique theme or a niche sector, and those opportunities are not abundant. M&A is likely to see an uptick. There is significant dry powder on the sidelines, REIT valuation levels have improved, and companies can now pursue strategic alternatives from more of a position of strength.

Schaevitz: REIT IPOs have a tremendous challenge. Private portfolio owners can run a dual-track process of sale versus IPO. With REITs trading at fulsome earnings multiples and premiums to net asset values, IPOs should price well. However, sale processes can surface strong all-cash bids that can be completed quickly and eliminate market risk. The wall of private equity paired with inexpensive debt is producing risk-adjusted sales prices that often look advantageous to sellers compared to an IPO exit.

The same combination of plentiful equity and inexpensive debt that has driven sales also drives M&A. Dry powder at opportunity funds, the resurgence of non-traded REITs, and sovereign wealth funds looking for the high yields and the relative safety of U.S. real estate are all driving demand and creating M&A potential. The challenge for many is the full pricing in the public markets and the transaction costs associated with go-private transactions.

Butcher: IPOs will likely be in niche sectors or sectors that are trading at premiums to NAV. The cost of going public—both the discount required and the actual IPO costs—continue to be a challenge to overcome for small and mid-cap companies but some will find structures/pricing that work. We’ll probably see some bigger private equity-backed companies that decide to try and come public as well. Again, mostly in niche sectors.

As for M&A, with rates at the levels they are at you could start to see go-private type transactions, particularly in sectors where companies are trading at discounts to NAV. You could see select transactions, perhaps in the retail, office, and lodging space if they continue to trade at a discount.

As for M&A, with rates at the levels they are at you could start to see go-private type transactions, particularly in sectors where companies are trading at discounts to NAV. You could see select transactions, perhaps in the retail, office, and lodging space if they continue to trade at a discount.

Where do you see foreign investment in U.S. real estate heading?

Schaevitz: There is plenty of discussion regarding the decline in foreign interest in U.S. real estate, however, we are not seeing it. It may be hard to get money out of China, but away from that, there is still a wall of foreign capital. Not only has sovereign wealth fund activity increased, the sovereigns are showing much greater comfort stepping into lead roles on transactions and not relying on fund managers.

In a low—and, in many cases, negative—interest rate world, real estate yields look attractive. In a slow growth world where U.S. GDP growth is outperforming many other regions, U.S. REITs are attractive.

Butcher: You have a global economic slowdown with historically low rates across the globe, so the U.S. looks attractive from a return perspective. Foreign capital will seek out U.S. real estate. At the same time, the global geopolitical environment is causing uncertainty and challenges, which probably pulls the other way on foreign investment. A more stable international geopolitical environment would lead to more investing in the U.S.

What are some of the other issues on your radar right now?

Fox: We’ve seen a transformation over the last handful of years in the REIT market. For a long time, it was all about office, apartments, industrial, retail, and hotels. Now there are these new sectors and they’re the ones that have captured the attention of the market, such as cold storage, single family for rent, and gaming REITs. We’re focused on trying to identify the next hot new sector.

Butcher: There’s been a lot of discussion around opportunity zones. It’s been slower going than a lot of people anticipated—it’s more complicated and challenging to get the money to the places that were intended to get the capital. You’ll see capital flow into the more major markets as opposed to flows into opportunity zones around more tertiary markets. Structural challenges are being worked through, it’s just going to take a bit of time.

Dickson: The impact of technological disruption on the CRE market is something that will garner more and more attention. As an industry with long-term holds and long-term leases, we’ve probably been slower to acknowledge and prepare for the impacts of automation, autonomous cars, preferences for mobility and experiences, just-in-time delivery, etc.

In addition to influencing physical real estate needs, technology could also transform things like fundraising, the construction cycle, brokerage activities, and banking. Those of us who embrace the change and utilize it as method to make our businesses even more effective and innovative will benefit long-term.