VICI Properties, and other investors, see the city as an odds-on favorite in continuing to attract visitors—despite the pandemic’s challenges.

Las Vegas has been at the forefront of a resurgence in leisure travel this year. While concerns remain over the impact of new coronavirus strains on visitor levels, particularly for convention traffic, the city’s thriving gaming real estate arena continues to attract investment capital.

In a significant vote of long-term confidence in the city, VICI Properties Inc. (NYSE: VICI), which leases its properties to gaming operators, said Aug. 4 that it would acquire MGM Growth Properties LLC (NYSE: MGP) for $17.2 billion, including debt.

“Las Vegas was a leading destination before COVID for tourism, conferences, conventions, and trade shows, and it will continue to be after COVID,” says VICI CEO Ed Pitoniak.

Lockdowns in the spring of 2020 turned the bustling and noisy Las Vegas Boulevard into a silent, neon-festooned ghost town. But visitors began returning later in the year amid tight restrictions, and then a torrent of tourists began traveling to the Las Vegas Strip once it fully reopened this spring.

This July, even as delta variant cases spiked in the city and eventually triggered a return to indoor masking, 3.3 million visitors descended on Las Vegas, marking a year-over-year increase of 129.7%, according to the Las Vegas Convention and Visitors Authority. Hotel occupancy on the Strip nearly doubled to 81% from a year earlier, and revenue per available room (RevPAR) grew nearly 170% to more than $130.

While tourism isn’t back to where it was prior to the pandemic—in July 2019, Las Vegas welcomed 3.7 million visitors, and there are far fewer overseas travelers and conventions today—the rebound is encouraging news, especially for VICI.

Landmark Deal

When it finalizes, which is expected to be in the first half of 2022, the deal will give VICI ownership of 10 iconic casino resorts on the Strip. It currently owns Caesars Palace and Harrah’s, and the acquisition of MGM Growth Properties adds seven more: The Mirage, Park MGM, Excalibur, New York-New York, Luxor, Mandalay Bay, and MGM Grand. In September, VICI completed a 115 million share equity offering priced at $29.50 per share to help pay for the acquisition.

VICI also struck a deal earlier this year to buy the land and real estate assets of the Venetian Resort for $4 billion in partnership with a fund affiliate of Apollo Global Management, Inc., which agreed to acquire the Venetian Resort operations from Las Vegas Sands Corp. That acquisition is expected to close in the first quarter of 2022.

“We will be a very big owner of real estate along what we are calling—and I haven’t had anybody correct me on this yet—the most economically productive street in America,” Pitoniak says.

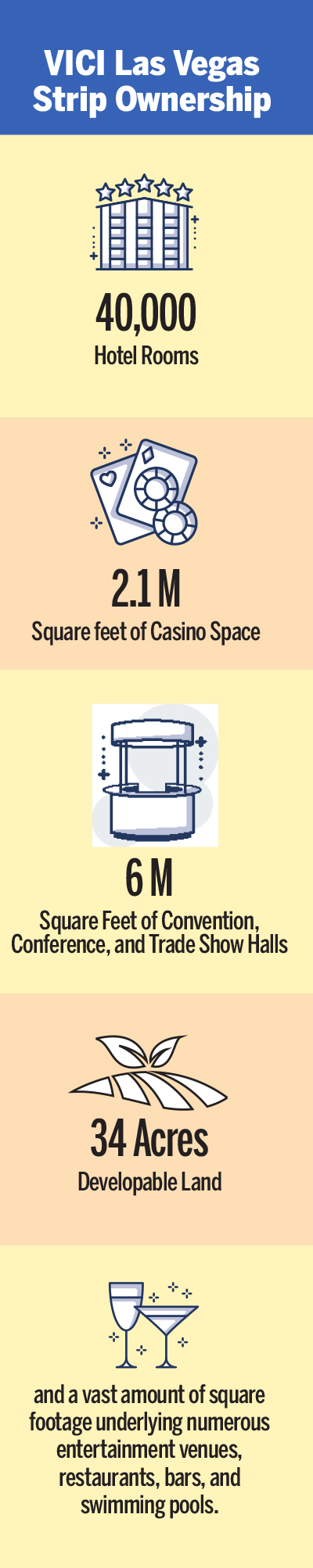

The MGM Growth Properties acquisition will also expand VICI’s regional casino resort holdings to 33 from 25. But on the Strip alone, VICI will own close to 40,000 hotel rooms, 2.1 million square feet of casino space, some 6 million square feet of convention, conference, and trade show halls, 34 acres of developable land, and a vast amount of square footage underlying numerous entertainment venues, restaurants, bars, and swimming pools.

Beyond being immediately accretive to earnings, the substantial expansion of VICI’s portfolio via the purchase of MGM Growth Properties represents a considerable feat given the finite number of properties in the gaming sector from which to source acquisitions, says Spenser Allaway, senior analyst of net-lease, gaming, and self-storage REITs with Green Street.

“This is a landmark deal,” she says. “There are several assets that are not in REIT hands in Las Vegas, but VICI certainly controls the upper echelon of the market.”

Ample Liquidity

Yet VICI isn’t the only real estate investor setting its sights on the Strip.

- In July, Blackstone announced that it would pay MGM Resorts nearly $3.9 billion for the Aria casino resort and the Vdara non-gaming resort in City Center.

- In late September, Blackstone also restructured the ownership of its Cosmopolitan resort property on the Las Vegas Strip, selling the operation to MGM Resorts and the real property to a joint venture of Blackstone Real Estate Income Trust (BREIT), Stonepeak Partners, and the Cherng Family Trust.

- Blackstone Real Estate Income Trust (BREIT) currently owns 49.9% of the Mandalay Bay and MGM Grand through a joint venture with MGM Growth Properties, and it will maintain that stake in the assets when VICI closes its deal. BREIT also owns 95% of the Bellagio with MGM Resorts.

“The pandemic proved that even when casinos were closed or were operating under tight capacity restrictions, these huge operators had a lot of liquidity and were able to pay rent throughout the near-zero revenue environment,” Allaway says. “So, I don’t think that the transaction activity on the Strip is all that surprising—the pandemic was a really great case study for the owners of gaming real estate.”

Newfound efficiencies among resort operators, such as scaling back marketing programs and reining in loss leaders like buffets, have enhanced profitability despite lower revenues, Allaway says.

Meanwhile, VICI likely isn’t done yet in Las Vegas. At the discretion of Caesars Entertainment, VICI has the first right of refusal to buy two of the following Caesars Entertainment assets: the Flamingo, Bally’s, Paris Las Vegas, Planet Hollywood Resort & Casino, and the LINQ Hotel & Casino. VICI also is first in line to buy the 550,000-square-foot Caesars Forum Conference Center through a put-call agreement with Caesars. Thomas Reeg, CEO of Caesars Entertainment, VICI’s largest tenant, noted during the company’s second quarter earnings call in August that it expects to sell a Las Vegas asset in 2022.

VICI would also consider opportunities to expand into downtown Las Vegas and in the Summerlin area on the city’s west edge, Pitoniak says. He makes the case that along with Orlando, Las Vegas is the top tourism and convention destination in the U.S., largely because it possesses the infrastructure to handle a massive volume of guests. That includes the continual expansion of McCarran International Airport, which has tripled in size since 1981.

“One of the key realities and benefits of Las Vegas is that it is run as a destination,” he adds, “and it is a destination that is constantly willing to reinvest in itself to continue to grow.”

Resiliency-tested

The city is also experiencing its share of population and economic growth, especially as people flee high-tax states like California, Pitoniak asserts. After eclipsing 20% in the spring, monthly job growth in Las Vegas’ home of Clark County slowed to 9.5% in July, according to the U.S. Bureau of Labor Statistics. That still put the market among the top 10 job-producing metros in the U.S. for the month and was about double the national rate.

More recently, uncertainty about the Strip’s durability rose along with new COVID cases. Upon reopening in the spring, however, resort operators took aggressive steps to ensure the safety of their workers and guests, from following strict sanitation policies to establishing vaccination centers on the Strip for employees. Additionally, MGM Resorts later made vaccination a requirement for salaried employees and new hires beginning Aug. 30.

After being lifted on June 1, an indoor mask mandate was reinstated in Las Vegas and other areas of Nevada two months later, and then went statewide in September.

Still, resort operators are optimistic that crowds will keep coming. During Caesars Entertainment’s earnings call, Reeg said that he expected the company’s hotel occupancy to remain in the low to mid-90% range on the Strip. He also noted that the new mask mandate came with fewer restrictions than the previous one.

Meanwhile, at MGM Resorts, weekend visitor volume on the Strip returned to normal in July and average daily rates surpassed 2019 levels, according to comments made by CEO Bill Hornbuckle during the company’s second quarter earnings call in August.

“July was the best month this year by far in terms of operating performance, and we ultimately feel great about our long-term positioning in Las Vegas,” he told analysts. “The last few months have inevitably proven that the city remains a top destination for business, and specifically for tourism.”

Foot traffic at street-front stores along the Strip is also returning at a much quicker pace than other prime urban corridors like Times Square, says Michael Hirschfeld, vice chairman at JLL in New York. For the last few years, he has been working with Eli Gindi, a New York businessman who has assembled some 2,000 square feet of retail frontage across the street from the Park MGM and New York-New York, including the Showcase Mall. Gindi is also developing a 300,000-square-foot indoor-outdoor retail and restaurant project at the site.

On an annualized basis, foot traffic on that part of the Strip in July was already 70% of the pre-pandemic norm of about 35 million a year, Hirschfeld says. By comparison, some 130 million pedestrians visit Times Square annually, but in July, annualized traffic had recovered by only 59%, according to the Times Square Alliance.

“If you are on the Las Vegas Strip on a Thursday night through the weekend, you probably wouldn’t notice anything was different from the way it was in 2019,” Hirschfeld says. “It’s mind boggling how quickly it became busy after the reopening.”

Beyond Casinos

The MGM Growth Properties acquisition will provide VICI with eight hotel and casino resorts beyond Las Vegas, which will expand its regional gaming portfolio to 33 assets. Those include the MGM National Harbor in Maryland, south of Washington, D.C., and the MGM Grand Detroit.

For VICI, the expansion outside of Las Vegas isn’t stopping with regional casinos. In fact, rather than being referred to as a gaming REIT, Pitoniak asserts that VICI should be thought of as a diversified entertainment, leisure, and experiential real estate company.

In August 2020, the company provided an $80 million mortgage loan to Chelsea Piers, a sports and entertainment project in New York. In July, it agreed to a strategic arrangement to loan hotel and indoor water park company Great Wolf Resorts up to $300 million in mezzanine debt to develop new projects, with the first in Maryland. In September, VICI partnered with BigShots and agreed to a strategic arrangement to provide up to $80 million of mortgage financing for the construction of up to five new BigShots Golf™ facilities across the U.S. VICI owns four championship golf courses, as well.

“We’ll continue to look at categories that have similar characteristics that we have found in gaming, recreation, and leisure assets,” Pitoniak says. “We’ll consider water parks, certain recreation and fitness categories, theme parks, and potentially ski resorts. They are not commodities, and they should benefit from demographic tailwinds, whether it’s Boomers entering their retirement and leisure years or millennials forming families.”

Regional Strength

While not providing visitors with the same experience as Las Vegas, regional casino resorts possess several advantages.

They typically serve local customers who visit frequently and operate in a restricted-license environment that tends to keep competition to a minimum, says Matthew Demchyk, chief investment officer of Gaming and Leisure Properties, Inc. (Nasdaq: GLPI), a Wyomissing, Pennsylvania-based net-lease gaming REIT that owns 52 properties in 17 states.

Prior to the pandemic, regional casinos generated $35 billion in gross gaming revenues compared with $7 billion on the Strip, according to Green Street. And like casino resort performance on the Strip, regional operations have enhanced efficiency to drive greater profitability from revenues amid Covid, Demchyk explains. The expansion of sports betting across the U.S. is also bringing in new, younger customers to regional casinos, he adds.