REITs are gaining ground in their efforts to attract generalist investors.

Generalist investors are a bit of an enigma for the REIT industry. They represent an attractive equity source as REITs work to diversify and grow their investor base, yet at the same time the group has persistently been a tough nut to crack.

Generalist, or non-dedicated, REIT investors represent a large—and relatively untapped—market. That audience has become an increasingly important target in recent years as REITs battle outflows and reduced ownership among their dedicated investor base. As REITs get bigger, capital flows into the industry have to come from sources other than just dedicated REIT investors.

“The most obvious reason that REITs are looking to attract the generalist investor has been the shake-up that has occurred in the industry through activist shareholders,” agrees Jonathan Keehner, a partner at Joele Frank, a strategic communications firm that advises companies on investor relations and public relations. Over the past five years, there has been a significant uptick in investor activism in the REIT industry, which has put more pressure on REITs to defend their business. Other potential advantages of a diversified investor base include higher share prices, lower discounts to net asset value (NAV), and less overlap between investors in other REITs.

“The REIT dedicated investor is not the marginal buyer of our stock these days because of all of the fund outflows that have been happening. So, when you are searching for people who have capital, the generalist is definitely in the crosshairs of people we are targeting,” says David Bujnicki, senior vice president, investor relations and strategy at Kimco Realty Corp. (NYSE: KIM). Generalists make up about 20% to 25% of Kimco’s shareholder base.

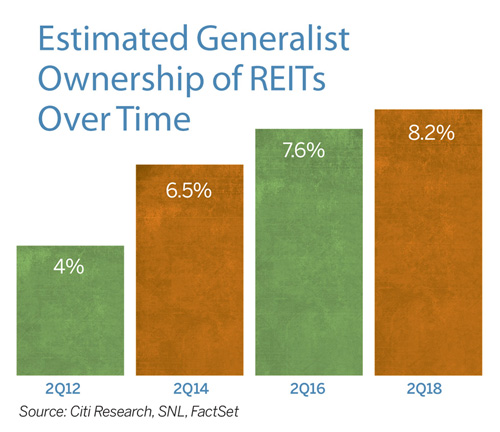

REITs see plenty of opportunity ahead to carve out a bigger foothold among an audience of generalists that are, for the most part, underweight in REITs. In an effort to gauge the true gap in generalists’ ownership of REITs, Citi looked at about 550 of the largest active mutual funds, further filtering the analysis to approximately 170 of the largest non-dedicated owners of REITs that non-dedicated managers own and that are benchmarked to equity indexes. That analysis shows that generalist investors are underweight in REITs by about $30 billion.

Keeping the Story Simple and Focused on Growth

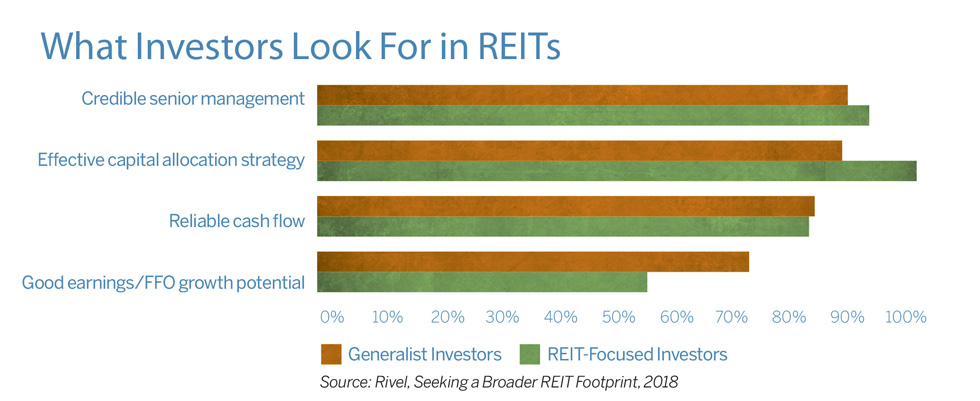

One of the challenges in reaching the generalist investor community is dispelling some of the misperceptions they have about REITs. To that point, Nareit commissioned a generalist investor study last year, conducted by Rivel Research Group, to better understand the factors and issues which trigger generalist and REIT-focused investor investment decisions. “If there is one thing that I want to make sure that the REIT community receives from this study, it is that they have to weave a better story,” says Stephen Chuck, senior vice president at Rivel. For example, the dividend is a huge part of the REIT investment thesis, yet the dividend yield ranked low on the list of investment drivers for both generalists and REIT-dedicated investors. The reason for that is if an investor is looking at 10 different REITs, they all have a dividend, he says.

“That was a little bit surprising to the REIT community because that shows it is still about the story relative to what your company is doing,” Chuck says. Generalist investors want to know how the REIT is going to grow; what that growth is going to look like; how growth is going to be accomplished; over what time frame; and what potential obstacles might derail that growth, he adds.

One of the common themes coming from consultants and generalist investors themselves is that REITs need to present a story that is “less REIT-like” and more focused on the businesses they run. “Generalists are very accessible for one key reason: REITs own assets that are tangible and relatable,” Keehner says. Whether people are going to work in an office building, visiting the mall, living in an apartment, or booking a stay at a hotel, the REIT industry touches everyone’s lives in some way on a daily basis.

The REIT strategies that are most effective are those that create a value proposition that taps into a broader storyline, notes Keehner. Those narratives are sector specific, such as talking about the baby boomer tailwind driving demand in seniors housing. “Ultimately, REITs need to leverage what they do in terms of their operations to get their story in front of an audience that may care more about the broader narrative versus just the real estate play,” he says.

Oftentimes, reaching the generalist audience requires multiple meetings and may involve several members of the management team to both educate investors and establish credibility. “Much of our industry vernacular is new to them,” says Tracy Ward, senior vice president of investor relations at Prologis, Inc. (NYSE: PLD). “This makes it crucial to have a simple story and to stay top of mind, while also demonstrating a durable growth profile,” she adds.

Ward pointed out the differences between the generalist investor and the dedicated REIT investor. “Generalist investors really want to understand the growth drivers of the business and how the company is better-suited than its competitors. The dedicated REIT investor is more hyper-focused on growth within specific markets and on understanding the intricacies of all the pieces; where at the end of the day, the generalist investor is going to look at cash flow growth and the durability of that growth profile.”

The average generalist is following more than 120 companies, and REITs have to understand that the conversation with generalists is going to be different, Chuck notes. “When they talk about their business and their story, it needs to be simpler, more direct, and more succinct,” he says. Generalist investors listening to a REIT presentation are not going to be as familiar with all the ins and outs of REIT financials and structure.

Additionally, the survey found that some of the factors that will differentiate one company from another are:The credibility of the senior management team; The effectiveness of the capital allocation strategy; The reliability of cash flow; and The effectiveness of the overall business strategy.

New Strategies Pay Off

Although generalist investors remain underweight in REITs, data shows that REIT strategies targeting generalists are starting to pay off. According to

Citi Research, generalist ownership of commercial property REITs is now at about 10.2% of total equity float.Percentage ownership has increased 50 basis points year-over-year and is more than double the 4.0% generalist owners held in 2012.

“There are a number of factors that have helped to drive the generalist ownership higher,” says Michael Bilerman, managing director and head of the real estate and lodging team at Citi Research. One of the significant factors was the GICS change implemented in 2016 that took real estate out of financials and made it a standalone sector. “That was definitely a very important catalyst for REITs to garner more share out of the generalist investor community,” Bilerman says.

Growth in the size and scope of the REIT industry has made it a sector that is tough to ignore. Investors also have more choices. The REIT sector today is much broader than it has ever been before with a number of different real estate verticals. Finally, REITs have performed well coming out of the financial crisis, and that performance has helped put REITs on the radar for generalists, Bilerman notes.

In the current environment of declining interest rates and yield-starved investors, which does help to open the door to starting conversations with the generalist audience. “The challenge is identifying who is a generalist, because they don’t wear a hat or moniker,” Bujnicki says. “You have to do your research and create a database of who they are. And just because they are a generalist doesn’t mean they have a mandate, or an allocation ascribed to investin REITs.”

Improving Strategies to Reach Generalists

REITs are tapping into the generalist audience through a variety of means, such as leveraging relationships with sell-side analysts who have long-standing relationships with generalists. Companies also can reach that audience by participating in industry conferences outside of the traditional REIT conference circuit, such as financial, consumer, or technology conferences.

“Another piece that is really important is tapping into the good relationships you have with your existing shareholders,” says Prologis’ Tracy Ward. Generalist investors own about 15% of Prologis, and that number increases to 20% to 25% when including dedicated REIT investors who have ancillary funds. For example, larger firms, such as a JP Morgan or Fidelity, have both specialist and generalist funds. So, oftentimes the dedicated investors can be a good conduit toward making the right introductions to generalists at the same company, Ward adds.

“Another piece that is really important is tapping into the good relationships you have with your existing shareholders,” says Prologis’ Tracy Ward. Generalist investors own about 15% of Prologis, and that number increases to 20% to 25% when including dedicated REIT investors who have ancillary funds. For example, larger firms, such as a JP Morgan or Fidelity, have both specialist and generalist funds. So, oftentimes the dedicated investors can be a good conduit toward making the right introductions to generalists at the same company, Ward adds.

Nareit also is working to put more resources in the hands of members to support those initiatives. For example, Nareit is developing a best practices tool kit aimed at helping REITs develop presentation materials that are better structured for a generalist audience.

“From an industry perspective, we seek to arm our member REITs with improved tactics to use as an individual company, because this is a sale that can’t really be done at the industry level. It has to be done at the company level,” says Nareit Vice President, Investment Affairs & Investor Education, Abby McCarthy.

MiFID II Puts More Work and Costs on U.S. REITs

REITs courting European investors are still adapting to Markets in Financial Instruments Directive (MiFID) II regulations. Effectively, the new rules that went into effect in January 2018 have created more work for financial services firms in Europe, and in some cases, disrupted distribution channels. For U.S. REITs, the fluid outreach they had enjoyed in the past is now more challenging, and potentially more costly.

The first round of MiFID regulations was introduced in 2007 with an aim to bring more uniform practices to financial markets and reduce trading costs. Following the global financial crisis, the additional rules aim to increase transparency and put additional safeguards in place to protect investors.

However, MiFID II has created challenges throughout Europe’s financial services chain as firms have adapted to new reporting and documentation requirements, notes Kevin Demeyer, a senior manager in the strategy regulatory and corporate finance department at Deloitte Luxembourg. Two key changes are:

The distributor needs to identify the target market for the investment product, the type of underlying investment, and whether it is targeted toward institutional or retail investors.

The distributor also must determine the cost of the product. In the case of publicly traded REIT stock, the cost would generally relate to brokerage fees.

One of the changes that occurred with MiFID II is that investment managers have to determine whether they are going to pay for certain industry research that has historically been bundled into other services. As a result, some investment managers are no longer doing business with certain equity research firms. “The consequence is that many of the equity research firms that we would deal with are no longer clients of certain investment management firms,” says Kimco’s David Bujnicki. So, it has put the onus back on the IR teams now to either do a dual coordination with the equity research firms if they are going on the road and schedule their own meetings, or coordinate directly with the investment management teams, he says.

Logistically, coordinating with multiple investment management teams all across Europe is much more complex and time consuming. Potentially, there is an opportunity for boutique firms to step into that gap and provide that service. However, REITs will likely have to bear some of the cost for those services, whereas, in the past, the equity research firms would have taken that on themselves.