The smallest of the four publicly traded timberland REITs, CatchMark Timber Trust, Inc. (NYSE: CTT) is a pure play timberland REIT focused on highly-productive, well-located timberlands and long-term supply agreements—a strategy that has transformed the company from a little-known REIT into a strong competitor amongst its industry peers.

The Atlanta-based REIT began operations in 2007 and takes its name from the term “catchmark,” the branding symbol at the end of cut logs to ensure easy ownership identification of high-quality timber.

CatchMark concentrates on owning and investing in premium assets in leading mill markets, primarily in the southern United States. It also utilizes fiber supply agreements and delivered wood sales to help maximize cash flows throughout the business cycle.

These characteristics, and the REIT’s execution of its strategy, have become increasingly valued by analysts and investors alike. Disciplined underwriting of counterparties and savvy asset management have also contributed to the company’s stability during the COVID-19 pandemic.

– Brian Davis, President and CEO

Brian Davis took over as president and CEO in January 2020, after serving as president since 2019 and CFO since 2013. He says that CatchMark has always believed that acquiring prime timberlands in high-demand mill markets and managing operations to generate sustainable harvest yields and highly predictable cash flow would enable the REIT to comfortably cover its dividend and deliver consistent growth—a belief that has been put to the test in the wake of COVID-19.

Consistent Growth

Since its initial public offering in December 2013, the company has achieved a 22% revenue compound annual growth rate (CAGR) and has consistently paid fully-covered quarterly distributions. CatchMark paid its first dividend in March 2014 and has had two dividend increases since then: a 14% increase in the third quarter of 2014 and an 8% increase in the second quarter of 2016.

Direct acquisitions and ownership investment in two joint ventures have quintupled timber acreage under company management, to 1.5 million acres, and more than doubled annual harvest volume for company-owned timberlands to 2.2 million tons. An expanded investment management platform that supervises joint ventures produced $11.9 million in asset management fees in 2019.

The company’s second quarter 2020 results, while diminished due to pandemic-related disruptions, were in line with company expectations. Revenues of $21.8 million compared to $28.7 million in the second quarter of 2019, which was bolstered by a 15% increase in total harvest volume.

Davis says that after initial pullbacks by customers early in the pandemic, CatchMark was able to step up harvests to capitalize on mill uptime and increased demand for both pulpwood and sawtimber products.

“We’ve been especially encouraged by the quick rebound in the housing market and heightened activity in home remodeling and home improvements, which have generated strong demand in our mill markets. Our business model, execution, and flexibility continue to provide us an advantage,” he says.

The Pure Play Factor

Underlying CatchMark operations is a lower-risk cash flow model hinging on the company’s pureplay strategy. By limiting its business model to investment in and management of timberlands, the REIT does not engage in manufacturing or land development.

Cash flow stems from sustainable harvests, continual improvement of the harvest mix on owned timberlands, and investing in markets with favorable current and long-term supply/demand fundamentals.

Enhancing careful asset management is the timber industry’s natural line of sight, according to Davis. “Well-managed timberlands grow in size and value over time,” he says. By having trees in each of the pulpwood, chip-n-saw, and sawtimber age groups, CatchMark always has merchantable inventory available and can shift harvests in line with the specific demand from these three different markets. “Given our positions in leading mill markets, we’ve also been able to achieve better pricing for our harvests.”

Davis says CatchMark’s emphasis on delivered wood sales to creditworthy counterparties results in better control of the supply chain, producing more stable cash flows with greater visibility. Not surprisingly, the company’s business model has been tested this year by conditions stemming from the pandemic.

“We were really excited at the beginning of 2020, because the outlook for the housing market was strong, and a lot of business was in the pipeline,” Davis says. By April, however, sawmills were slowing production.

“We were really excited at the beginning of 2020, because the outlook for the housing market was strong, and a lot of business was in the pipeline,” Davis says. By April, however, sawmills were slowing production.

“This gave us the opportunity to bench-test our underwriting model, which said our counterparties should provide for our safety. And so far, that has been the case,” Davis says. “When you’re pure-play in the timber industry, it’s not just about the trees and the merchantable inventory, it’s about counterparty risk, so you have to underwrite your counterparties really well.”

Strong relationships and supply agreements with leading lumber producers and paper/packaging manufacturers help secure dependable outlets and pricing for CatchMark’s harvests. The company’s fiber supply agreement with WestRock, for instance, calls for CatchMark to supply a certain tonnage of pulpwood to a particular mill, which WestRock agrees to purchase. The arrangements allow for quarterly pricing adjustments based on a third-party benchmark.

“While pulpwood demand remains strong, a bottom-quartile mill might actually shut down during the pandemic. However, our top-tier counterparties are well capitalized and can withstand such a fall-off and potentially flourish due to the essential products they produce,” Davis says.

A Three-pronged Capital Strategy

With half of CatchMark’s earnings before interest, taxes, depreciation, and amortization (EBITDA) derived from timber harvests, a deviation in the economy presents a risk to cash flow. However, Davis points out that although some harvest revenues have been deferred due to the pandemic, they have not been lost.

“Trees store value on the stump, and therefore if a tree is not harvested it simply grows larger and more valuable.” he says. “Our trees are still growing and creating merchantable inventory, and the resources we provide make us an essential business.”

In addition to the firm’s delivered wood agreements, CatchMark can take advantage of opportunistic stumpage sales, which are contracts with third parties for an option to harvest on CatchMark property, usually at prices slightly above market.

Investment management activities produce another 25% of EBITDA, and dispositions of timberlands that do not meet production criteria provide the remaining 25%.

Paul Quinn, an analyst with RBC Dominion Securities, Inc., says CatchMark is doing well with both mergers and acquisitions activity and portfolio diversification.

“Publicly owned timberland REITs constitute a tiny but very closely watched group, and these are times when they should outperform,” Quinn observes. “CatchMark is small, nimble and has good relationships with the sawmills it works with. They’re also opportunistic in their purchases and dispositions, and because of their size, they can buy small tracts that might not interest their larger competitors, but make a difference for CatchMark.”

“Publicly owned timberland REITs constitute a tiny but very closely watched group, and these are times when they should outperform,” Quinn observes. “CatchMark is small, nimble and has good relationships with the sawmills it works with. They’re also opportunistic in their purchases and dispositions, and because of their size, they can buy small tracts that might not interest their larger competitors, but make a difference for CatchMark.”

Joint ventures are another area of opportunity for CatchMark, allowing it to partner with institutional investors in opportunities that might otherwise not be feasible, Davis points out.

In 2018, the company made a $200 million investment in Triple T Timberlands, a $1.39-billion joint venture undertaken with five institutional investors to purchase 1.1 million acres of timberlands in east Texas. At the time of purchase, the Triple T acreage added 38 million tons of merchantable inventory and opened the channel for multi-million-dollar asset management fees, which CatchMark has used in part to cover dividends.

Triple T and a much smaller Georgia joint venture known as Dawsonville Bluffs together generated $13 million in revenues in 2019, growing CatchMark’s investment management earnings by 35%, to $16.7 million.

CatchMark’s more recent move to improve Triple T revenues caught the attention of Anthony Pettinari, an equities analyst at Citi Research. He notes that in addition to stepping up harvests to capitalize on increased demand for both pulpwood and sawtimber products, CatchMark successfully renegotiated the wood supply agreement in the Triple T joint venture. The renegotiation allows Triple T to realize market-based pricing on its timber sales, and also to sell sawtimber and large parcels of land to third parties.

Additionally, the company recycles and optimizes capital by selling non-core assets, managing leverage, and reinvesting in its core portfolio. The recent sale of 14,400 acres of Georgia timberlands produced $21 million in proceeds, which was used to pay down debt and increase liquidity.

A Simpler Future

Davis admits that CatchMark’s business model and cash flow visibility allows the company to support higher leverage than its peers for acquiring additional timberlands in top-tier locations.

“You want to be really close to a mill in this business, and the manufacturer should be one you want to sell to. Ninety percent of our assets are in such locations, and our average distance to a mill is 45 miles. Selling to top mills has meant that we have not been as impacted by the current slowdown,” Davis explains.

As for future joint ventures, Davis says he prefers greater simplification. “I like joint ventures when they’re smaller and provide more diversified risk. It’s possible we’ll do more joint ventures like Dawsonville Bluffs, along with deleveraging our balance sheet, and simplifying our narrative.”

Quinn also looks for Davis to run a simpler company and thinks investors and analysts will approve.

Quinn also looks for Davis to run a simpler company and thinks investors and analysts will approve.

“Deleveraging should be a good thing, and homebuilding repairs and remodeling should pick up further as consumers complete smaller projects, spelling a trend of good demand,” he says. RBC Dominion recently upgraded CatchMark to outperform on the basis that current wood products demand is sustainable for at least the near future.

Citi Research also raised its expectations for CatchMark. “While leverage remains high, the company’s priority is reducing leverage, ahead of using cash for buybacks or acquisitions,” Pettinari says.

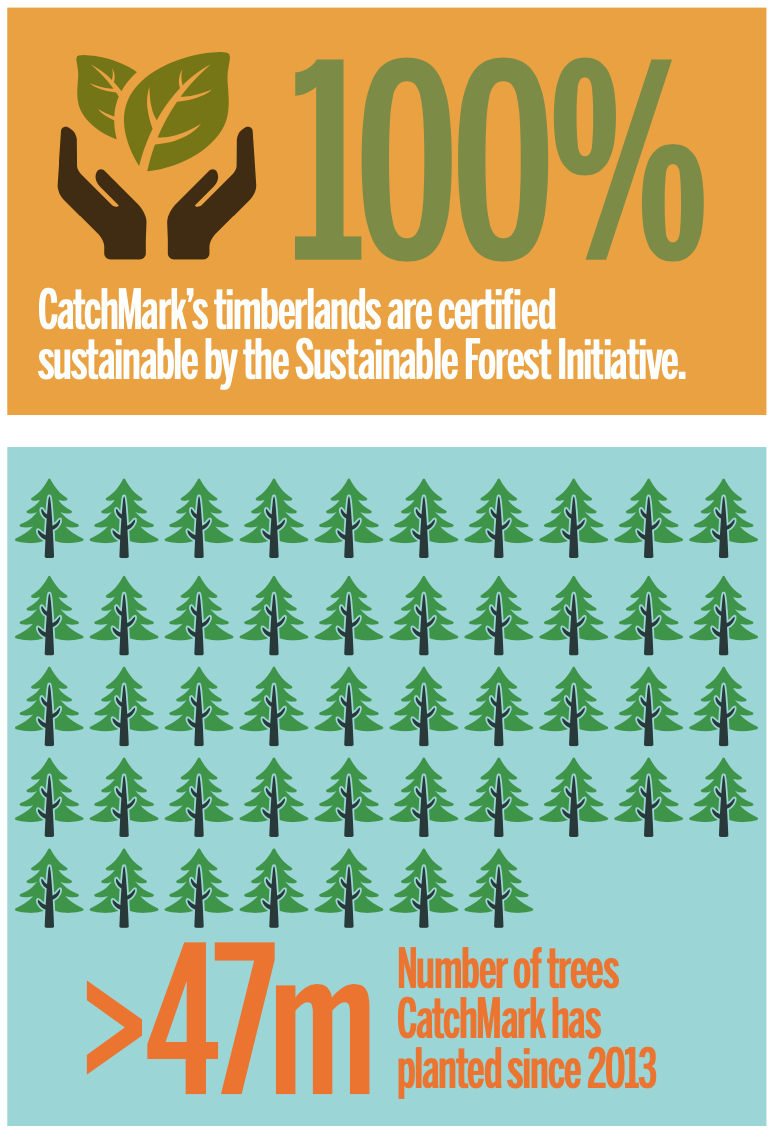

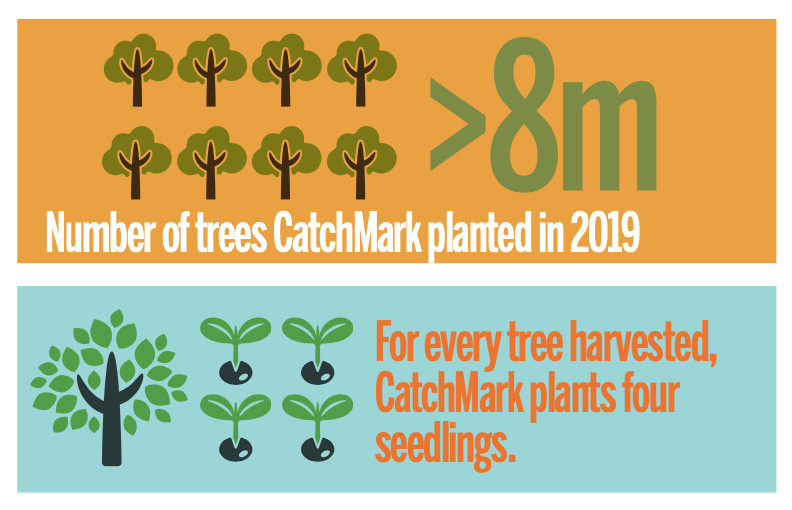

Through the cascade of challenges and successes marking 2020, Davis reflects on CatchMark’s fundamental strategy. “We’re literally a growth story, through our business model and through our trees. We practice sustainable harvesting that benefits wildlife, recreational users and the environment, and we adhere to best practices in governance. We’ve done a lot of things recently to make our best even better. There’s a lot to like about this asset space.”

Read more from September/October issue of REIT magazine, available now in an interactive PDF.