REIT CFOs share their views on market challenges, reporting metrics, improving transparency, and the changing nature of their role.

REIT CFOs play a central role in their organization, with almost every major decision requiring their input. While a company’s financial health is their key focus, they are also dealing with complex issues related to growing investor demands for transparency around issues such as climate risk, cost of capital, and diversity, equity, and inclusion (DEI).

REIT magazine recently talked with five CFOs about some of the key issues on their agenda, the challenges and opportunities they see ahead, and what their role actually entails.

What is the biggest financial issue facing your company in the coming year?

Moina Banerjee: As is the case with all companies, we will continue to grapple with the challenges and uncertainties associated with the pandemic for some time. That said, we are well-positioned to benefit from the continued growth of Amazon’s new headquarters and Virginia Tech’s Innovation Campus, as well as our own investments that will create the nation’s first Smart City at scale in National Landing in Arlington, Virginia.

In addition, our portfolio recycling efforts, development pipeline, and targeted acquisition opportunities are enabling us to continue to advance our transition to a majority multifamily portfolio in Washington D.C.’s high growth submarkets.

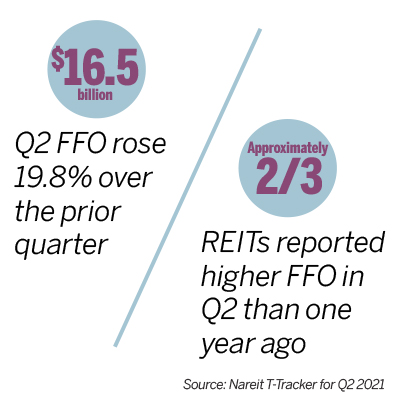

Anna Chew: Growth and cost of capital. We are a small cap REIT and in order to grow we use preferred stock, which is higher in cost compared to other forms of capital. We have been reducing our cost of capital by replacing our preferred stock with lower cost capital. Last year, we replaced our $95 million of 8% series B preferred stock with 2.62% mortgage debt, generating over $5 million, or $0.11 per share, of incremental funds from operations (FFO).

Laura Clark: At Rexford, our biggest financial challenges are around making sure we stay focused as we grow, that we are innovative in our processes, reporting and procedures, and that we continue to differentiate ourselves.

With my team, I’m very focused on having best-in-class technology and tools for development and growth opportunities, as well as making sure we have the right amount of capacity to support our rapid growth.

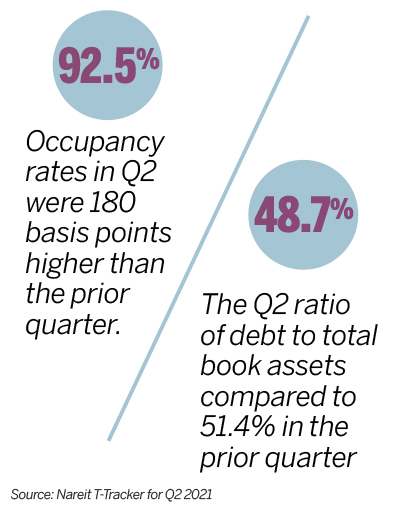

We are experiencing robust leasing demand, elevated leasing spreads, and high levels of occupancy. Our external growth prospects continue to remain very strong.

Michelle Ngo: As an office and life science landlord and developer, our biggest financial challenge is leasing and growing rents. Unfortunately, with the restrictions we had in place over the past year, leasing activity has been slow. However, we’re starting to see strong momentum as vaccinations have accelerated and restrictions eased.

In terms of how we position ourselves, it is doing what we have been doing, which is cultivating and assembling one of the highest quality, most sustainable office and life science portfolios catering to innovation-driven companies in strong markets. Limited lease expirations and a strong balance sheet with strong liquidity and low leverage will position us well.

Barb Pak: Inflation and rising interest rates seem to be on investors’ minds these days. During the pandemic, we took advantage of the low interest rate environment and refinanced approximately one third of our consolidated debt with long-term bonds, making us less susceptible to rising rates over the next several years.

Overall, Essex is in a strong financial position given our low-leveraged balance sheet and minimal near-term funding needs. This puts us in an advantageous position to play offense or defense as necessary, without a major impact to the company’s financial health.

Are financial disclosures presenting new challenges for you?

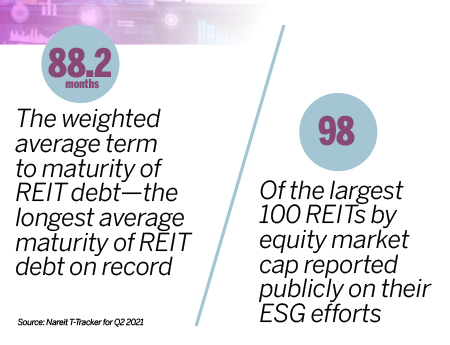

Banerjee: The current reporting systems, processes, and controls for financial disclosures have been developed and refined over a long period of time. As we prepare for additional disclosures, such as those surrounding ESG, we need to have the same robust controls in place for the collection and preparation of that data.

Chew: Documenting climate risk is the biggest challenge related to financial disclosure. There is currently no consistent framework for companies to disclose how they are responding to risks related to climate change, including a company’s strategy, metrics, and targets. We currently include ESG information on climate change risks in our ESG report, and we are working on additional disclosures.

We have hired a third-party consultant to gather consumption data on our utility usage and convert this data to equivalent greenhouse emissions. From this information, we will be able to set targets, monitor our progress, incorporate climate change into our operating strategies, and report to our shareholders.

Clark: Potential financial disclosures around ESG measures will probably be one of the biggest challenges we face in the near term. ESG disclosure, such as documenting climate change risk, can be challenging given the difference in property type, operating models, and access to data.

When it comes to reporting around environmental metrics and our ability to have an impact on reducing greenhouse gas emissions, we have to get creative with how we develop, redevelop, and reposition our properties because we have very little control over how our tenants operate within the four walls of our buildings. Access to data can be challenging and one way we are working to solve that is a new process to benchmark energy use across our portfolio. We’re also conducting a climate-related scenario analysis that will align with Task Force on Climate-related Financial Disclosures (TCFD).

Ngo: I don’t see a big challenge for us unless the Securities and Exchange Commission (SEC) comes out with additional requirements. However, I do see ESG disclosure requirements starting to get some spotlight and the issue with ESG disclosures is consistency, or lack thereof, with respect to how companies define ESG.

What is the most useful ESG information in the current market?

Pak: Essex conducted a materiality assessment to better understand what our various stakeholders deem relevant and to prioritize those disclosures. Although disclosure frameworks and presentation format continue to evolve, there are several common categories of useful information, including diversity and inclusion, especially with respect to the board and senior leadership, data security, water conservation, and climate risk, to name a few.

Banerjee: We commissioned a third-party assessment in 2020 to identify the ESG topics most relevant to our business and shareholders to help us tailor our disclosures. As you might expect, issues pertaining to climate change ranked very high on the list.

Responding to this input, we developed specific performance targets and completed a climate change risk analysis to better understand the impact on our business and portfolio. We also found heightened interest on issues surrounding discrimination in the workplace and we addressed this topic in our inaugural Diversity & Inclusion report, which documented the progress we have made over the past calendar year.

Chew: Investors are interested in the impact we have on the environment, including climate change and the use of renewable energy sources. Since our homes are constructed in controlled factory environments using green construction practices, energy and waste is reduced compared to other forms of housing.

From a social aspect, affordable housing is a national major concern. We are committed to providing quality affordable housing. Additionally, investors are concerned with the diversity of our board and workforce. Two of our directors are female and approximately half of our executive management team and half of our total employee population are female.

Clark: There is an alphabet soup of frameworks and reporting tools out there. Due to our real estate specific focus, the GRESB survey and framework is the most relevant and useful for stakeholders. I believe that there should be a focus on standardizing ESG disclosures across the entire REIT sector, with a focus on those frameworks that are best-in-class.

Ngo: We think investors and lenders look to a company’s sustainability report as well as GRESB scores, and certifications like Fitwel, LEED, and Energy Star. Other metrics include water, utility usage, and alternative energy offsets. But as we continue to progress, investors and the industry will focus more on DEI metrics.

Should ESG information be filed with the SEC?

Banerjee: This is a subject of considerable debate. No matter what decision the SEC makes, we will continue to utilize best practices and strive for third party assurance for all our ESG data.

Chew: ESG information should be furnished with the SEC to afford the company with certain liability protection. Reporting standards and frameworks are new and rapidly changing. There is a lack of common reporting standards and consistency.

Clark: Yes, absolutely. Given the importance of ESG to a company’s overall success, I firmly believe we need to provide better transparency, as well as oversight over disclosure. Filing this information with the SEC would allow for better transparency and oversight. Most importantly, we need to come up with standardized ESG disclosures with a real estate focus that would be relevant for stakeholders.

Ngo: I don’t think it should be filed anytime soon. It is still loosely defined, and people are still trying to get their arms around what ESG encompasses. Once you get more consensus around definitions, then you can think about SEC filings. It could be a consideration in a few years, but I don’t think we are there yet.

Pak: Currently, we disclose as part of the risk factors section of our 10-K, material information about the risks and impact of climate change to our business. However, until there is a clear set of standards related to ESG disclosures that would be material to the company, we don’t believe any additional information should be furnished with the SEC.

Has the role of a REIT CFO changed in recent years?

Chew: CFOs are no longer just focused on accounting and financing issues. CFOs must interface with other departments and help to develop and execute strategic ideas and bring change.

Technology is evolving very quickly. We continually look into automation and digital technology, including artificial intelligence, robotics, and optical character recognition, not just for the accounting department but also for operations. CFOs need to be concerned about learning and integrating emerging technologies that will produce greater efficiency and productivity.

CFOs must also deal with new and complex business risks, including cybersecurity. We need to ensure that the correct cybersecurity protocols are in place to protect the company and ensure data security and privacy.

CFOs must be concerned with the varying concerns of the shareholders, including ESG. We must prepare for the increased focus on ESG metrics from our investors and regulators. CFOs must balance long-term and short-term performance. Long-term planning is key to business success and ESG issues are part of this planning.

Clark: The role continues to evolve as today’s CFO plays a key role in setting the strategic direction of the business. I see the CFO role continuing to evolve and deepen around ESG and the instrumental role a CFO holds in setting strategic ESG priorities, executing on goals and objectives, and ESG reporting.

Banerjee: JBG SMITH maintains a progressive approach to the role of CFO that extends beyond what might be considered traditional financial priorities. From that vantage point, I believe we will see increasing focus among CFOs on how ESG and the cultivation of a fair and equitable workplace can help drive a company’s success.

Does Nareit-defined FFO adequately report the profitability of your REIT?

Ngo: Generally, yes. Real estate is fairly consistent, particularly with office where you have long-term leases. Capital recycling and investment activity can create big swings driven by gains and losses, but a lot of our investors and sell-side analysts that follow the industry carve that out so it’s more of a true apples-to-apples comparison.

Clark: A tool like Nareit FFO that is real estate specific is very important to our industry and enables the comparability of REITs across the industry. That said, we also report a core FFO metric that excludes non-recurring items, because we do believe it is more meaningful and a better consistent measure of operating performance, allowing investors to more easily compare operating results from period to period.

It would be helpful to look across the REIT space at the additional FFO metrics that are used in terms of disclosure and consider some potential updates to the Nareit FFO definition so that it is more consistently used.

Banerjee: We report Nareit-defined FFO, which we believe is a helpful operating performance benchmark for the REIT industry. We also provide core FFO, which adjusts for items that we believe are not representative of ongoing operating results, such as transaction and other costs, which when used in conjunction with Nareit-defined FFO provides investors with a clearer picture of our recurring, normalized earnings.

What role do you play in your firm’s broader focus on DEI?

Banerjee: I see myself as a strong advocate for women at all levels in the workplace. I’m a founding member of JBG SMITH’s Women’s Initiative. It began as a cross-functional team of female leaders focused on identifying ways to better engage and connect with women within our company and has since evolved to include women throughout the firm.

In 2020, JBG SMITH launched its comprehensive diversity and inclusion strategy focused on advancing our efforts companywide. I am committed to supporting this work, doing my part to drive accountability, and serving as a role model for leading the change we want to see.

Chew: UMH understands that a diverse workforce brings different experiences, skills, and perspectives. We hire and promote based on a person’s demonstrated abilities. At UMH, I feel like I am an equal part of the team.

Clark: Diversity is certainly a key focus for me, our executive team, and the rest of our board. We’re committed to fostering a diverse workforce and further imbedding inclusion into our culture.

Last year we formalized our approach to diversity and recently publishing a diversity and inclusion policy. We’re also using data to better understand diversity in our company. We have set formal goals to really guide those long-term improvements.

Ngo: Our CEO has been a big proponent of meritocracy, supporting women and giving everyone equal opportunities, and that has trickled down throughout the company. I am making sure that I mentor, lead, and inspire the rest of the team to grow and make sure we are a diverse group. It’s extremely important to our culture to foster this environment.

Pak: Essex is unique given that 50% of our senior leaders are female. The company culture has fostered a place where both men and women can succeed, and we are proud that we have no gender pay gap.