Green leases offer diverse and quantifiable ways for tenants and landlords to advance their shared ESG goals.

Interest in green leases continues to rise as tenants and landlords with a shared commitment to advancing their environmental, social, and governance (ESG) goals appreciate the diverse and flexible tools these agreements provide to address not only energy usage and health and wellness issues, but to quantify essential data for investors and regulators.

With commercial buildings contributing about 16% of all carbon emissions in the United States, owners, tenants, and investors are all eager to focus on reducing their carbon footprint, and green leases are seen as an important tool in that effort.

Green leases, also known as high-performance leases, have been in use by some companies for more than a decade to meet ESG goals, delineate responsibilities for both landlords and tenants, provide transparency and data, and to create a mechanism for course correction as needed, says Margaret Lo, director of business engagement for the Institute of Market Transformation (IMT), a nonprofit that aims to decarbonize buildings by catalyzing demand for high-performance buildings.

Ben Myers, vice president, sustainability for BXP (NYSE: BXP), says a longstanding challenge for the commercial real estate industry has been to determine the role of the landlord and the tenant to meet their sustainability objectives. “Just like green bonds are a finance tool that aligns investor and issuer towards more sustainable outcomes, green leases are a legal tool to advance sustainability goals that require collaboration between BXP and our clients.”

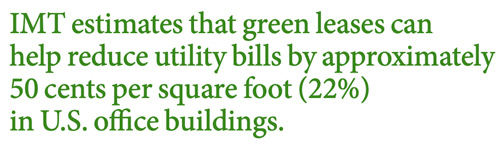

An inherent conflict in real estate is the split incentive issue of who pays for energy efficiency improvements—usually the landlord—and who benefits—usually the tenant, says Vicki Worden, president and CEO at the Green Building Initiative, an international nonprofit and developer of the Green Globes building certification.

Yet both landlords and tenants often share a commitment to sustainability goals.

“The core challenge for commercial real estate is that landlords control the decisions from an efficiency perspective, but tenants control how much energy they use,” says Rex Hamre, national sustainability director for JLL. “Green leases acknowledge that agreements need to be legal and on paper, otherwise it can be hard for tenants and landlords to accomplish their ESG goals.”

IMT and the U.S. Department of Energy established the Green Lease Leaders program in 2014 to encourage building owners and tenants to align their ESG objectives and commitments. More than 20 REITs earned the 2022 Green Lease Leaders designation, which recognizes landlords and tenants who negotiate leases to collaborate on a range of issues including energy efficiency, decarbonization, cost savings, health, and other environmental and social issues.

This year, five Nareit members, BXP, Brandywine Realty Trust (NYSE: BDN), Digital Realty (NYSE: DLR), Empire State Realty Trust, Inc. (NYSE: ESRT), and Physicians Realty Trust (NYSE: DOC) were named to a new Platinum tier for their achievements in integrating higher performance leasing and social equity practices into building operations.

“To be a Green Lease Leader you should have a sustainability point of contact in both (landlord and tenant) organizations; disclose all energy use data, submeter all energy and water use, provide training, and include a clause about cost-recovery,” Lo says. “How the costs are split depends on the owners and the tenants. All we need to know is that it is clear for both sides.”

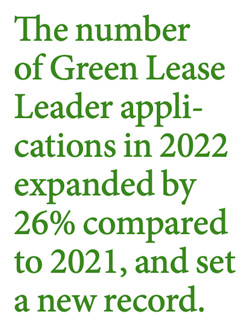

The number of Green Lease Leader applications in 2022 expanded by 26% compared to 2021, and set a new record. The cumulative floor area of all Green Lease Leaders is now five billion square feet of U.S. building space, according to IMT. Still, Lo says, there are many firms and lawyers who are not familiar with green leases or are resistant to change.

“Companies tend to be more supportive when both the landlords and the tenants have ESG goals instead of just one side,” Lo says. “Building owners benefit from green leases because they have more engaged tenants, lower energy costs, increased value, and higher NOI.”

Tenants benefit from green leases with increased communication from their landlords, reduction in energy use and utility costs, and by making progress on their ESG goals, Lo adds. Both sides benefit from increased tracking and reporting of the building’s performance.

Investors and Green Leasing

Investor interest in ESG has increased in recent years, along with regulatory oversight of ESG reporting.

In March, the Securities and Exchange Commission (SEC) proposed new requirements that, if adopted, would require public companies to disclose greenhouse gas emissions and risks related to climate change, including both physical risks to property and financial risks related to increased costs or reduced values. The proposed regulations include a requirement for companies to disclose emissions related to tenant utility use.

“Landlords need to provide ESG reports for every building across their portfolio and tenants may also need ESG reports,” BXP’s Myers says. “But if a tenant has direct metering, there’s no transparency for the building owner unless they have a clause in their lease that requires them to provide that data to the landlord.”

Myers says direct metering is more common in industrial and retail properties with triple net leases.

“Investors are very interested in ESG generally and they’re also aware that lower water and energy use benefit the community around our sites, too,” says David Lanzer, general counsel and secretary for Rexford Industrial Realty, Inc. (NYSE: REXR), which won gold level recognition as a Green Lease Leader.

“The proposed SEC rules make it even more imperative that we have clear language and uniform information for our investors about greenhouse gas emissions and other data. If we don’t have that information from our buildings, we won’t be able to comply,” Lanzer says.

In addition to investor interest and SEC proposals, many states and local jurisdictions have regulations such as reporting water and energy use that green leases can address, according to Worden. Los Angeles, for example, has energy use data collection requirements, Lanzer adds.

Understanding the Legal Language

Every tenant and landlord relationship has individual nuances to address in green leases, but typically both sides are aware of sustainability issues as well as the cost savings that come with efficient use of energy and water.

“It’s very important to put sustainability subject matter experts from both sides of the negotiations at the table because they understand the intent of the green clauses and the split in costs and savings,” says Hamre at JLL. “Green leasing isn’t only about the clauses themselves. Half of the process is understanding the legal language of the clauses, getting agreement about what they mean, and then implementing them.”

Green lease negotiations differ depending on the tenant, says Christy David, COO and executive vice president of InvenTrust Properties Corp. (NYSE: IVT), a retail REIT that won silver level recognition as a Green Lease leader.

“First, we need to understand our tenant’s requirements and then we have a mix of mandatory requirements and guidance to encourage sustainability efforts,” David says.

Most of the larger anchor tenants at InvenTrust’s properties are top national brands that have their own ESG requirements for corporate responsibility, so green leases are a win-win for both sides, she says. Some of their larger tenants actually request green leases.

“Our smaller mom-and-pop tenants usually need more guidance and sometimes they think sustainability measures will be expensive,” David says. “Some of our leases last 10 years or more and some have automatic renewals, so it can take educating tenants before we can begin green lease negotiations.”

A few years ago, tenants were more resistant to green leases, David says, but now they are more routine and accepted. “One of the most important elements of a green lease is making sure that energy efficiency upgrades are included in financial clauses, so those expenses are shared by all the tenants,” she says. “Another important element is to require tenants to report their energy and water consumption, so we have that information for our reporting.”

Most tenants are supportive of green leases, says Amber Felix, senior corporate counsel for Rexford Industrial, because they know the future of real estate depends on minimizing everyone’s carbon footprint. “However, we do need to explain to tenants what we do with the information they provide us,” she says. “We make it clear that we don’t name individual tenants in our disclosures of energy consumption.”

Green leases can also include an ability to submeter high intensity equipment, such as the extra cooling needed for a data center, Myers at BXP says. This allows for more equitable distribution of energy spending between tenants.

Myers explains that a common clause in their green leases addresses cost recovery for capital expenditures for sustainability. “For example, if we modernize a chiller plant and that reduces operating costs for our tenants, we can pass on those costs to them. Cost sharing provides a business case for sustainability investments.”

Many tenants want to be in buildings with third-party certifications that operate efficiently and align with their green building goals, Myers says. “For tenants, green leases connect the dots for them between their sustainability commitments and their real estate decisions,” he adds.

Property Sectors and Green Leasing

The office sector has been the fastest adopter of green leases in North America, JLL’s Hamre says, in part because office owners and their tenants have been quicker to adopt ESG goals. “Sustainability initiatives are important for office owners to attract tenants and talent. There are also opportunities in the industrial and retail sectors for greater adoption of green leases. In the industrial sector, it’s a matter of asking to see the data from tenants and then jointly managing energy use.”

Hamre says that while green leases are still a relatively small percentage of all leases, their use is rapidly accelerating. Lanzer at Rexford Industrial says the REIT’s leases are typically triple net, which mean it doesn’t have a lot of control inside the building. “Our green leases allow us to collect information we need from tenants, especially around energy consumption.”

Rexford Industrial’s sustainability department supports building construction and operations as well as shared innovations that benefit tenants as well as the REIT, Lanzer says.

“All of our new leases are green leases, but we have inherited leases that sometimes last years on buildings that we acquire,” says Felix, the REIT’s general counsel. “As those leases roll over, we add green amendments as soon as possible.”

In industrial properties, tenants can benefit environmentally from a lower carbon footprint and financially from lower energy costs related to sustainability improvements, says Hamre. Landlords who incorporate renewable energy want to recoup those investments with higher rents and valuations.

“We have the right to pass through certain costs to the tenants if they lower energy costs and the tenant can see the benefit,” Lanzer says. “Anything we do to lower costs for our tenants makes our properties more marketable, so that’s partly why we need to collect data so we can see the outcome of building improvements.”

In the retail sector, fewer tenants are focused on green leases, and many are less amenable to reporting requirements, according to Myers.

“One reason for this is that consumers choose companies or products because of their ESG commitments, but they don’t usually make decisions on where they shop because of them,” he says. “But incentives can be used with retail tenants around ESG commitments and the health of the building to encourage them to negotiate a green lease.”

Future of Green Leases

The next step for many building owners is to achieve net zero energy use. Green leases are a tool that can be used for cost sharing between tenants and landlords to achieve those goals, Myers says.

Meanwhile, investor demand for transparency is driving more cooperation between landlords and tenants, according to Worden at the Green Building Initiative. “New technology with built-in systems that provide immediate data feeds the demand for voluntary reporting and helps buildings achieve higher values,” she says. “Portfolio owners need to have a long game in mind because there’s still an incredible amount of work to do to reorient buildings.” Worden believes green leases will focus more in the future on climate change resiliency along with decarbonization and electrification.

“Green leases are a determining factor in how we think about our ESG initiatives,” says InvenTrust’s David. “We’re investing in our properties with things like cool roof designs, energy management systems, EV charging stations, LED lights, and solar programs.” Green leases are part of the bigger picture of sustainability, she says.

Lanzer at Rexford Industrial says more green leases are likely to be seen among publicly traded companies. “Every year we’re seeing major investors such as Vanguard and BlackRock put out their ESG goals and they’re likely to get bigger each year. Green leases are one way that everyone can ramp up what they’re doing in a way that everyone benefits.”

While green leasing began primarily around goals for greater energy efficiency and reducing carbon emissions, the pandemic and renewed focus on social justice and equity issues expanded the scope of leases to include health and wellness within buildings and to address social issues, says IMT’s Lo.

“We’re redefining what high performance buildings mean and looking at how a building can benefit a community,” Lo says. “We can look at how a building can provide passive survivability benefits during power outages and natural disasters, such as a place for heating and cooling.” While these are ambitious goals, Lo believes bringing tenants and landlords together to address them during lease negotiations can lead to positive progress.