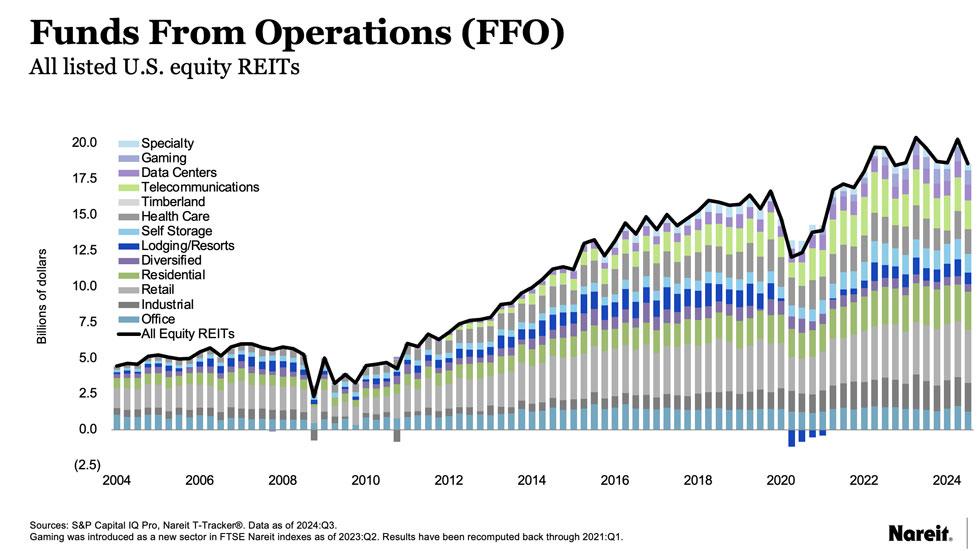

Nareit’s Total REIT Industry Tracker Series – the Nareit T-Tracker– is the first quarterly performance measure of the heartbeat of the U.S. listed REIT industry. The series includes three key REIT industry measures: the Nareit FFO Tracker, which monitors equity REIT Funds From Operations; the Nareit NOI Tracker, which reports the equity REIT industry’s Net Operating Income; and the Nareit Dividend Tracker, which monitors the dividends U.S. listed equity and mortgage REITs pay to their shareholders.

Download the 2024 Q3 T-Tracker results (PDF with charts)

Download the comprehensive T-Tracker data

Key Takeaways for T-Tracker 2024 Q3

- 79.5% of REITs’ total debt was unsecured in the third quarter of 2024

- 91.3% of total debt was at a fixed rate

- Leverage ratios remained modest with debt-to-market assets at 30.7%

- Weighted average term to maturity of REIT debt was 6.5 years

- Weighted average interest rate on total debt was 4.1%

- Nearly two-thirds of REITs reported year-over-year increases in Net Operating Income (NOI), with NOI increasing 1.7% from one year ago

- Same Store NOI experienced 3.1% year-over-year gain, outpacing inflation

- Occupancy stayed steady at 93.6%

- More than half of REITs reported year-over-year increases in Funds From Operations (FFO)

- REIT implied cap rate was 5.4%