REITs, CRE markets, and the economy as a whole are bolstered by the solid fundamentals that were in place when the pandemic hit, in sharp contrast to prior recessions. Conditions will be mixed in the first half of the year, strengthen in the second half, and 2022 is likely to see a more complete recovery.

What is the 2021 Outlook for the Macroeconomy?

What didn’t cause the recession is as important as what did.

The outlook for 2021 remains uncertain, in part due to the continuing risks from the coronavirus (as of this writing, new cases of COVID-19 were surging, but three vaccines had been reported to have high success in preventing infection and appear on track to be approved and begin distribution soon). In addition, the lack of any historical precedent complicates projections for next year and beyond. Since the presidential election, the incoming Biden Administration appears more open to fiscal stimulus, which could bolster the economy. The change in administrations, however, brings a degree of uncertainty about possible changes to other policies.

The current recession was caused by dramatic changes in consumer behavior linked to business shutdowns, travel restrictions, and social distancing during the pandemic. The downturn came on more suddenly than any recession in the past, and the magnitude of the declines in GDP and employment in the spring were unprecedented. Economic activity and job growth have begun to recover as parts of the economy reopen, but remain well below pre-pandemic levels.

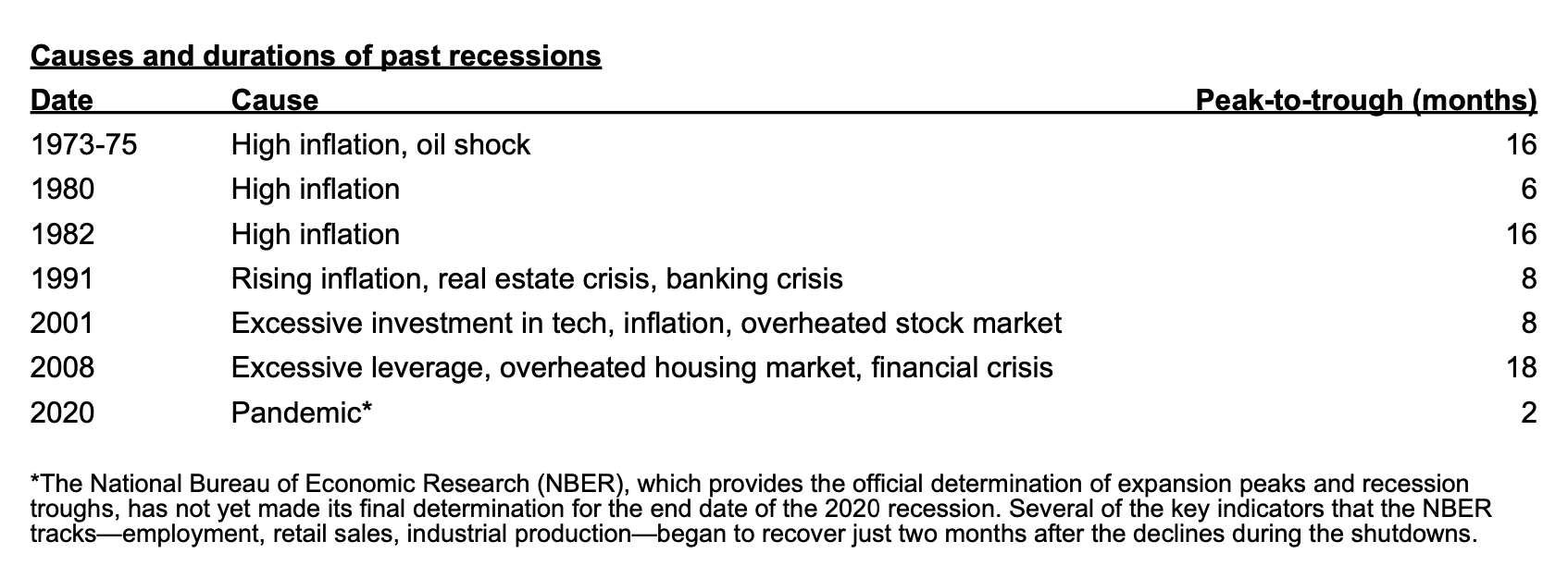

A careful look at what caused the recession—and, just as important, what didn’t cause it—can help gauge what to expect in 2021 for the economy, commercial real estate, and REITs. Past recessions were caused by internal weaknesses in the economy—overheating and rising inflation that prompted the Federal Reserve to raise interest rates to cool the economy, excessive investment that was followed by production cuts to work off inventories, high leverage, and banking or financial crisis (see Appendix A on past recessions). It took more than several months to heal these internal weaknesses, and the recovery process often took years to be completed.

The pandemic recession, in contrast, was caused by an external shock to an otherwise healthy economy. In addition, prompt action by policymakers on Capitol Hill and at the Federal Reserve to help protect the economy and financial markets, including fiscal stimulus and the CARES Act, helped ameliorate some of the damage. As a result, many of the underlying fundamentals of the U.S. economy remain sound, and may be able to recover more quickly once the pandemic is brought under control. (See Appendix B for a comparison of the financial strength of households in the Great Financial Crisis (GFC) of 2008-2009 and the pandemic recession today.)

In the meantime, however, the U.S. economy is following a two-track path. Those parts of the economy that require in-person interactions and face-to-face contact (or, face-to-plexiglass-to-face contact) remain well below pre-pandemic levels due to risks of infection. The commercial real estate sectors that are associated with these activities—lodging/resorts, restaurants, retail, skilled nursing and senior living—have also experienced more significant weakening during the pandemic, and face a longer, slower recovery in the months and years ahead.

Some other parts of the economy, however, have already recovered from the initial shock in the spring. For example, most categories of retail sales are above pre-pandemic levels, as those households that have remained employed (and perhaps work from home) but are not spending money on dinners out and travel, have new room in their budgets for additional purchases. In addition, the housing market is quite robust, with home sales, house prices, and new construction all surging. The tech sectors, meanwhile, are riding a wave of demand for digital communications and e-commerce. As we will see below, this strength of the digital economy also has a parallel in the data centers, cell towers, and industrial parts of the REIT universe.

What is the 2021 Outlook for Commercial Real Estate?

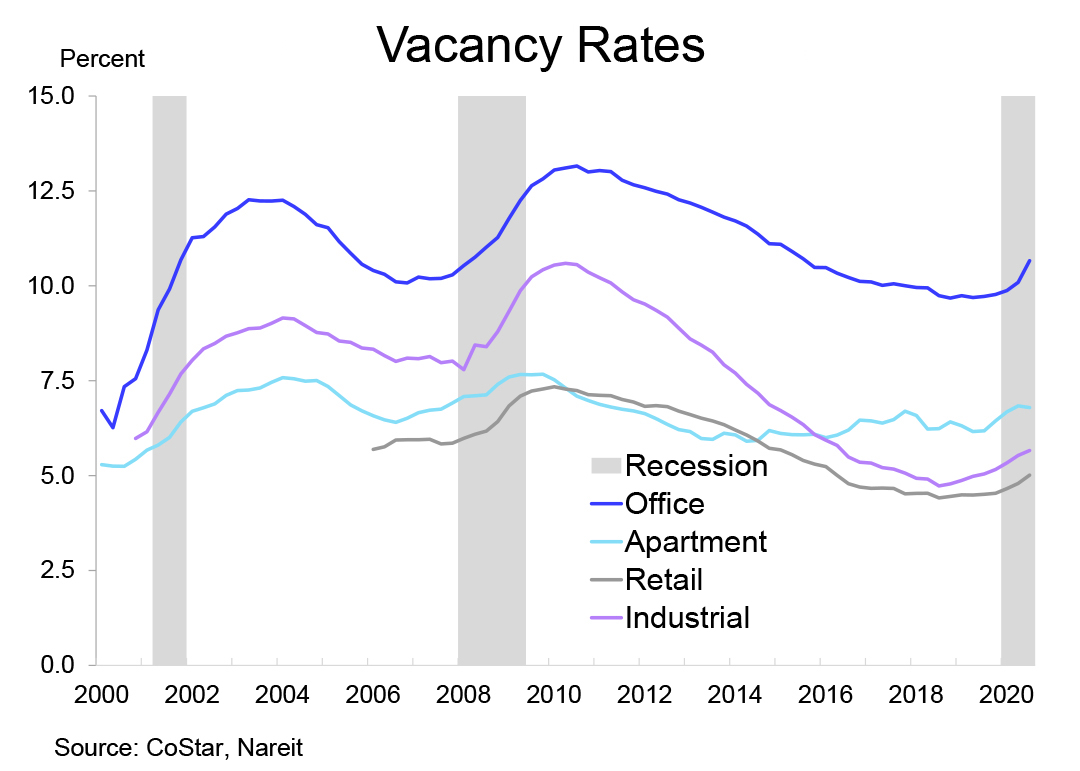

Rising vacancy rates, falling rents Commercial real estate markets overall have suffered from the pandemic and recession, but with considerable variation across the property types, geographies and quality of the property. Vacancy rates have increased in 2020 for most property types.

-

Office vacancy rates rose 80 bps, from 9.9% in the first quarter to 10.7% in the third quarter. Office vacancies are still well below the 13.1% reached in 2010, but experience in past recessions suggests that vacancy rates will continue to rise through 2021 and perhaps reach a peak only in early 2022.

-

Industrial vacancy rates also rose, from 5.3% in the first quarter to 5.7% in the third quarter. Despite relatively strong demand for logistics space used to ship goods bought on the internet, the elevated pace of construction resulted in higher vacancies.

-

Retail vacancy rates increased 30 bps, from 4.7% in the first quarter to 5.0% in the third quarter. Retail markets in many ways are the flip side of industrial: demand for industrial continues to rise, but new supply has exceeded demand in 2020, while demand for retail properties is quite weak, but new construction has been minimal.

-

Apartment vacancy rates were flat in the third quarter. This relative stability masks a geographic shift, however, with weakening demand in many of the core urban markets in gateway cities, but relatively stronger demand in suburbs and smaller cities. Concerns about the pandemic as well as greater use of work-from-home has caused a net move-out from areas with higher density and higher costs, to areas with less density and greater affordability.

Performance was mixed outside of the traditional sectors of office, industrial, retail, and apartments. Hotels largely shut down or operated at extremely low occupancy levels during the early months of the pandemic. Travel volumes have been rising for the past six months, however, and many hotels have reopened and report rising occupancy rates. In the health care sector, both skilled nursing and senior housing have suffered significant drops in occupancy, as well as higher costs for PPE and staffing. These sectors will not have a complete recovery until the pandemic is brought under control and infection rates subside.

Property sectors that support the digital economy, in contrast, have enjoyed a burst in demand. These sectors include data centers, which house the servers that host Internet websites and other data communications, and cell towers, that transmit much of the voice and data, including teleconferencing and e-commerce transactions. The recent surge in demand builds on steady growth for the past several years, and is expected to continue to increase through the pandemic and beyond.

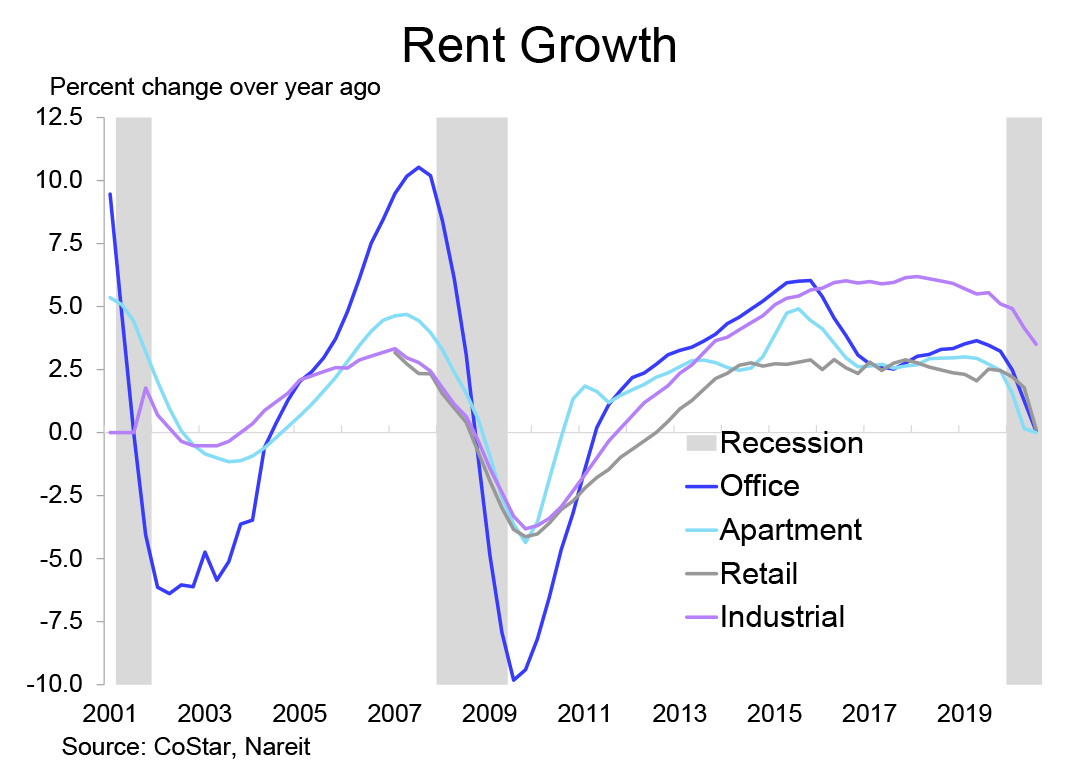

With demand in most sectors weakening, rent growth stalled or turned negative. Rents on retail properties declined 0.6% quarter-on-quarter, bringing the change from one year ago to near zero. Office and apartment rents show a similar trajectory, with slight declines in both the second and third quarter leaving rents flat with year ago. Industrial is the only major property category with rents still rising, but the pace of increase decelerated from 6% through 2018 to 3.5% in 2020.

Rents are likely to decline over the coming quarters as demand weakens further and as more leases roll over. Store closures and bankruptcies in retail are a particular concern. One should not expect a near-term stabilization, as rents continued declining after the 2001 recession and the GFC in 2008 for a full two years after those downturns ended. This suggests that even if the economy continues to recover in 2021 (with a vaccine), rents will not bottom out until 2023.

Low supply, long-term leases are sources of strength

Two features of commercial real estate have blunted the recession’s immediate impact. First, there is not a large new supply of buildings being completed. Construction as a percent of the existing stock of buildings was not as elevated when the pandemic began as it had been prior to past real estate downturns. For example, office buildings under construction at the start of this year equaled roughly 2% of the existing market, according to data from CoStar. This is about half the size of the construction pipeline ahead of the 2008 GFC, and one-third the size of the office construction boom in the mid-1980s. As a result, there are far fewer buildings being completed in a market with falling demand than there had been in past downturns. This reduced construction pipeline has kept vacancy rates from rising as sharply as they would have had there been more construction, and has also softened the impact on rents.

Second, the long-term leases for most types of commercial real estate help buffer the impact of a crisis that came on very quickly but whose rebound also began with little delay. Tenants that have a lease with several years remaining, and who would prefer to remain in the same location, may continue to pay rent even as the office or other type of space is largely empty. To be sure, there are many tenants who may desire to remain in a given location but have suffered a sharp drop in their own cash flow; this caused rent payments to fall dramatically in the spring, especially in lodging/resorts and retail sectors. The pandemic is likely to have a greater impact on valuations in sectors where rent collections have been most impaired. Rent collections began to recover in the summer months but remain below pre-pandemic levels (see the Nareit rent collections survey).

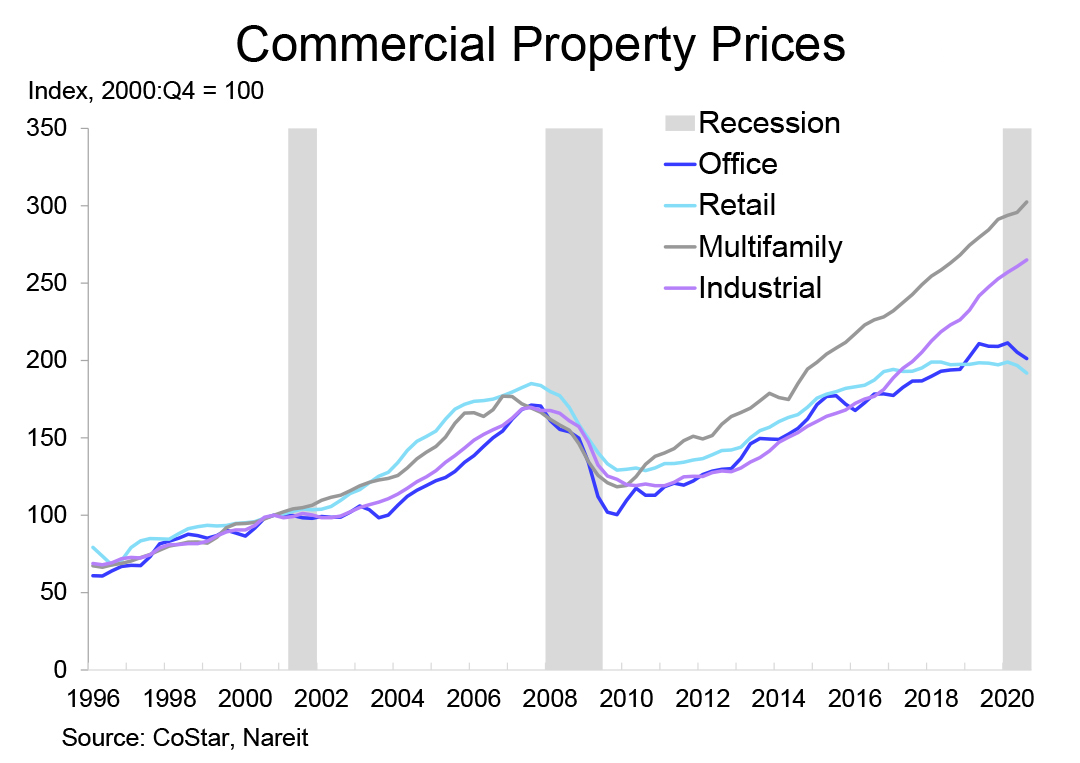

These factors have also limited the impact of the pandemic on commercial property prices. There is greater uncertainty about valuations due to the low level of transactions since the pandemic hit, but measures like the CoStar commercial repeat sales index have told a consistent story through the summer and fall, as transaction activity has begun to recover. Prices have turned lower in both retail and office markets, declining 3.2% and 3.8%, respectively, in the third quarter compared to one year ago. Valuations in retail and office markets are likely to continue to weaken through the first half of 2021, but stabilize in the second half of the year.

Valuations of multifamily and industrial properties, in contrast, have continued to rise steadily. Each of these property markets faces a favorable supply-demand balance over the medium to long term. The strength of e-commerce is driving demand for logistics facilities, and has received a significant boost during the pandemic. Multifamily markets remain tight due to low levels of apartment construction in the decade following the GFC (See recent market commentary, Post-pandemic Demand for Apartments and Single-Family Rentals Looks Robust). Prices of multifamily and industrial properties are likely to continue rising at a 6% rate or higher.

What is the 2021 Outlook for REITS?

Financial strength brings resilience

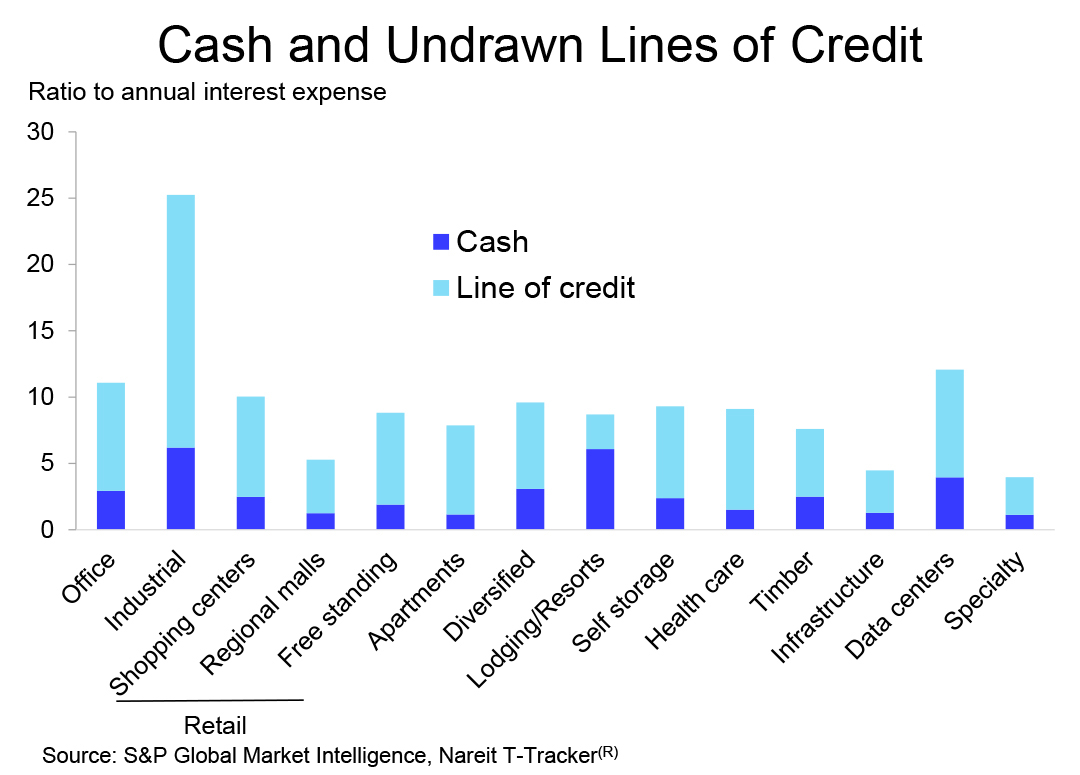

REITs have largely been resilient during the pandemic due to measures they took to strengthen their financial positions since the GFC. REITs raised $460 billion in common equity capital between 2009 and 2020, and when the pandemic began the overall leverage ratios were at or near the lowest on record. REITs also lengthened the maturities of their debts to reduce risks of having to refinance during adverse market conditions. REITs maintain high levels of liquidity, both on balance sheet through holdings of cash and securities and also through committed lines of credit.

REIT operating performance stabilized in the third quarter

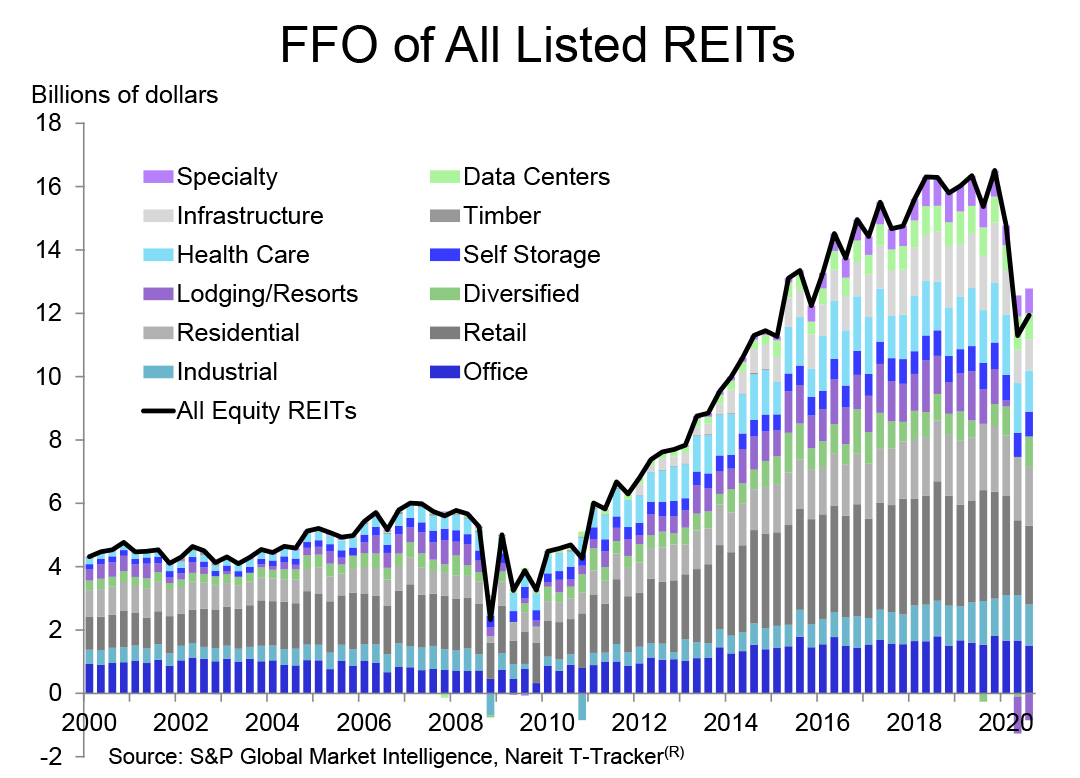

The shutdowns during the pandemic interrupted cash flows of many tenants, especially those in the lodging/resorts and retail sectors. Many tenants stopped paying rents during the initial shutdowns, and REIT earnings, as measured by funds from operations (FFO), fell 23.5% in the second quarter (see the Nareit T-Tracker® for a summary of REIT operating performance).

Conditions improved as stores and businesses reopened, however, and earnings stabilized in the third quarter, with FFO rising 5.6%. Much of the improvement was in the sectors that had been most directly impacted by the shutdowns in the spring: lodging/resorts, retail, and diversified REITs. FFO has further to go to recover completely, and in the third quarter was 22.3% lower than one year earlier. Many REITs report that tenant rent collections continue to recover as the economy reopens more completely. The surge in new cases of COVID-19 in the fall of 2020 may postpone further improvements, but FFO is likely to return to recovery when the pandemic slows.

Stock market performance shows a partial recovery

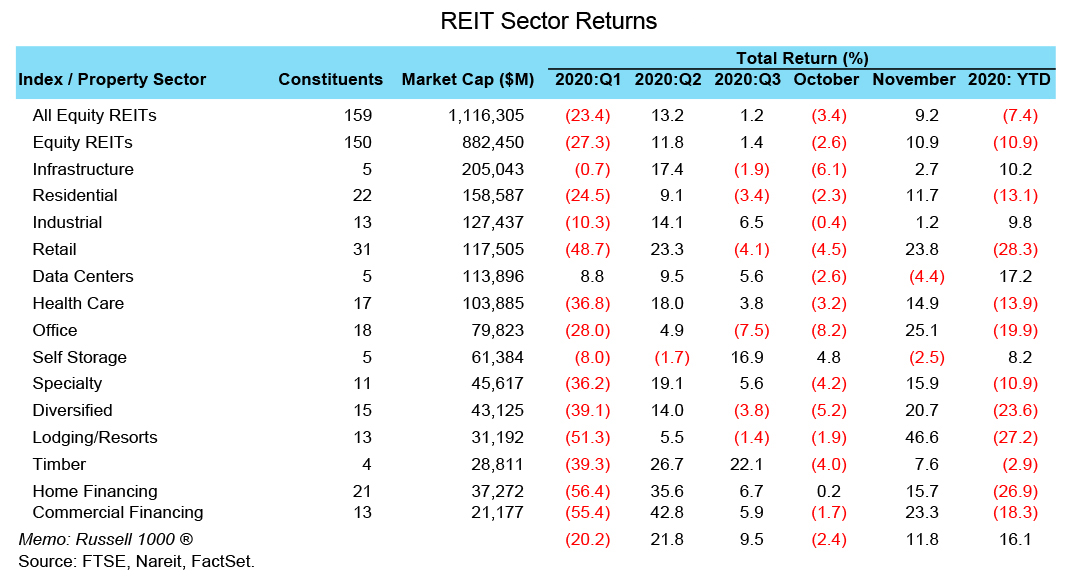

REIT stock market performance has recovered partially from the initial downturn when the pandemic hit, when as of March 23, 2020, the FTSE Nareit All Equity REITs index had a -37.6% return year-to-date. REITs have delivered a 50% total return from the trough (as of Nov. 30), but the total return is still down 7.4% year-to-date.

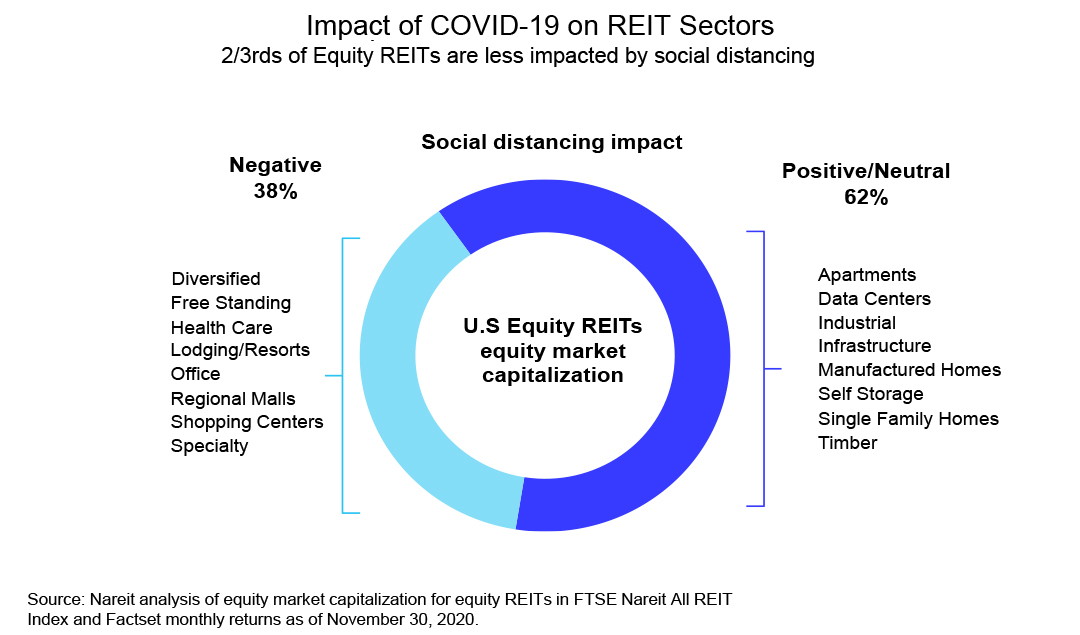

There is considerable variation, however, within the property sectors. The differences across REITs reflects the increased diversification of the industry over the past decade or two, with significant growth in new economy types of real estate. REITs in sectors whose operations were most directly impacted by the shutdowns and social distancing, including lodging/resorts, retail, and diversified still have significant declines for the year. These sectors that have been most impacted by social distancing, however, represent only about one-third of the REIT industry.

The remaining two-thirds of the REIT industry include those with little impact from social distancing, as well as the sectors that support the digital economy. This latter group has posted strong gains for the year. Infrastructure REITs, which own cell towers that transmit both voice and data, had a total return of 10.2% as of Nov. 30. Industrial REITs, which own and operate logistics facilities used to ship goods bought on the internet, had a total return of 9.8%. And data centers, which house the servers that host websites and process these data transmissions, had a total return of 17.2%.

What is the Outlook for REITs and Commercial Real Estate in 2021?

The most important factor for REITs and commercial real estate, and indeed the overall economy, will be progress against the pandemic and the much-anticipated introduction of a vaccine against COVID-19. Barring further setbacks in this fight, conditions will gradually return to normal as the year progresses. The severity of the losses during the shutdowns, however, including business failures and corporate bankruptcies as well as unemployment and other hardships, will take additional time to heal.

There will continue to be wide variation across property sectors in 2021, and it may well be the mirror image of 2020. Those sectors that were most directly affected by reduced travel, business closures, and social distancing, including lodging/resorts, retail, and health care REITs, may have a more robust recovery in 2021. This reflects, however, the larger declines in 2020 that give them more potential for upside gains as the vaccine against COVID-19 is administered and the economy returns to more normal conditions.

It will be important to distinguish between short-term or transitory effects of the pandemic versus long-term or permanent changes to commercial real estate markets. Most of the weakness in the first few months of the crisis was due to temporary declines in demand that are likely to reverse as the pandemic eventually subsides. Although data are scarce, there are indications that economic activity tends to return to more normal conditions in countries where new cases of COVID-19 have fallen. There may also be, however, longer lasting changes to how commercial real estate is used. For example, teleconferencing and work-from-home may have long-lasting effects on office markets, as well as hotels, apartments, and single-family home rentals. In addition, e-commerce has accelerated the closure of many bricks and mortar retail locations, but hybrid retail models like online orders with curbside pickup may transform the use of retail properties in the future (for a more complete analysis of the short-term and longer-term effects of the pandemic, see the Nareit Fall 2020 Economic Outlook for REITs and Commercial Real Estate).

Appendix A

Appendix B

Sources of Financial Resilience

Most past recessions were followed by a long recovery period to repair the financial damage to personal incomes, household savings and net worth. Weak bank balance sheets and falling corporate earnings also limited the ability of the financial system and corporate businesses to recover. During the pandemic recession, however, there has been financial resilience among households, banks, and corporate businesses, despite the severity in the declines in economic activity during the shutdowns. This box examines three measures of household financial strength—disposable personal incomes, household saving rate, and household net worth—and contrasts recent experience with the GFC.

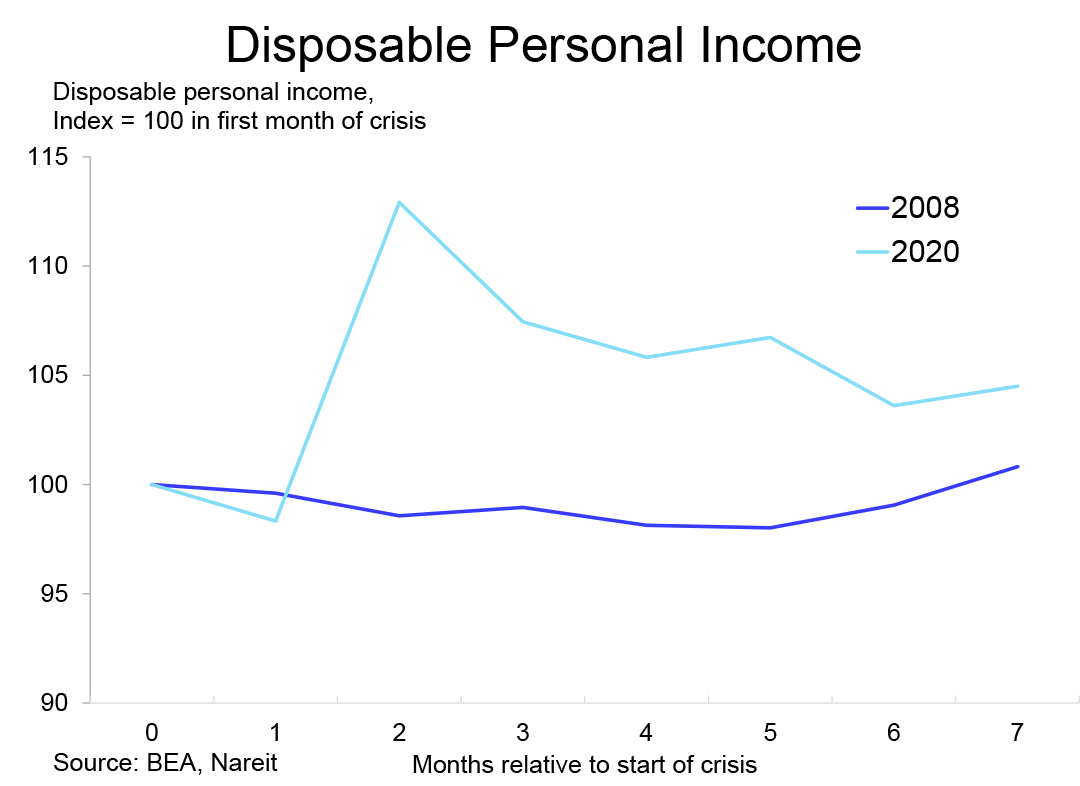

Disposable personal income is up

Disposable personal income declined during nearly all past recessions, including the GFC. Wages and salaries declined more than 6% in the first six months of the recession in 2008-2009, which was only partly offset by higher payments from unemployment insurance. By March 2009, disposable personal income had fallen 2%. During the pandemic, wage and salary income fell even more sharply, and in May 2020 was 8.3% below its pre-pandemic level. Increased payments through

unemployment insurance, pandemic insurance and the CARES act, however, more than offset the decline in wage income, and by July total disposable personal income had risen 6.7%. Higher incomes have helped sustain consumer spending and limit the second-round of retrenchment that often worsens the severity of economic downturns.

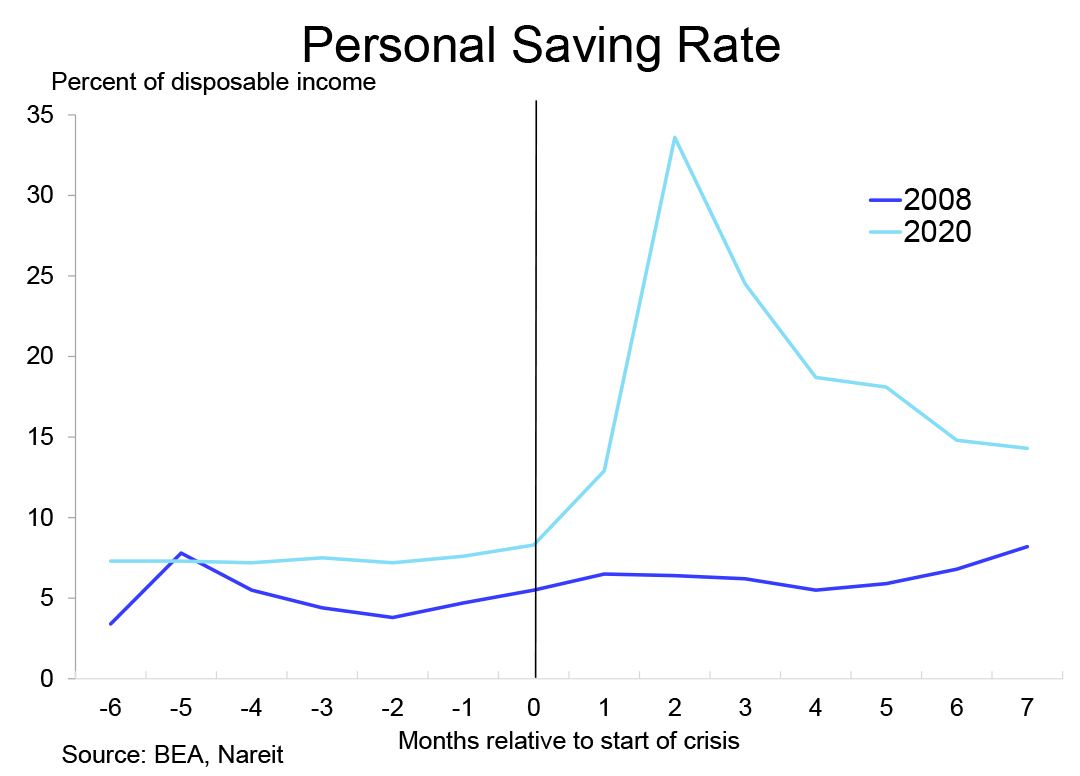

Saving rate is high

Millions of people lost their jobs during the business shutdowns in the spring 2020, and one should not lose sight of the financial loss suffered by these households. Over 90% of workers, however, kept their jobs, and many of them cut spending on restaurants, travel and entertainment, and other goods.

Household saving surged as a result, reaching a record high of 33.6% of disposable personal income in April 2020. The saving rate has declined as consumers resumed spending as stores reopened, but is still well above pre-pandemic levels. Consumers have additional spending power not only from current paychecks, but also from pent-up spending power from their surplus savings since April. This spending power can help fuel a recovery in 2021.

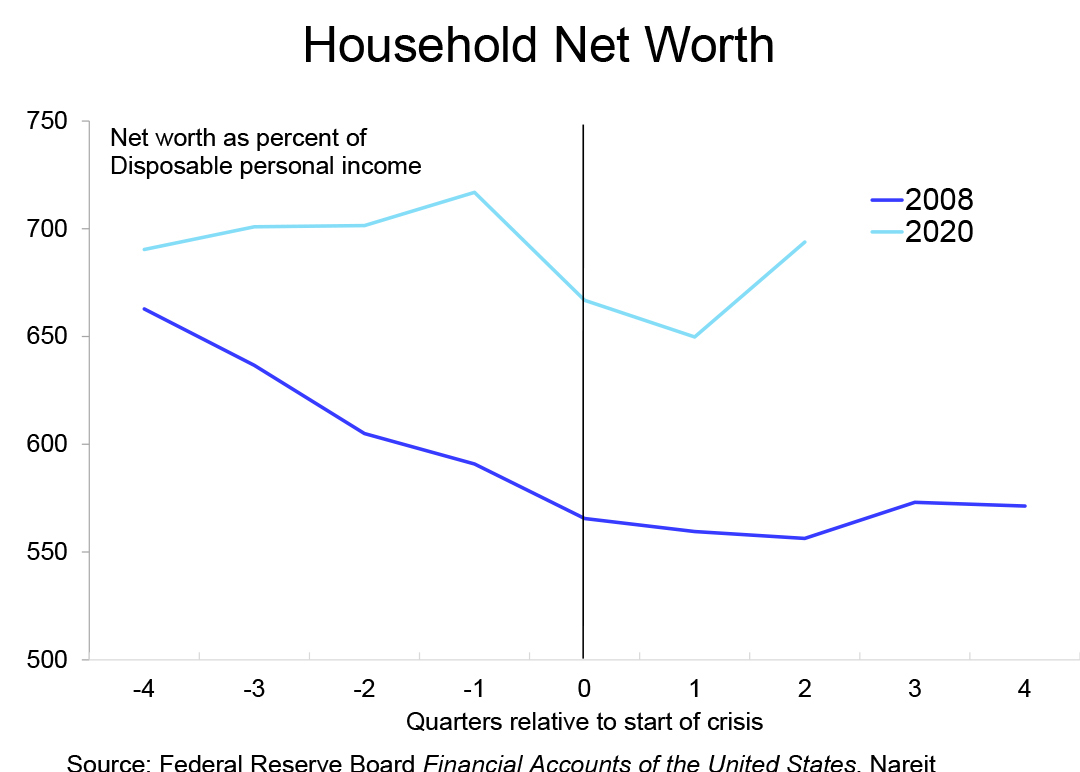

Household net worth

Past recessions have damaged household net worth, leading consumers to pull back spending to repair their balance sheets. House prices fell and millions of families lost their homes during the GFC, which contributed to a $6.2 trillion decline in the value of residential real estate held by American households. Stock prices declined sharply in 2008 and early 2009, resulting in $5.4 trillion decline in household stock holdings. These declines in home values and stock prices reduced household net worth from 663% of disposable income (dpi) one year before the GFC, to 556% of dpi two quarters into the crisis.

Housing markets and stock markets have both recovered quickly during the pandemic. Federal Reserve data through the third quarter show household net worth rebounded to 696% of dpi. Both home prices and stock prices continued to push to new record highs in the third and fourth quarters of 2020.

Banking and nonfinancial corporate sectors are more resilient today

The GFC was not only a severe recession but a banking crisis as well. Many banks failed, and authorities took unprecedented actions to support the largest banks in the country. Their weak condition worsened the economic downturn and limited their ability to help finance the recovery. Today, however, while the pandemic has caused bank losses and concerns about future credit exposures, including in commercial real estate, there have been few signs of a systemic banking crisis.

Corporate profits fell 40% during the GFC and took nearly two years after the trough to return to pre-recession levels. Continued losses and weak earnings led many firms to delay hiring and capital spending, which slowed the recovery from the crisis. During the pandemic, however, many firms have adapted to social distancing, use of teleconferences, and e-commerce for product sales. Total U.S. corporate profits rose to a record high of $2.3 trillion (annual rate) in the third quarter, according to recent data from the U.S. Bureau of Economic Analysis. Profitable companies are more likely to hire new workers and invest in the economy in 2021.