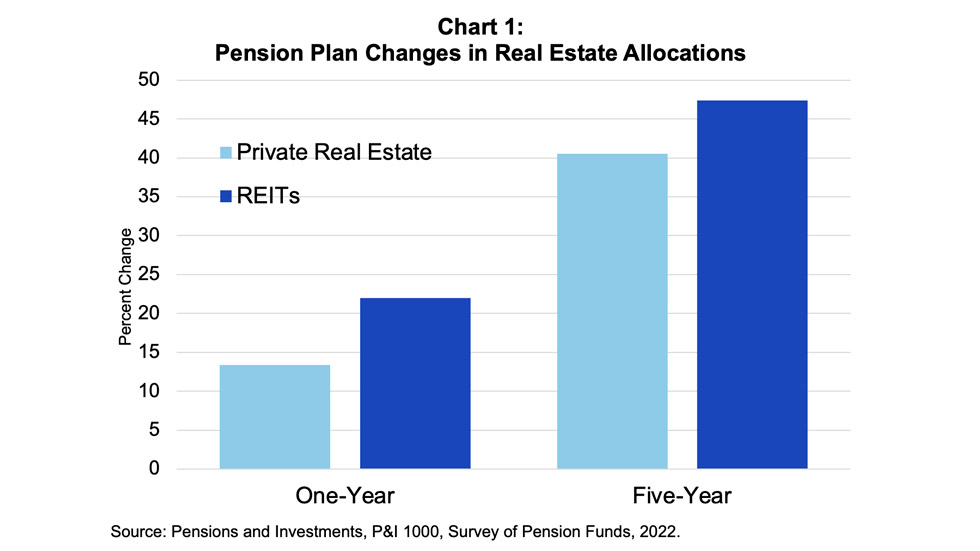

The 2022 Pensions & Investments annual survey of pension plans found that REIT assets in the largest 200 U.S. retirement plans grew 22% to $34.2 billion during 2021 and are starting to play catch up with those plans’ private real estate portfolios that grew just 13.4% over the same time period. Over a five-year period, REITs also outpaced private real estate with assets up 47.4% compared to private real estate’s 40.5% increase.

There are a number of good reasons for defined benefit (DB) pension plans, endowments and foundations as well as other investors to consider using REITs in their real estate strategies:

- Access to 21st Century Real Estate: As the economy has become increasingly digital, the real estate landscape has also changed. REITs have been on the forefront of commercial real estate innovation. Today, more than 35% of the market capitalization of the FTSE Nareit REIT Index is comprised of real estate that powers e-commerce and the digital economy including data centers, communications towers, and industrial and logistics facilities. As DB pension plans broaden the footprint of their real estate investment , REITs are a natural complement to their existing portfolio.

- Access to Global Real Estate: REITs provide low-cost access to global real estate returns. The FTSE EPRA Nareit Global Index includes 523 companies with $2 trillion in market capitalization from 39 countries around the globe.

- Returns: REITs have outperformed private real estate by an average of nearly 2 percentage points per year over the past 20+ years. Both practitioner and academic studies show the consistent REIT outperformance.

- ESG Performance: REITs have embraced ESG and are outperforming private real estate in ESG performance metrics. In 2020, 98 of the 100 largest REITs publicly reported on ESG efforts and outcomes. In the 2021 GRESB results, REITs outperformed private real estate in the U.S. and globally.

If you would like to send a question directly to the Nareit Investor Outreach team, please email us.

Related Content

1. REITs and Private Real Estate as Complements: FTSE Russell Portfolio Completion Paper

4. Comparing Performance of Private Equity Real Estate Funds and REITs: Academic Study

5. Institutional Consultant Structures Real Estate Portfolios Using REITs (Podcast)