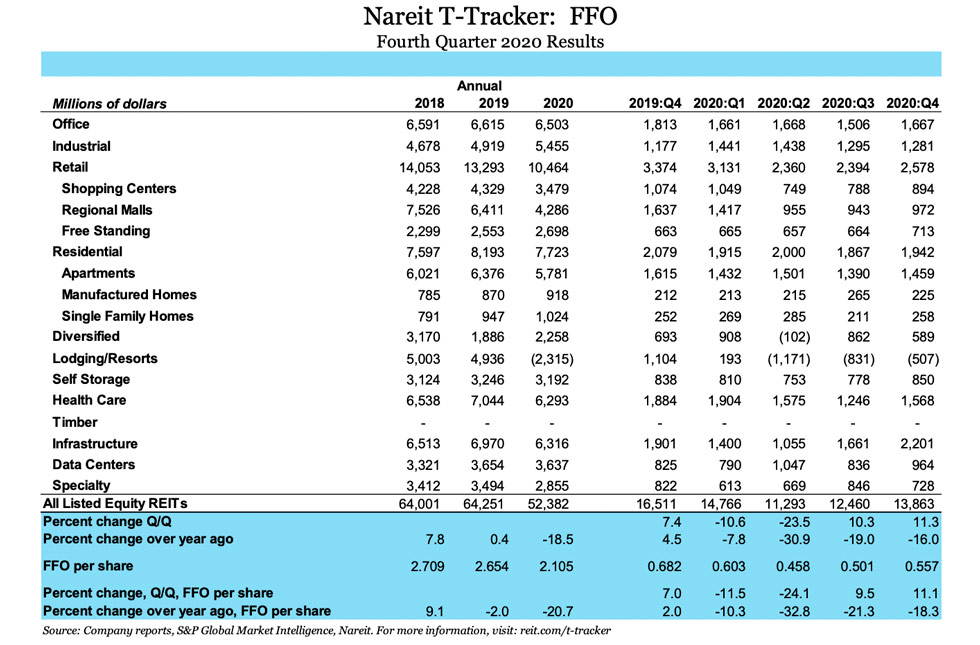

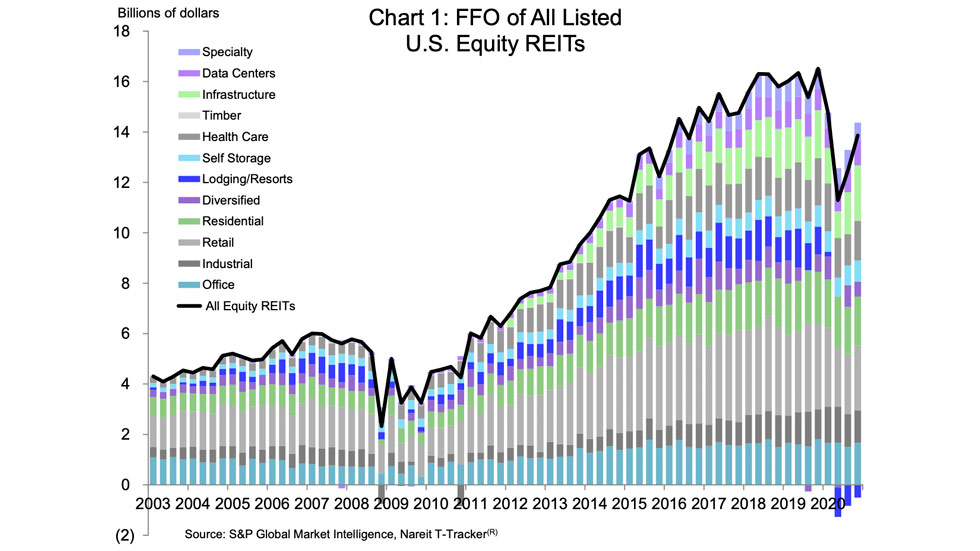

Funds from operations (FFO) of all equity REITs rose 11.3% in the fourth quarter to $13.9 billion, after an increase of 10.3% in the third quarter, according to the Nareit T-Tracker®. FFO of the overall REIT industry was 16.0% lower than one year ago, the final quarter before the pandemic began. The increases in the third and fourth quarters, however, reversed half of the declines that occurred in the first and second quarters.

Results varied widely by property sectors. Lodging/resorts and retail REITs were most directly affected by the shutdowns and social distancing last spring, and in these sectors FFO remains well below last year. Not all types of real estate had a negative impact from the pandemic, however, and the sectors that support the digital economy—data centers, infrastructure, and industrial REITs—enjoyed a surge in business and in FFO in the second half of the year. The remaining sectors, including office, residential, diversified, self storage, health care, and specialty, posted gains on balance in the fourth quarter.

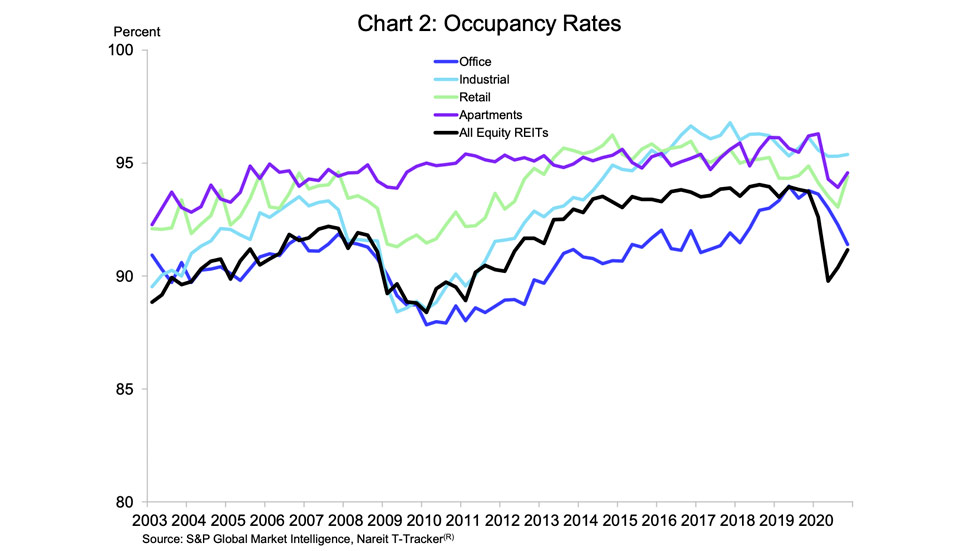

Operating conditions improved as the economy continued to reopen in the fourth quarter, and occupancy rates of all properties owned by REITs rose 80 bps, to 91.2%. There were gains in occupancy of most property types except office.

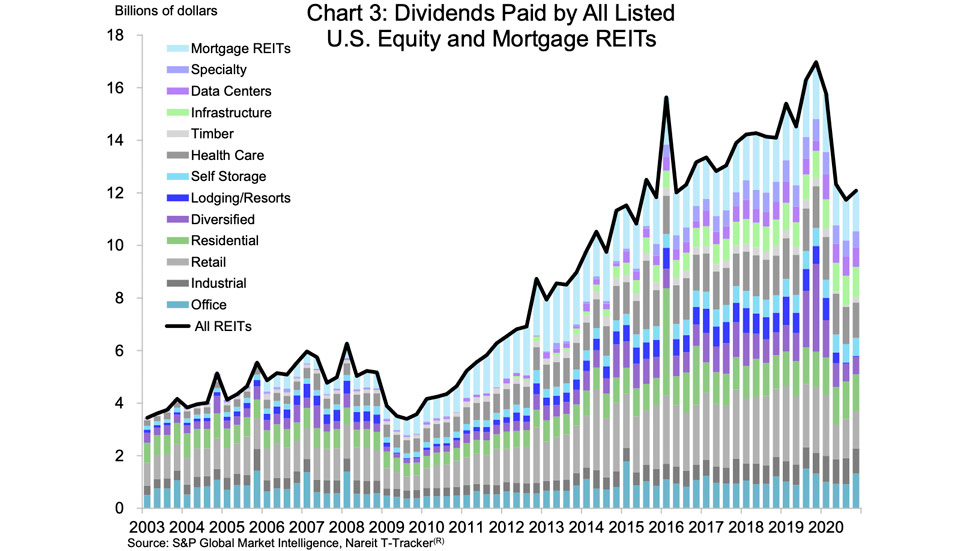

Dividends paid rose slightly, rising 3.0% from the third quarter, to $12.1 billion. This includes a 3.5% increase in dividends paid by equity REITs but a 0.2% decline in dividends paid by mREITs. Total dividends are down 28.8% from one year ago.

For comprehensive data on fourth quarter operating performance of the REIT industry, including these and other series in both charts and a spreadsheet for download, visit the Nareit T-Tracker.