Many employers are eager for pre-pandemic, in-office operations to resume, but many workers remain reluctant to return. Yet recent reports indicate that increasing pressure from executives, as well as fears of potential layoffs, may be encouraging workers to be in the office on a more regular basis.

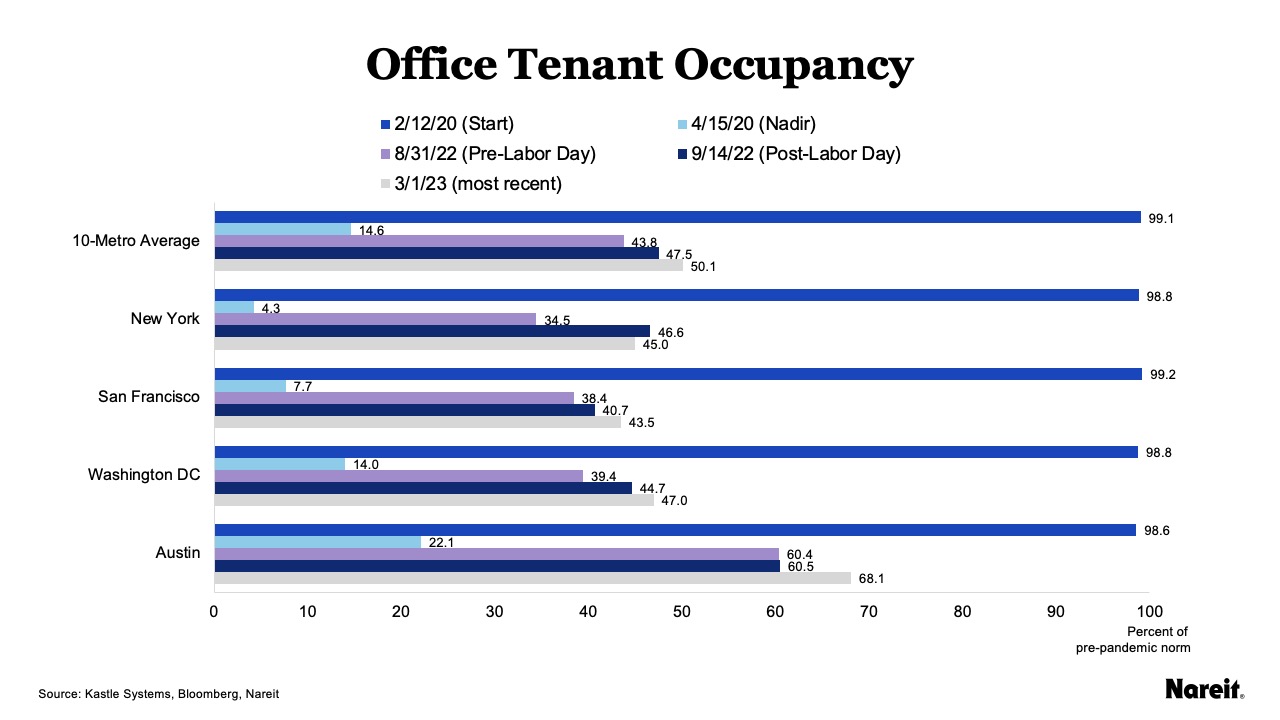

Kastle Systems, which uses keycard, fob, and app access data to determine weekly office tenant occupancy rates for 10 U.S. metropolitan areas, found that as of the week of March 1, 2023 (the most recent data available), the 10-metro average occupancy rate was 50.1%.

Austin had the highest occupancy at 68.1%, while San Jose had the lowest at 40.6%. Chicago and the three Texas metros—Austin, Dallas, and Houston—all posted occupancy rates above 50%. The remainder of the cities had occupancy rates between 40% and 50%.

This year, some companies have announced they will implement stricter return-to-office policies with Amazon and Disney requiring their employees to be in the office three and four days each week, respectively. In addition, the U.S. House of Representatives passed a bill February 1, 2023, that would require federal agencies to reverse pandemic work-from-home policies.

Many employers are also adamant that employees spending more time in the office is key to successful operations. In a January interview with Fortune, Ken Griffin, CEO of hedge fund firm Citadel, credits the firm’s record profits in 2022 to having all workers together in the office.

Using Kastle data, the chart above displays in-person office working trends from the pandemic to the present across select geographies. The 10-metro average highlights the challenges and slow recovery of office occupancy. Many employers were hopeful that Labor Day 2022 would have been a turning point for office occupancy. While occupancy did increase to an average of 47.5% after Labor Day 2022, it stayed relatively flat through the end of the year, but it has accelerated since the start of 2023.

Office REITs Display Operational Strength

Nareit T-Tracker® data for the fourth quarter of 2022 show that office occupancy is lagging other sectors at 89.3% which remains below pre-pandemic levels. Despite slow returns to the office, office REITs displayed considerable operational strength. In aggregate, office REITs posted annual funds from operations (FFO) of $7.3 billion in 2022, a 4.9% increase over the prior year. Keeping pace with inflation, 2022 office REIT net operating income (NOI) grew by 10.4% over the prior calendar year indicating that while employees have shown reluctance to return to the office, their employers have remained diligent in paying rent.

Office real estate is at the center of a natural workplace experiment, and 2023 is marking a new phase in this experiment. We likely won’t know the future of office though for at least a few more quarters or years.