This is part one of a two-part market commentary series. Please read part two here.

A common myth tells us that ostriches bury their heads in the sand when faced with danger. While not true, the phrase “burying your head in the sand” has become a popular idiom to describe an individual who ignores the existence of a problem with the hope that it will just go away. Financial market volatility index pioneer Dan Galai and his co-author Orly Sade coined the term the “ostrich effect” in a 2006 article in The Journal of Business. The expression describes investor behavior where risky situations are avoided by pretending that they do not exist. Their paper finds that some investors prefer, and are willing to pay for, the “bliss of ignorance.”

Heads in the Sand? Private Appraisal Cap Rates

With the current economic and capital market landscapes marked by uncertainty, the ostrich effect may aptly describe the behavior of many private institutional real estate investment managers and appraisers as it relates to their valuation practices. Despite surges in the 10-year Treasury yield and property debt rates, and corresponding material increases in public implied and private transaction cap rates, private appraisal cap rates have only increased slightly. While private real estate investors may find comfort in the resultant modest declines in appraised property values, these adjustments provide a false sense of security as they fail to reflect market realities.

A recent Nareit market commentary highlighted the divergence in U.S. public and private real estate markets via differences in cap rates. It found that the narrowing spread between REIT implied and private transaction cap rates demonstrated progress in the real estate price discovery process, but the continuing wide gap between REIT implied and private appraisal cap rates showed that the wheels of progress turn slowly. Newly released data from the Nareit Total REIT Industry Tracker Series, or T-Tracker®, shine a light on the current state of the property valuation adjustment process and its progress.

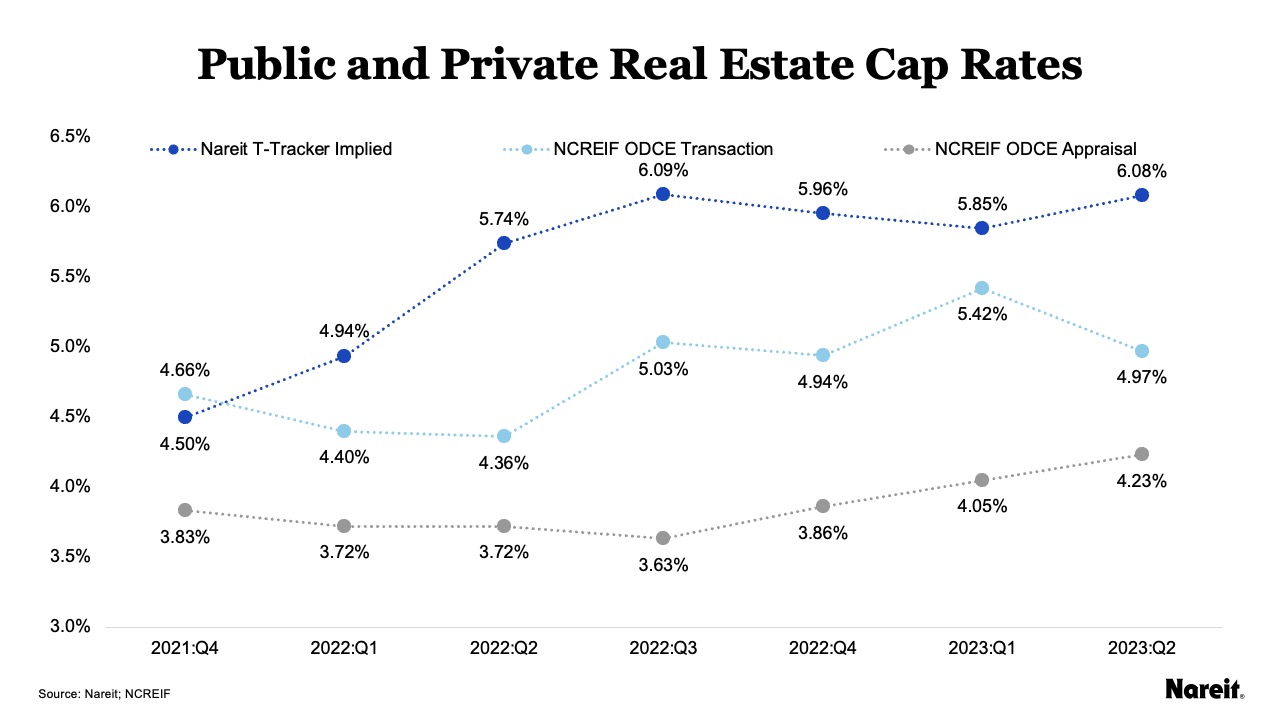

The chart above displays public (REIT implied) and private (transaction and appraisal) real estate cap rates from the fourth quarter of 2021 to the second quarter of 2023 using data from Nareit’s T-Tracker and the National Council of Real Estate Investment Fiduciaries (NCREIF). The NCREIF transaction and appraisal cap rates solely focused on properties from open end diversified core equity (ODCE) funds. All the cap rate calculations used historical (backward-looking) net operating incomes.

A review of the chart shows that the REIT implied cap rate was consistent over the last four quarters, staying close to 6%. The recent drop in the NCREIF ODCE transaction cap rate reflected the marketplace’s limited sales activity, particularly for some property sectors. A closer look at the data revealed that there were no office transactions in the second quarter of 2023; all four traditional property types were represented in the transaction cap rate composite in the previous quarter. While the REIT implied and private transaction cap rates meaningfully responded to changing market conditions, the private appraisal cap rate has been incredibly slow to adjust to current market conditions. It had measured—and possibly managed—increases from the third quarter of 2022 to the second quarter of 2023, averaging just 20 basis points per quarter.

Real Costs of Pretending

Some investors may find the modest declines in appraised property value reassuring, particularly during times of uncertainty, but these reassurances come at substantial costs. For markets, these actions act as impediments to the price discovery process and limit transaction market liquidity. For investors, these actions result in real hard costs related to artificially high investment management fees, as most fees are based on some measure of assets under management.

The modest and measured value adjustments in property appraisals have been token gestures; they may have acknowledged the property valuation problem, but they have failed to address its severity. Unfortunately, ignoring the gravity of a situation does not make it go away. This type of behavior may be akin to burying one’s head in the sand, perhaps with one eye out. These actions have impeded the market’s price discovery process, limited transaction market liquidity, and incurred real hard costs on investors in the form of artificially high investment management fees. Despite these costs, the current observed appraisal behavior is unlikely to change due to its ability to bolster returns, limit volatility, and maintain fee levels in uncertain times. At times, ignorance can, in fact, be bliss.