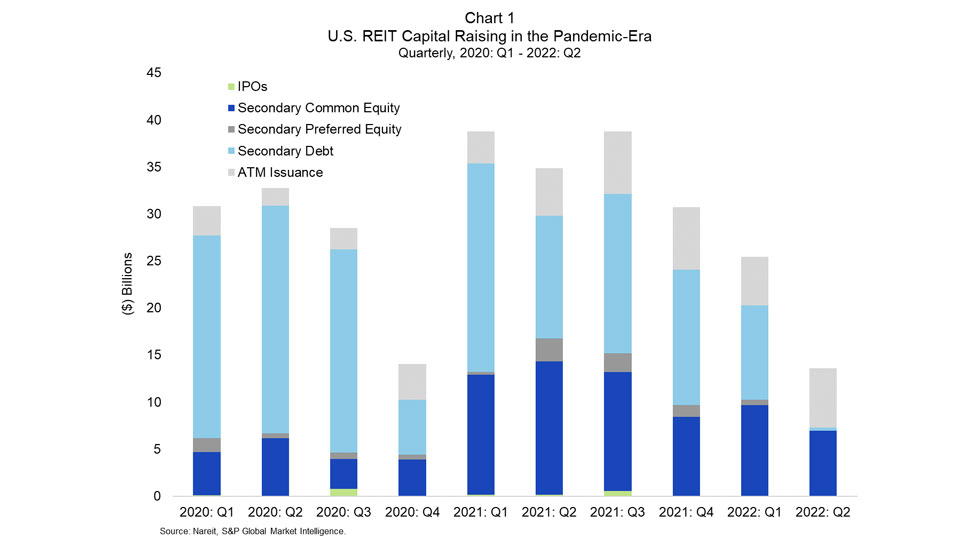

U.S. REITs raised $13.6 billion from secondary debt and equity offerings in the second quarter of 2022, down from $27.5 billion raised during the same period in 2021. $7.0 billion came from secondary common equity, $320 million from secondary debt offerings, and $6.3 billion came from ATM programs. The capital raising total represented a marked decline from the same period in 2021 when REITs raised $27.5 billion. The drop was largely attributed to the decline of secondary debt and preferred stock offerings. The $320 million in debt issuance reflected the lowest total since 2011: Q3, when REITs issued $250 million in debt offerings.

However, the decline in capital raising is reflective of the flexibility afforded REITs by the strength of their balance sheets. As market conditions have made capital raising more disadvantageous than it has been in recent years, REITs have avoided needing to issue equity at unfavorable valuations or refinance debt during a period of high-rates and widened spreads. ATM offerings continue at a record pace: the $21.8 billion issued in 2021 was an all-time record, up from the $11.1 billion issued in 2020. Through 2022: Q2, REITs have issued $11.5 billion at-the-market.

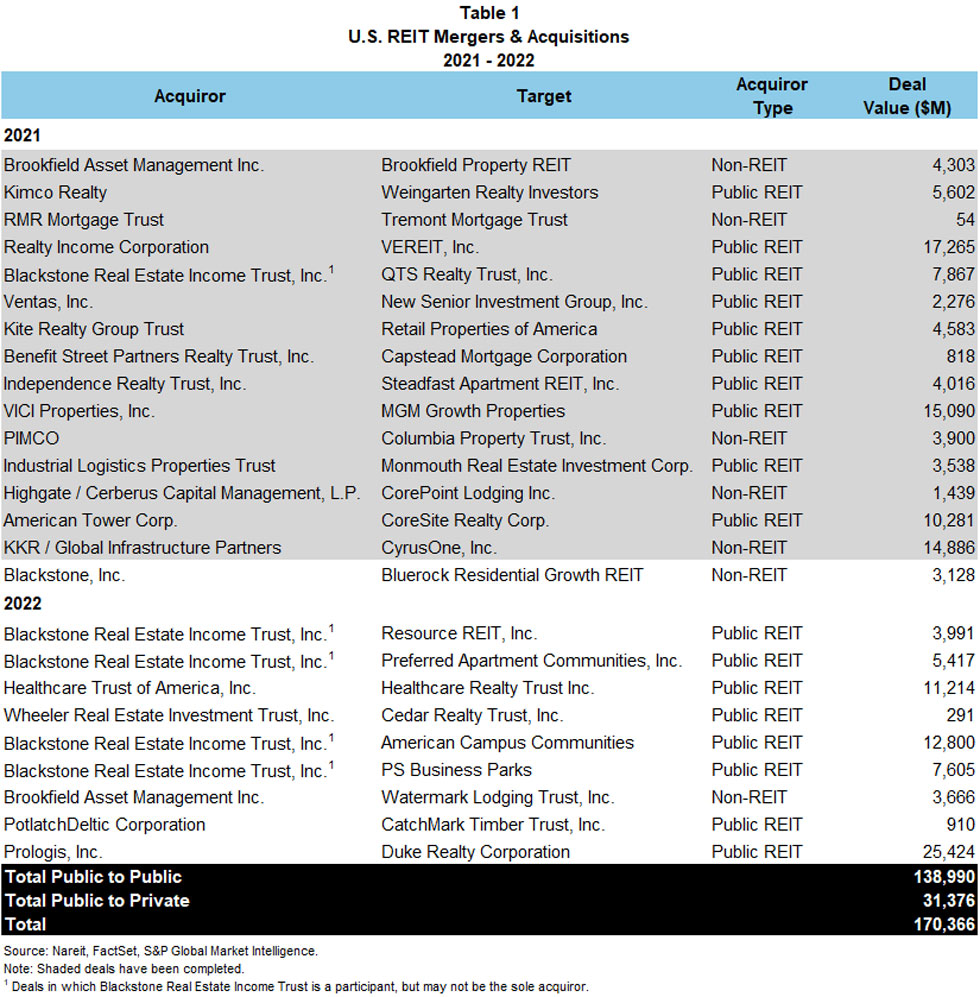

During the quarter, five acquisitions of U.S. REITs were announced, with a total deal value of $50.4 billion.

Capital Raising

- Equity issuance totaled $6.9 billion, all through common equity offerings. Total equity issuance in 2021: Q2 was $10.7 billion, with $6.6 billion in 2020: Q2.

- Debt issuance totaled $320 million raised at the secondary market, down from the $16.7 billion issued in 2021: Q2 and $24.1 billion in 2020: Q2.

- At-the-market equity issuance was $6.3 billion in 2022: Q2, following $5.2 billion in 2022: Q1. In 2021: Q2, $5.0 billion was raised at-the-market, with $1.9 billion in 2020: Q2.

Mergers & Acquisitions

In 2022, nine deals to acquire public-listed U.S. REITs have been announced, representing a total deal value of $71.3 billion. Five of these deals were announced in Q2, for a total of $50.4 billion, with four of these five transactions representing acquisitions by other publicly traded U.S. REITs with a total deal value of $46.7 billion. Since the beginning of 2021, deals for 25 REITs have been announced or completed. Of the $170 billion represented by these deals, 82% is attributed to acquisitions by other publicly-traded REITs.

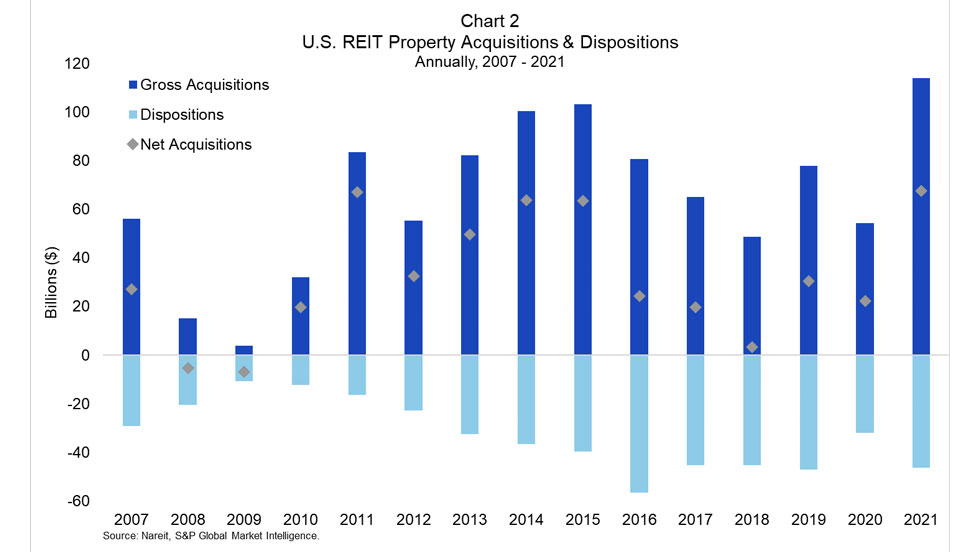

Property Acquisitions & Dispositions

REITs posted $19.0 billion in property acquisitions and $7.9 billion in dispositions in 2022: Q1. Full-year totals for 2021 were $114.1 billion in acquisitions with $46.3 billion in dispositions. In Q1, the retail, specialty, and office sectors led with acquisitions of $5.2 billion, $4.8 billion, and $2.1 billion, respectively.

As shown in Chart 2, REITs have been net acquirors of real estate on an annual basis since 2010 and set a new record for net acquisitions in 2021, surpassing the previous high-water mark set in 2011. Please see Nareit’s T-Tracker for further details.