REITs have strengthened their balance sheets over the past decade, raising equity capital and reducing their interest rate exposures. Leverage for the sector as a whole has fallen to a two-decade low, both in terms of book value and market value, according to the Nareit T-Tracker®. Interest expense as a share of net operating income (NOI) has dropped to a record low, and interest coverage ratios, a key risk metric, are well above where they were a decade ago.

These measures show that the REIT sector has the strongest balance sheets in decades, on a weighted average basis. Industry averages, however, don’t reveal what is going on in the tails—the REITs with exposures higher or lower than the broad average. To explore whether there are pockets of risk that may be hidden among the averages, we analyzed the full distribution of REIT interest exposures and how they have changed over the past decade.

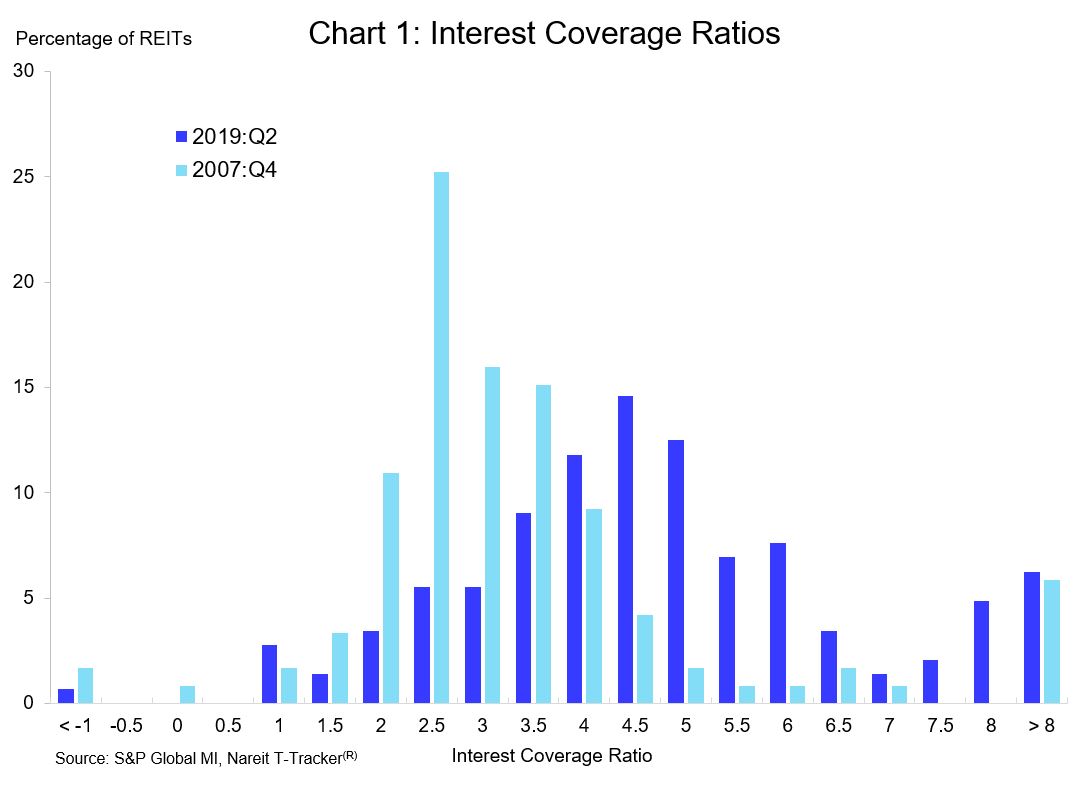

REITs have significantly reduced the tail risks across all these measures of interest rate exposures. An interest coverage ratio of 3x is often considered a benchmark for being able to cover fixed charges (coverage ratio is calculated dividing EBITDA over interest expense). In 2007, 40% of REITs had a coverage ratio greater than 3x. In 2019, however, 80% of REITs have a coverage ratio greater than 3x. Chart 1 demonstrates how the number of REITs with lower coverage ratios has fallen dramatically.

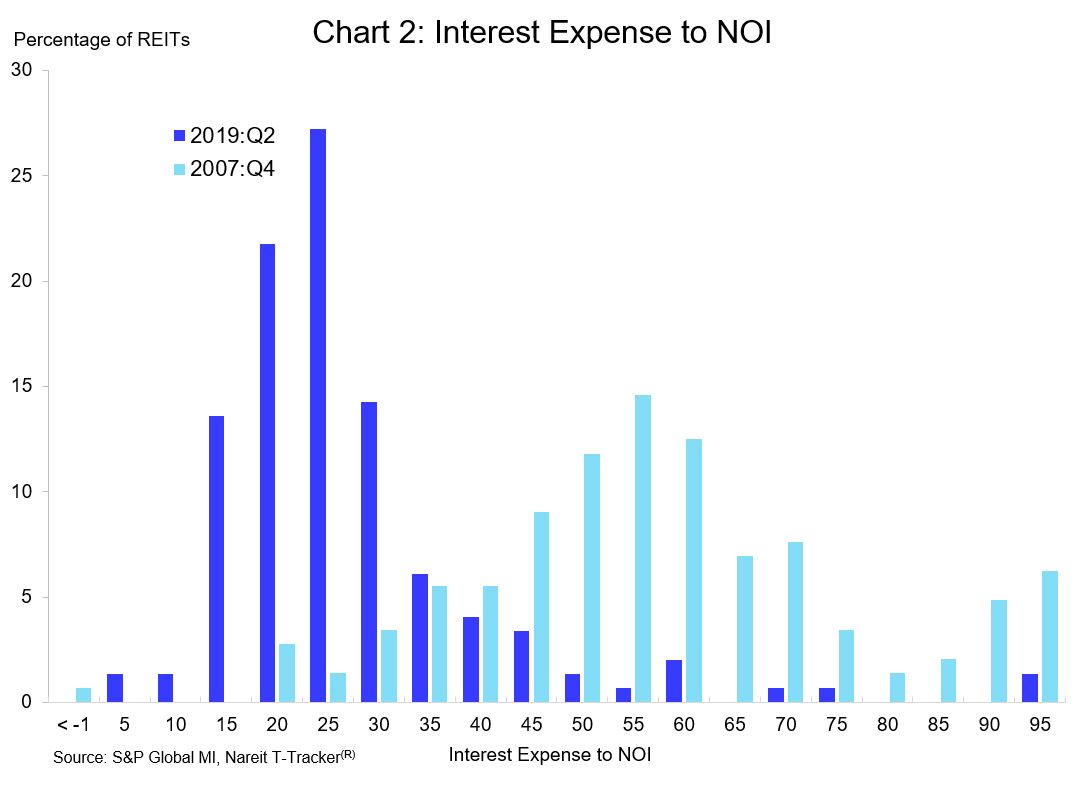

There has been a comparable change in the tails of the distribution of interest expenses. In 2007, 81% of REITs had interest expenses that were greater than 40% of NOI. In 2019, however, only 10% of REITs have interest expenses this high. Lower interest rates have reduced interest expense for all REITs, but the chart shows how dramatic the decline has been in the right-hand tail of higher interest expenses.

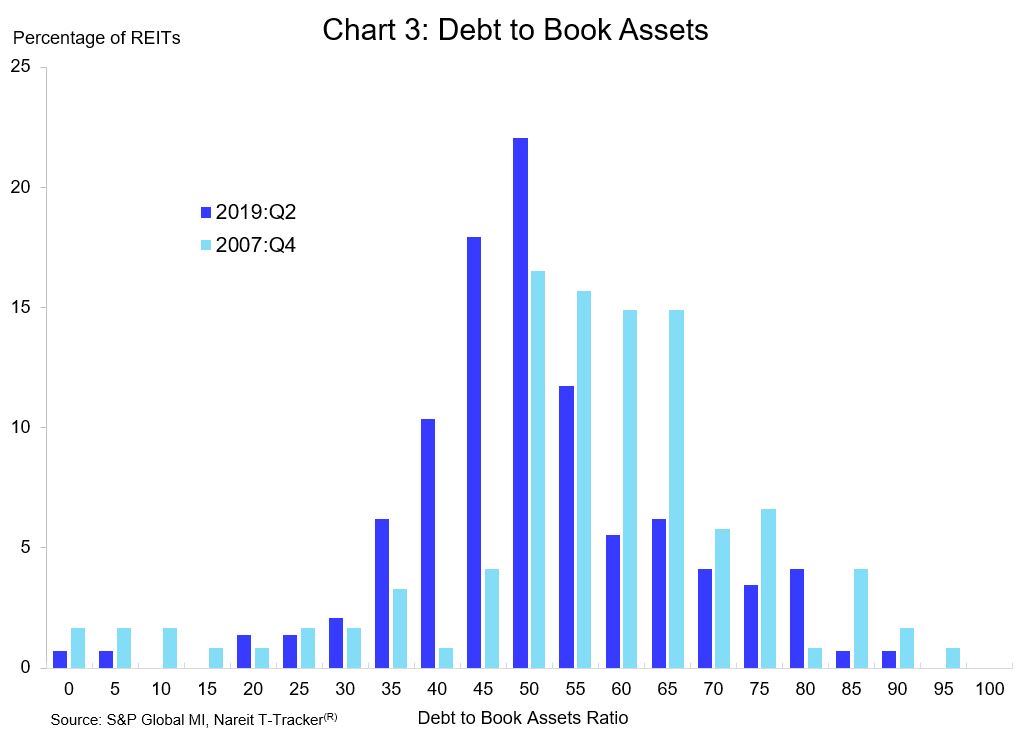

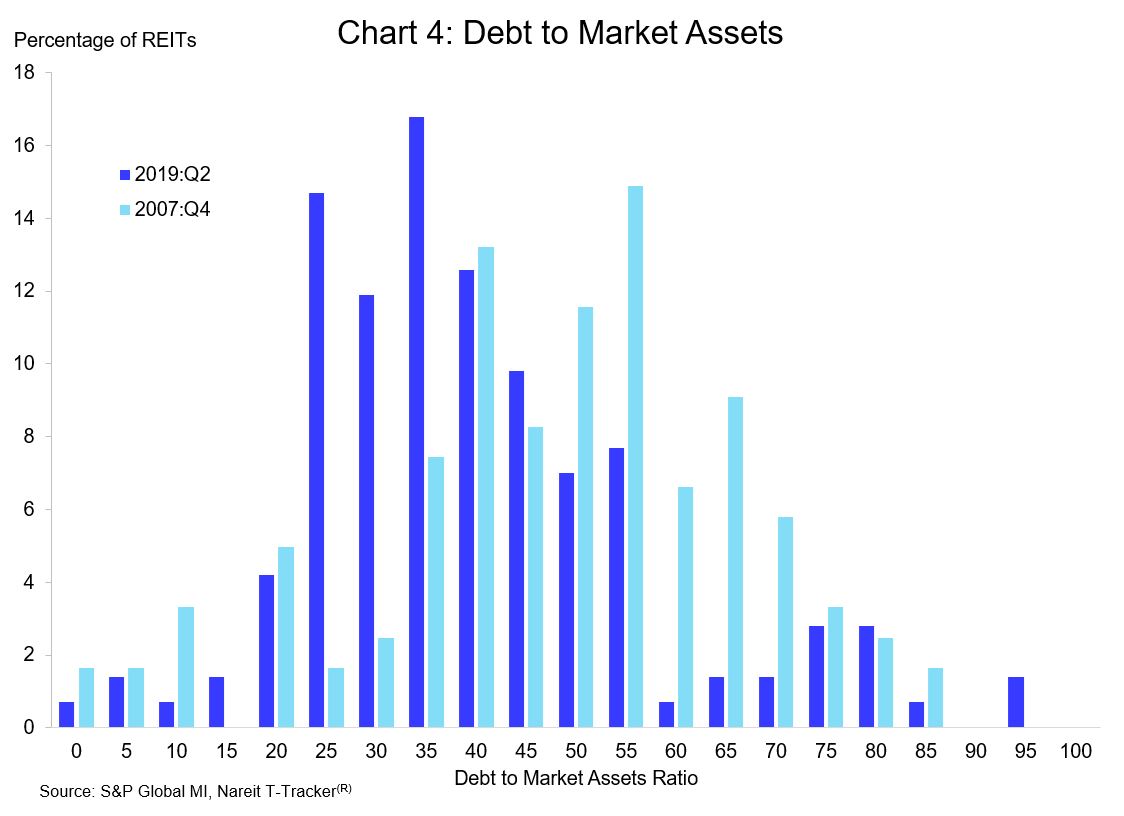

Leverage ratios show a similar convergence, with the number of REITs with higher leverage lower today than in 2007. In 2007, half of all REITs had a book leverage ratio greater than 60%; today, one-quarter have leverage ratios that high. Market leverage saw a similar transformation.

These declines in the tails of the ranges of interest rate exposures show how broadly based the improvements in balance sheets have been across the entire REIT industry. Not only have overall average REIT exposures to interest rates declined, but the number of REITs with greater exposures, in terms of higher leverage, higher interest expense or lower coverage ratios, has fallen dramatically as well.