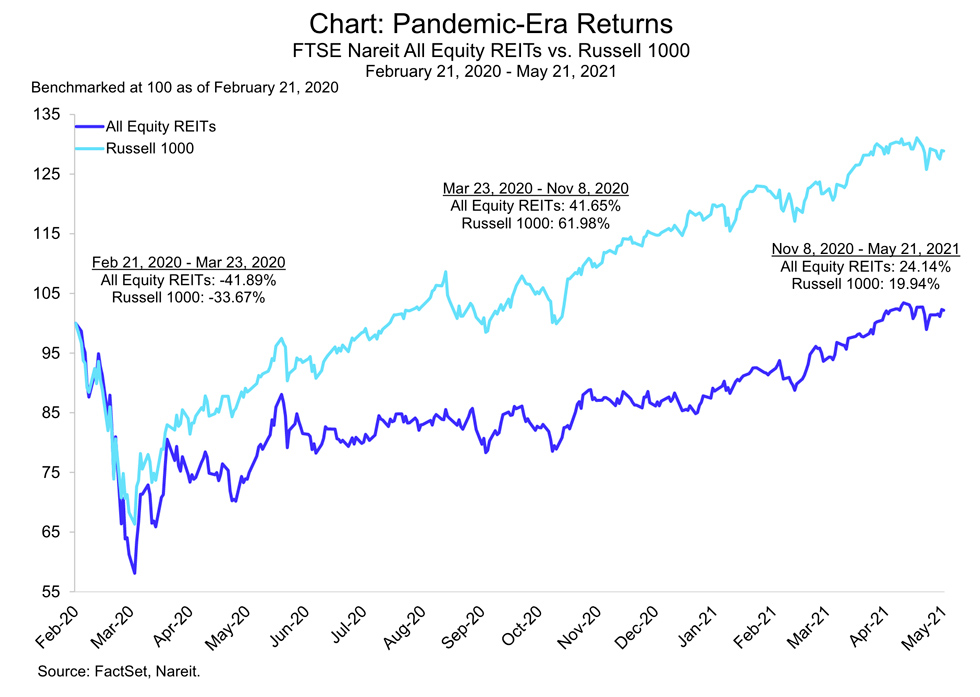

REIT stock market performance has continued to rebound from the declines during the shutdowns in the early months of the pandemic. REIT total returns at the one year mark had remained more than 8% below the pre-pandemic high. As of May 21, which marks 15 months since the market peak prior to the pandemic, REIT total returns have fully recovered from the initial losses in early 2020.

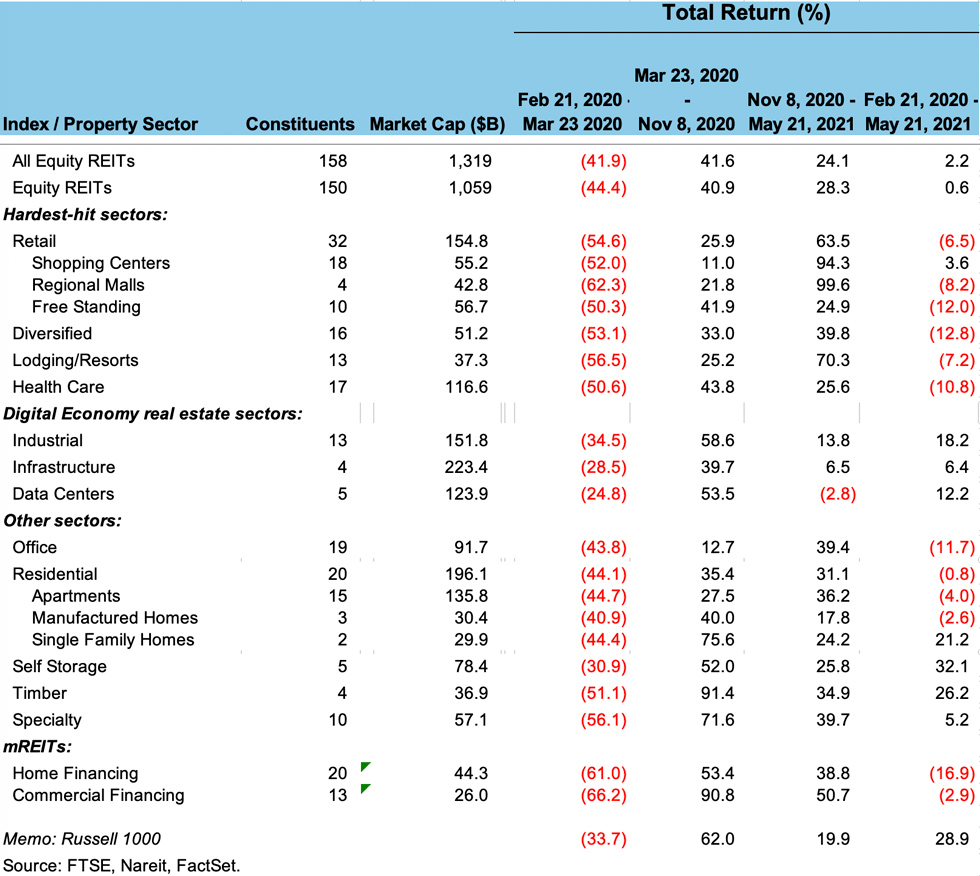

The pandemic has had different impacts on the REIT property sectors, which can be broadly characterized as:

- Those property sectors that were hardest hit by the initial economic shutdowns (retail, diversified, lodging/resorts, and health care). These sectors had the largest initial price declines from Feb 21, 2020 through the low point for the overall market on Mar 23, 2020 (first column of returns in the table). Since the announcement in early November that tests of vaccines against COVID-19 had been highly successful, however, these sectors have posted the strongest recoveries, but generally remain below pre-pandemic prices (third column of returns);

- Digital economy real estate, which benefitted from a shift in many types of economic activity from in-person to online (industrial, infrastructure, and data centers). These sectors performed especially well during the period from the market bottom in late March of last year until the announcement of test results last November, but have had modest returns over the past six months;

- Other sectors generally declined less than the hardest-hit during the initial period but rebounded somewhat less dramatically following the vaccine news. Within this group, office REITs remain down nearly 12% from the pre-pandemic peak, largely due to unresolved uncertainty about the long-term impact of work-from-home (WFH) on the demand for office space. Other sectors, in contrast, have not only recovered fully, but have total returns of 20% or higher from the pre-pandemic peak, including self storage (32.1%), timber (26.2%), and the single family subsector of residential REITs (21.2%).

- mREITs have not quite recovered from the declines of greater than 60% during the initial month of the pandemic. Home financing mREITs have a total return of negative 16.9% over the past 15 months, while commercial financing mREITs are nearly back to the prior peak, with a total return of negative 2.9% through May 21st.