Public and private real estate valuations diverge from time to time. These dislocations present opportunities for investors. The Strategic Property REIT Execution and Delivery (SPREAD) team at Teacher Retirement System of Texas (TRS) recognized the opportunity in the current divergence and seized it with a $400 million commitment for a tactical investment in U.S. public equity REITs. The investment yielded a 17.1% internal rate of return (IRR) with $47 million in profit.

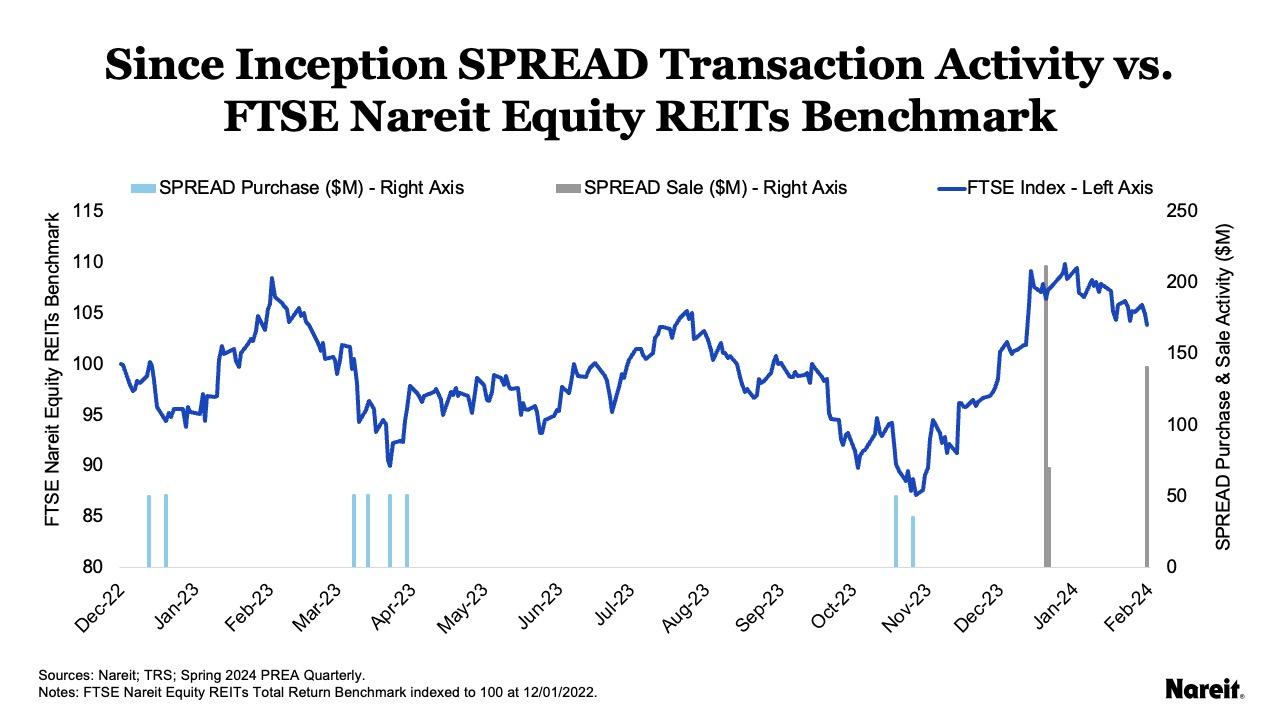

The chart above presents the amounts and timing of the deployments (light blue) and realizations (gray) of SPREAD investment capital. It also shows REIT index performance (dark blue) using the FTSE Nareit Equity REITs Index (FNRE) indexed to 100 at the SPREAD approval date of December 1, 2022.

TRS is an approximately $200 billion pension fund; the real estate portfolio is targeted at 15% of the trust. Focusing on deploying $50 million weekly tranches, one-quarter of the commitment was invested in December 2022, half was deployed in March 2023, and the remaining quarter (less reserves) was invested in October 2023. These deployments occurred at times of notable FNRE drawdowns. Two-thirds of the position was sold in December 2023; one-third in January 2024. Average invested capital over the holding period was $246 million. The investment yielded a 17.1% IRR with $47 million in profit.

The TRS experience highlights the importance of including U.S. public equity REITs as part of an overall real estate investment strategy. Failing to do so may result in missed opportunities. It also highlights the importance of being ready and having the appropriate infrastructure in place to act when opportunity knocks.

The details of the investment environment, approval processes, capital deployment and realizations, investment outcomes, and lessons learned by TRS are documented in the Spring 2024 PREA Quarterly article, “SPREADing the Wealth by Tactically Investing in REITs: A Case Study by Teacher Retirement System of Texas.”

To read the full story, visit PREA Quarterly (pdf).

Read additional portfolio completion case studies