Dividend distributions are a vital part of the REIT total return proposition. Since 1995, Nareit has worked with representatives of the Investment Company Institute (ICI) and the Securities Industry and Financial Markets Association (SIFMA) to develop procedures for corporate members that are designed to facilitate the timely reporting of the required dividend distribution information while minimizing reporting discrepancies.

As shown in the above chart, in 2023, 79% of REIT common share dividends were taxed as ordinary income, and 11% were taxed as long-term capital gains. As shown in the chart below, 9% were taxed as return of capital. This is highest percentage represented by ordinary dividends since 1999.

In 2022, 70% of REIT common share dividends were taxed as ordinary income; 16% as long-term capital gains; and 14% as return of capital. The historically small share of dividends represented by capital gains and return of capital in 2023 may be owed largely to the relatively low level of property dispositions in a commercial real estate market and marked by limited transactions activity. From 2022 to 2023, U.S. REIT property dispositions fell from $36 billion to $26 billion. Further information on property dispositions can be found in Nareit’s T-Tracker.

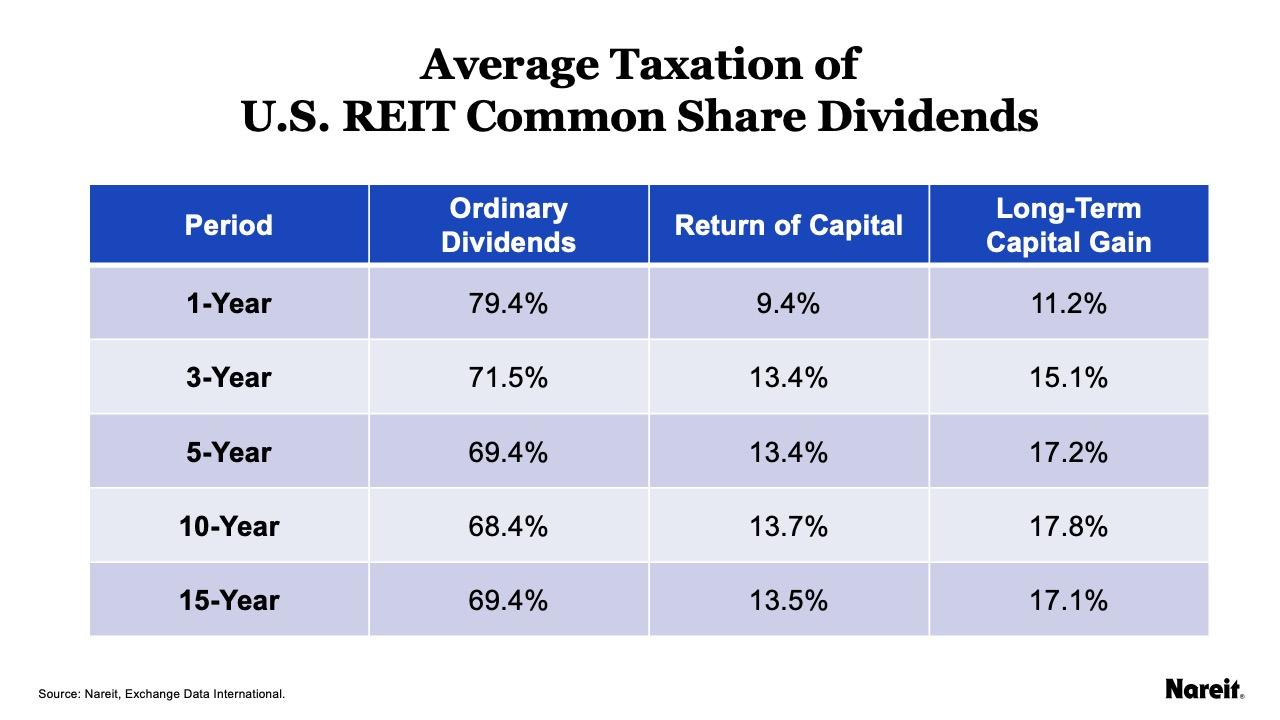

As reflected in the above table, over the past 15 years, the ratio of dividends taxed as ordinary dividends has trended slightly higher, while long-term capital gain has decreased and return of capital is little changed.

REIT dividends received by individual investors are generally taxed at the investor's ordinary income tax rates. However, a significant portion of REIT dividends can qualify as capital gains, which are taxed at the lower long-term capital gains tax rates. REITs may also distribute dividends that are classified as return of capital, which are not immediately taxable as income but reduce the investor's cost basis.

Further detail from Nareit’s Year-End Tax Reporting Project, including the taxability of individual REIT dividends, can be reviewed here.