Net acquisitions hit record highs in 2021; FFO recovery in 2021 was divergent across sectors; Impressive gains realized in industrial

WASHINGTON, D.C. (March 4, 2022) – REIT earnings, measured by funds from operations (FFO) for all equity REITs, rose 24.6% from 2020 to 2021 to $64.8 billion, according to the Nareit Total REIT Industry Tracker Series (T-Tracker®) released today. FFO in the fourth quarter of 2021 was little changed from the third quarter of 2021, decreasing slightly by 3.0% to $16.8 billion, while 22.4% higher than the fourth quarter of 2020. FFO of all equity REITs is above its pre-pandemic levels.

Performance in the quarter varied widely across property sectors, with significant increases in the industrial sector; more moderate gains at retail, residential, lodging/resorts, and self-storage; slight declines at data center, infrastructure, health care and specialty REITs; and larger declines in the office and diversified REIT sectors. On an annual basis, nearly every sector experienced FFO growth between 2020 and 2021. Only health care experienced a full year decline in FFO.

Operating performance improved with increases in occupancy rates across most property sectors.

“REITs have had an impressive recovery from the early stages of the pandemic, with FFO totaling a record $64.8 billion in 2021, up 24.6% from the year before,” said John Worth, Nareit EVP, research and investor outreach. “Strong balance sheets bolstered REITs’ resilience during the pandemic and leave them well-positioned for the likely higher interest rate environment ahead.”

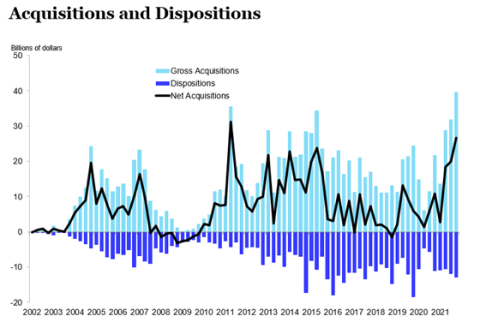

Net acquisitions in the fourth quarter totaled $26.7 billion, the second-highest on record. Net acquisitions for the year as a whole were a record $67.8 billion.

“Rising share prices have given REITs an attractive cost of capital to fund their record net purchases of income producing properties,” said Calvin Schnure, Nareit senior economist and SVP research and economic analysis. “REITs are investing in the future and expanding their footprint in commercial real estate markets.”

T-Tracker highlights include:

The industrial sector reported significant gains in the fourth quarter, up substantially from the fourth quarter of 2019 (pre-pandemic).

- FFO for the industrial sector rose 13.8% in the fourth quarter to $1.9 billion, and 51.2% higher than one year ago.

- Compared to pre-pandemic levels, FFO was 64.5% higher than in the fourth quarter of 2019.

- Data centers and infrastructure, the other REIT sectors supporting the digital economy, each recorded an 8.0% decline in FFO from the prior quarter. All three sectors, however, are still reporting historically high FFO due to the large gains at the beginning of the pandemic and reported double digit full year FFO growth.

Sectors that were greatly affected by the pandemic continue to demonstrate recovery. After a slight dip in the third quarter, the retail sector reported a rise, and lodging/resorts reported their second straight quarter of FFO gains.

- FFO of retail REITs rose slightly overall in the fourth quarter of 2021, increasing by 3.0% to $3.2 billion, compared to a decrease of 4.1% in the third quarter.

- Shopping centers saw the largest FFO increase in the retail sector in the fourth quarter, rising 8.4% over the prior quarter to $1.09 billion; Free-standing retail FFO increased 0.7% to $848 million; Regional malls’ FFO increased 0.2% to $1.27 billion.

- Lodging/resorts rose by 3.4% to $431 million in the fourth quarter. After four quarters of negative FFO as many hotels were closed during 2020 and early 2021, FFO has returned nearly halfway to pre-pandemic levels.

The office sector experienced its second straight quarter of declining FFO and lower occupancy rates.

- FFO for the office sector declined 13.8% in the fourth quarter to $1.6 billion, following a 7.1% decrease in the third quarter.

- FFO was 11.7% below its pre-pandemic level in the fourth quarter of 2019.

Interest expense as a percentage of NOI hit a new record low in the fourth quarter of 2021, improving upon the previous record low in the third quarter.

- The decline in both leverage and interest rates over several years has reduced net interest expense as a percentage of NOI to well below prior levels.

- The ratio dropped to 17.3% in the fourth quarter, compared to the previous record low of 19.2% in the third quarter.

- In the fourth quarter of 2019, pre-pandemic, the ratio was 21.6%.

- In contrast, interest expense as a percentage of NOI had been as high as 38% in 2007.

Dividends continue to lag compared to the recovery in FFO and were flat in the fourth quarter of 2021. Dividends remain 18.5% below the pre-pandemic level of $16.9 billion.

- Total dividends were flat falling marginally by 0.2% to $13.78 billion in the fourth quarter. This is a 14.4% increase compared to the fourth quarter of 2020 total of $12.04 billion.

- Dividends paid by equity REITs fell by $51 million in the fourth quarter to $12.02 billion.

- Dividends paid by mortgage REITs rose by $22 million in the fourth quarter to $1.76 billion.

Occupancy rates increased due to robust demand for commercial space. The overall occupancy rate of REIT-owned properties rose 40 bps to 92.9% in the fourth quarter of 2021, up from a low of 89.7% in the second quarter of 2020.

- Apartment REITs reported an occupancy rate of 96.1%, bringing them back to their pre-pandemic levels.

- Industrial REITs reported record-high occupancy rates of 96.8%, up 30 bps from the previous quarter.

- Retail REITs reported a 96.0% occupancy rate in the fourth quarter, a 70 bps increase.

- Office REITs saw a 20 bps decline in occupancy rates to 89.6% in the fourth quarter.

The T-Tracker report includes several factors that demonstrate the resilience of the REIT industry, including:

- The debt-to-EBIDTA ratio declined to 5.9x in the fourth quarter from 6.3x in the third quarter. Debt-to-EBITDA is considerably below its average of 6.3x between 2000 and the present.

- Leverage ratios declined in the fourth quarter, with the weighted average debt-to-total book assets ratio dropping to 48.1% from 49.5% in the third quarter. The debt-to-market assets ratio declined to 25.7% from 29.4%.

- Same-store NOI (SS NOI) rose 7.8% in the fourth quarter of 2021 compared to the fourth quarter of 2020. This is the third straight quarter of increases after four consecutive quarters of declining SS NOI.

- Weighted average term to maturity of REIT debt continued to lengthen in the fourth quarter to 89.4 months, or 7.45 years, from 88.3 months in the third quarter of 2021. Average maturities had been less than 60 months (5 years) in the Great Financial Crisis of 2008, and maturity was 65 months as recently as 2016. REITs have locked in record low interest rates for many years into the future.