Transparency & Reporting

REITs focus on providing key metrics and insights for stakeholders on the impact of sustainability-related items on business operations, focusing on delivering relevant information on risk and opportunity to financial decision-makers.

REITs Report on Sustainability

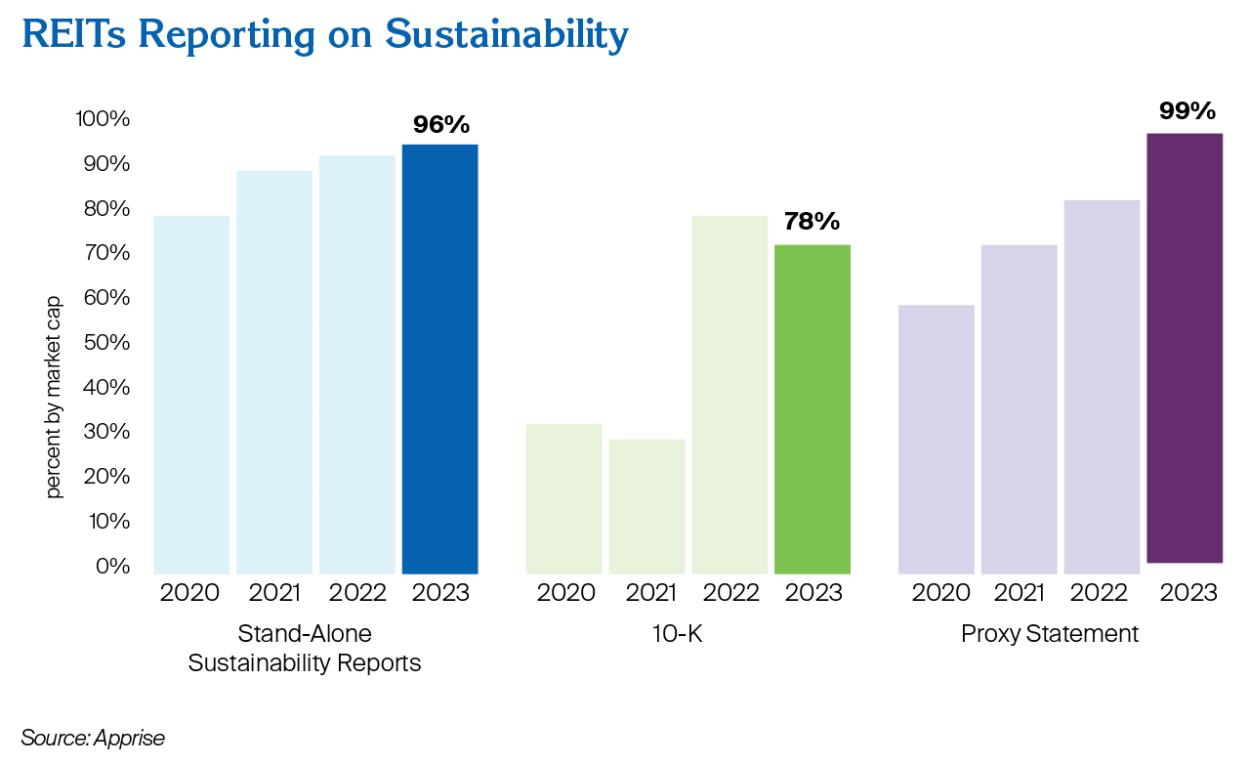

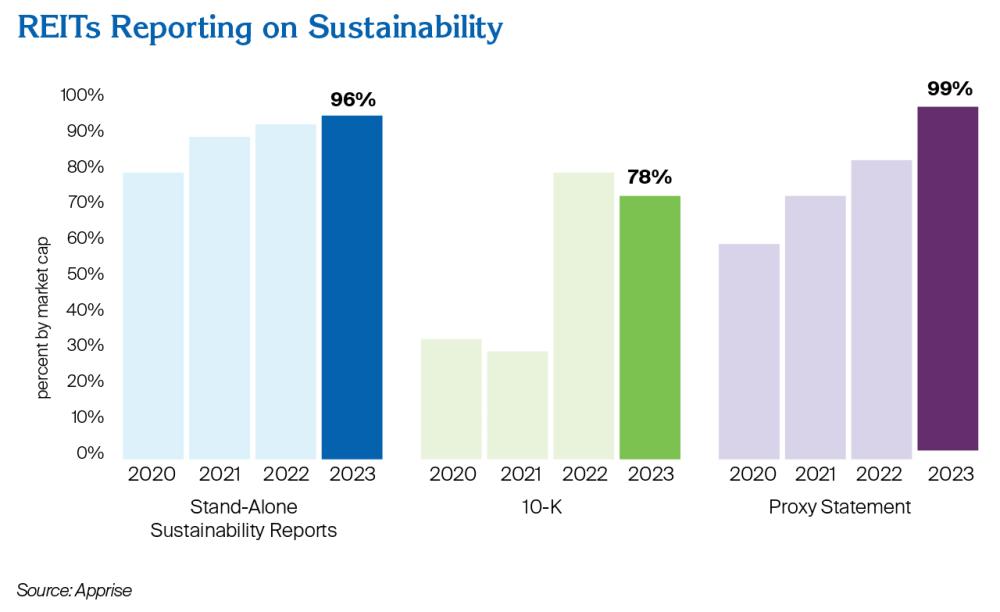

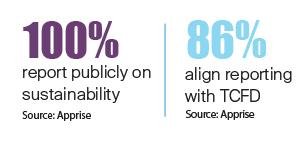

REITs provide transparency for investors, customers, employees, and community members in managing environmental and social issues. The global effort to standardize the disclosure of sustainability information remains a key area of focus for investors that want to understand the financial impact of issues such as climate change and societal trends. While legislative and regulatory agendas continue to develop around the globe, REITs are focused on providing comparable, consistent, investment decision-useful information on sustainability matters.

Related content:

Effectively Communicating Sustainability Strategies (Nareit webinar on demand)

REITs Align with Global Sustainability Frameworks

U.S. REITs may align with global reporting standards. Some frameworks, such as the Global Reporting Initiative (GRI), the Task Force for Climate-related Financial Disclosures, and the Sustainability Accounting Standards Board (SASB) guide companies on reporting specific sustainability topics and metrics. Others such as the U.N. Sustainable Development Goals (SDGs) focus on a company's environmental and social impact.

REITs Report Responsible Investment Practices

REITs demonstrate their commitment to transparency around corporate responsibility by participating in voluntary third-party assessments. REITs submit information on their policies, procedures, and performance to groups such as the GRESB Real Estate Assessment, CDP's environmental reporting framework, and the S&P's Corporate Sustainability Assessment (CSA), which is used to identify companies for inclusion in the Dow Jones Sustainability Index (DJSI).

REITs Outperform in Sustainability

A peer-reviewed, academic study, sponsored by Nareit, provides the first meaningful analysis comparing the sustainability performance of REITs and private equity real estate (PERE) funds, as well as an analysis of the relationship between sustainability reporting and the financial performance of REITs.

The comparison of the sustainability performance of REITs and PERE funds shows that they have pursued different paths toward sustainability disclosures. While REITs continue to outperform PERE on average, over time, the performance gap between REITs and private real estate appears to be narrowing.

The study also finds that REITs with higher levels of sustainability disclosure have stronger financial/operational performance than those that do not, even after controlling for observable factors.

Related content:

REITs Continue to Improve GRESB Scores

Next Section: