Community & Business Connections

REITs foster connections with tenants, local organizations, suppliers, and

service providers to support

cost-effective, sustainable, ethical, and inclusive real estate operations.

REITs Impact Communities

REITs are having a positive impact on local communities through investments in public spaces and corporate giving. REIT employees are encouraged to volunteer, and many REITs have organized giving programs and have established relationships with local organizations that connect their employees with opportunities to give back.

Related content:

UMH Looks to Innovative Solutions to Alleviate Affordable Housing Shortage

Armada Hoffler Transforms Strip Center into Vibrant, Mixed-Use Destination

Dividends Through Diversity Grant Program

Nareit Foundation’s Dividends Through Diversity (DTD) Grant Program identifies, funds, and connects the REIT and publicly traded real estate industry with non-profit organizations focused on reaching diverse individuals and businesses in the areas of talent development, education, capacity building, and entrepreneurial support. In 2023, nine nonprofit organizations were awarded grants.

The grants were made possible by the Nareit Foundation's 2022 DTD Giving Campaign where Nareit and 41 REIT donors made a collective commitment to advance diversity through philanthropic support on behalf of the REIT and publicly traded real estate industry.

Related content:

Project Destined's REIT Bridge Program Graduates

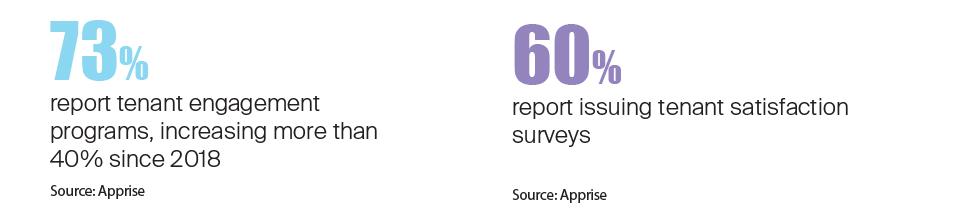

REITs Engage Tenants

REITs are meeting the evolving needs of the customers that occupy their buildings by gathering feedback, directly engaging with occupants, and employing innovative ways to connect with these stakeholders. The landlord-tenant relationship is essential to driving business value and meeting sustainability goals. REITs continue to collect feedback on tenant satisfaction with building quality, location, and services.

Related content:

Residential REITs Work to Bolster Financial Empowerment of Residents

Vornado Puts Sustainability at the Heart of THE PENN DISTRICT

REITs Practice Green Leasing

REITs are raising awareness with commercial tenants and residents about efforts to improve sustainability, indoor air quality, inclusive practices, and amenities in the building. REITs incorporate lease clauses and building operating procedures that provide opportunities for landlords and tenants to improve the quality of the built environment, improve customer and employee satisfaction, and reduce their environmental impact.

Related content:

REITs Named as 2024 Green Lease Leaders

REITs Focus on Health and Wellness

REITs focus on occupant health by incorporating wellness strategies as part of tenant engagement and building operating plans. Healthy building certifications can help to formalize and document programs and policies and supports leasing and marketing efforts by improving occupant satisfaction and community connectivity.

Related content:

REITs Team Up to Increase Awareness of 988 Lifeline Emotional Support Services

REITs Manage Supply Chain Responsibly

REIT operations rely on service workers, skilled trades, and goods and services from a global supply chain. Through formal policies and programs that focus on the welfare of workers, fair labor practices, and responsible sourcing, REITs are reducing the risk of disruption to their business and contributing to a more equitable society.

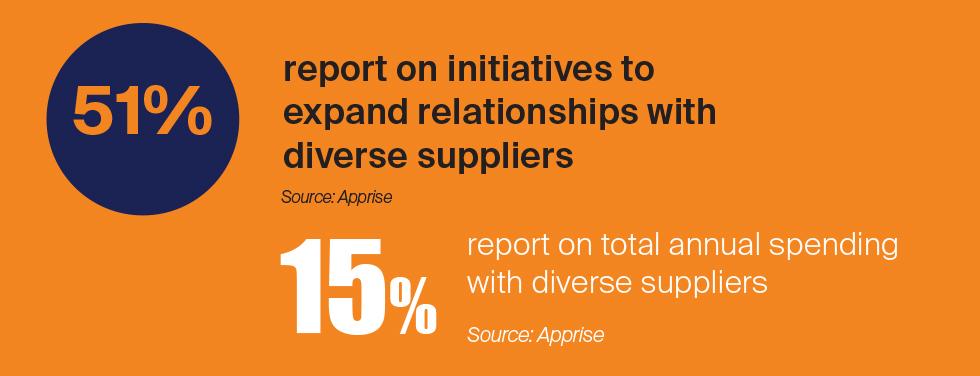

REITs Connect with Diverse and Locally Owned Businesses

REITs connect with a wide range of businesses and organizations in their day-to-day operations and are expanding relationships with minority, women, and locally owned businesses. By reporting on the percentage of total annual spending with diverse suppliers, REITs can provide transparency to stakeholders on the effectiveness of supplier diversity policies, programs, and practices.

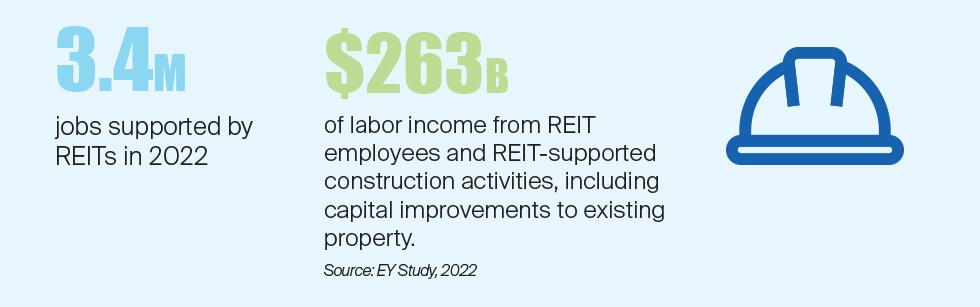

REITs Contribute to the Local Economy

REIT operations and investment activities contribute labor income to the U.S. economy and REITs distribute dividends and interest payments, contributing to current and future consumer spending. In a study, commissioned by Nareit, EY estimated the current economic contribution of all U.S. REITs (including public listed, public non-listed, and private REITs) in the United States.