Global REIT and Real Estate Performance and 2024 Expectations

Key Takeaways

- The demand conditions supporting data centers, telecommunications towers, and other digitally driven real estate are global in nature and will continue to drive growth in these sectors.

- There will likely be more REITs and listed real estate companies around the world specializing in digitally driven real estate sectors.

The FTSE EPRA Nareit Global Real Estate Index Series is the longest running family of global real estate benchmarks, providing investors with liquid access to REITs and publicly listed real estate around the world. The series covers 506 constituents in 40 countries, with a combined market capitalization of $2.3 trillion. The performance of the index series informs Nareit’s analysis of 2023 and its expectations for 2024.

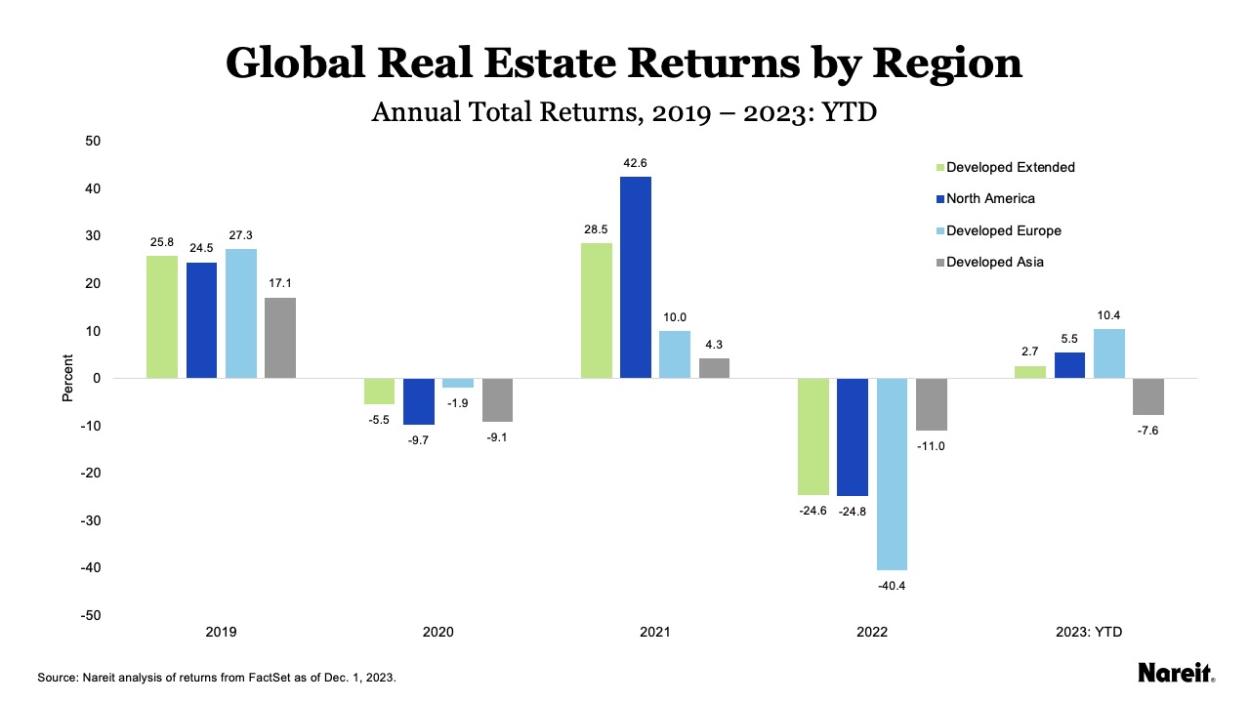

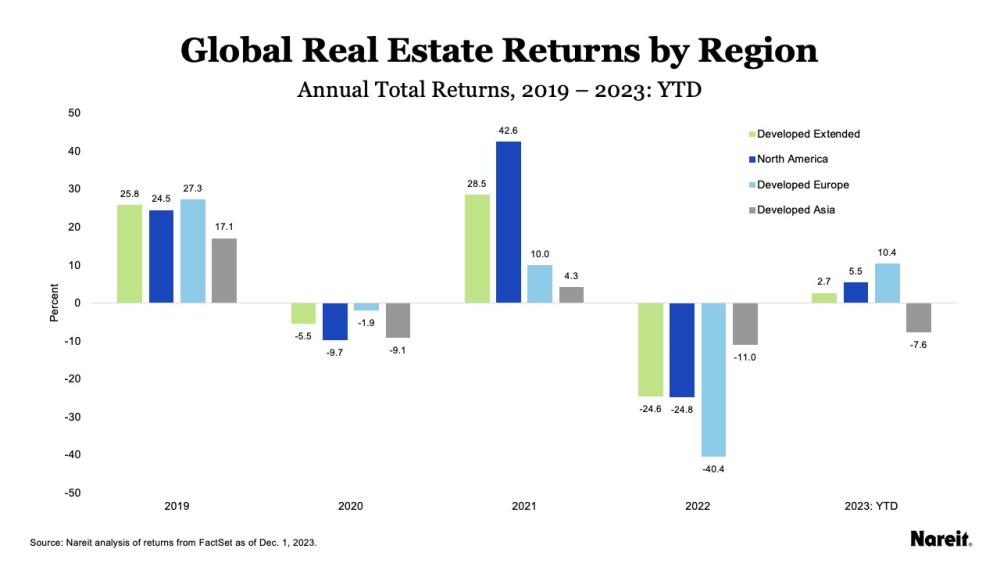

Before discussing 2024 expectations, it is worth looking at 2023 and noting the comparative outperformance of the FTSE EPRA Nareit Developed Extended index and its component regions compared to 2022.

The total return performance of the FTSE EPRA Nareit Developed Extended Index year-to-date is up 2.7%, after declining 24.6% in 2022. Regionally, Developed Europe leads, with a total return of 10.4%, outpacing the prior year by over 50%. North America follows with a total return of 5.5%, outperforming 2022 by over 30%. Finally, Developed Asia, which was down 11.0% in 2022, is outperforming by 3.4% with a total return of -7.6% in 2023.

10-Year Treasury Yield Peak Could Mark Beginning of REIT Rebound

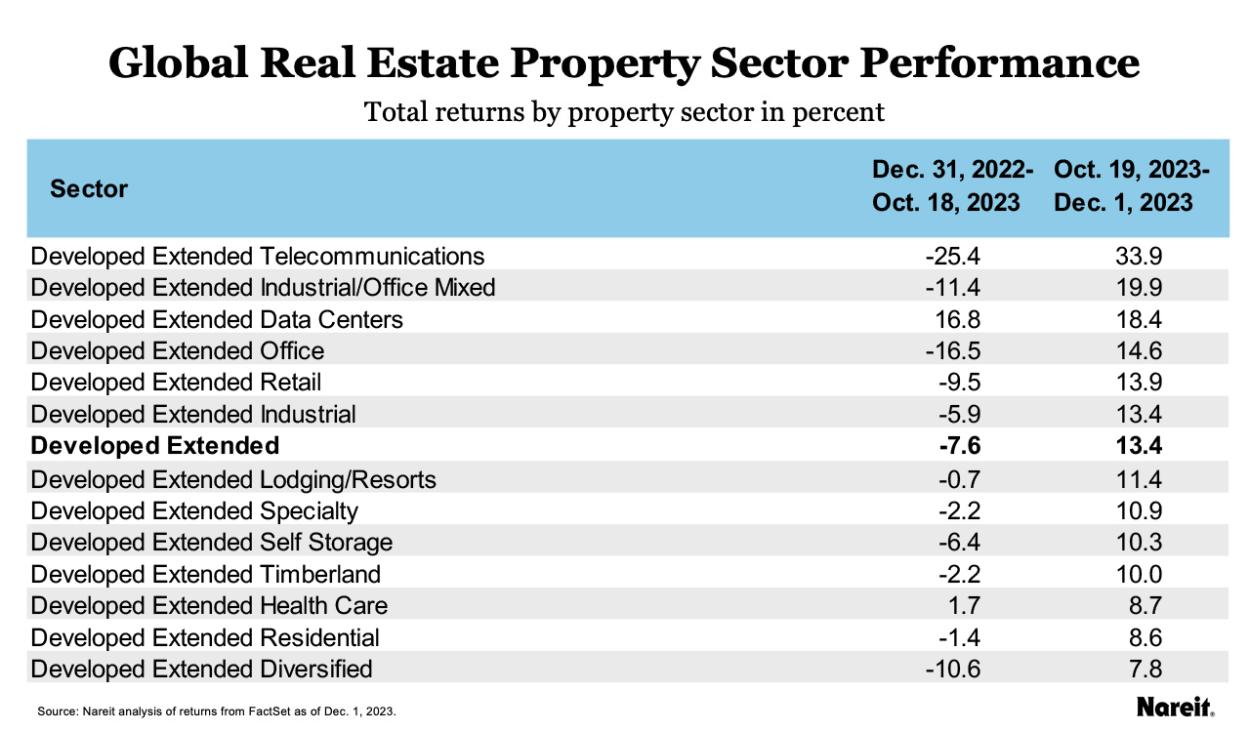

Despite the comparative outperformance, rising bond yields and hawkish monetary policy clearly continued to present headwinds for real estate around the world, as reflected in the -7.6% total return performance of the FTSE EPRA Nareit Developed Extended Index, as of Oct. 18. Late 2023, however, could mark the beginning of the REIT rebound.

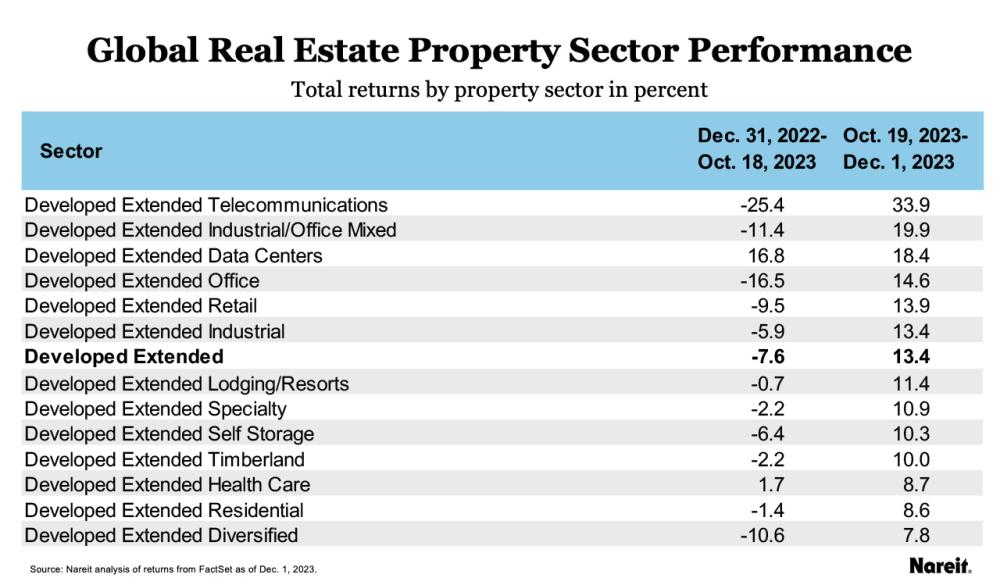

The chart above demonstrates that as the yield on the 10-year U.S. Treasury pulled back from its peak on Oct. 19, global real estate sectors responded positively. For example, as of Dec 1:

- The Developed Extended Index is up 13.4% since Oct. 19.

- The Developed Extended Telecommunications Index is up 33.9% since Oct. 19.

- The Developed Extended Data Centers Index was up 16.8% through Oct. 18 and has risen 18.4% since Oct. 19.

REITs and Listed Real Estate: Regional and Sector Performance

Before focusing on 2024, it is also helpful to take a deeper look at the regional and sector performance in 2023.

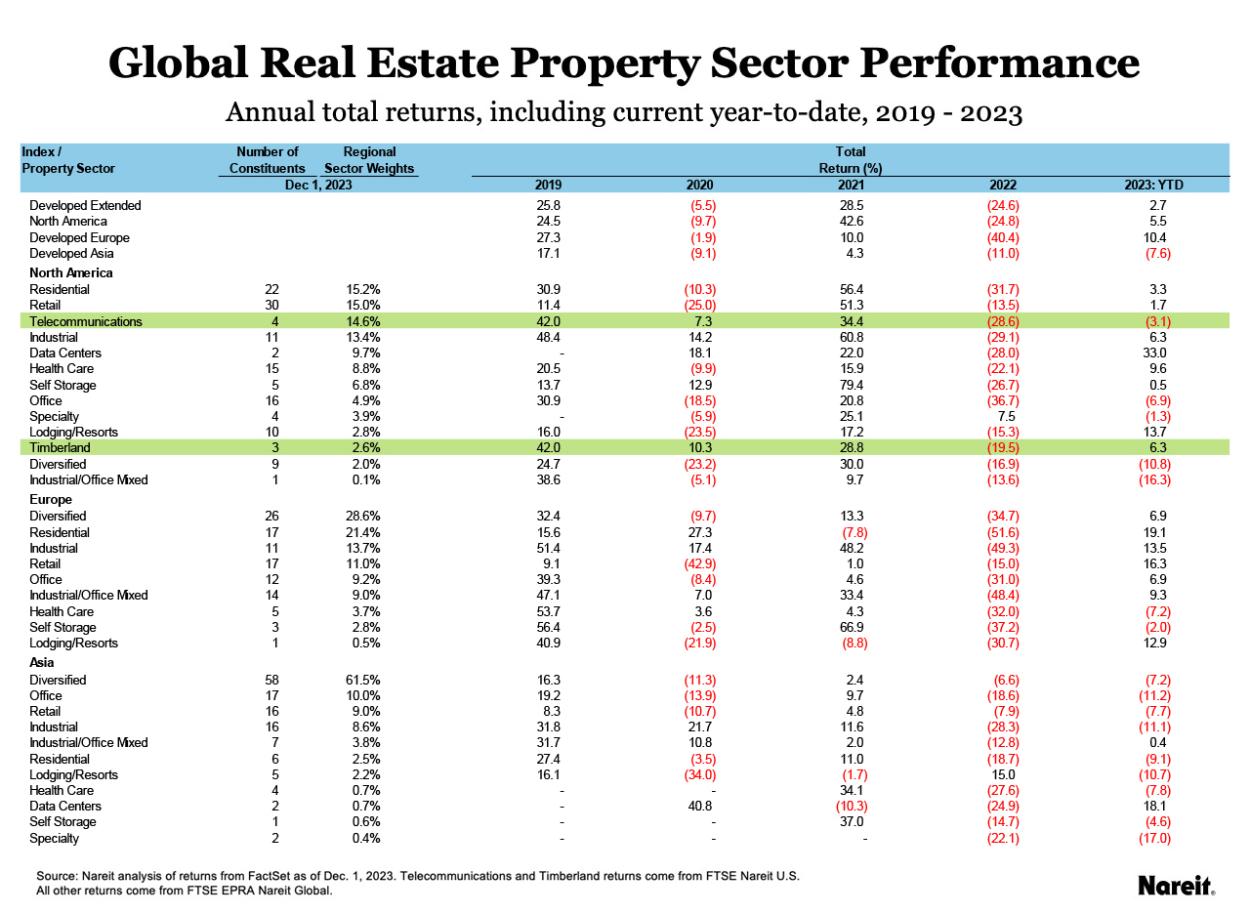

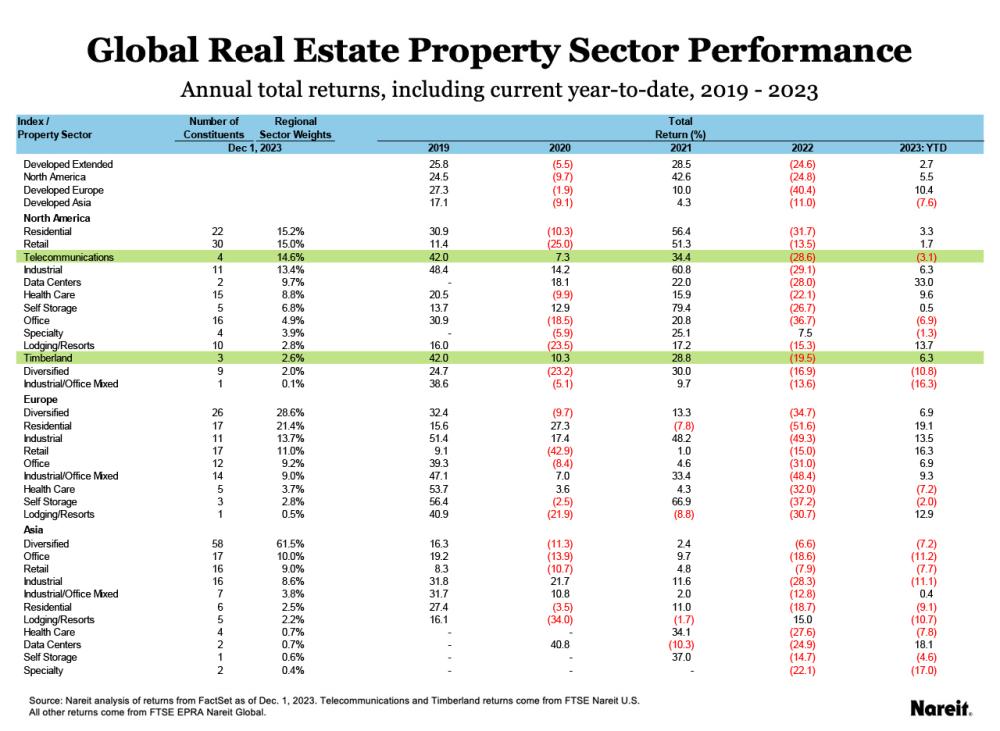

Developed Europe leads on a year-to-date basis through Dec. 1, with a total return of 10.4%; while North America is up 5.5% and Developed Asia is down 7.6%. Comparing sector performance across regions presents some similarities and a few key differences:

- The data centers sector leads in North America and Asia with respective returns of 33.0% and 18.1%.

- Health care is positive in North America with a total return of 9.6%, while the sector has lagged in Asia and Europe, with respective returns of -7.8% and -7.2%.

- Industrial is the fourth-best performing sector in North America: North America has posted a year-to-date total return of 6.3% for industrial. In Europe, industrial is the third-best performing sector with a total return of 13.5%. In Asia, industrial has declined 11.1% year-to-date in 2023.

- The office sector is performing better in Europe than other regions: Europe has seen returns of 6.9% in the office sector, versus -6.9% in North America and -11.2% in Asia.

- The diversified sector has performed better in Europe and Asia: Europe and Asia have posted returns of 6.9% and -7.2% year-to-date in the diversified sector, while North America, which includes notable exposure to office properties, is down 10.8%.

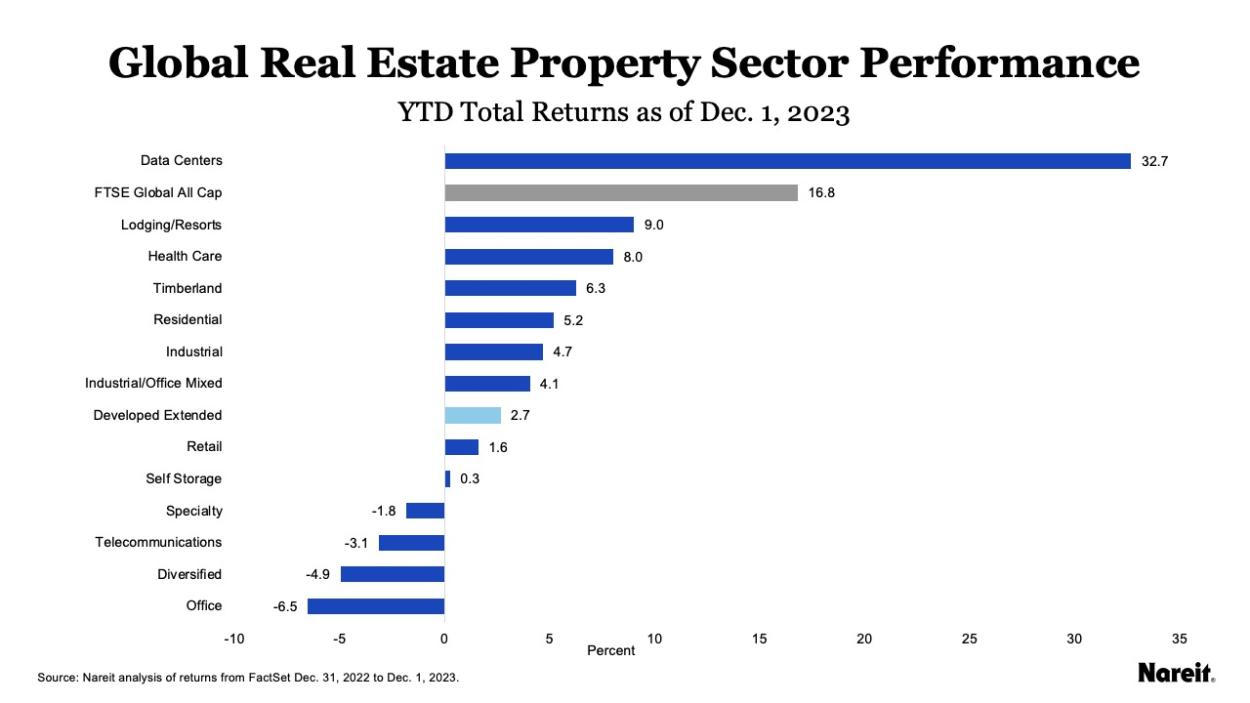

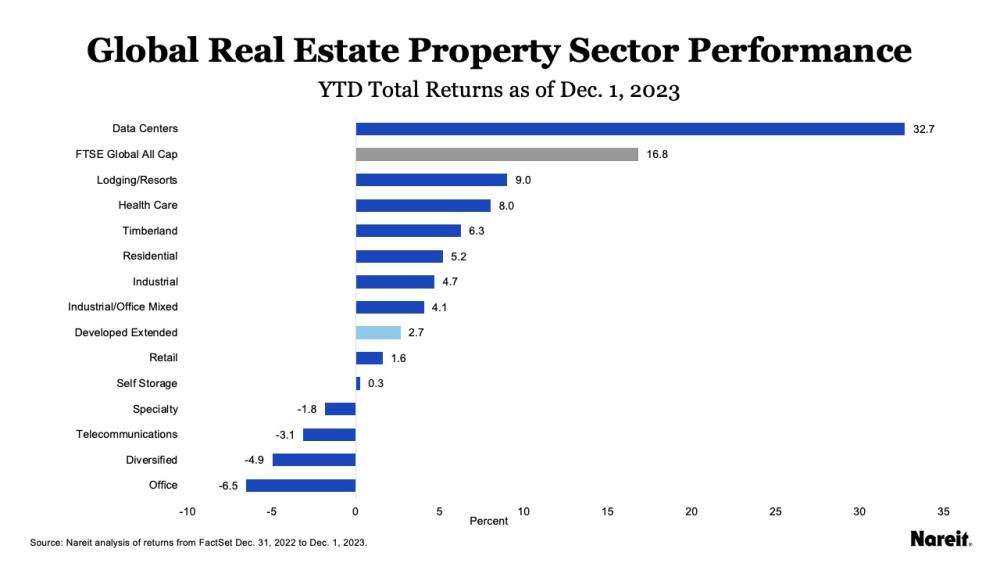

Ultimately, data centers, lodging/resorts, and health care have been the strongest performing sectors in 2023.

As shown in the above chart, the data centers sector leads with a return of 32.7%, followed by lodging/resorts at 9.0%, and health care at 8.0%. Telecommunications, diversified, and office have recovered as Treasury yields have declined, though they still lag with respective returns of -3.1%, -4.9%, and -6.5%.

2024: Digital Real Estate Sectors Have Global Growth Opportunities

Looking to 2024 and beyond, there will likely be global growth in data centers, telecommunications towers, and other digitally driven real estate, including industrial facilities. This is partly because there is significant room to expand in key regions around the world. For example, currently there are two listed telecommunications tower companies in Europe and two listed data center companies in Asia.

Looking to 2024 and beyond, there will likely be global growth in data centers, telecommunications towers, and other digitally driven real estate, including industrial facilities.

Usage trends offer reasons to be optimistic for the future. In telecommunications towers, the continuing propagation of 5G technology will lead to further densification of cellular networks, and consumer usage trends point to an increasing need for bandwidth. In data centers, the AI-driven demand wave is likely to continue to drive a heightened need for data center space. Finally, the continued expansion of e-commerce, onshoring, and nearshoring will likely present future global growth opportunities for the industrial sector.

The 2023 performance of the FTSE EPRA Nareit Global Real Estate Index Series suggests that, though the macroeconomic environment continued to present challenges for REITs, there is reason for optimism in 2024.

John Barwick is vice president of index management and industry information at Nareit.