REITs: Late 2023 Performance Suggests Brighter Outlook for an Evolving Industry in 2024

As we look ahead to 2024, the high interest rate environment will likely continue to broadly impact both commercial real estate (CRE) and REITs. The rapidly emerging consensus is that the Federal Reserve is entering a new, more accommodative period that increases the prospects for stabilizing and even declining interest rates.

Even in this new phase of monetary policy, the current high level of interest rates will continue to affect CRE. Nevertheless, we are cautiously optimistic that despite those challenges, the REIT recovery could begin next year. The impressive performance of REITs during late October and November may be a signal that, as in previous periods of monetary policy adjustments, the end of the rate-rising cycle will herald a period of REIT outperformance.

Despite that late-year surge, it is unlikely that 2023 REIT returns will create lasting happy memories for investors. However, as we look back on 2023, we note two key trends that we believe will gain increasing traction in 2024 and beyond.

First, despite higher interest rates, REIT consolidation will continue; there were seven public REIT-to-REIT mergers within the same property sector announced in 2023 with a total deal value of $52.8 billion. These mergers underscore the benefits of having scope, scale, and a robust operating platform in real estate, the last of which is a natural advantage for REITs.

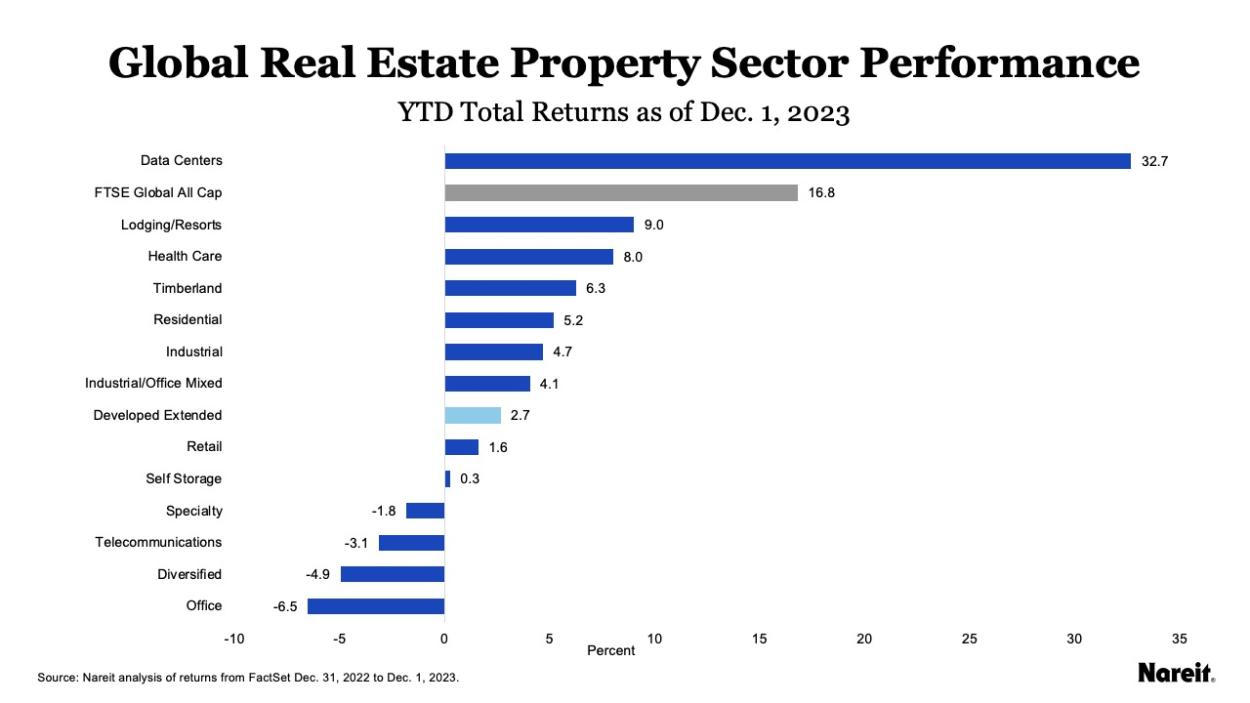

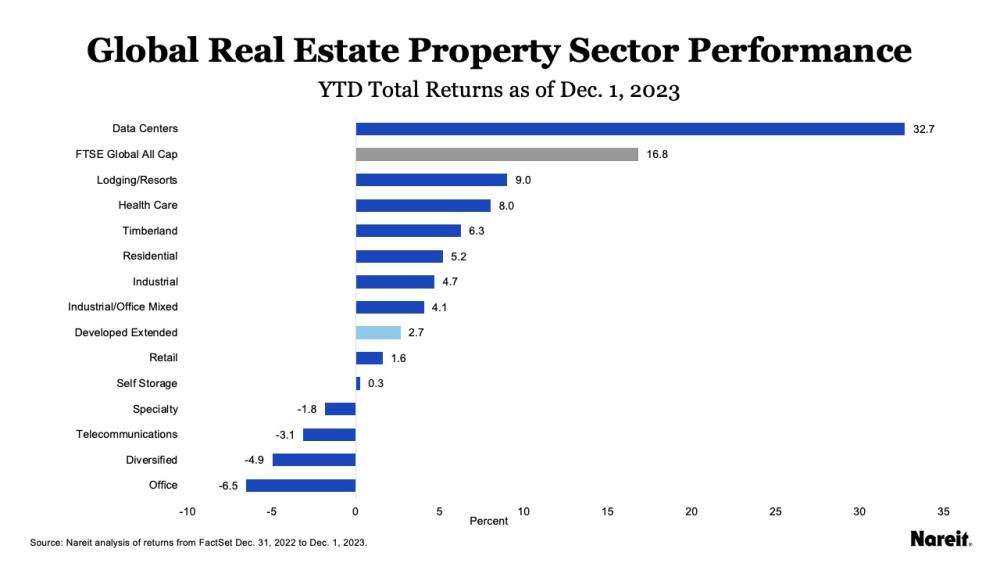

The second trend that will gain traction in the coming years is that REITs will continue to create and provide notable access to new and emerging property sectors as the economy evolves. In 2023, this has been evident in the increased demand seen for REIT data center space, fueled by the artificial intelligence boom, as well as the creation of the gaming real estate sector in the FTSE Nareit U.S. REIT indexes. REITs will also continue to provide access to global real estate and industry leading sustainability performance.

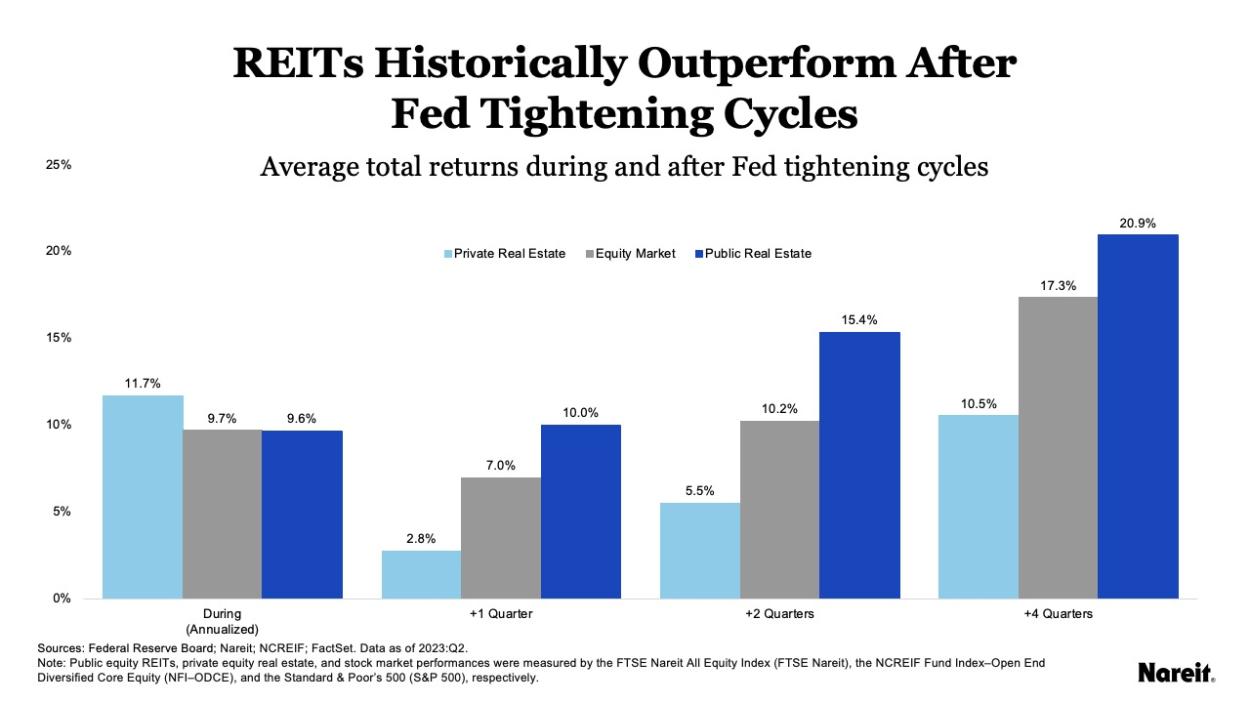

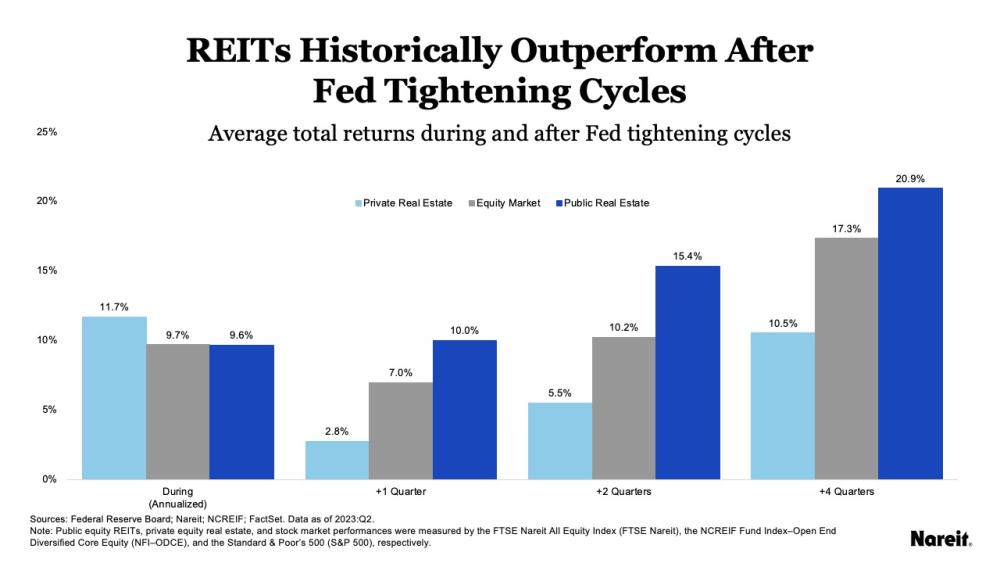

Looking at the broader landscape, our outlook for CRE and REITs highlights three themes: REITs historically have had impressive outperformance at the end of Fed tightening cycles, the public-private CRE valuation divergence will continue to close, and REITs are well positioned to navigate a prolonged period of high interest rates.

Though REITs have typically experienced relative total return underperformance during Fed tightening cycles, they have outperformed both private real estate and equities in post-rate hike periods. With the Fed at or near the end of its interest rate hike cycle, this bodes well for 2024 REIT performance.

Meanwhile, the wide valuation divergence between REITs and private real estate, which has been surprisingly and stubbornly slow to close, presents meaningful opportunities for investors to arbitrage between the two markets. We expect the convergence process to gain speed in 2024 as private real estate reprices and REITs recover. Though the higher interest rate environment will continue to create challenges for CRE in 2024, we believe that REITs are well-positioned for higher rates because of their strong balance sheets. These disciplined balance sheets have also made REITs well-prepared for market uncertainty, while paving the way for potential opportunistic real estate acquisitions. As further discussed in our CRE outlook, we believe REITs provide an important tactical advantage at this point in the real estate cycle.

We believe that REITs are well-positioned for higher rates because of their strong balance sheets. These disciplined balance sheets have also made REITs well-prepared for market uncertainty, while paving the way for potential opportunistic real estate acquisitions.

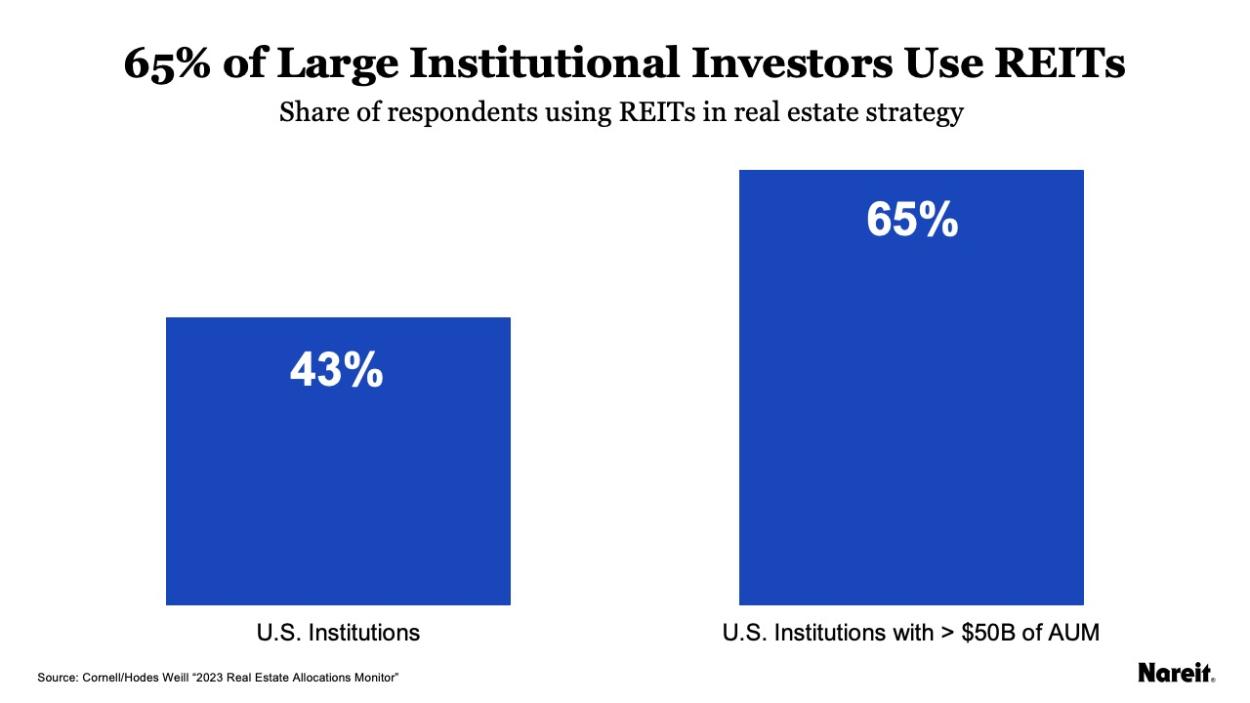

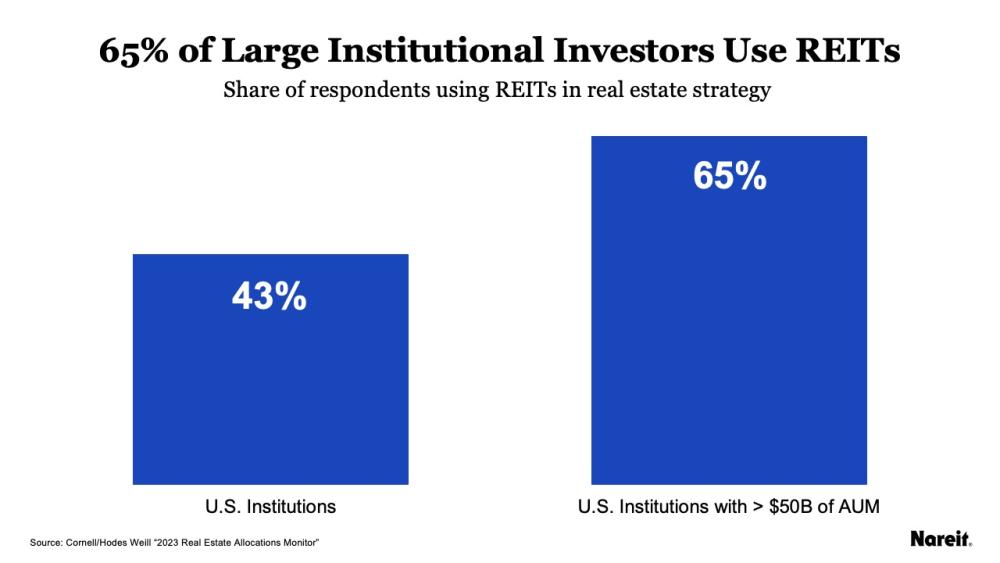

Institutional investors also are increasingly understanding that REITs offer significant tactical advantages and strategic opportunities, and as a result should be included in their real estate portfolios. We expect this trend to continue in 2024, because institutional investors are recognizing that REITs have historically provided benefits in terms of higher total returns and strategic access to new and emerging property sectors and global real estate, all while exhibiting leading sustainability metrics.

In this outlook, we summarize four case studies showing how institutional investors are tactically and strategically using REITs to meet their real estate portfolio objectives, which include increasing property sector diversification and increasing returns.

In addition to the case studies, we graphically show the evolution of REIT property sectors by market capitalization and the growth of the REIT and listed real estate opportunity set globally.

Our outlook wouldn’t be complete without examining the global REIT landscape. Though REITs and listed real estate underperformed broader markets in 2023, they seemed to have turned a corner late in the year. Through mid-October, the year-to-date total returns of the FTSE EPRA Nareit Developed Extended Index were -7.6% but since mid-October the index has gained 13.4%, outperforming the broader market. However, the performance of the countries, regions, and sectors underlying the index series do not behave uniformly. Our review of global listed real estate returns highlights these important differences and considers how opportunities for access to new and emerging property sectors are emerging globally. In 2024, we believe the global footprint of REITs and listed real estate companies will continue to expand, with digitally driven real estate likely to account for a growing share of that enlargement.

The past two years have been challenging for REIT returns, as the Fed ramped up its fight against inflation. The REIT industry, however, has continued to evolve and it appears that a recovery is likely on the horizon in 2024 and beyond.

Listen to John Worth discuss the 2024 REIT Outlook on the REIT Report Podcast:

John Worth is the executive vice president for research and investor outreach at Nareit. He conducts REIT-focused research, works with Nareit's sponsored research partners, and participates in outreach activities with investors, analysts, and policymakers.