Mid-Year Report: Real Estate Active Managers Diversify Portfolios and Embrace Newer Property Sectors

One of the unique aspects of REITs is the large, dedicated active management investment community. These active managers have been critical to the long-term success of the REIT model because of their real estate investment expertise and analysis. Tracking actively managed dedicated REIT funds and how they’re allocating their assets provides insights critical to understanding the evolution and current state of the REIT market.

Nareit’s active manager tracker monitors the 27 largest actively managed real estate investment funds focusing on REIT investment on a quarterly basis. The most recent analysis is from the first quarter of 2024 and looks at those strategies within the context of the past 14 years. The funds had $36 billion in assets under management in the first quarter of 2024. The analysis offers three main takeaways:

- REIT active managers’ strategies meaningfully diverge from the FTSE Nareit All Equity REITs Index as they seek to capitalize on economic trends.

- REIT active managers have embraced new and emerging property sectors, which now account for 54% of assets under management.

- New research suggests that these allocations, and REIT active manager company selection, has generated positive alpha.

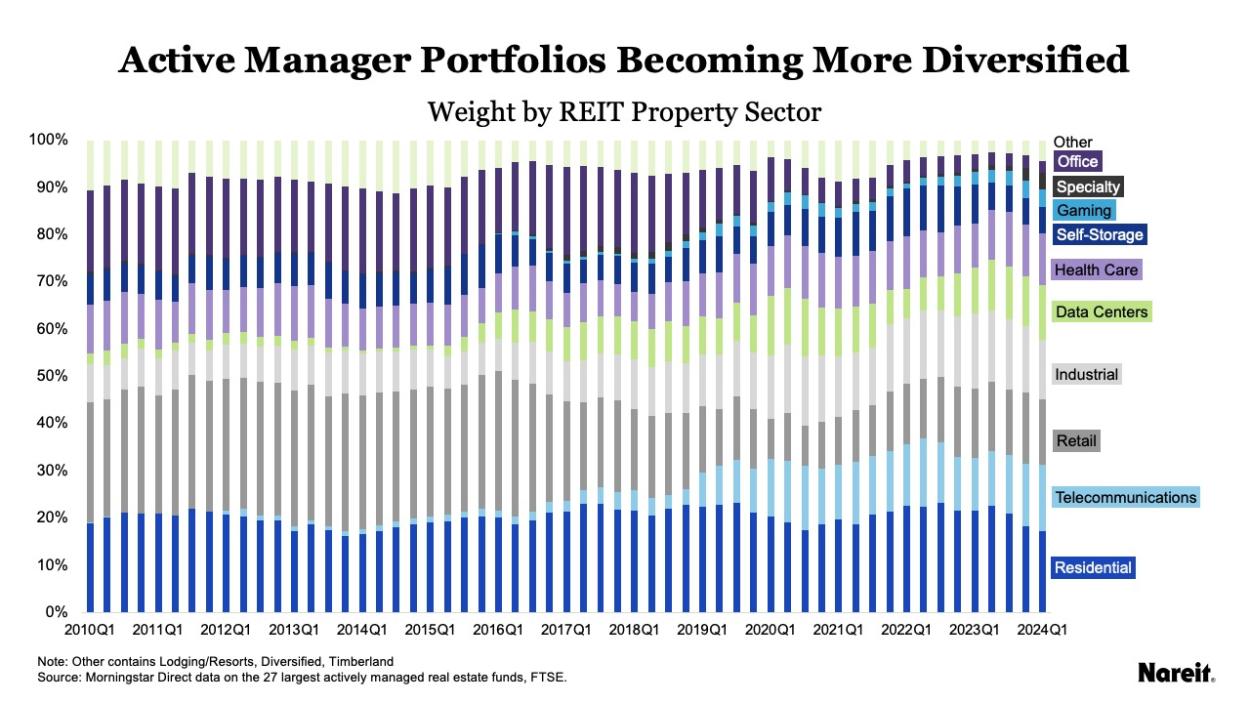

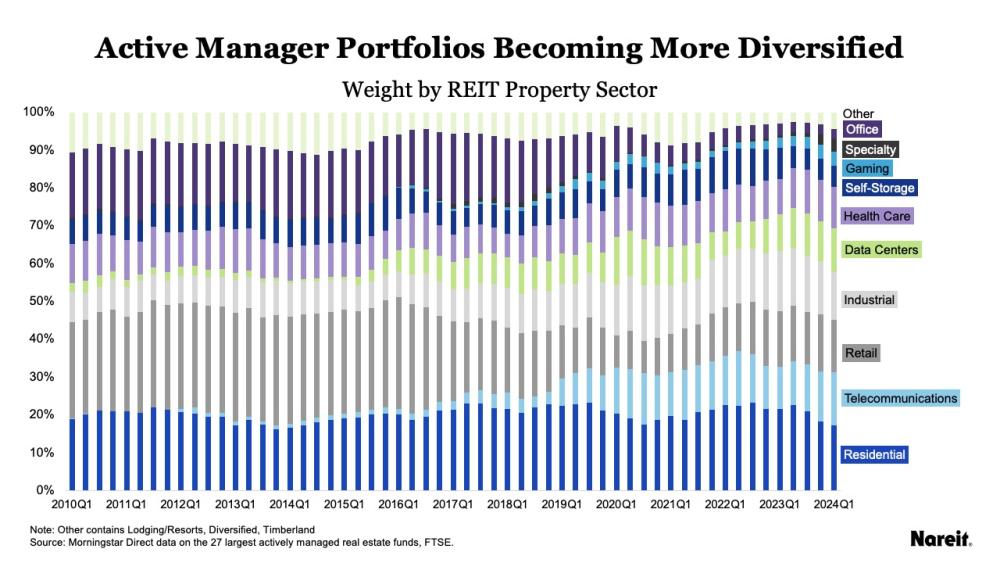

The share of REIT assets in the funds for each property sector on a quarterly basis from 2010 to the first quarter of 2024 is shown in the chart above. Overall, the portfolios are more diversified in 2024 than in 2010, especially as new sectors have been added. In 2010, the top three sectors, retail, residential, and office, accounted for 63% of the assets in the funds. At the beginning of 2024, the top three sectors, residential, retail, and telecommunications, accounted for only 45% of total assets.

Taking a closer look at specific sector allocations offers other key observations:

- Retail had the highest share (26%) in 2010 Q1 and peaked at a 30% share in 2016 Q1 before beginning a steady decline and dropping below 10% in 2020 at the onset of the pandemic. It started increasing again in 2021 and now is 14% of total assets as of 2024 Q1.

- Residential had the highest share (17%) in 2024 Q1; it overtook retail at the beginning of 2017 and has remained the sector with the highest share of assets.

- Office had a 17% share of assets in 2010 Q1 and was in the double digits for most of the period until it dropped to 9% in 2020 Q1. Office’s share continued declining and was 3% in 2024 Q1.

- Telecommunications became a sector in 2012 Q1, with a 0.8% share of assets, and now has the second highest share at 14% in 2024 Q1. The sector’s growth was slow until the pandemic, jumping from 3% of assets in 2018 Q4 to 7% in 2019 Q1 to 12% in 2021 Q1.

- Data centers’ share hovered around 1% or 2% until it began to increase from a 3% share in 2015 Q3. The sector now has a 12% share of assets as of 2024 Q1.

- Other sectors, like health care and self-storage, have maintained consistent shares throughout the period, averaging 10% for health care and 7% for self-storage.

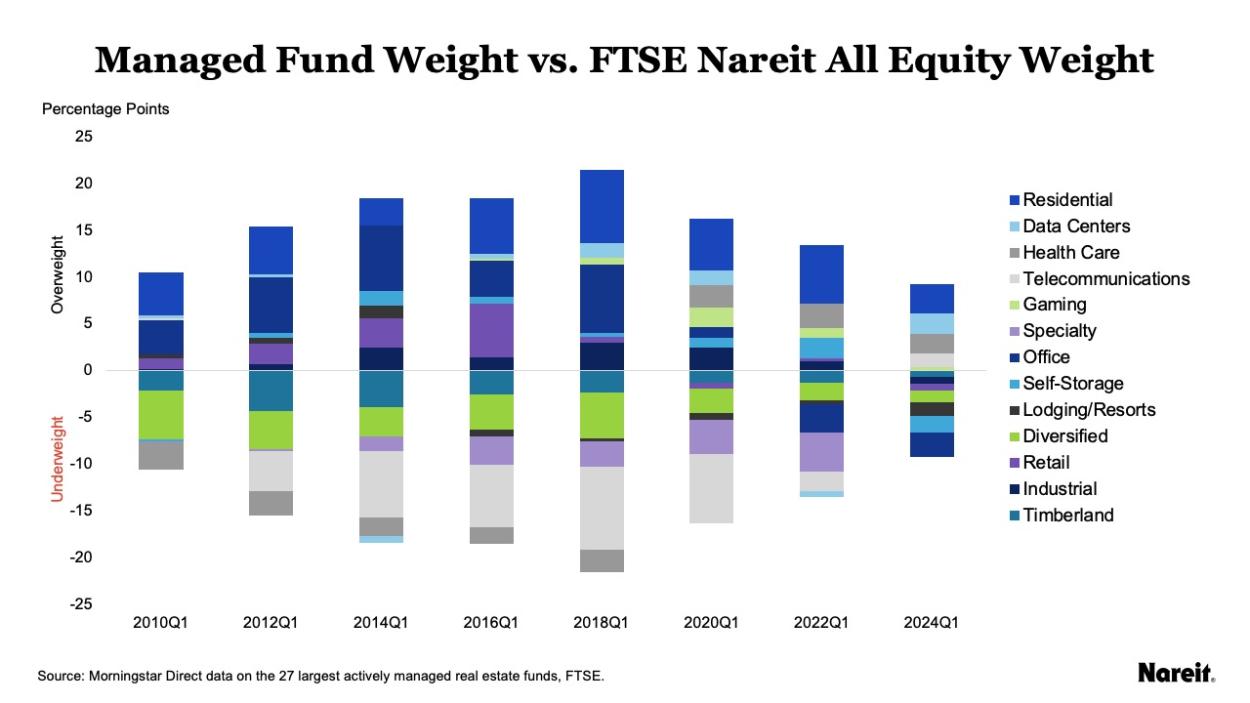

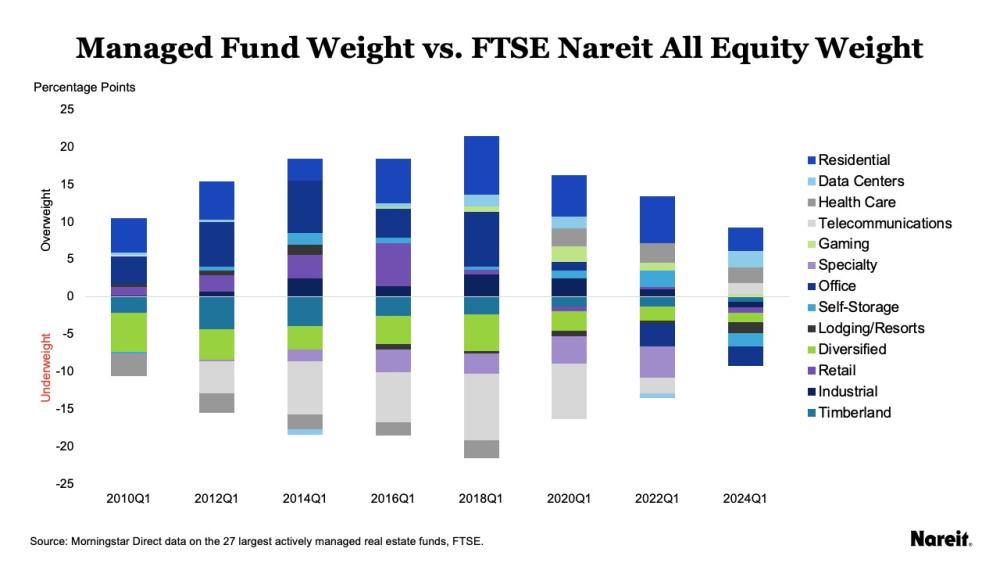

The chart above compares the share of equity market capitalization of each property sector in the FTSE Nareit All Equity REITs Index to the share of assets in the actively managed real estate funds. The dispersion of the bars fluctuated over time, showing periods where active managers differed most and least with the FTSE Nareit All Equity REITs Index. Much of that dispersion was due to the large overweight of residential after 2016 and the large underweight of telecommunications.

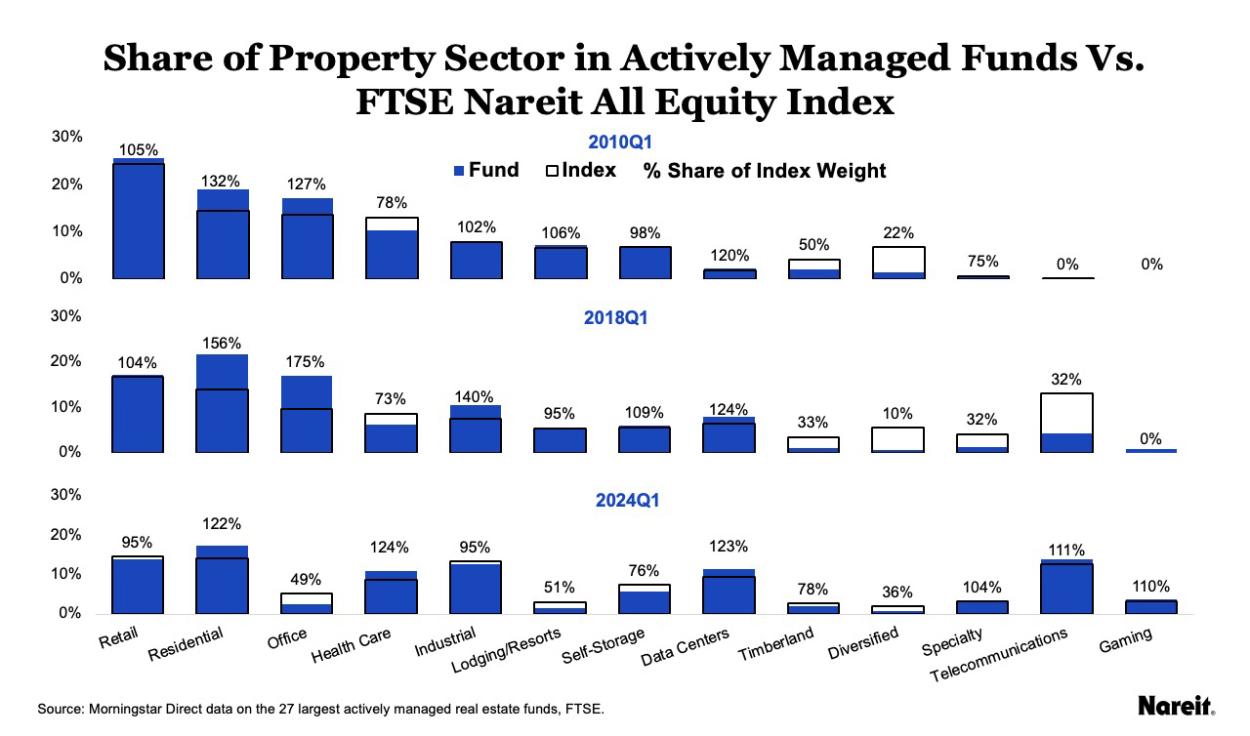

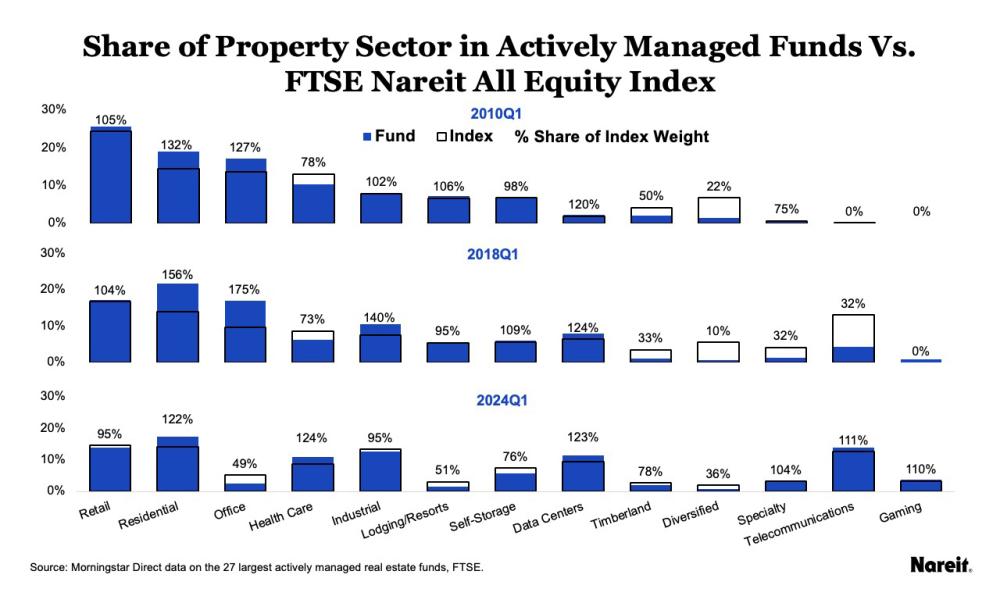

To provide a clearer view of these changes over time, the chart above compares the weight in the funds to the weight in the index for the first quarters of 2010, 2018, and 2024. All three charts are sorted by each sector’s fund weight in 2010. The text gives the fund weight share of the index weight so the overweight or underweight is represented proportional to its index weight.

- Residential is the only sector overweight through the entire period. At 3.1 percentage points overweight in 2024 Q1, it has the largest overweight position of all the property sectors. This represents 122% of its share in the index.

- Office and lodging/resorts were overweight in the funds for most of the period, then were underweight during the pandemic. Both are underweight in 2024 at 49% and 51% of their shares in the index respectively.

- Telecommunications was highly underweight in the funds in 2023 Q3 when it began to approach parity with the index. The sector flipped to overweight in 2024 Q1 by 1.4 percentage points, or 111% of its index share.

- Industrial and self-storage have been overweight through much of the period, although both are slightly underweight in 2024 Q1.

- Data centers have stayed overweight for most of the period, even as the sector’s weight has increased in the index. Most recently, the sector has been over 120% of its index share from 2022 Q4 until 2024 Q1.

Analyzing REIT active fund managers’ allocations offers important insight into REIT dedicated investors’ views of the real estate market. Looking at the most recent analysis of changes since 2010 identifies macro trends in the real estate market.

- REIT active managers favor residential real estate as housing supply continues to be an issue.

- Investment in retail has declined over time, but REIT active managers view in-person shopping as a healthy part of the economy.

- REIT active managers have increased their investments in modern economy sectors, including industrial, data centers, and telecommunications.

- In health care, lodging/resorts, and office, REIT active managers are sensitive to business cycles that affect the strength of these sectors.

To read more of Nareit’s analysis, including future editions of its quarterly active managers’ tracker, sign up for Nareit’s quarterly research newsletter .