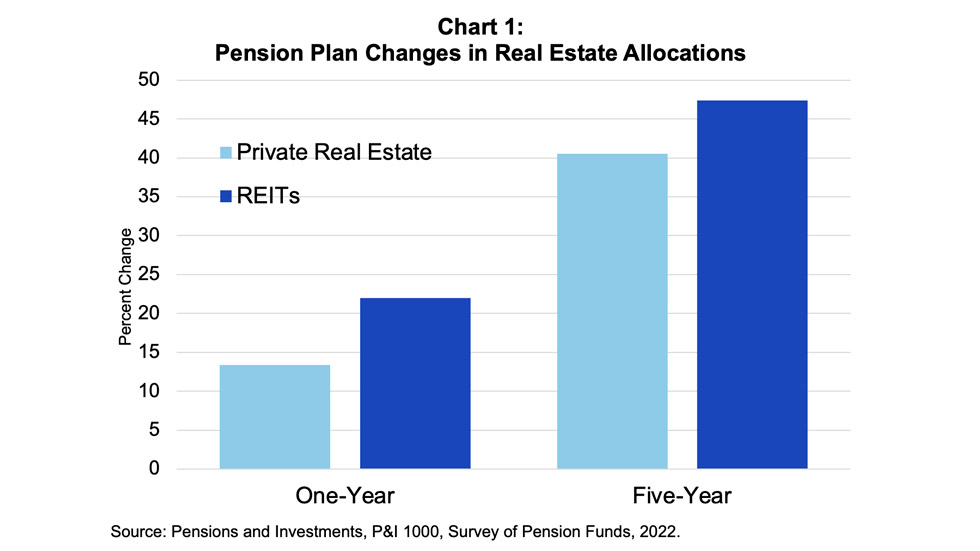

The 2022 Pensions & Investments annual survey of pension plans found that REIT assets in the largest 200 U.S. retirement plans grew 22% to $34.2 billion during the year and are starting to play catch up with those plans’ private real estate portfolios that grew just 13.4% over the same time period. Over a five-year period, REITs also outpaced private real estate with assets up 47.4% compared to private real estate’s 40.5% increase.

These findings are consistent with Nareit analysis of defined benefit (DB) pension plans showing REIT usage increasing slowly, but steadily, over this period. Using data from Preqin, Nareit has found that the share of DB pension plans using REITs as part of their real estate strategy grew from 55% in 2016 to 67% in mid-2021.

This growth in REIT adoption and use by pension plans does not come as a surprise. There are a number of good reasons for DB pension plans to consider using REITs in their real estate strategies:

- Returns: REITs have outperformed private real estate by an average of nearly 2 percentage points per year over the past 20+ years. Both practitioner and academic studies show the consistent REIT outperformance.

- Access to 21st Century Real Estate: As the economy has become increasingly digital, the real estate landscape has also changed. REIT have been on the forefront of commercial real estate innovation. Today, more than 35% of the market capitalization of the FTSE Nareit REIT Index is comprised of real estate that powers e-commerce and the digital economy including data centers, communications towers, and industrial and logistics facilities. As DB pension plans broaden the footprint of their real estate investment, REITs are a natural complement to their existing portfolio.

- Access to Global Real Estate: REITs provide low-cost access to global real estate returns. The FTSE EPRA Nareit Global Index includes 523 companies with $2 trillion in market capitalization from 39 countries around the globe.

- ESG Performance: REITs have embraced ESG and are outperforming private real estate in ESG performance metrics. In 2020, 98 of the 100 largest REITs publicly reported on ESG efforts and outcomes. In the 2021 GRESB results, REITs outperformed private real estate in the U.S. and globally.

Learn more about using REITs in a well-diversified portfolio.

The full article from Pensions & Investments about REIT assets growing in pension plans is available below.

REPRINTED WITH PERMISSION

February 14, 2022

REITs post 22% growth over the year, outpacing real estate equity's gains

By ARLEEN JACOBIUS

Real estate investment trust assets in the largest 200 U.S. retirement plans grew 22% to $34.2 billion in the year ended Sept. 30, and are starting to play catch up with those plans' less liquid, much larger real estate equity portfolios that grew 13.4% to $418.3 billion in the same period, results of Pensions & Investments ' most recent annual survey show.

Indeed, over the five years ended Sept. 30, REITs also outpaced real estate equity, albeit from a much smaller basis, with assets up 47.4% compared to real estate equity's 40.5% increase.

Returns accounted for a portion of the increase. As of Sept. 30, the FTSE Nareit All Equity REIT index was 31.5% in the 12 months and 8.41% for five years, while the NCREIF Fund Index-Open End Diversified Core Equity index returned 13.54% for one year and 6.56% for five years.

Today, more than 60% of pension funds and endowments have REITs as part of their real estate strategy, said John Worth, executive vice president for research and investor outreach at Nareit, a Washington-based trade group.

Based on Preqin data, Nareit estimates that the asset-weighted share of U.S. defined benefit plans investing in REITs as part of their real estate allocation has grown to 67% as of Sept. 30 from 55% as of Sept. 30, 2016. Including endowments and foundations, REITs' share increases to 63% as of Sept. 30 from 51% on Sept. 30, 2016.

The California State Teachers' Retirement System , West Sacramento, the third largest defined benefit REIT investor on P&I 's list, invests in them as part of its real estate portfolio. The $313.9 billion pension fund's REIT portfolio was up 14.3% to $3.2 billion as of Sept. 30 from $2.8 billion a year earlier, while its real estate equity portfolio grew 12% to $40 billion as of Sept. 30 from $35.7 billion a year earlier. CalSTRS began investing in REITs in 2019. It also has joint ventures with private and public REITs including a real estate debt joint venture with 3650 REIT, a private REIT.

The $496.8 billion California Public Employees' Retirement System , Sacramento, tops the REIT list with assets roughly flat from a year ago, at $6.5 billion. CalPERS is also in the first position on P&I 's list of real estate equity managers with assets down 7% to $41.2 billion as of Sept. 30 from $44.4 billion as of Sept. 30, 2020.

CalPERS does not invest in REITs as part of its real estate portfolio, but rather gets its REIT exposure from its global equity portfolio. Most of its real estate equity portfolio is invested directly in properties or in separately managed accounts, a real estate report for the investment committee's Feb. 14 meeting showed.

The COVID-19 pandemic accelerated a theme that has been big among asset owners over the past year, Nareit's Mr. Worth said.

Institutional investors "are realizing that their (private) real estate portfolios are not capturing the entire breadth of the real estate footprint," according to Mr. Worth.

These asset owners are investing in REITs to get access to growing sectors such as data centers, logistics and cell phone towers, Mr. Worth said.

When CalSTRS first began investing in REITs in 2019, its director of real estate, Mike DiRe, said at the time that one use of REITs was to gain access to specialty sectors.

Reprinted with permission from Pensions & Investments. © 2022 Crain Communications Inc. All rights reserved.

Further duplication without permission is prohibited. Visit www.pionline.com. PI22017